- Ethereum’s demand side remains strong, signaling potential for further growth.

- ETH has dropped by 2.61% over the past 24 hours.

Since reaching $4.1k two months ago, Ethereum [ETH] has failed to maintain an upward momentum. Over this period, it has experienced extreme volatility, even dropping as low as $2.1k.

These market conditions have awakened strong sentiments among crypto analysts, with some being optimistic while others are highly pessimistic.

One of those who have shown high optimism despite the price struggle is CryptoQuant’s analyst Mac, who has pointed out that Ethereum still has room for growth.

Why Ethereum can grow more

According to the CryptoQuant analyst, despite the prevailing negative supply side factors, Ethereum’s potential for upward growth remains significantly high.

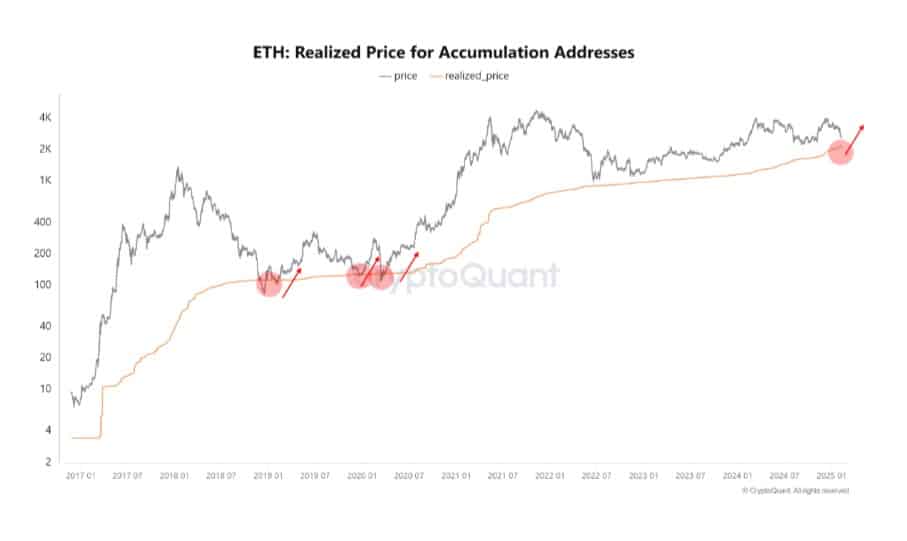

This upward potential can be seen through four major factors. First, Ethereum’s current realized price was around $2.2k at press time, which was considerably undervalued, compared to its price of $2.6k.

2.2k serves as a strong support level, as such, the circulating MVRV based on the realized price yields a value above 1. At this level, it indicates that ETH is highly undervalued.

