- Stablecoin metrics underlined the lack of potential for a price recovery in the market

- Altcoin market cap chart highlighted the likelihood of more pain ahead

The sentiment across the crypto market is one of dejection right now. The market has been rocked by the LIBRA scandal, coming days after President Trump’s tariff wars. In fact, the altcoin market may be at an inflection point, and the direction it has chosen to move in may be worrying too.

Source: Alternative.me

The sentiment across the crypto market has swung dramatically over the past month. It had been above 60 throughout January, going as high as 84. However, the losses across the market, and especially for altcoins, have hit sentiment hard.

While technically neutral, online engagement has remained predominantly bearish too.

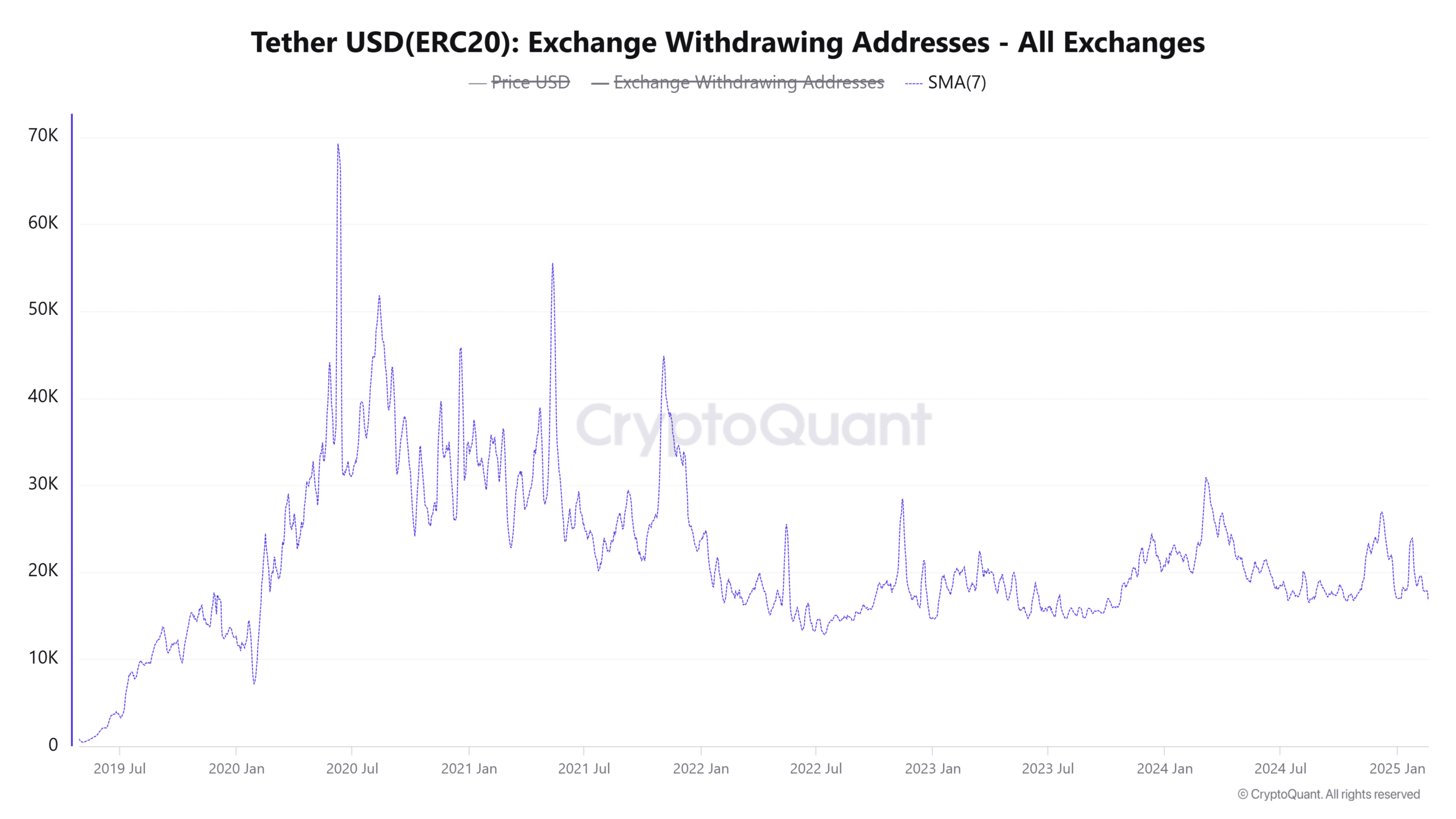

Tether metrics emphasize steady selling and lack of bullish hope in the short term

Source: CryptoQuant

Exchange withdrawing addresses for Tether have fallen over the past few days. This metric tracks the number of addresses making outflow transactions from exchanges. While it usually indicates accumulation, for a stablecoin such as Tether, it may be a bearish sign.

