- Arbitrum whales have accumulated 10M ARB in the last two days

- Network activity has been rising too after dApp volumes climbed by 121% in 24 hours

Arbitrum (ARB), at press time, was trading at $0.729 after its gained by over 5% in 24 hours. Trading volumes also rose by 89% to $414M, with the same highlighting growing interest in the altcoin.

Despite these gains, however, ARB remains under bearish pressure on the charts. In fact, according to IntoTheBlock, 80% of ARB holders seem to be Out of the Money (in losses) after a 55% year-over-year price decline.

And yet, several bullish signs have emerged lately, signs that could aid a trend reversal and support a sustained uptrend.

Whales accumulate 10M ARB tokens

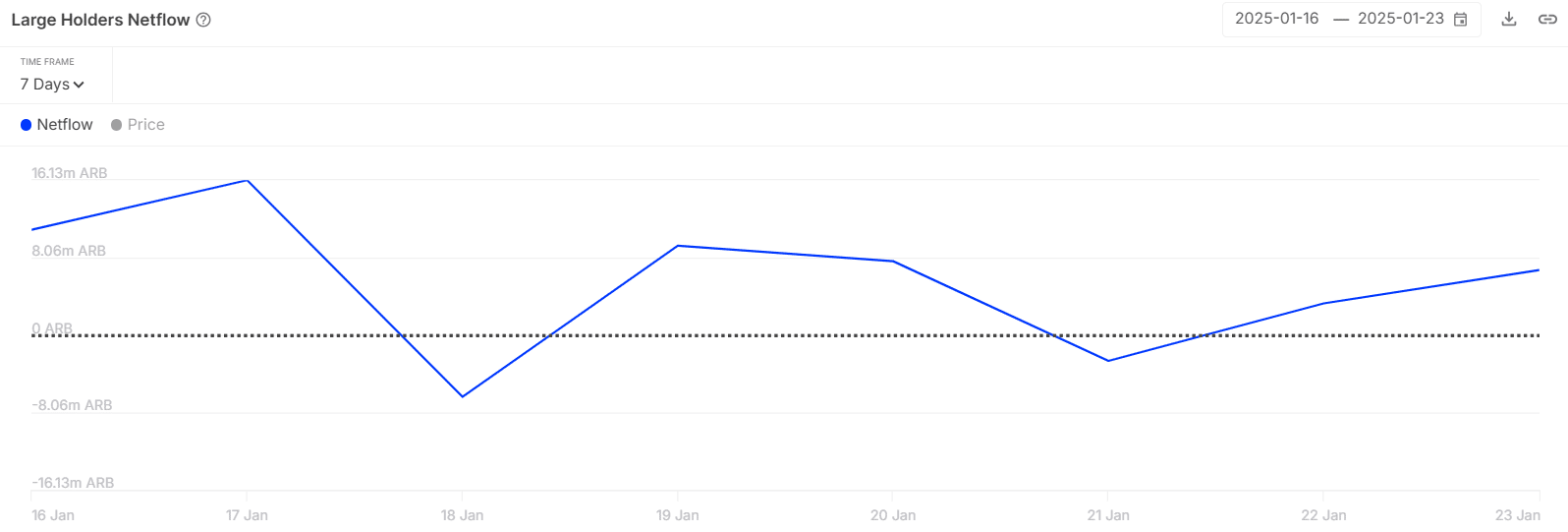

Arbitrum whales have increased their activity lately, after large transaction volumes climbed by 38% in 24 hours to 85.9M ARB. Much of this surge stems from whale accumulation, as depicted by rising large holder inflows.

Over the last two days, large addresses have accumulated 10M ARB tokens – A sign of positive momentum. This accumulation also coincided with the recent gains, an indication that whale buying has been driving the uptrend.

Whales make up 47% of Arbitrum’s total supply. Therefore, if this cohort is buying, it is bound to have a significant effect on the price.

Rising dApp volumes could fuel the rally

According to DappRadar, volumes for decentralized applications (dApps) created on the Arbitrum layer two network have risen by 121% in just 24 hours to $1.27 billion. The transaction count also climbed by 16% to 143,000.

DeFiLlama further revealed that Arbitrum flipped its top rival, Base, by decentralized exchange (DEX) volumes. At press time, Arbitrum’s DEX volumes stood at $1.26 billion, slightly higher than Base network’s $1.25 billion.

