- Pump.fun’s massive Solana deposits fueled speculation as stablecoin dominance strengthens in the DeFi space.

- Solana’s price action remained uncertain, with social volume rising but liquidation risks looming.

Pump.fun continues its relentless Solana [SOL] deposits, transferring 90,000 SOL worth $20.5M to Kraken. So far, nearly two million SOL worth $407M have been moved, with 264,373 SOL already sold for $41.64M USDC.

Total earnings from these transactions have surged to 2.57M SOL worth $588.6M, fueling speculation about potential market impact.

With such large movements, traders are questioning whether Solana will maintain its bullish trend or face heightened volatility.

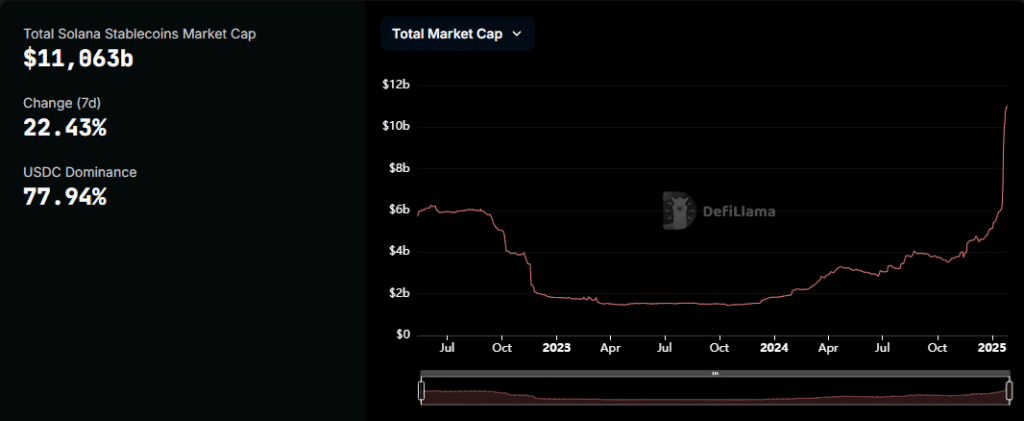

SOL stablecoin market dominance signals growing strength

Despite ongoing whale activity, Solana’s stablecoin market has reached an all-time high of $11.06 billion, showing strong demand.

USDC remains dominant, accounting for 77.9% of the stablecoin supply, while USDT holds a minor presence under $2 billion.

This rapid expansion reflects increasing DeFi adoption on Solana, challenging Ethereum and Tron’s stablecoin leadership. However, it remains uncertain whether this trend will be sustained or driven by temporary speculative inflows.

SOL price action holds key support

Solana recently bounced off a descending wedge trendline, indicating potential for further upside. The price surged to $270 before retracing to $234.30, at press time, reflecting a 3.27% gain.

However, resistance near $250 remains a significant hurdle. Failure to break above it could invite renewed selling pressure. If buyers regain control, Solana could push for another breakout. Continued whale activity might lead to unpredictable swings.

