- Chainlink whales withdrew 100,000 LINK tokens worth $2.95 million in 24 hours.

- LINK has declined by 3.02% over the past day.

After hitting a recent high of $30.49, Chainlink [LINK] has experienced a market correction. This pullback saw the altcoin hit a low of $27.49.

Since then, the altcoin has struggled to maintain its upward momentum. As of this writing, Chainlink is trading at $28.22, marking a 3.02% decline on daily charts.

Previously, Chainlink had been on an upward trajectory, rising by 21.43% on weekly charts and 97.74% on monthly charts.

The recent retrace and subsequent decline in daily charts have created a buying and accumulation opportunity. As a result, most investors, especially whales, have started accumulating the altcoin.

Chainlink whale accumulates 100,000 tokens

According to Lookonchain, a Chainlink whale has turned to accumulation as LINK declines on its price charts.

This whale withdrew 100,000 LINK tokens worth $2.95 million from Binance in the last 24 hours. Over the past three days, this whale has withdrawn a total of 529,999 LINK tokens worth $15.5 million from Binance.

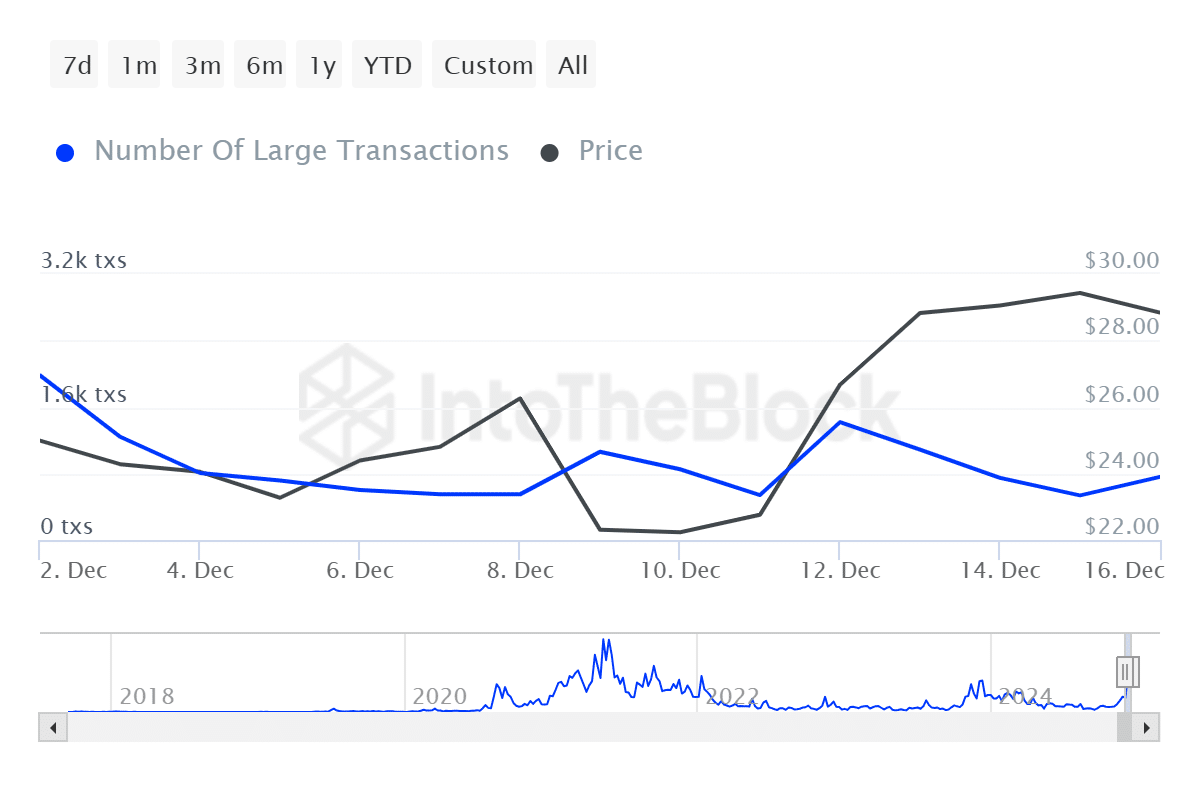

This behavior among large holders is emphasized by the rising whale activity. According to IntoTheBlock, whale activity has surged by 41.5% over the past day. This signals that whales are actively participating in the network.

