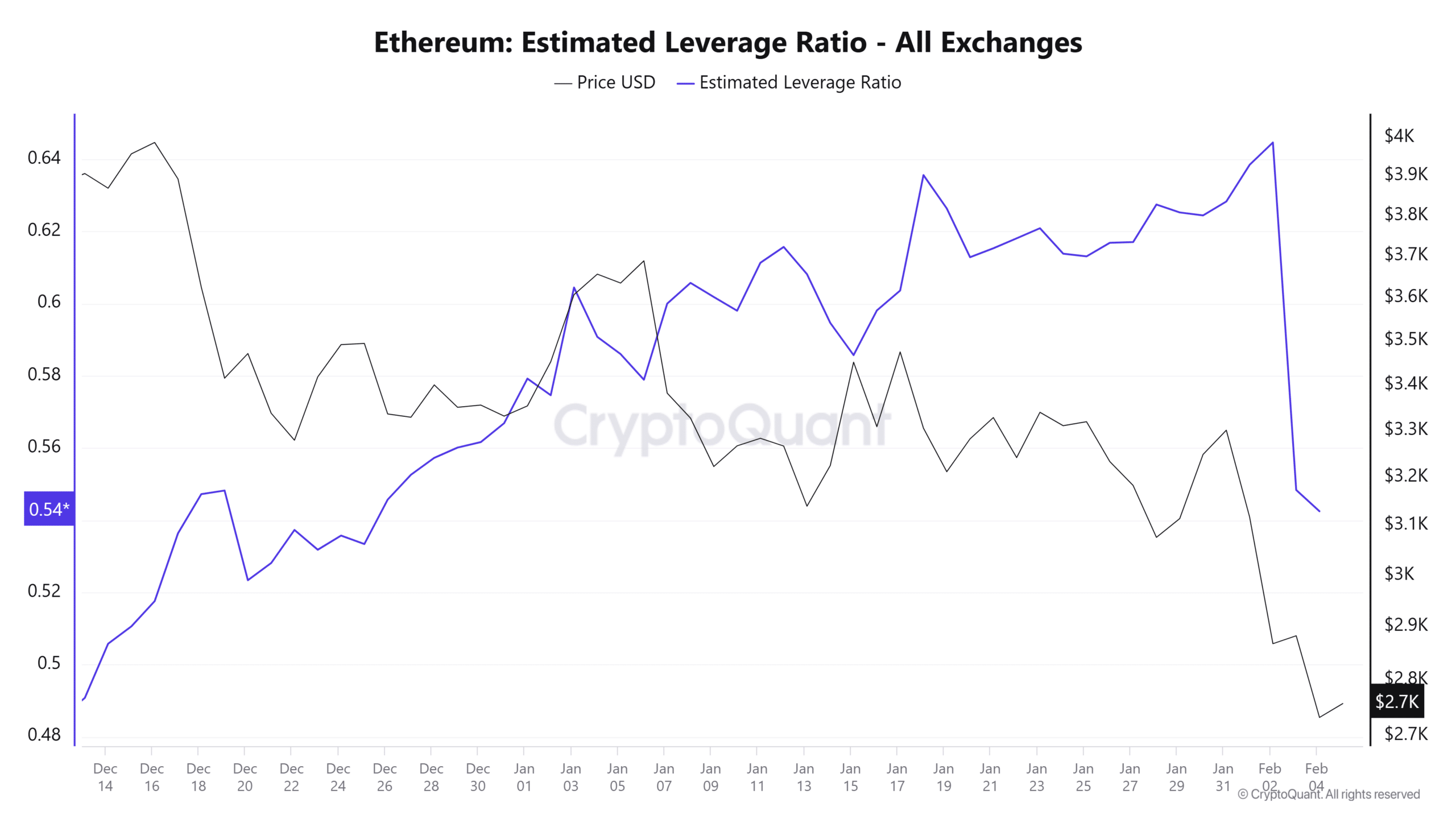

- Ethereum’s Estimated Leverage Ratio dropped by 15% in two days, showing reduced leverage in the Ethereum market.