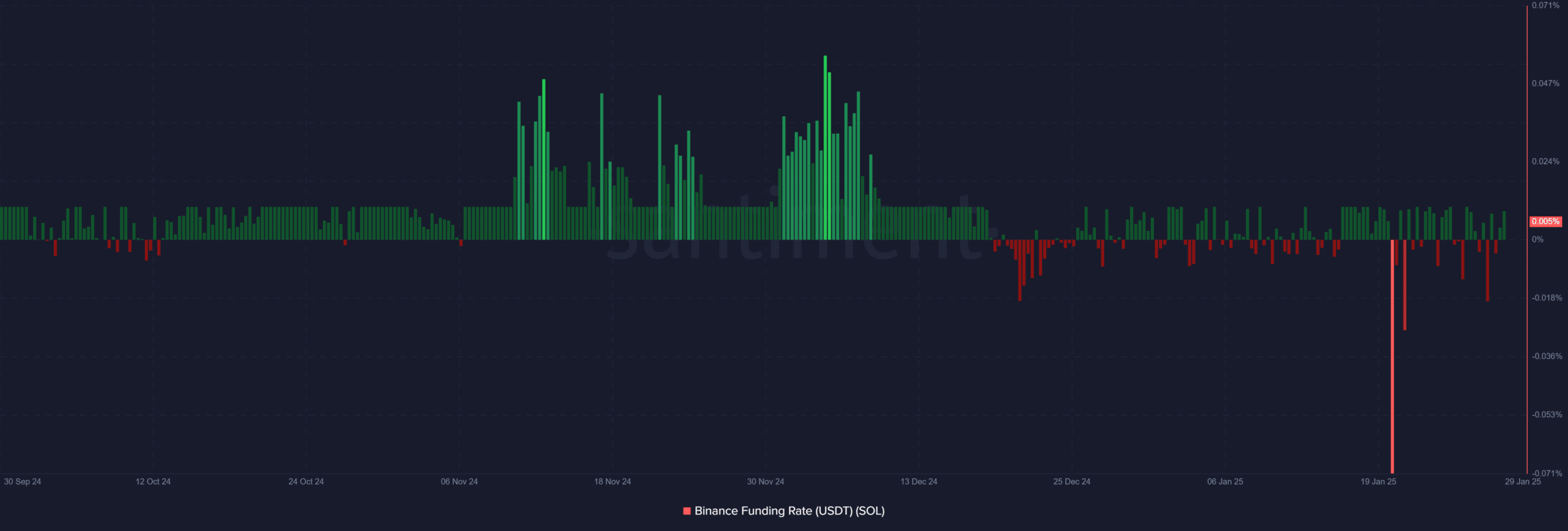

The Funding Rate remains steady but risks still exist

The Binance Funding Rate for SOL is currently at 0.005%, suggesting a neutral stance in the derivatives market. This balance indicates that neither long nor short positions are overly dominant, reducing immediate liquidation risks.

However, if Funding Rates shift aggressively, sudden price swings could emerge. Additionally, Pump.fun’s frequent deposits and sales could create imbalances that impact market sentiment.

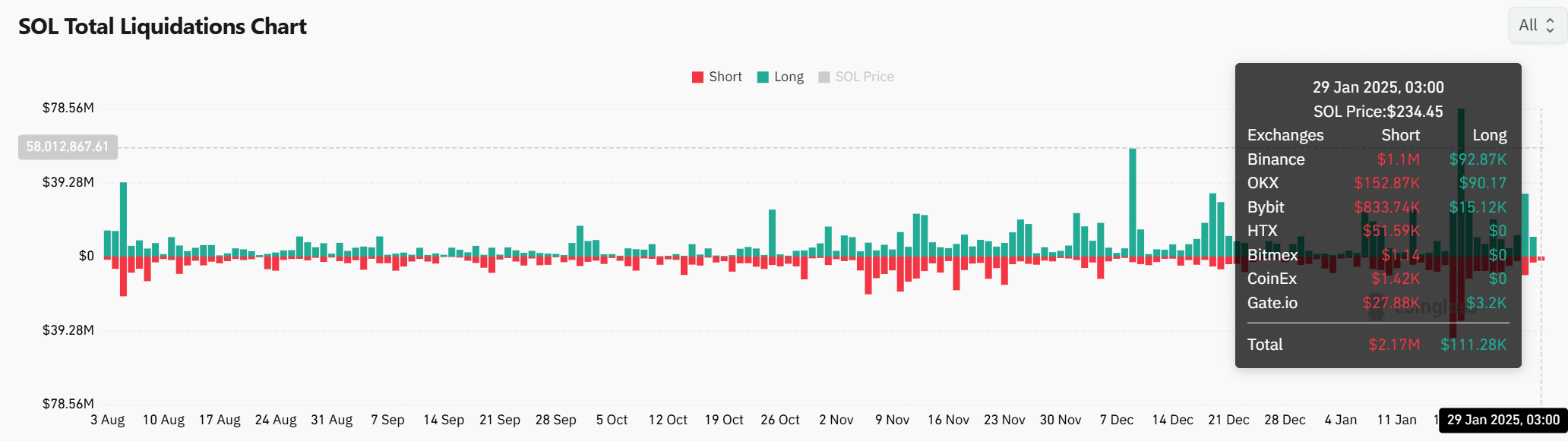

Liquidation data shows Shorts under pressure

Total liquidations show $2.17M in Short positions were wiped out, compared to $111.28K in long liquidations. This suggests a short squeeze contributed to Solana’s recent rebound, forcing traders to cover bearish bets.

