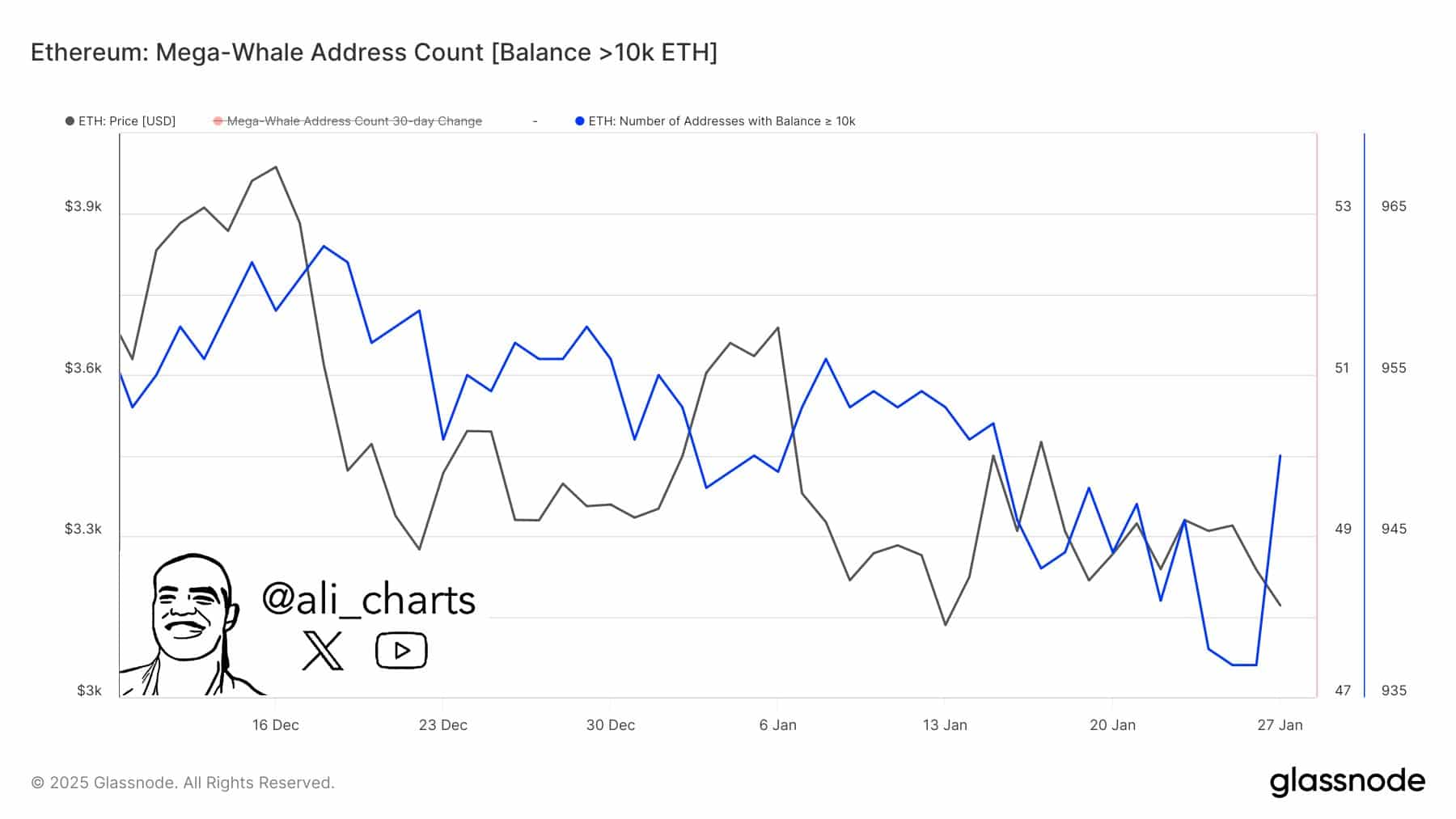

- Mega whales, each holding over 10K ETH, joined the network as WLFi spent $10M on ETH.

- Once Ethereum closes above $4K, it could reach $5K and then $6K within 6–8 weeks.

In the past 24 hours as of press time, 13 mega whales each holding over 10000 ETH, bolstered the Ethereum [ETH] network.

Simultaneously, World Liberty Fund purchased 3247 ETH worth $10M elevating their total holdings to $189M, indicating an accumulation trend.

This spree of acquisitions underscored strong confidence in ETH’s value proposition despite its current price struggle.