It hinted at profit-taking and investors moving their profits elsewhere. This could be to DeFi applications, optimistically, but it could also be to hot wallets to wait for a dip. Such a metric tends to run higher during bullish trends while falling during bearish ones.

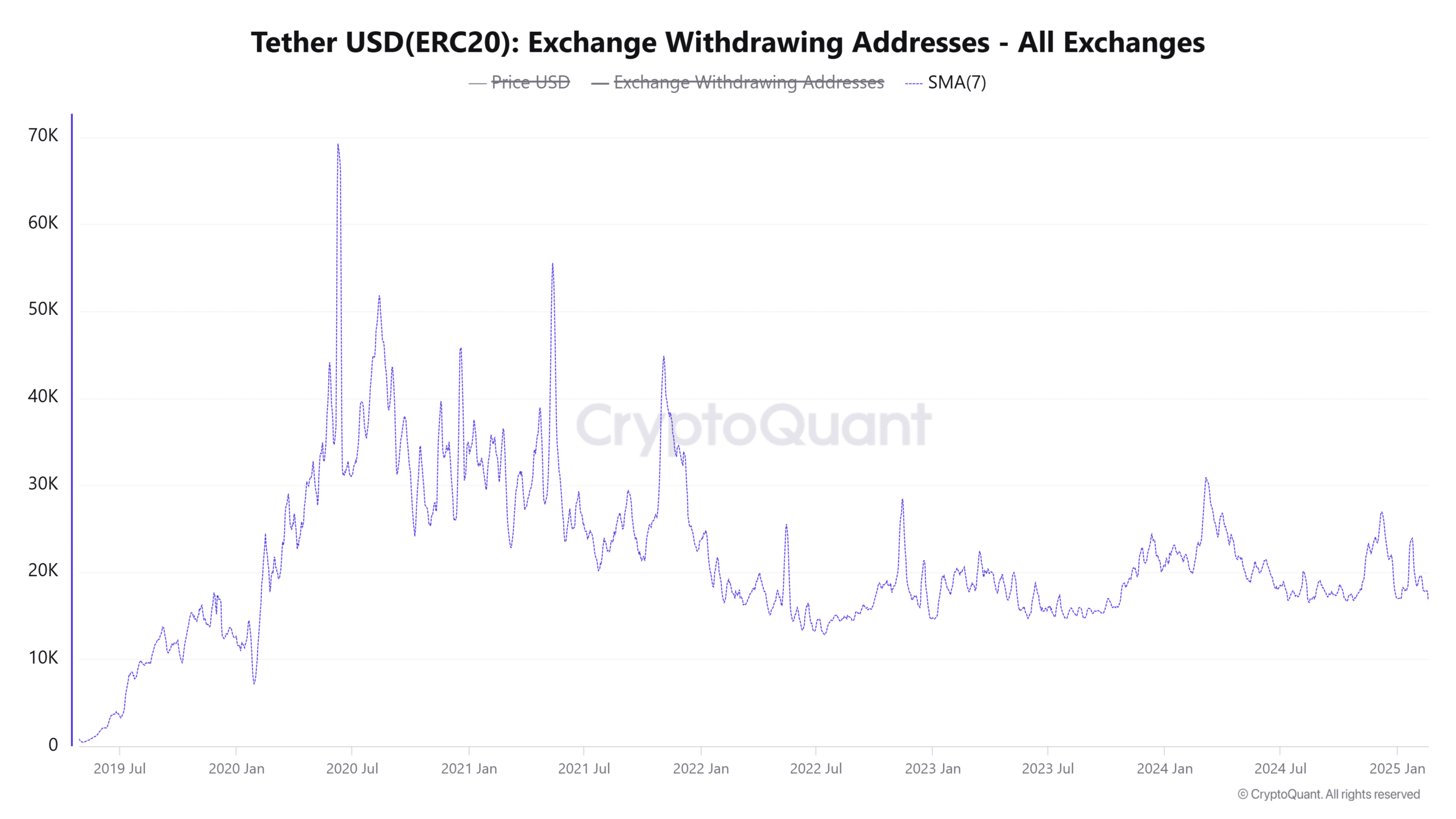

Source: CryptoQuant

Exchange netflow for USDT has also been negative on average over the past few days. The 7-day SMA revealed the metric was in negative territory for the third time since mid-December. Before December, it had been negative back in October.

Positive netflows indicate inflows of the stablecoin to exchanges. This is opposite to the withdrawing addresses seen recently and implies more buying power in the market. The November and early December periods of high inflows were replaced by scant inflows and noticeable outflows over the last ten days.