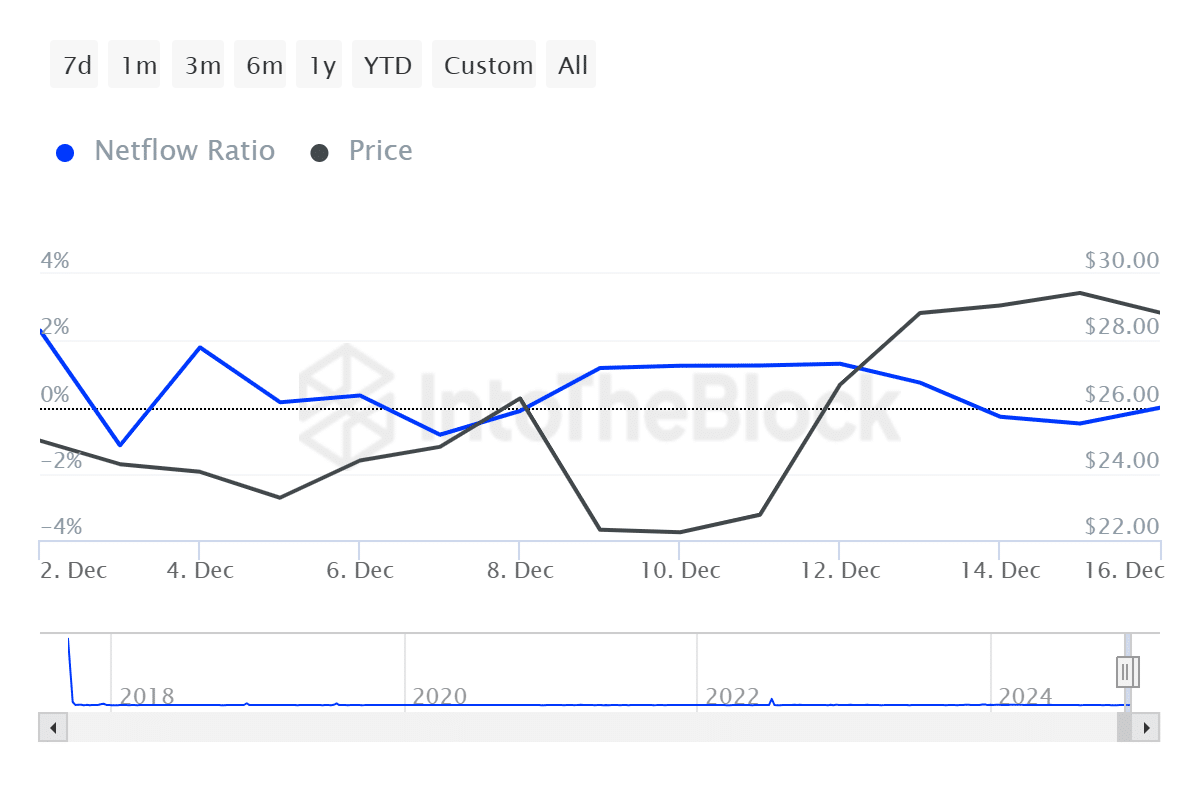

With rising whale activity, it suggests that most whales are hoarding their assets. Consequently, the Large Holders Netflow to Exchange Netflow Ratio has declined over the past week and remained negative for the past three days.

When this ratio drops, it coincides with positive market sentiment as whales accumulate. This shows more asset outflows from exchanges than inflows among whales.

When whales turn to accumulation, it often reflects long-term holding intentions. Significantly, withdrawals from exchanges by large holders reduce potential selling pressure, thus creating a bullish signal if demand increases.

Any impact on LINK?

While increased whale accumulation is a bullish signal, the market is yet to reflect it as LINK has declined over the past day.

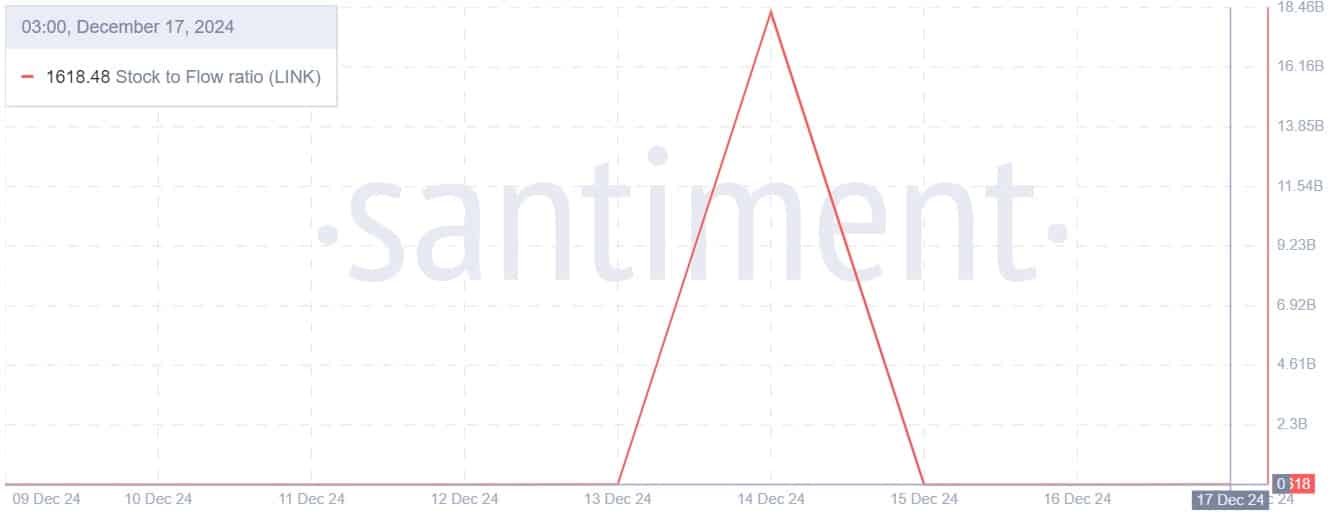

However, despite the drop on daily charts, the overall LINK market remains bullish. This bullishness is not only evident from the rising whale accumulation but also from a surge in the stock-to-flow ratio.

Accordingly, Chainlink’s SFR has spiked from 0, indicating oversupply, to 1618.48. This rise suggests increased scarcity, prompting hoarding or accumulation among investors and reducing market liquidity. A drop in liquidity can drive prices up if demand outpaces supply.

Is your portfolio green? Check out the LINK Profit Calculator

Simply put, Chainlink is experiencing favorable market conditions from both whales and retail traders. If this bullish sentiment holds, LINK will reclaim the $30 resistance level and attempt $32.2. However, if the decline on daily charts gains momentum among sellers, the altcoin could dip to $26.9.