- DeXe skyrocketed to a multi-year high then plummeted by double digits in a single day.

- Surging derivatives volume and a critical support zone near $14 can determine DEXE’s next move.

After witnessing a massive buying rally, DeXe [DEXE] saw an uptrend toward its three-year high near the $21 mark this week.

However, the coin recently saw an over 30% single-day drop, which has sparked high volatility. As traders look to capitalize on these wild price swings, here’s what you need to know.

Bulls eye the $14.5 support

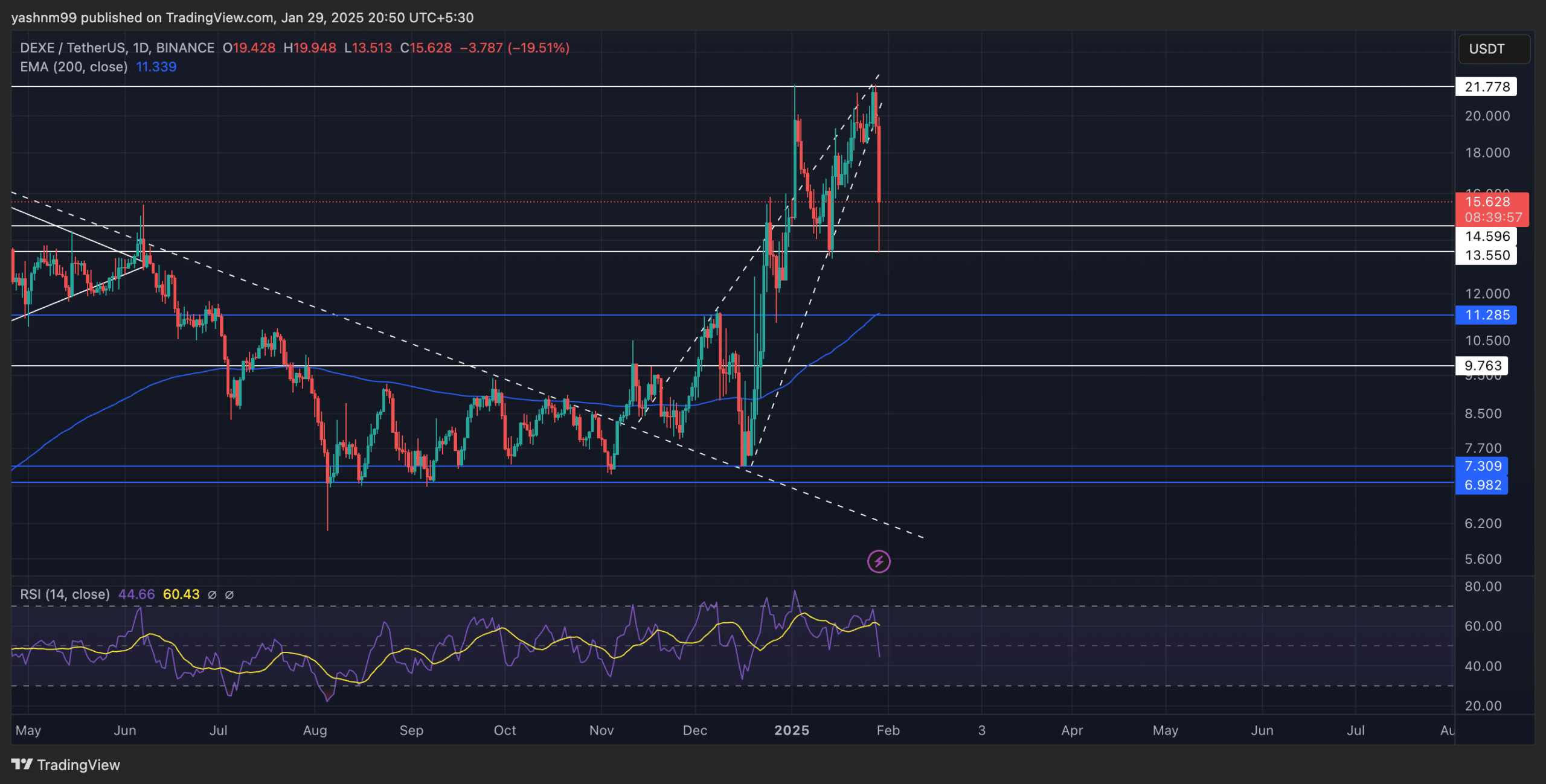

After failing to see a bullish break out of a symmetrical triangle back in April 2024, DEXE entered a prolonged downtrend and lost around 60% of its value until it bottomed out at the long-term support of $7 in December.