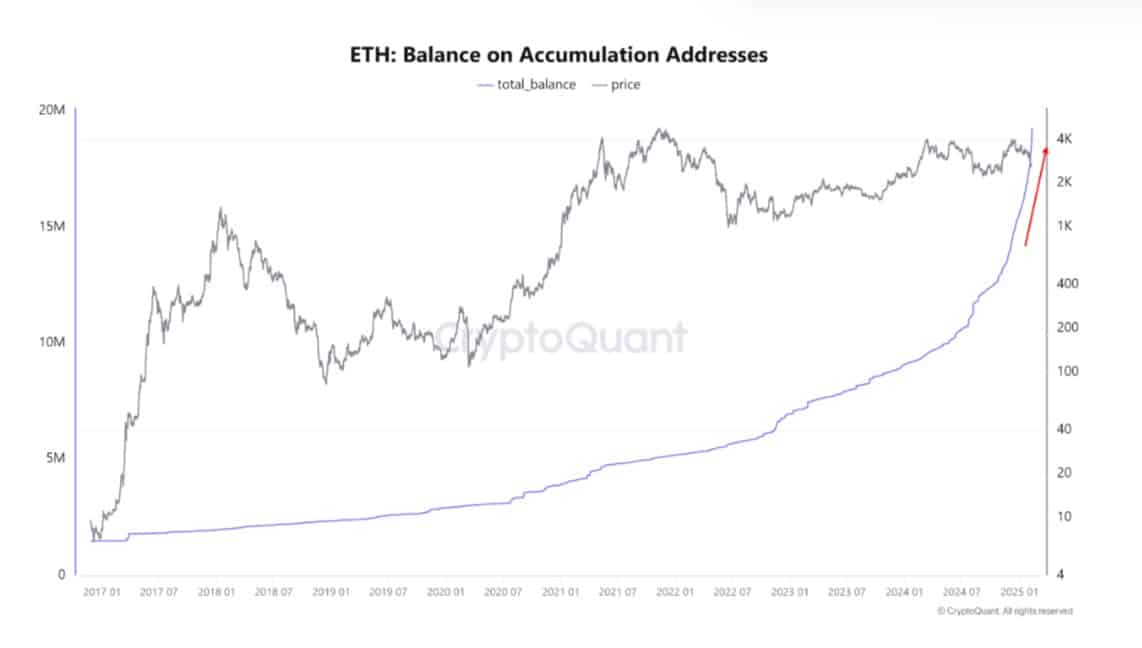

Second, Ethereum’s number of permanent holders who have accumulated Ethereum and never sold has experienced a sustained rise.

While some whales may have closed their positions, permanent holders have absorbed this selling pressure.

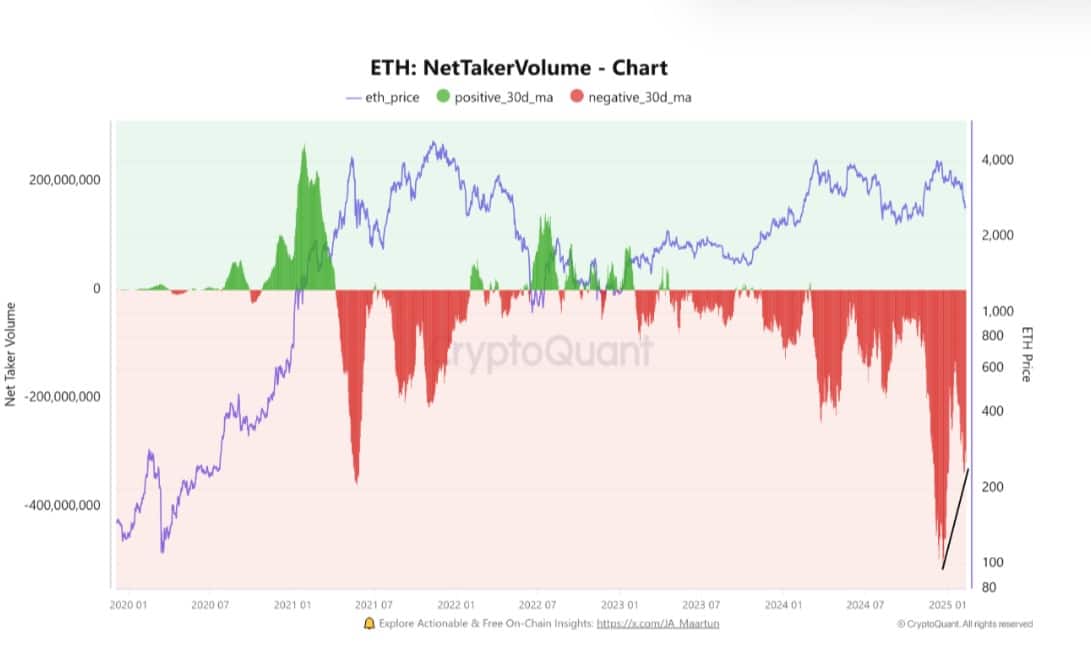

Third, Ethereum has seen the selling pressure in the futures market reduce. This indicates that although prices have declined, the selling pressure has also decreased, suggesting a relative inflow of buying power.

Finally, institutional investors are aggressively accumulating Ethereum. When ETH’s price plunged, institutions turned to buy the dip.

Thus, BlackRock bought 100.5k ETH worth $276 million, Cumberland ETH worth $174 million, and other institutions such as WLFI are actively buying.

This buying pressure is key as it’s acting as a factor offsetting downward pressure.

Therefore, although Ethereum is struggling to sustain gains, there are positive factors from the demand side.