However, if bullish momentum fades, another round of Short selling could emerge. Traders should monitor liquidation clusters, as they could provide clues for Solana’s next major move.

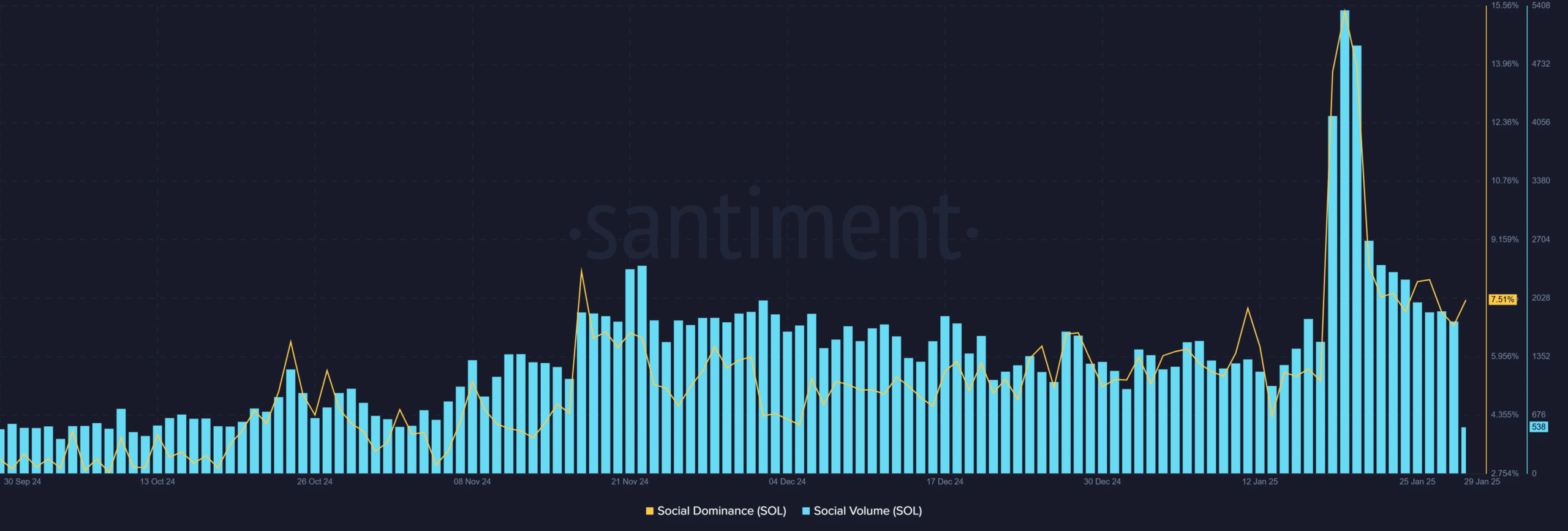

Social volume and dominance rebound

Solana’s social dominance fell sharply after a recent peak but is now recovering. Social volume is at 538, and dominance is at 7.51%. This suggests renewed interest among traders, but enthusiasm remains lower than previous highs.

If social activity continues rising, it could attract more speculative inflows. However, if interest stagnates, momentum may shift, putting pressure on Solana’s short-term outlook.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Solana’s bullish structure remains intact, but Pump.fun’s continuous transactions introduce uncertainty. If buying pressure absorbs whale sell-offs, a breakout above $250 could propel the price higher.

However, if traders grow cautious and liquidations increase, volatility could intensify. Therefore, Solana faces a make-or-break moment, with its next move hinging on whether buyers can overpower ongoing whale activity.