- PEPE’s multiple Breaks of Structure confirmed bearish momentum, while the liquidity sweep signaled $0.00000800 as a potential bounce zone.

- PEPE needs to reclaim the zone between $0.00000900-$0.00001000 price levels for an upside shift or face further downside continuation.

Following a broader correction in the crypto markets, the price action of Pepe [PEPE] is testing crucial support levels as it trades around $0.00000822. This confirmed the bearish momentum highlighted by multiple Breaks of Structure (BOS) below $0.00000900.

Recent trading activities have seen liquidity sweeps below the $0.00000800 mark, suggesting this could act as a springboard for potential price rebounds. This was evident after the run on the equal lows that saw a short rally to the upside.

If PEPE can reclaim levels between $0.000009 and $0.00001, it could signal a possible shift in sentiment from bearish to bullish.

This hinges on PEPE price sustaining above $0.00001, which could trigger an uptrend and entice investors looking for entry points during this dip.

Conversely, failure to maintain support could lead to further declines, with PEPE potentially testing lower support levels at $0.00000700.

This scenario could reinforce the current bearish trend, making it essential for investors to watch for sustained closures below current support as a sign of continued market weakness.

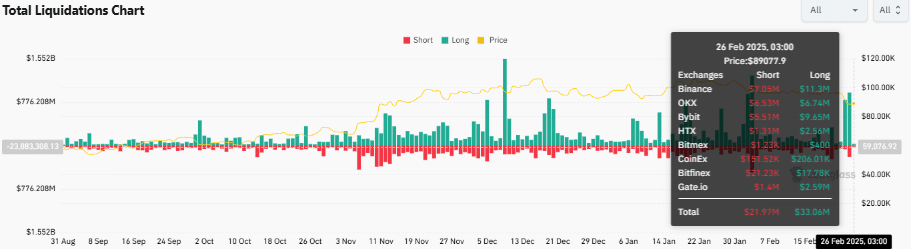

PEPE’s total liquidations

Despite the bearishness, PEPE showed signs of stabilization following a tumultuous two-day spike in total liquidations. Data indicated significant cooling off, with both short and long-position liquidations decreasing sharply.

For example, on Binance alone, short liquidations dropped to $7.05m from $63M and $22M in the last two days. Long liquidations were at $11.13M, reflecting reduced volatility.

This easing could suggest that traders are becoming cautious, potentially waiting for clearer signs of direction amidst the ongoing correction.

As liquidations decrease, it could provide a more stable environment for PEPE to regain strength. Conversely, another spike in liquidations could lead to further price declines, urging investors to stay vigilant.

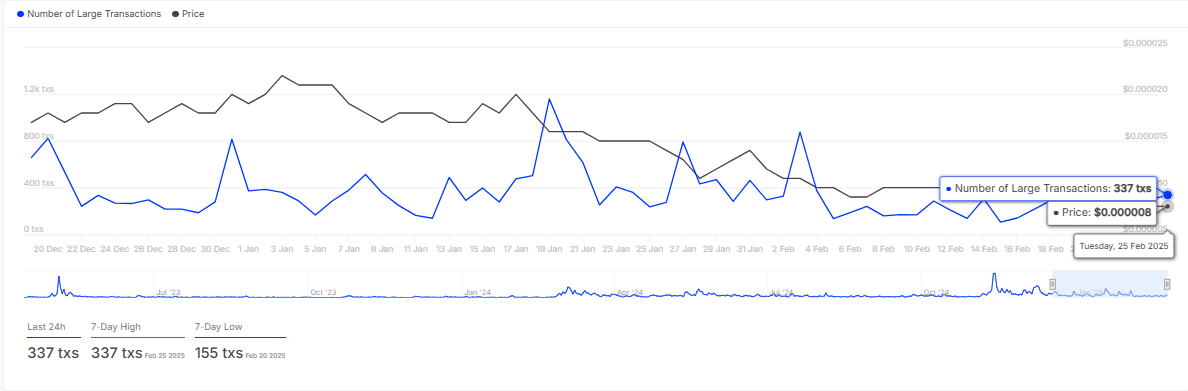

The number of large transactions stays flat

Despite the recent market dip, the number of large transactions for PEPE has remained consistent, with no significant spikes or drops. The transaction count stood at 337, mirroring the steady trend observed throughout early 2025.

This flat transaction volume, against a backdrop of declining PEPE prices, suggested caution.

Consistent transaction activity may indicate a lack of regular buyers and sellers. This hints at potential stabilization or a slow recovery phase.

If the trend continues, it could signal a consolidation period for retail traders rather than large holders.

However, a sudden increase in transaction volume could either propel a quick recovery or lead to further price declines if motivated by sell-offs.