What ETH’s charts say

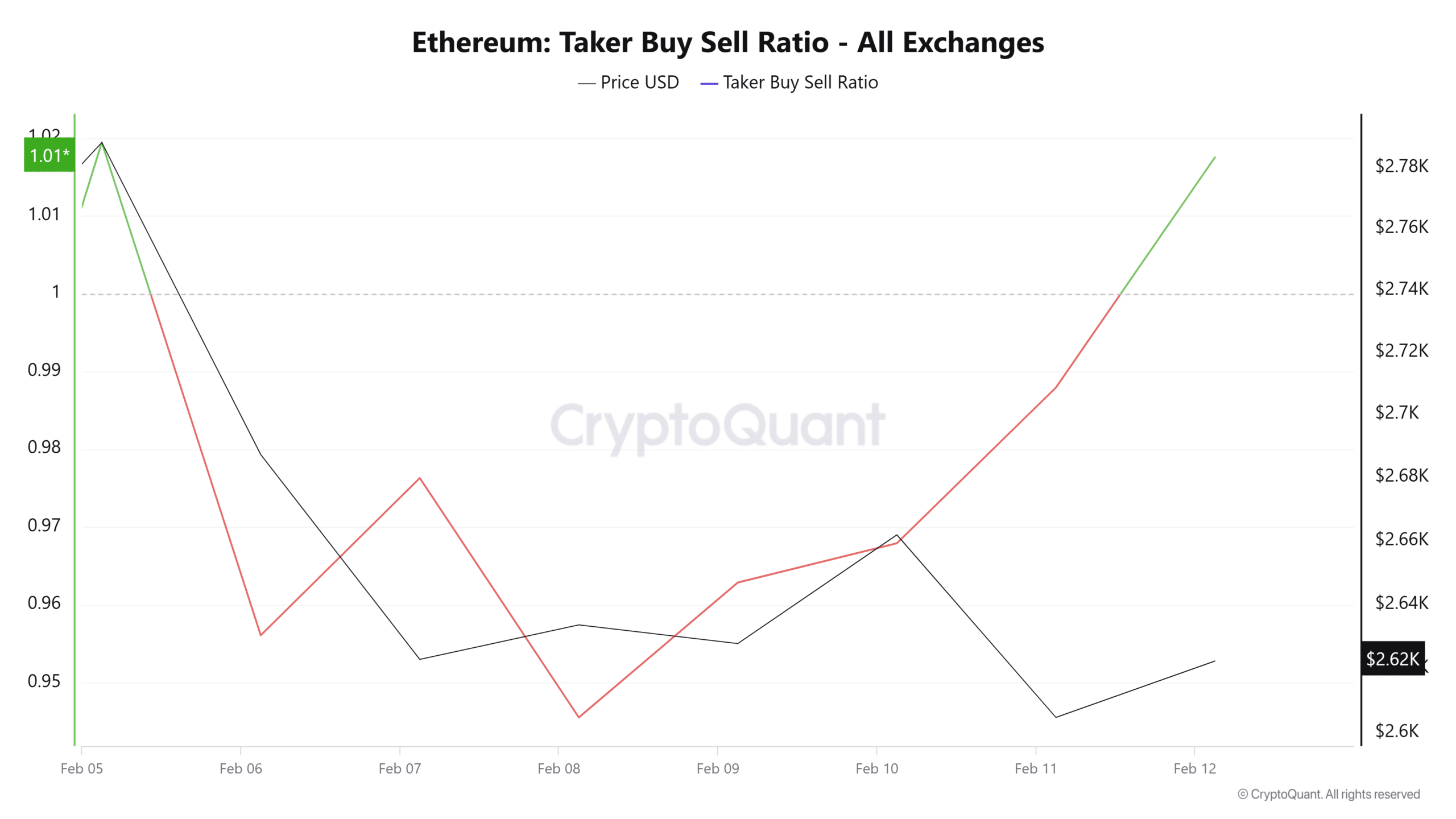

Notably, ETH was experiencing positive sentiment from the demand side.

At press time, Ethereum’s Taker buy-sell ratio flipped positive to reach 1.05 after being negative for the past five days. This implies that buyers have reentered the market and are outweighing sellers.

