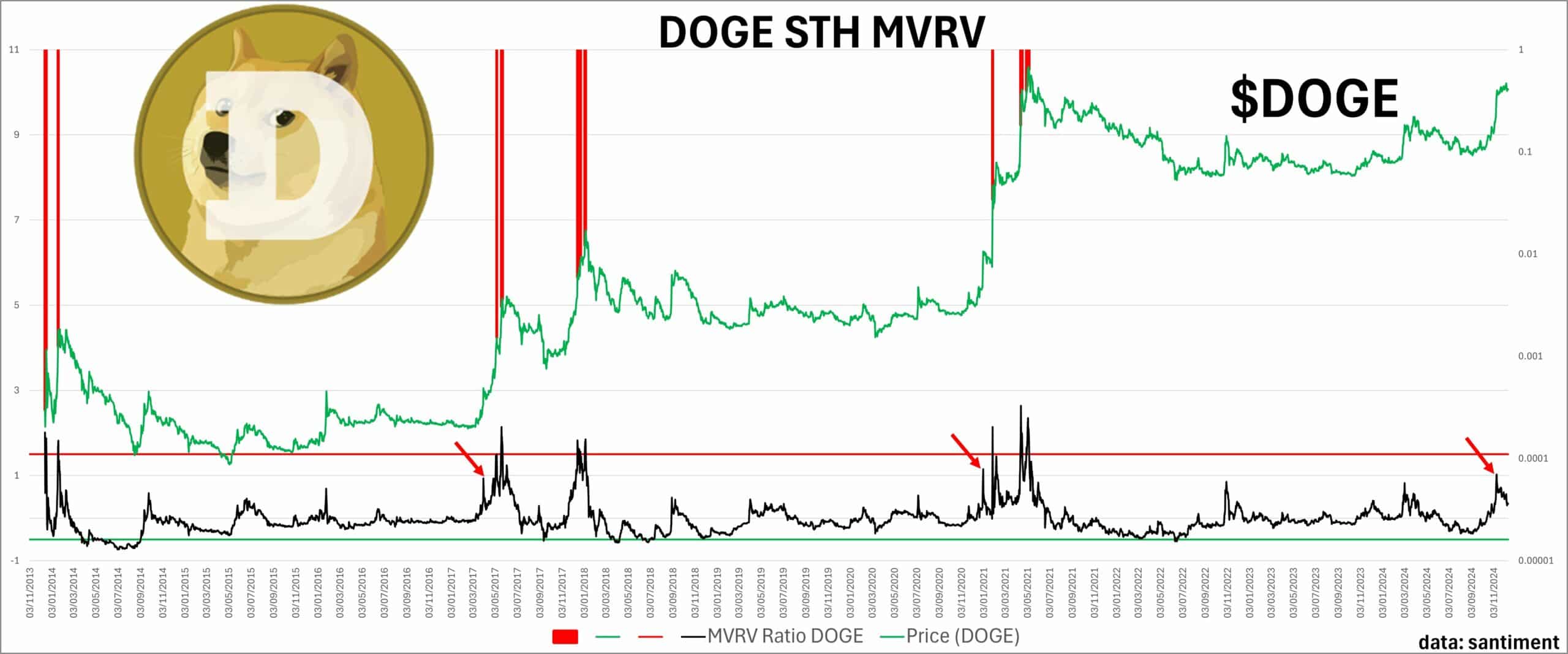

- Dogecoin repeats similar MVRV pattern when prices near highs.

- Propietary Indicator breaks out, thus the DOGE correction could be short-lived.

Dogecoin [DOGE] continues to be a force in the memecoin market as it exhibited cyclical patterns on the market value to realized value (MVRV) ratio chart.

Historically, each surge in DOGE’s MVRV suggested overvaluation, followed by retracements, especially when prices neared all-time highs. Recently, the MVRV ratio again approached these higher levels.

Peaks in early 2014, late 2017, and early 2021 were met with sharp declines, aligning with corrections post-hype phases.

Post-retracement periods entered phases of consolidation, laying the groundwork for the next uptrend.

The patterns have held as DOGE’s correction before potentially climbing higher is in play. This suggested a repetitive cycle of hype.

