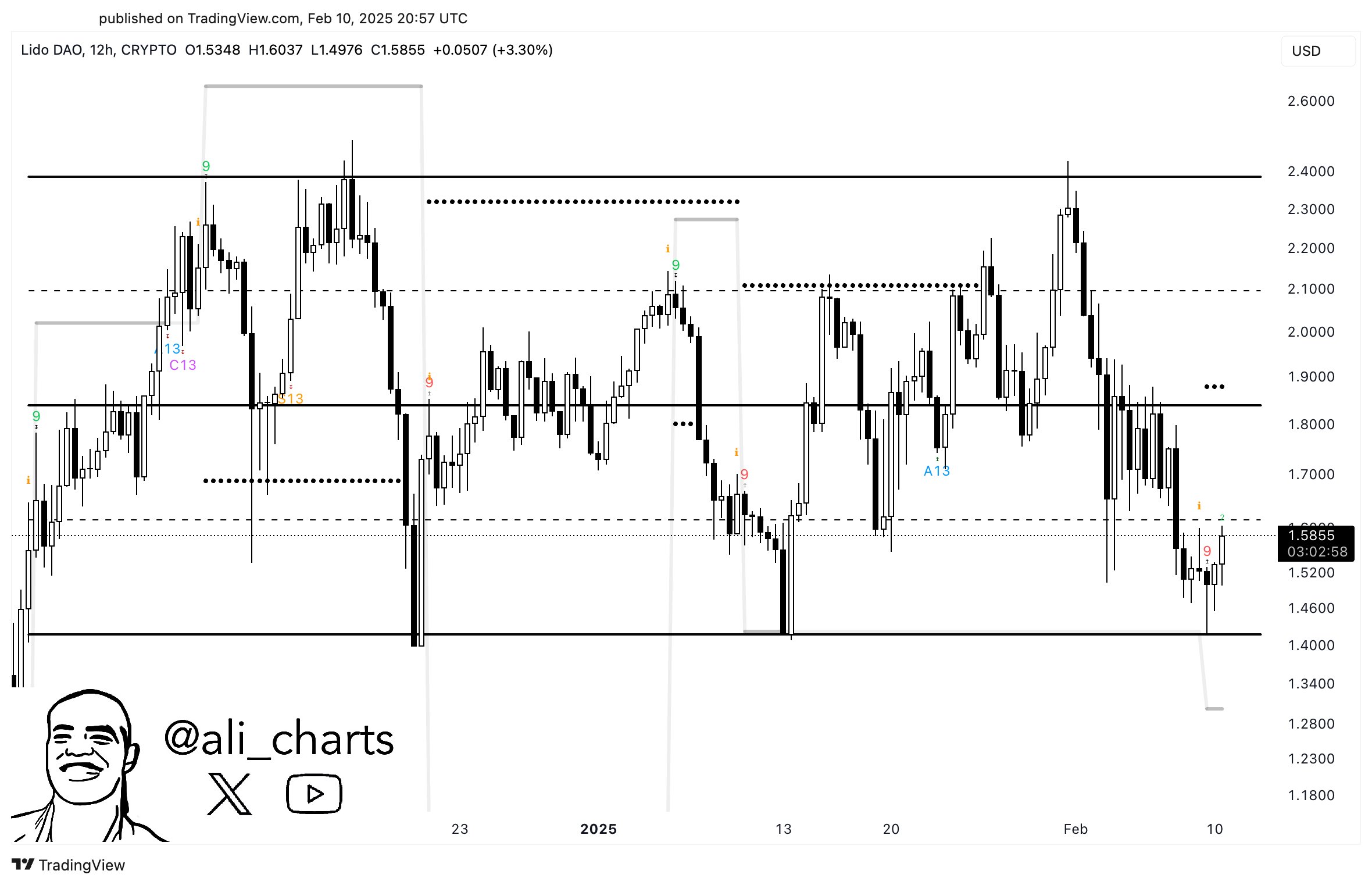

- LDO’s price showed signs of a potential rebound as it tested the lower boundary of its parallel channel.