The increasing number of large-scale holders potentially stabilizes the price of ETH by reducing market volatility and increasing the asset’s scarcity.

This dynamic is critical as ETH has shown a declining trend, with the price hovering around $3,190.27, a slight increase of 3.29% in a day.

Other assets in the World Liberty Fund’s portfolio were WBTC with a small uptick of 0.32% and TRON (TRX) appreciated by 1.6%. Conversely, AAVE dipped by 0.94%, standing at $301.89.

WLFi’s participation not only influences ETH’s market but could also hint at an emerging floor if these accumulation trends continue.

This strategic holding pattern might buffer ETH against further declines, suggesting a bullish outlook in crypto if the trend persists.

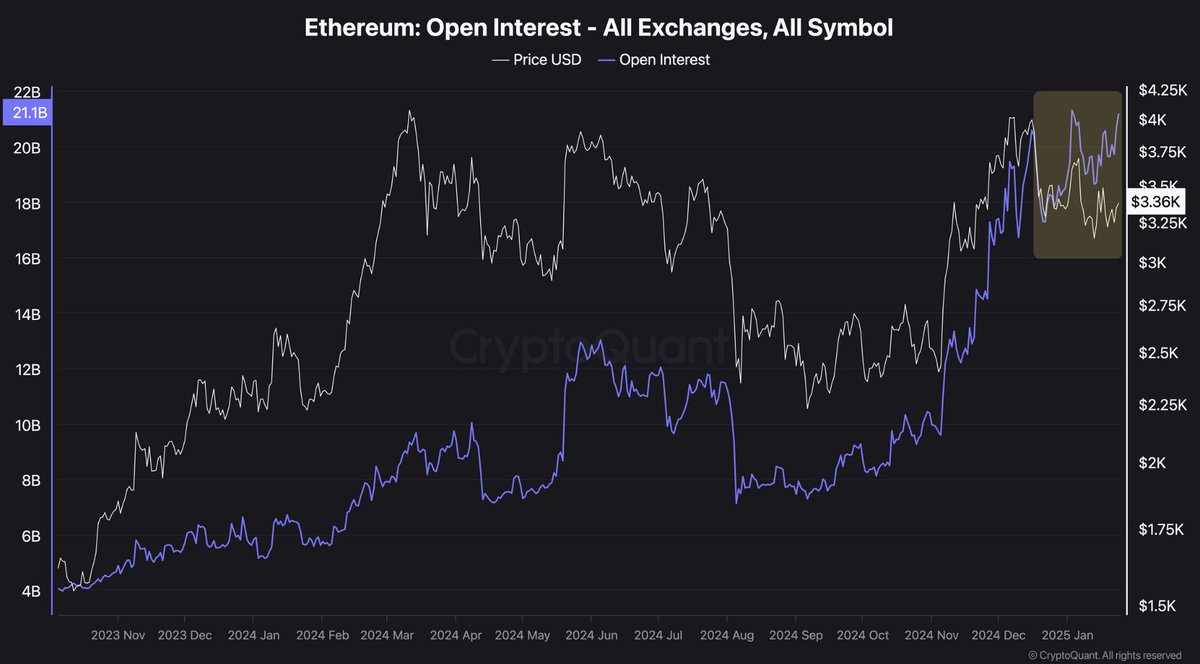

Open Interest rising

Ethereum’s Open Interest have been soaring since August 2024, closely tracking with Ethereum’s price action in the long-term.

By the end of 2024, both metrics surged, with Open Interest peaking near 21 billion by January 2025.

During this period, Ethereum’s price showed a volatile yet rising trend, moving from approximately $2,500 in early 2024 to highs around $4000 by year’s end.

The recent rise in Open Interest suggested that despite the current price decline, there was keen trading interest that could propel Ethereum’s price upwards once again.

Given the historical correlation, the increasing Open Interest could lead to a rally if Ethereum manages to stabilize and rebound from its press time levels of around $3,350.

ETH might see a rapid climb back to or even beyond previous highs, potentially reaching new thresholds.