DOGE prediction and profitability

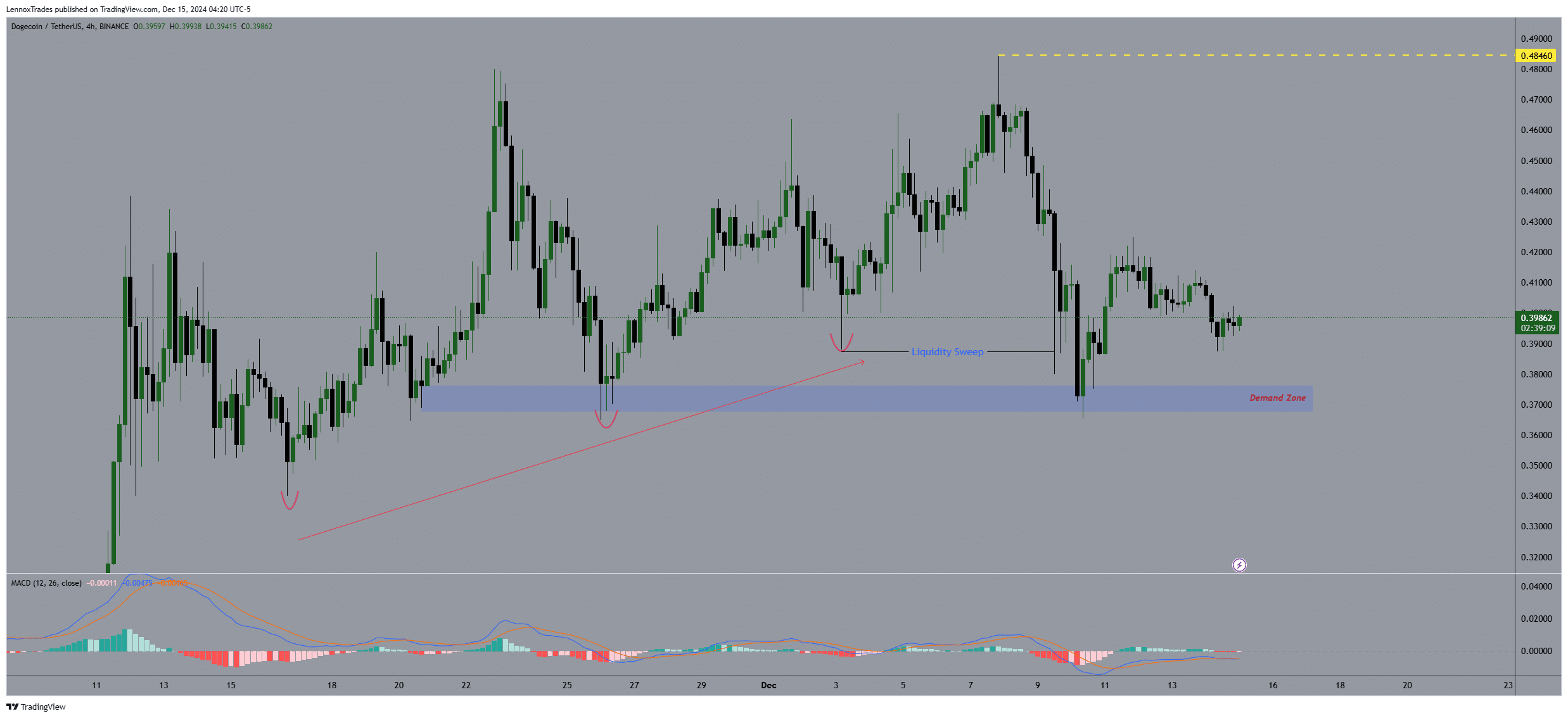

DOGE was in a corrective phase with repeated tests of the resistance level around $0.49, failing to break above it. Each attempt to break higher was followed by retracements, confirming resistance strength.

The price drops highlighted liquidity sweeps below the $0.39 mark, where market players likely captured available buy orders before pushing the price slightly up again.

The strong demand zone around $0.36 led to rebounds after touches, suggesting accumulation activities.

The MACD showed a convergence below the baseline as the price struggled, indicating weakening momentum.

If past behavior were to repeat, DOGE could dip below the mentioned demand zone at $0.36 before possibly rallying to higher levels. This pattern of hitting a low point followed by a potential rise is typical.

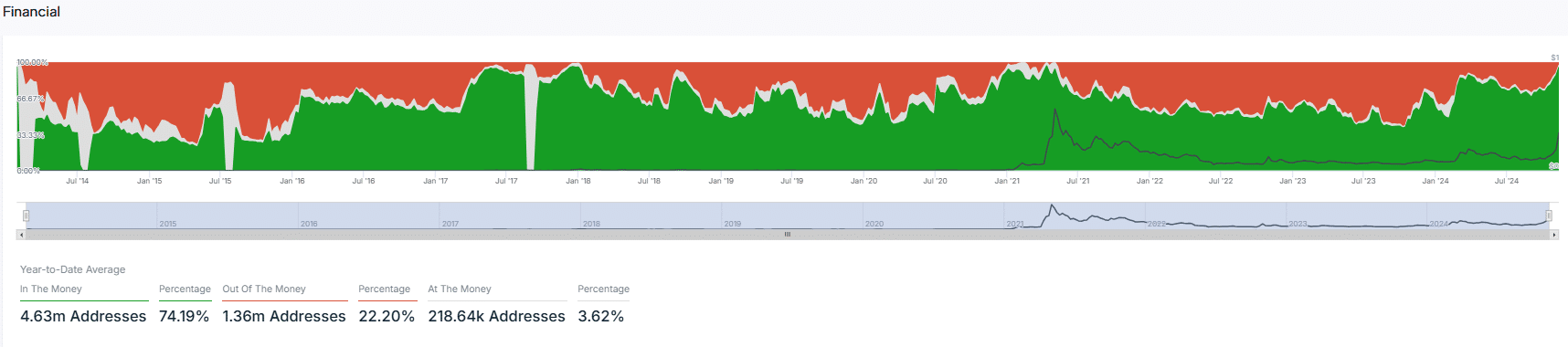

Further analysis showed that the majority of Dogecoin holders were profitable, with up to 86.67% in the money during early 2015.

The ‘In The Money’ percentage stabilized above the 50%. At press time, they were at 74.19% suggesting a strong base of holders has potentially benefited from price increases by holding through volatility.

Conversely, only 22.20% were out of the money, showing fewer holders at a loss compared to previous years. This suggested that DOGE could maintain or improve its profitability if past patterns continue.

Proprietary Indicator on altcoins

The chart previously depicted significant peaks in altcoin volatility against Bitcoin, signaling altseasons during “Wave 3” and “Wave 5” events.

These spikes corresponded to moments when altcoins outperformed Bitcoin, drawing interest and capital inflow.

Notably, the trendline established since early 2020 showed a consolidation forming a wedge pattern.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

Recently, this wedge was broken with a sharp upward movement, suggesting a possible onset of another altseason.

Historically, the pattern could lead to substantial market movements, where altcoins like Dogecoin may not remain in correction phases for extended periods, instead potentially surging to new highs.