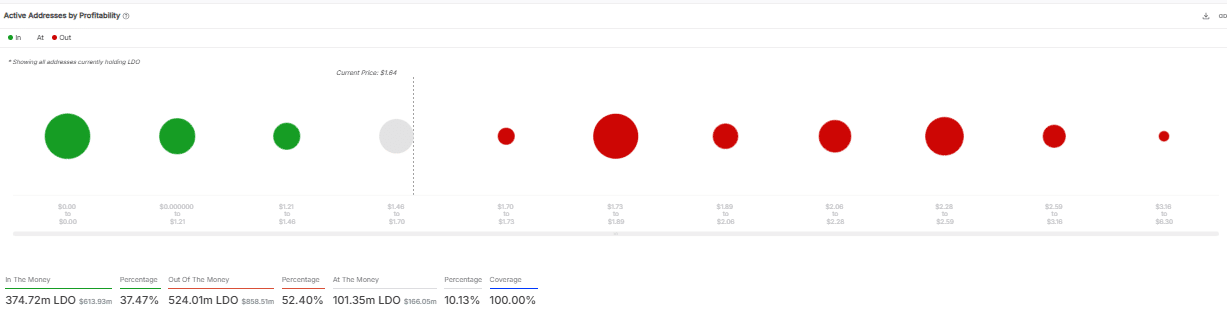

- More than half of active addresses holding Lido DAO tokens reported being “Out of the Money.”

Lido DAO [LDO] showed potential for a rebound as it interacted with the lower boundary of its trading channel.

The TD Sequential indicator provided a buy signal on the 12-hour chart when LDO approached $1.60 hinting at a possible uptrend.

Historically, LDO has touched the support level at $1.52, leading to price recoveries.

However, the price failed to break through the resistance level at $2.10 during its last few attempts at the $1.80 — $1.90 zone, indicating a consolidation phase within the channel.

If the buying momentum sustains and Lido breaks above $1.70, it could aim for the upper channel boundary at $2.40. This would spark a move to new highs.

Conversely, failure to hold current support might see LDO testing lower support levels, potentially down to $1.3400.

The future trajectory for LDO hinges on its ability to maintain above the mentioned support, coupled with sentiment and volume changes.

A successful rebound could affirm the bullish outlook, while a break below could signal a prolonged downtrend, challenging the current market structure.

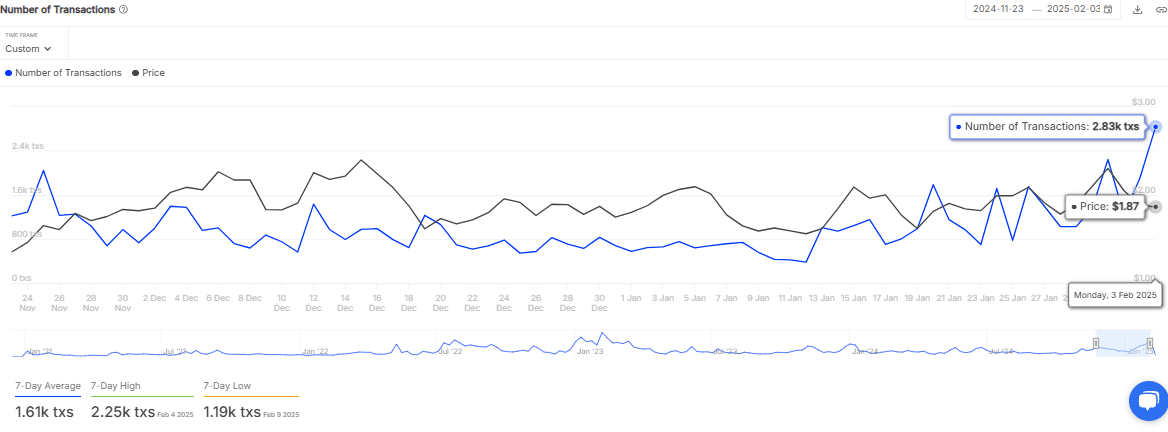

Breaking down the transaction count

Further analysis showed a rise in the number of transactions for LDO, reaching a peak of 2.83k transactions by early February 2025, correlating with an increase in price to $1.87.

This period of heightened transaction activity suggested growing interest or trading volume, which can positively impact LDO.

During late December and early January, transaction volumes consistently surpassed the 1.61k average.

This aligned with the price of Lido, which appeared to stabilize and even increase slightly during these spikes in transactions.

If this trend of increasing transactions continues, it could lead to further appreciation in LDO’s price, possibly reaching higher resistance levels.

Conversely, a decline in transaction activity could signal waning interest, potentially leading to a price correction.

Global profitability of LDO’s active addresses

The profitability of active addresses holding LDO showed 37.47% of the LDO volume was held being in profit.

Conversely, 52.40% of the LDO volume were “Out Of the Money,” showing a significant portion of holders might face losses if they sold at press time prices.

Interestingly, 10.13% of LDO holders were “At the Money,”, indicating that these addresses were at a break-even. This distribution suggested a cautious market sentiment among LDO holders.

Read Lido DAO’s [LDO] Price Prediction 2025–2026

The significant portion out of the money could act as potential selling pressure if prices rise, capping further gains.

Conversely, the in-the-money segment might provide some buying support at lower price levels, attempting to avoid losses.