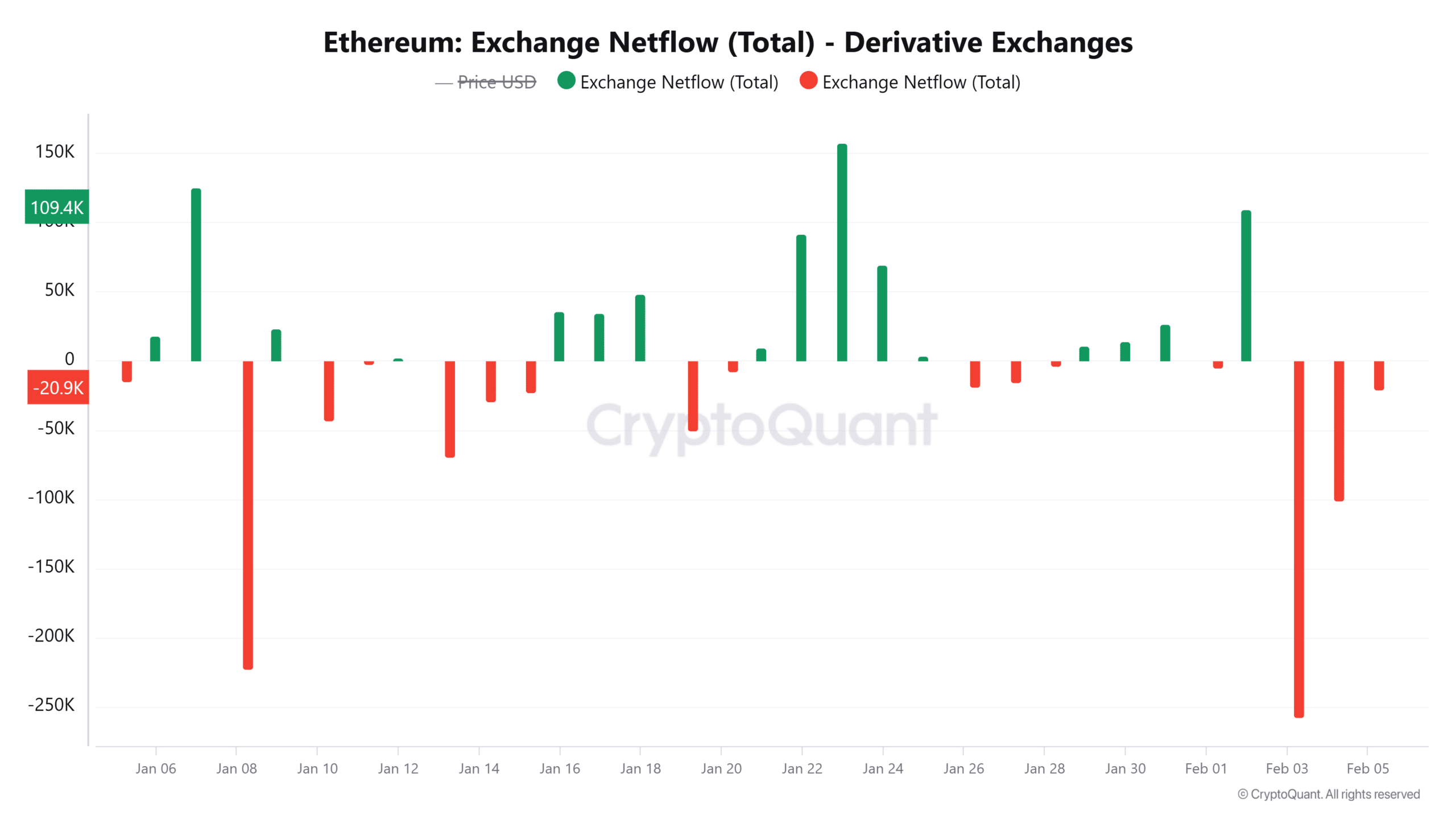

- 375,000 ETH has also been withdrawn from derivative exchanges as speculative interest wanes.

Ethereum [ETH] has had one of its most volatile weeks in history. After dropping to a five-month low of $2,160 earlier this week, the largest altcoin has since recovered to trade at $2,760 at press time.

However, this rebound could be short-lived due to shifting dynamics in the derivatives market.

Ethereum’s Leverage Ratio plunges 15%

The liquidations in the ETH market earlier this week caused a significant drop in open positions, reducing leverage.

In the last two days, Ethereum’s estimated leverage ratio decreased by 15%, from 0.64 to 0.54, marking its lowest level in six weeks.

The falling ratio follows a notable drop in open interest to $22 billion, its lowest since late November, according to Coinglass.

Looking at past trends, ETH price tends to fall whenever the leverage ratio declines.

If history repeats itself, Ethereum could likely plunge further until derivative traders begin opening new positions and show conviction in the trend.

375K ETH withdrawn from derivative exchanges

The reduced speculative activity around Ethereum is further seen in the large scale withdrawal of 375,000 ETH from derivative exchanges in the last three days.

The consistent withdrawals indicate that traders are de-risking. Moreover, the withdrawals coincided with surging inflows to spot exchanges, showing that traders are closing their leverage positions and selling ETH in the spot market.

This repositioning could exert bearish pressure on ETH due to selling activity. At the same, it shows a decline in liquidation risk, resulting in reduced market volatility.

Bearish crossover could fuel ETH’s downtrend

Ethereum had formed a bearish crossover on its one-day chart after the 50-day Simple Moving Average (SMA) crossed below the 100-day SMA.

This crossover suggests that the downward trend is gaining strength.

Despite this bearish signal, the Chaikin Money Flow (CMF) remains in bullish territory, indicating that buying pressure remains strong.

Traders need to watch for a possible dip to uncollected liquidity at $2,160. Ethereum could return to this level if sellers gain control and buying demand wanes.

Is your portfolio green? Check the Ethereum Profit Calculator

For ETH to overcome the bearish pressure, it needs to flip resistance at the 200-day SMA ($2,973). Breaching this resistance level has always boded well for ETH’s price.

Another crucial resistance level is at the 50-day SMA ($3,304), with a breakout set to ignite strong bullish sentiment.