Bitcoin (BTC) witnessed a sharp decline below $90,000 yesterday, sparking concerns about its near-term stability. However, the cryptocurrency has since rebounded, trading back above $96,000 at the time of writing.

This rapid recovery has drawn the attention of market analysts who are examining the underlying trends driving Bitcoin’s price movements.

Related Reading

Is Bitcoin’s Surge Above $96k A Stop Hunt?

A CryptoQuant contributor, Mignolet, shared an analysis highlighting the recent price dynamics. According to the analyst, the recent drop in BTC to $89,000 and the current recovery was triggered by the breaking of a key short-term support level.

Mignolet revealed that this pattern, referred to as “stop hunting,” occurs when price movements break support levels temporarily before recovering. Despite the recovery, Mignolet emphasizes that a true trend reversal would require stronger involvement from key market participants.

Mignolet’s analysis points to significant selling activity among whale entities, as observed in Coinbase Premium Gap (CPG) data. Typically, buying whales step in to absorb such dips, creating notable market volatility.

However, this time, such activity was absent, raising questions about the sustainability of the ongoing rebound. Additionally, Binance’s market-buy ratio data suggests that large-scale buyers on the exchange have not capitalized on the recent price movement, indicating cautious sentiment among key players.

Further evidence disclosed by Mignolet comes from the exchange-traded fund (ETF) daily inflow and outflow data, which is yet to confirm any major shifts in market dynamics.

While the daily candle pattern suggests a meaningful move, the lack of participation from whales could limit Bitcoin’s ability to sustain a long-term reversal. Mignolet also warned that market sentiment might shift too quickly to optimism without clear supporting data. The analyst noted:

While the candle pattern signifies a meaningful move, the major players are not capitalizing on the opportunity. What concerns me more is that many people’s sentiment may quickly shift to a sense of relief too soon.

Bitcoin Market Performance

After seeing a notable plunge in price yesterday dropping below $90,000 and triggering a total liquidation of over $300 million in the crypto market, Bitcoin is finally seeing a noticeable reversal in its bearish trend.

Particularly, over the past day, Bitcoin has increased by 5.6% bringing its price to trade at $96,351, at the time of writing. However, despite this increase, the asset is still roughly a 10.8% decrease away from its peak above $108,000 recorded last month.

While Mignolet’s analysis suggested that Bitcoin bearishness might not be over yet, it is worth noting that the asset’s current recovery coincides with reduced selling activity from long-term holders.

Related Reading

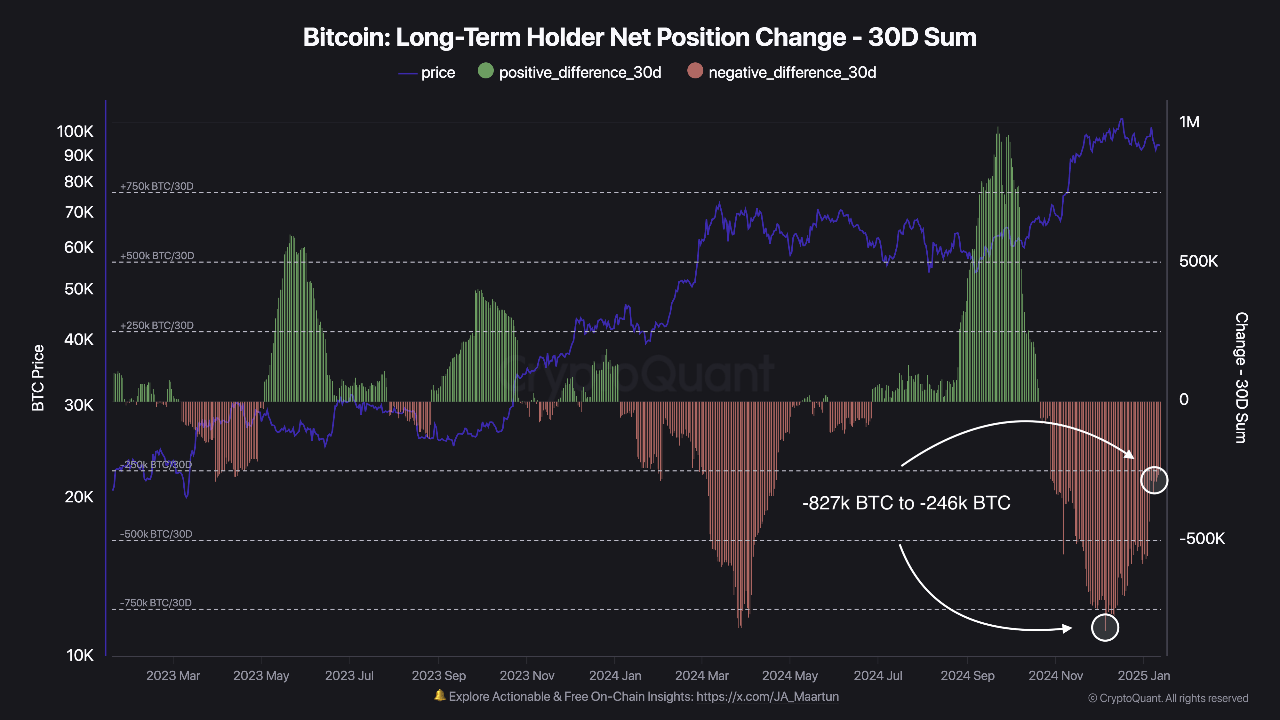

In a separate analysis, CryptoQuant contributor Darkfost revealed that the net position change of long-term holders (LTHs) over the past 30 days remains negative but shows signs of improvement. From a low of -827,000 BTC on December 5, the figure has improved to -246,000 BTC.

This reduction in selling pressure suggests that LTHs are less inclined to sell at current price levels as Bitcoin’s price declines. However, Darkfost noted that for bullish momentum to regain strength, LTHs would need to shift toward accumulation rather than reducing sales.

Featured image created with DALL-E, Chart from TradingView