That low set the stage for a 190% rebound that recently pushed DEXE to $21, partly fueled by the project’s unveiled roadmap.

However, the $21 resistance triggered heavy profit-taking, causing DEXE to plummet by double digits in a single day.

DEXE traded around $15 at the time of writing, declining below its 20-day and 50-day EMAs on the daily chart.

Despite the pullback, DEXE still sits above its 200-day EMA, which hovered near the $11 level. It’s worth mentioning that the immediate support level now stood near the $13-$14 range.

If the bulls defend this support, they could prevent a deeper drawdown and potentially open a path to reclaim higher levels.

A rebound from the immediate support could see DEXE retest the $17 near the 20-day EMA. The daily Relative Strength Index (RSI) was close to 40, suggesting a bearish edge.

Thus, if the buyers are unable to find a close above the 50-level, the chances of a near-term rally look slim.

Derivatives data points to mixed sentiment

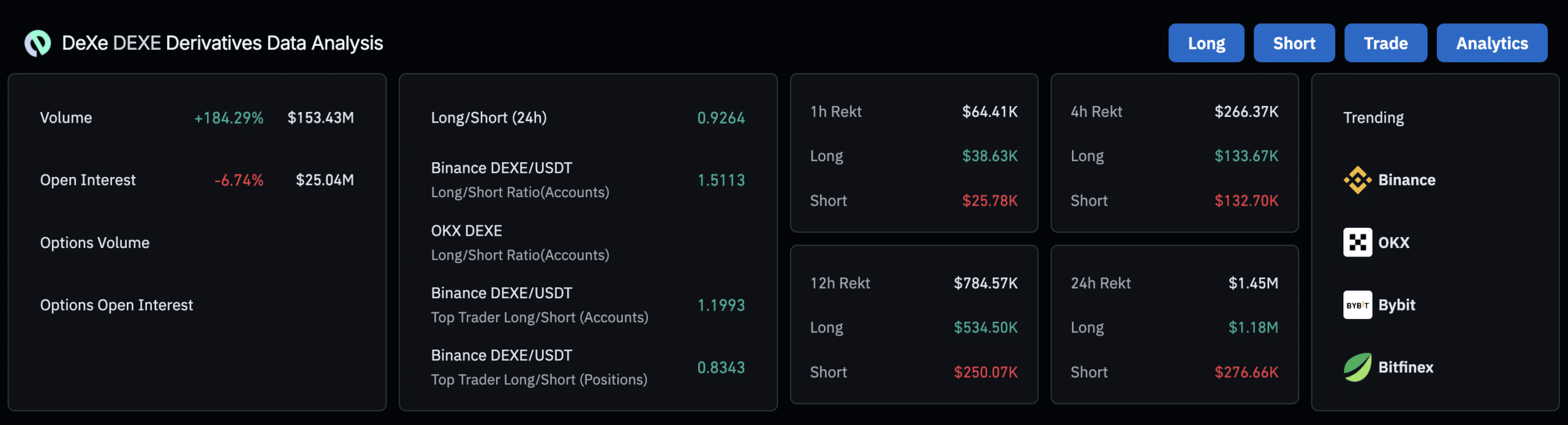

Per the latest Coinglass data, DEXE’s derivatives trading volume surged by over 180% to $153.43 million over the past day.

Meanwhile, Open Interest fell by around 6.74%, showing that some traders may be closing or reducing positions after the recent sell-off.

While the 24-hour Long/Short ratio was around 0.92, the Binance DEXE/USDT ratio (accounts) was 1.51, showing a more bullish stance among Binance traders.

Still, the broader near-parity ratio suggests caution as both bulls and bears fight for control.

If buyers defend the $14.5 zone (around the 50-day EMA), DEXE could see a recovery and attempt another rally toward its multi-year high of $21.

However, a breach below $14.5 could propel the correction and drag DEXE toward its 200-day EMA near $11.

Read DeXe’s [DEXE] Price Prediction 2025–2026

Before making any buying decision, monitoring the broader market sentiment is crucial.

With DEXE’s fundamentals and roadmap still providing a bullish long-term narrative, the coming days could offer short-term traders attractive entry points.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion