- Uniswap’s market share dropped as Raydium gained dominance, with netflows signaling investor uncertainty.

- UNI remained in a downtrend, with high liquidations and weak trader confidence limiting recovery.

A newly created whale wallet withdrew 461,874 Uniswap [UNI] ($4.56M) and 15.8M USDT from Binance within two days, raising speculation about a possible market shift.

Large withdrawals like these often signal upcoming price movements, either through strategic accumulation or preparation for a major trade.

Therefore, investors are closely monitoring whether this activity indicates confidence in Uniswap’s future or a change in liquidity strategies.

However, broader market trends suggest Uniswap faces challenges that could impact its short-term outlook.

UNI’s market share slips despite strong volumes

At press time, UNI traded at $9.02, down 2.33% in the last 24 hours. However, a bigger concern is its declining decentralized exchange (DEX) market share.

Raydium overtook Uniswap in January, capturing 27% of DEX volume, while Uniswap’s share dropped from 34.5% in December to 22%.

This shift is largely driven by Solana’s rising memecoin trading activity, which has attracted significant liquidity.

Additionally, growing dissatisfaction within the Ethereum community over Uniswap’s direction has further pressured its position.

Exchange netflow signals growing uncertainty

Uniswap’s exchange netflow showed a decline of 3.22%, indicating more UNI had left exchanges than entered. Typically, large withdrawals suggest investors are holding for the long term, which can be bullish.

However, sustained outflows also signal that traders lack confidence in short-term price appreciation. Additionally, concerns over UNI’s weakening position in the DEX market may be causing some investors to pull back.

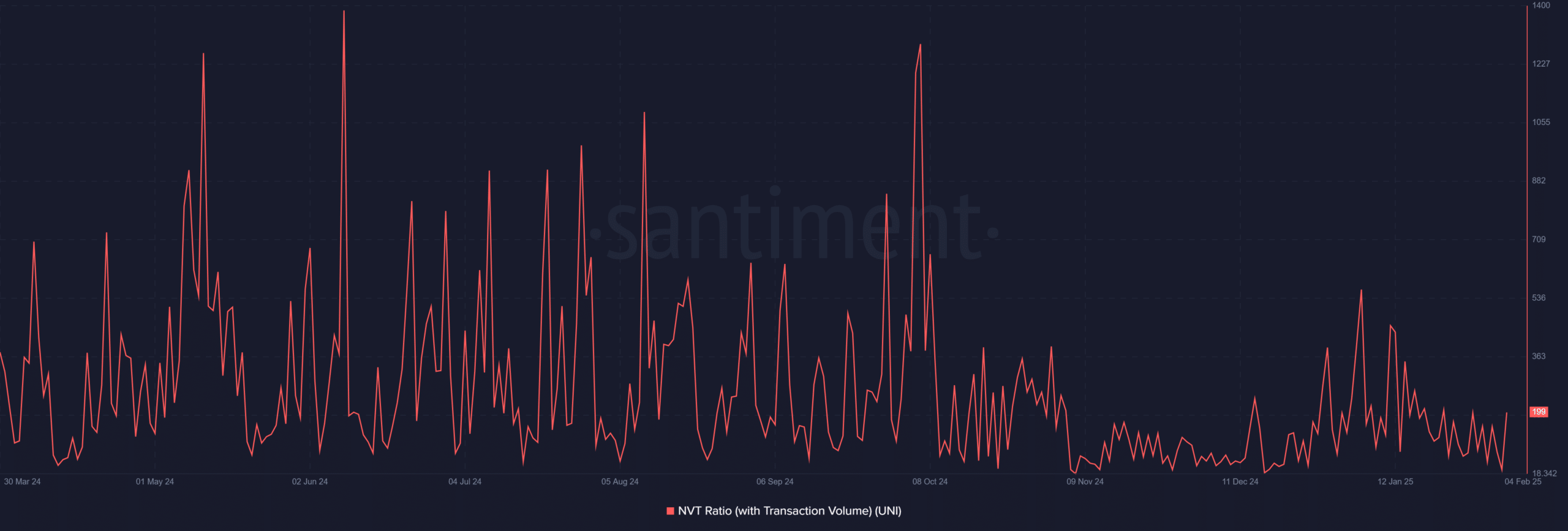

High NVT ratio raises concerns about network activity

UNI’s Network Value to Transactions (NVT) Ratio stood at 199.84, suggesting the token’s valuation is high relative to its transaction volume. Historically, elevated NVT ratios indicate a market may be overvalued.

Therefore, despite the recent whale accumulation, on-chain activity does not fully support UNI’s current price.

A high NVT ratio often leads to price corrections, as it suggests the asset is trading at a premium without sufficient transaction demand.

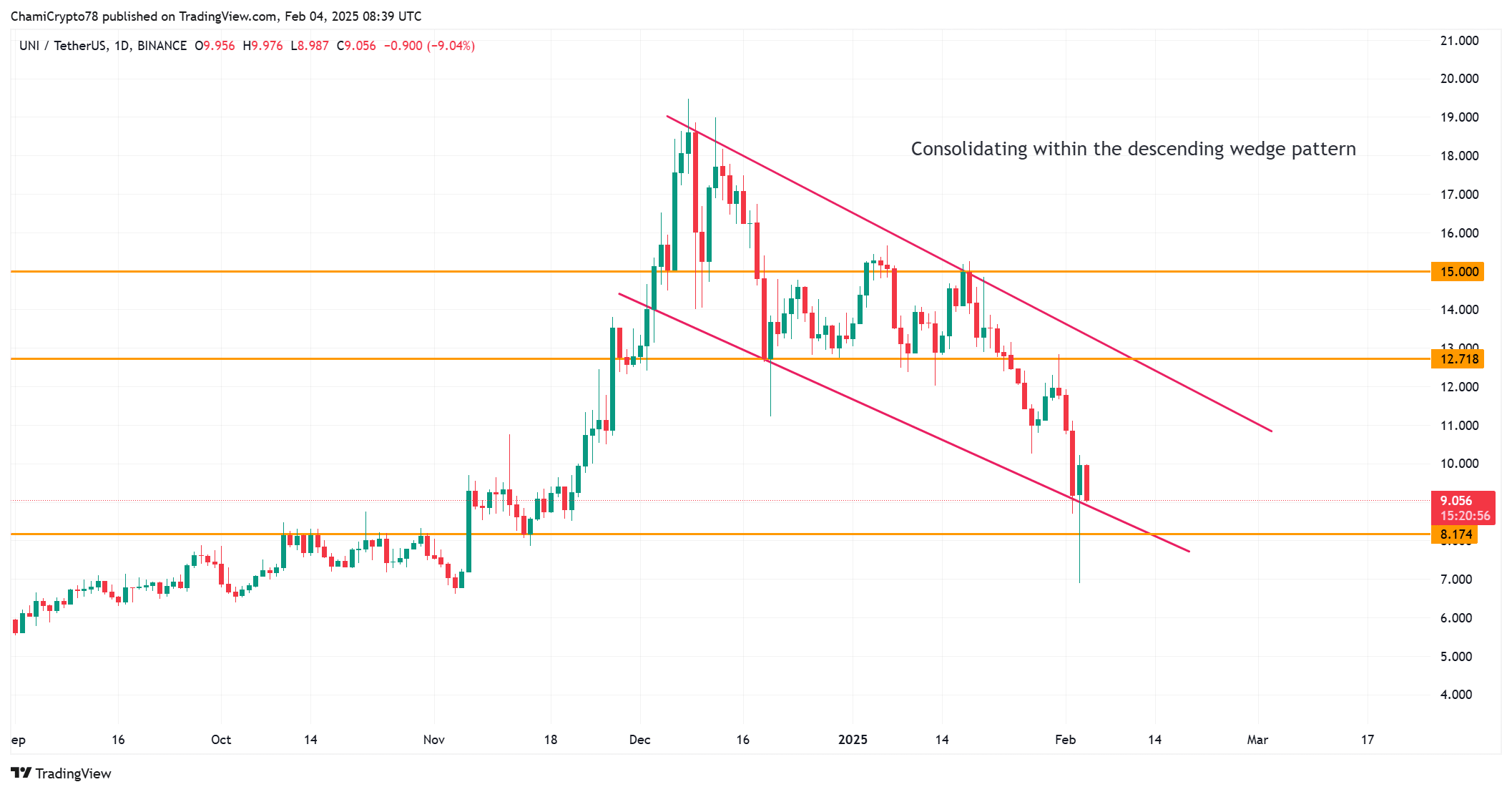

Uniswap trapped in a downtrend

Uniswap’s price was trading within a descending wedge at press time, a pattern that often precedes a breakout. The key resistance levels to watch are $12.71 and $15, while $8.17 remains strong support.

If UNI breaks above the wedge, it could signal a bullish reversal. However, failure to hold above support could lead to further downside pressure.

Therefore, the next few trading sessions will be critical in determining Uniswap’s near-term price direction.

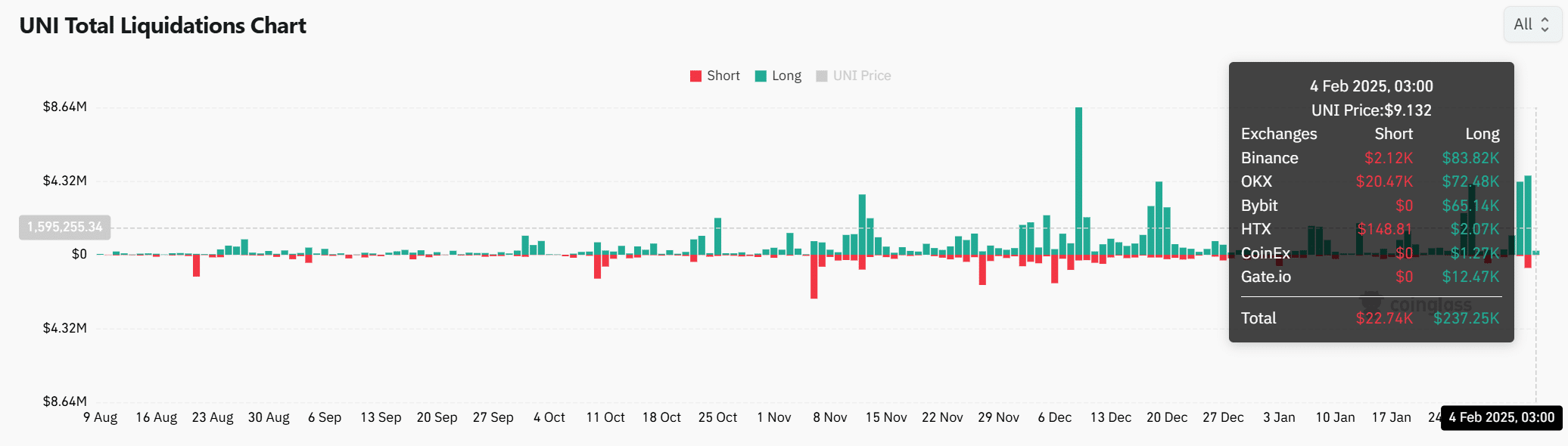

Weakening trader confidence

Open Interest in Uniswap Futures has dropped 8.85% to $235.12M, suggesting traders are closing positions due to market uncertainty.

Additionally, long liquidations ($237K) far exceeded short liquidations ($22.7K), indicating buyers were being squeezed as prices decline.

Therefore, market sentiment remains bearish, with traders reducing leverage and exiting positions. If open interest continues to fall, UNI may struggle to gain momentum.

Read Uniswap’s [UNI] Price Prediction 2025–2026

Conclusion: Will UNI recover or sink further?

Uniswap faces a tough battle as market share declines, exchange outflows rise, and network activity weakens. While the whale accumulation signals potential optimism, broader trends suggest UNI is struggling to regain momentum.

Therefore, unless it breaks resistance soon, Uniswap is likely to remain under pressure with further downside risks.