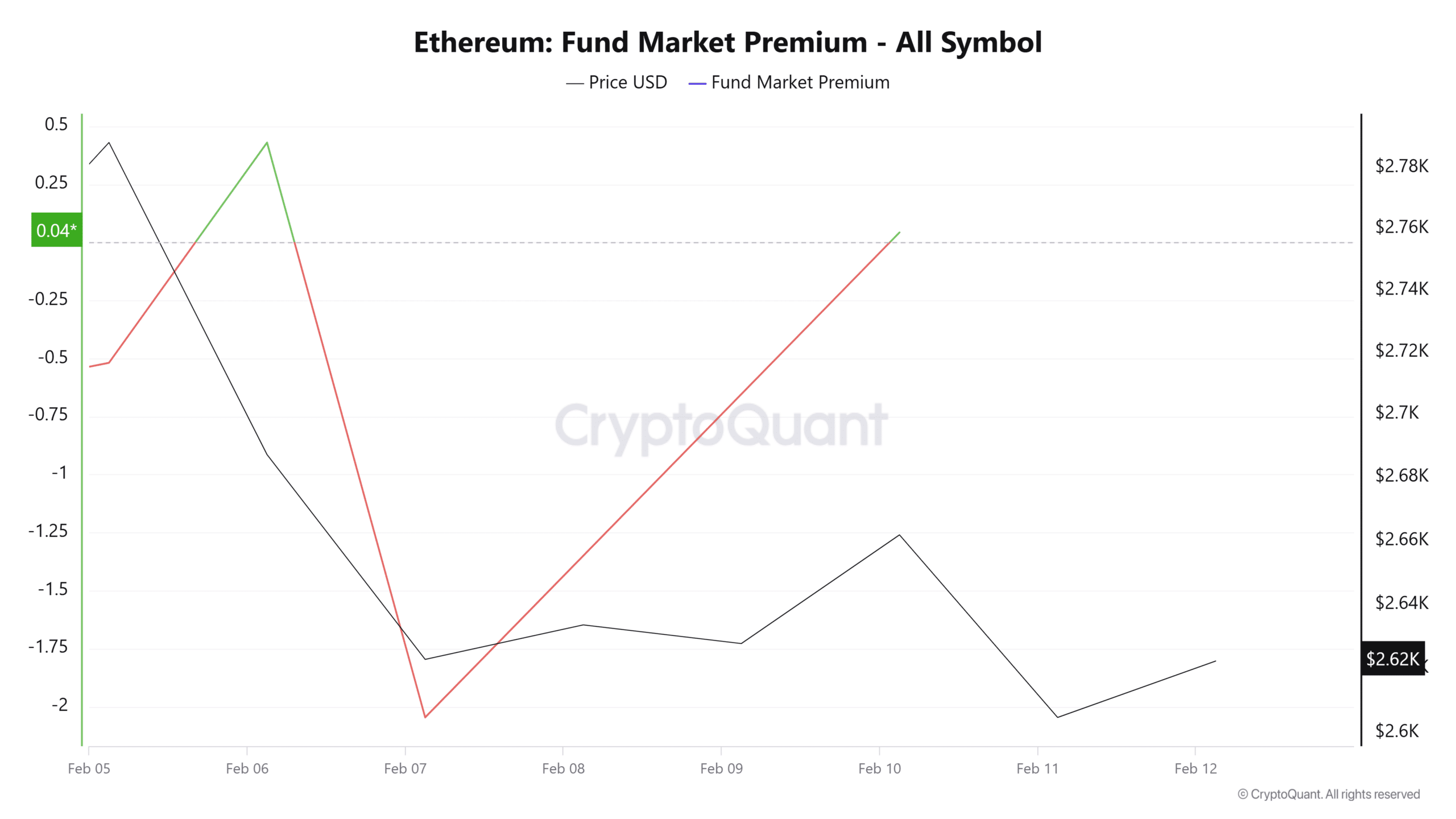

Additionally, Ethereum’s Fund market premium has flipped positive for the first time this week.

When FMP turns positive, it suggests that investors are bullish and longs are paying shorts to hold their trade as they anticipate the market to rebound.