An uptick in network activity is good for the price as it could fuel demand. If these volumes continue to climb, it could also support a sustained long-term uptrend for ARB.

Can Arbitrum reverse from bearish trends?

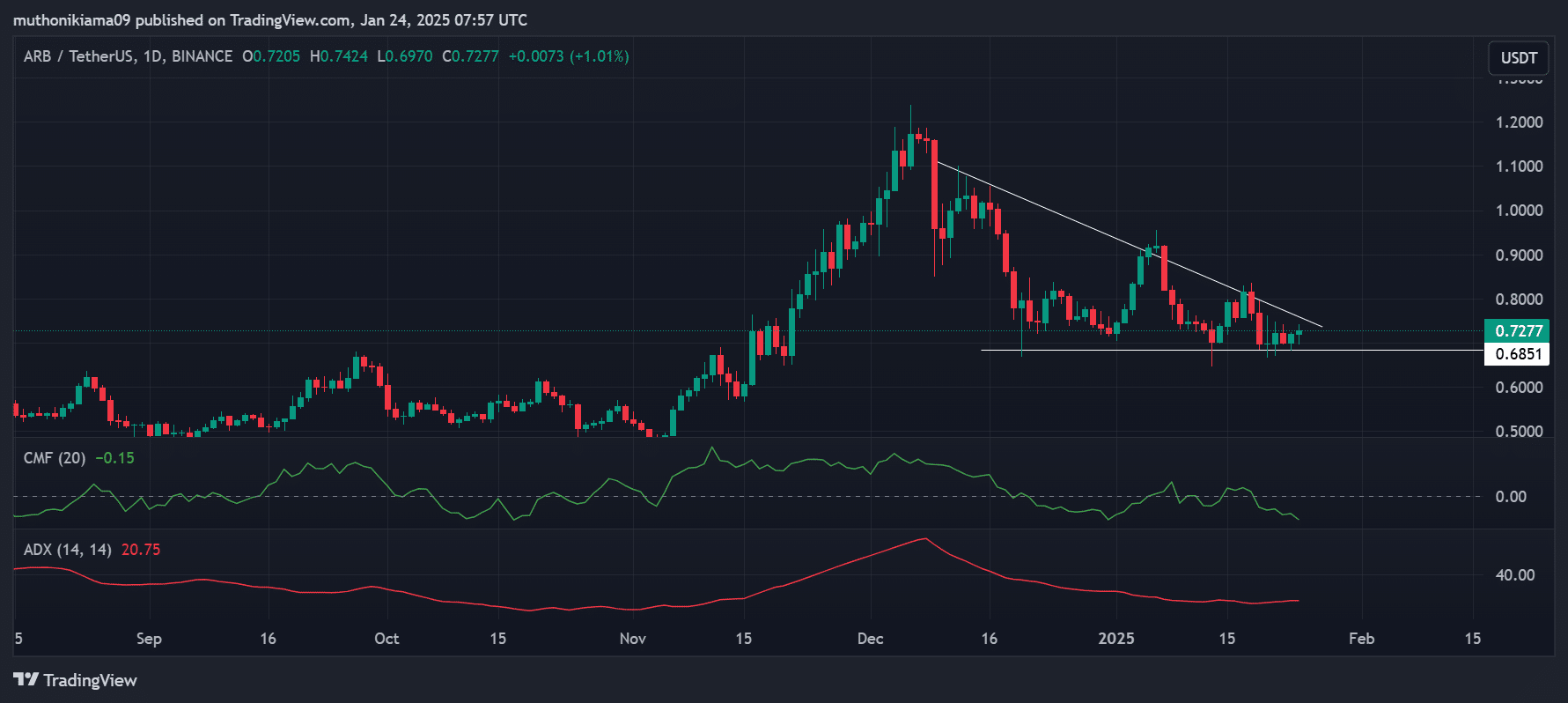

Arbitrum traded within a descending triangle pattern on its one-day chart, with the same showing that bearish trends were prevalent. A crucial support level stood at $0.68, with a dip below set to accelerate the downtrend.

The Chaikin Money Flow (CMF) also had a negative value of -0.15, indicating rising outflows from ARB through selling activity. This indicator further seemed to reinforce the bearish trend on the altcoin’s charts.

However, a look at the dropping Average Directional Index (ADX) revealed that the prevalent bearish trend has been weakening. This could lead to a price recovery. If buyers step in as whales continue to accumulate and the network shows strength, it could result in a strong bullish rally for Arbitrum.