These two metrics revealed something that is already pretty obvious – The bearish state of the market. The stablecoin metrics also underlined that a reversal was not yet in sight.

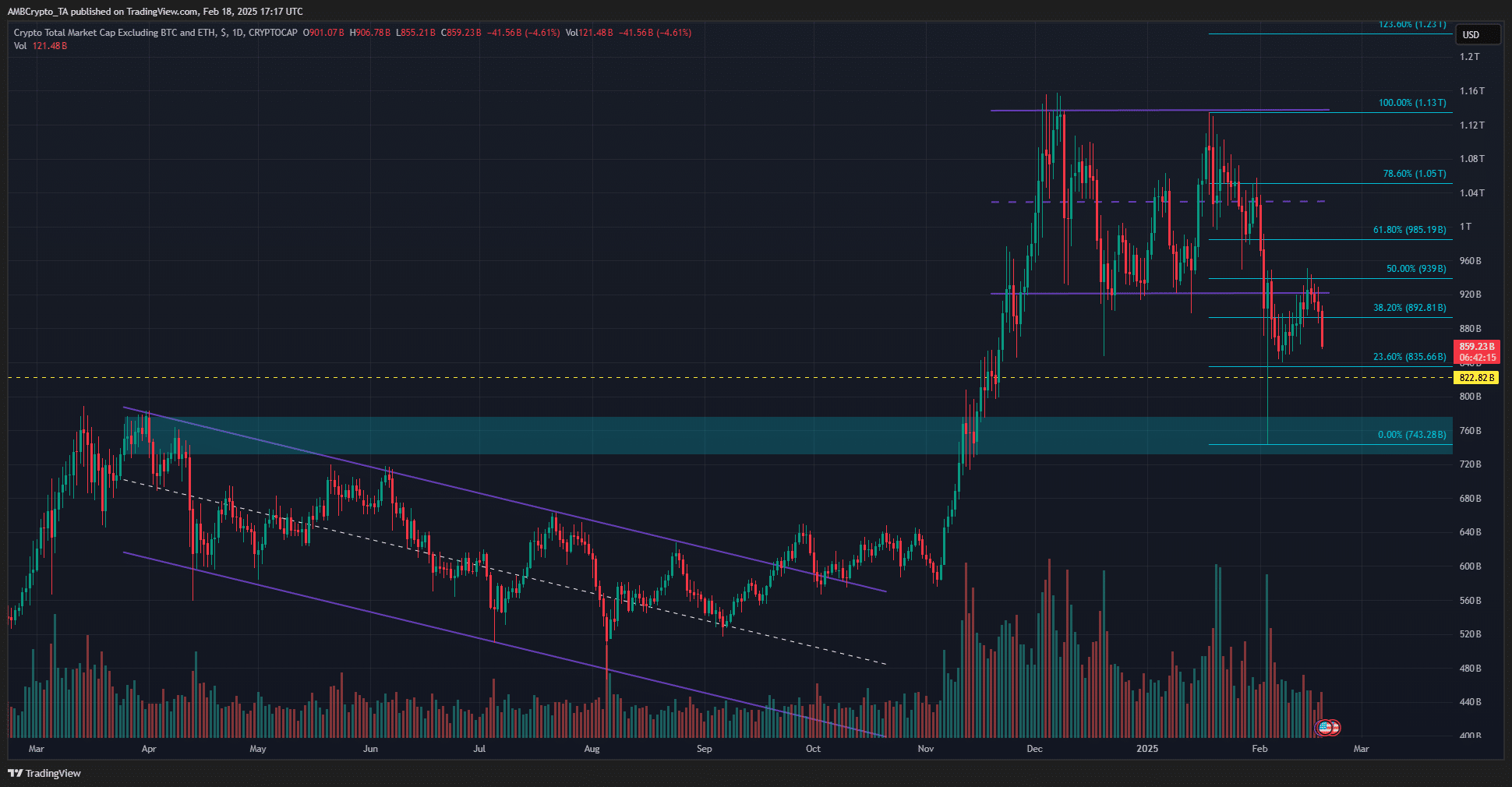

The altcoin market cap (excluding ETH) has been within a range since early December. The losses in early February forced it below the range lows at $920 billion. In the two weeks since then, TOTAL3 has retested the range lows as resistance and fallen lower once again.

The Fibonacci levels revealed that the 50% level coincided with the range lows. To the south, the support zone at $760 billion beckoned the altcoin mcap. The $822 billion-mark could also see a reaction from the market, provided Bitcoin [BTC] bulls can defend the $92k support level in the short term. The $94k level is also a short-term support level to watch BTC for a potential reversal.