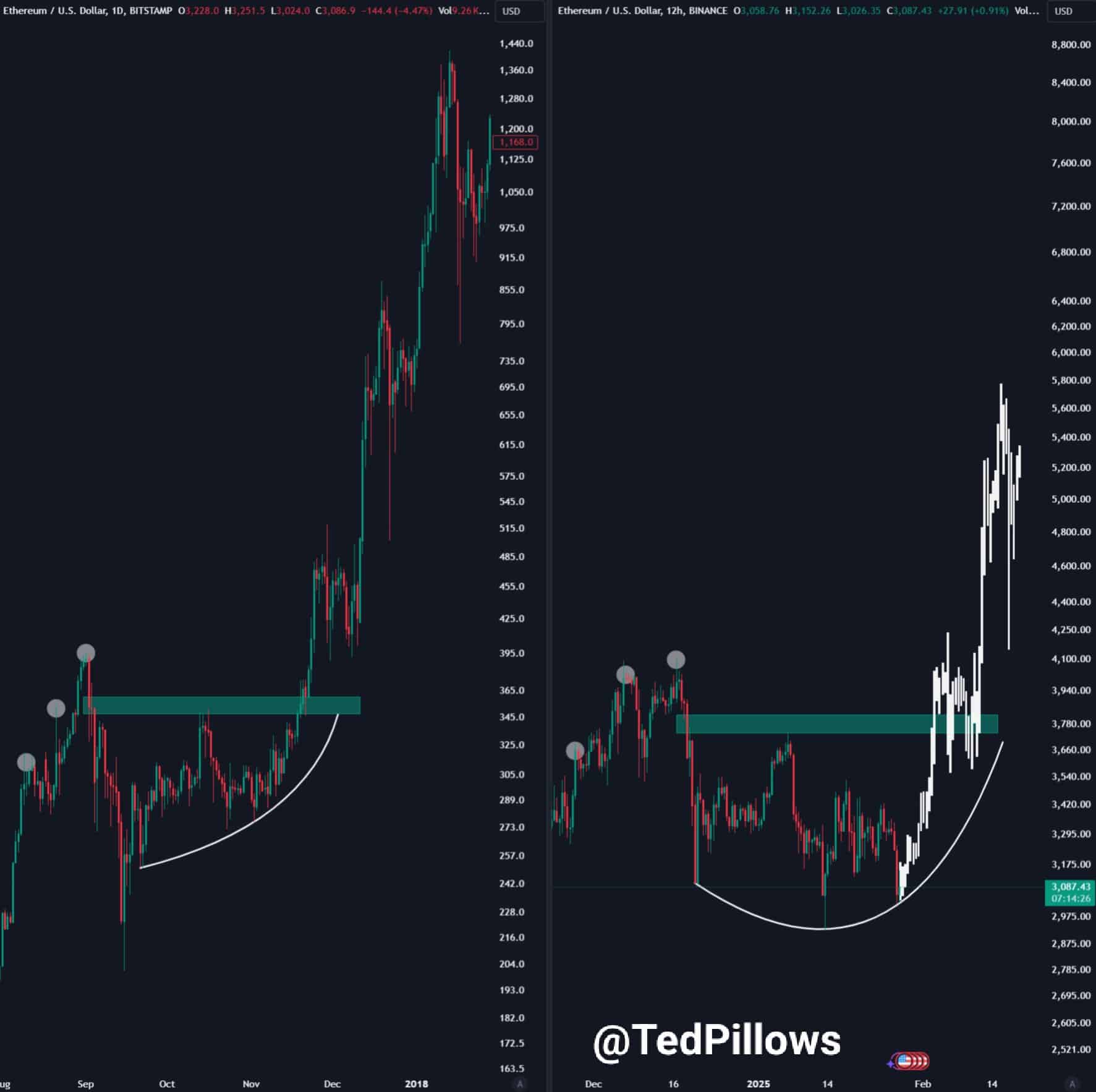

ETH repeating Q4 of 2020

Ethereum today mirrors the scene back in Q4 2020. During that period, despite Bitcoin’s rise and the buzz around DeFi, Ethereum struggled to break resistance levels, similar to the $4K barrier seen currently.

Back then, every pump of Ethereum was countered by significant resistance at $400, just as we now see with the $4,000 level.

Once ETH successfully overcame the $400 resistance, it sparked a vigorous rally, surging nearly 150% to top $1,000 within two months.

Today, Ethereum grapples with a similar pattern. The current chart shows repeated attempts to breach the $4K level, with similar rejections akin to the past.

Read Ethereum’s [ETH] Price Prediction 2025–2026

If Ethereum can sustain a close above $4K, expectations based on past patterns suggest a potential rapid climb to $5,000 and possibly $6,000 within six to eight weeks.

This forecast hinges on Ethereum breaking above these crucial resistance points, which could act as a catalyst for another substantial price surge, mirroring the explosive movements of late 2020.