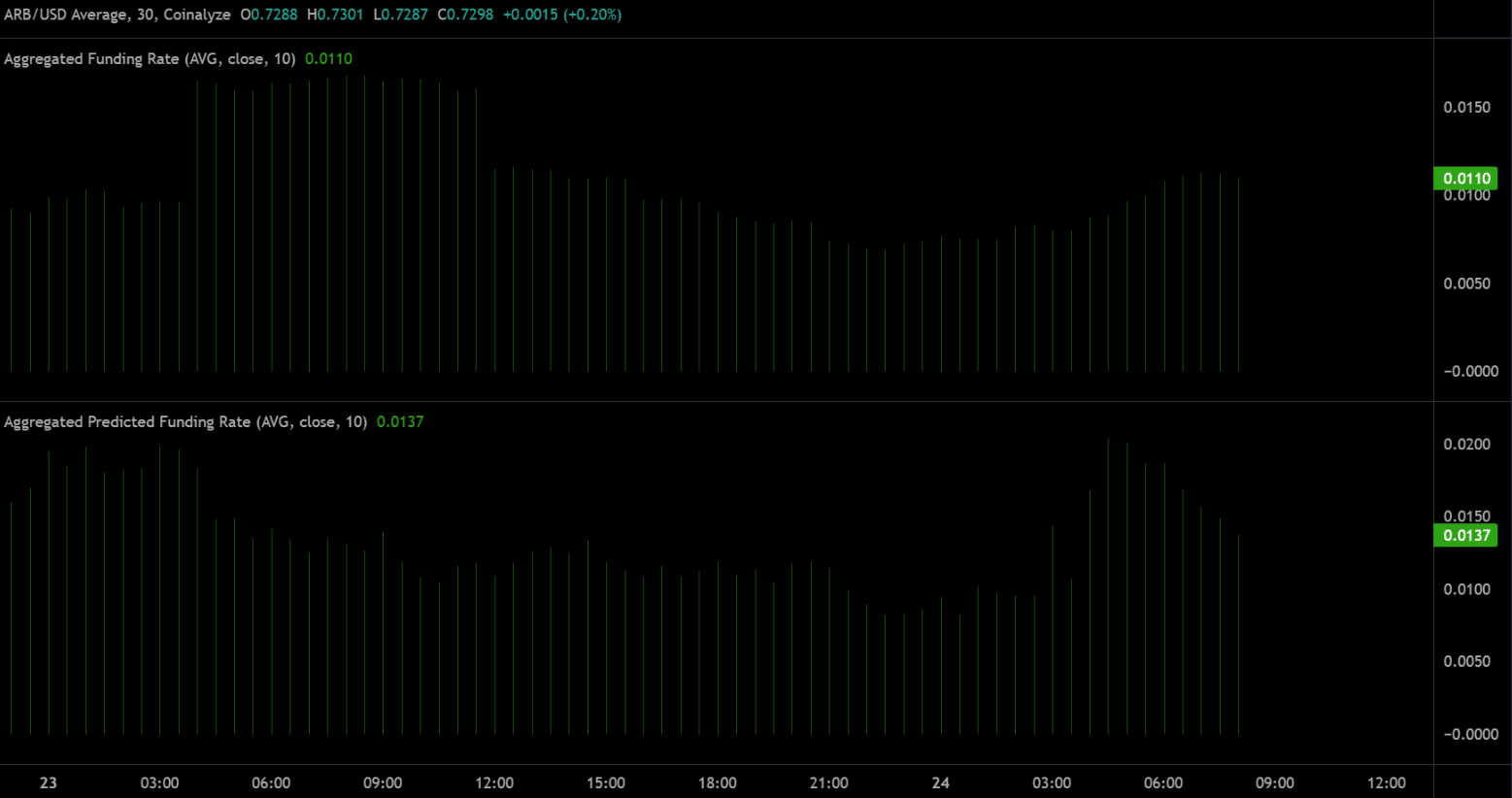

On the derivative markets front, traders have been positioning themselves for further gains. According to Coinalyze, ARB’s funding rates have risen slightly and remained in the positive region at press time. This suggested that long traders are willing to pay higher fees to maintain their positions.

However, a surge in long positions could fail to bode well for price if ARB breaches support at $0.68. The resulting downtrend could accelerate selling activity that will push the price even lower.