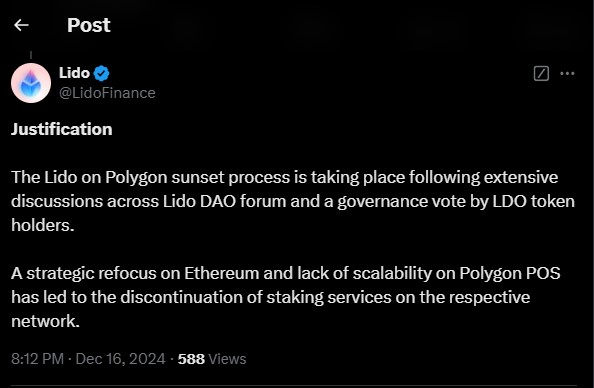

Lido Finance, the largest liquid staking protocol in decentralized finance (DeFi), is winding down its operations on the Polygon network due to limited user adoption and a strategic refocus on Ethereum. The decision follows a request from Lido DAO Token (LDO) holders, extensive discussions within the DAO forum, and a community vote where 99% of participants favored the proposal.

The move comes after a November vote that considered two options: transitioning away from Polygon or reevaluating the economics of the middleware. The justification for the wind-down stems from challenges Lido faced on Polygon, including resource-intensive maintenance, insufficient rewards, and a shift in the DeFi landscape, particularly the increasing focus on zkEVM (zero-knowledge Ethereum Virtual Machine) solutions

“This transition has led to reduced demand for liquid staking solutions on Polygon PoS, affecting Lido on Polygon’s potential as a foundational DeFi building block,” the Lido team stated. “Additionally, alternative liquid staking solutions have been built within an ecosystem that proved smaller than initially anticipated.”

Shard Labs, which initially proposed bringing the staking service to Polygon in 2021, noted that the DeFi migration toward zkEVM had diminished demand for Polygon proof-of-stake (PoS) and liquid staking as a core component of other protocols.

As of Dec. 16, Lido dao has discontinued staking requests on Polygon. However, users can still withdraw their staked MATIC through the Lido interface on Polygon until June 16, 2025. All rewards have also been discontinued.

The protocol will temporarily suspend all withdrawals between Jan. 15 and Jan. 22, 2025. By June 16, 2025, front-end support will end, and withdrawals will only be processable through browser tools.

Key dates for stMATIC holders include:

- December 16, 2024: Staking on Lido for Polygon discontinued.

- December 16, 2024 – June 16, 2025: Transition period for withdrawals via the Lido on Polygon UI.

- January 15-22, 2025: Temporary suspension of withdrawals.

According to DefiLlama data, Lido Finance has a total value locked (TVL) of $38 billion as of Dec. 16, making it the largest liquid staking protocol in the DeFi market. Dune Analytics reports Lido holds $45 million in staked tokens on Polygon, while DefiLlama data shows the Polygon network has a TVL of over $1.2 billion.

This isn’t the first time Lido has ceased operations on a blockchain. Last year, the protocol discontinued its services on Solana following a community vote and concerns over unsustainable financials and low fees. Lido had launched on Solana on Sept. 8, 2021.

The move by Lido follows a proposal by Aave, a prominent lending protocol on Polygon, to also cease operations on the network due to concerns about an upcoming review of the risk profile of bridged assets. Aave chain founder Marc Zeller launched the proposal on Dec. 13 in response to Polygon’s governance request to use a specific bridging mechanism.