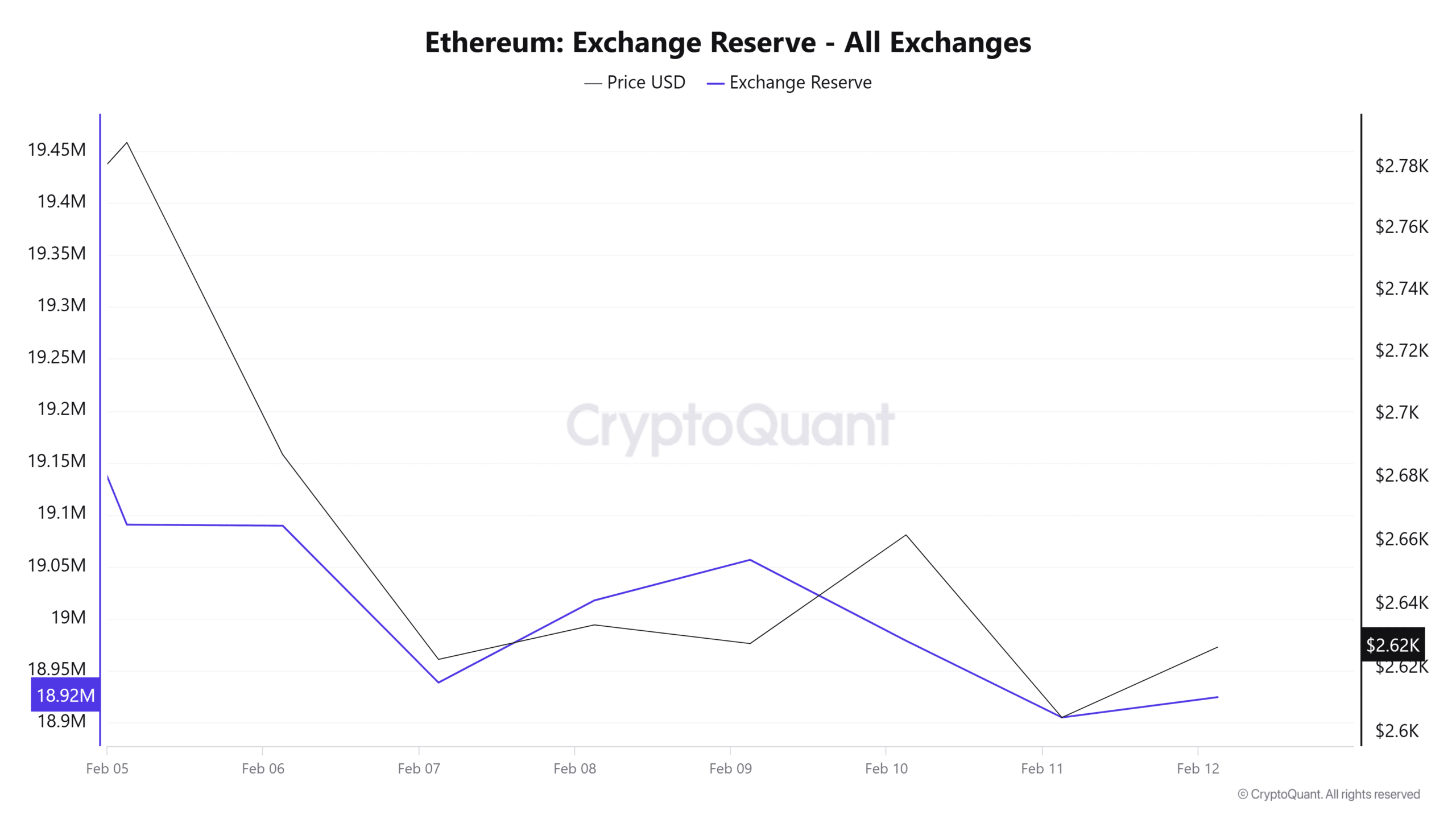

Finally, Ethereum’s exchange reserve is at a yearly low, suggesting that investors are actively accumulating ETH. As such, more ETH is moving off exchanges, suggesting that investors are keeping their assets in cold storage.

In conclusion, although Ethereum is struggling on the supply side, the demand is high. With a high demand, ETH could see the market strengthen to reclaim a higher resistance.

Therefore, with the supply and demand sides still fighting for control, ETH will continue to trade sideways until the markets and macroeconomic conditions are strong enough for an uptrend.