The largest cryptocurrency in the world, Bitcoin has plunged a dramatic 11% from its all-time high. Although some investors might find this price devaluation alarming, historical data indicates that it is really small in respect to the other market cycles of the cryptocurrencies.

The past price trends of Bitcoin show several abrupt declines and rises; volatility is always present. One has to consider the context of this most recent decline in order to evaluate its future course.

Related Reading

Historical Context Of Bitcoin Corrections

Bitcoin has seen many corrections since its inception. For instance, Between January 2012 and December 2017, the value of the alpha coin dropped more than 10% on at least 13 occasions. Some corrections have caused market value losses of billions of dollars before making decent rebounds; some have even reached 20% or more.

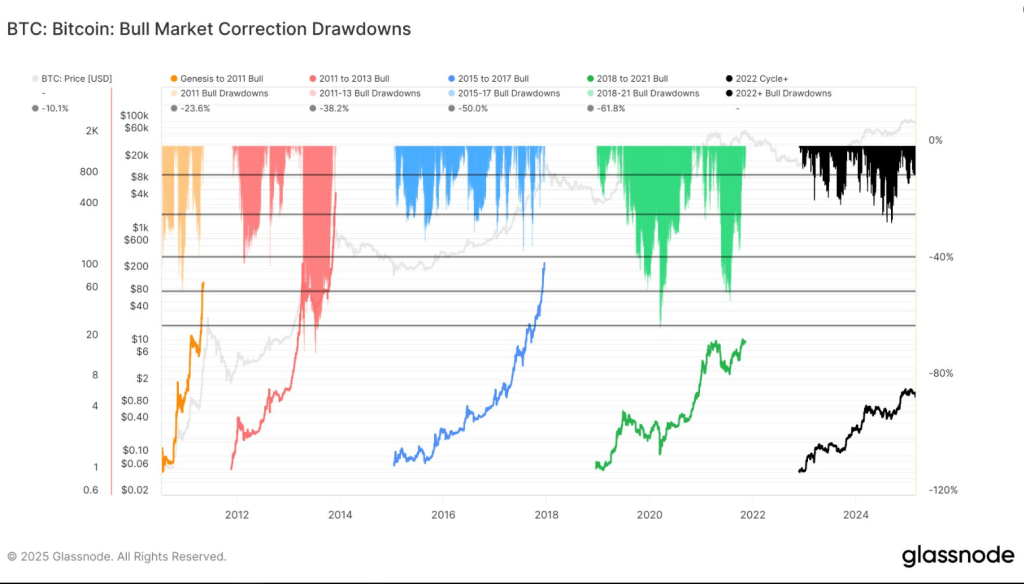

The fact that the current Bitcoin market cycle is less volatile than previous bull runs is among its most noteworthy features. The following patterns of drawdown are seen in historical data from prior cycles:

This cycle continues to be the least volatile of all:

🔹2011-2013: Avg. -19.19%, Max. -49.45%

🔹2015-2017: Avg. -11.49%, Max. -36.01%

🔹2018-2021: Avg. -20.41%, Max. -62.62%https://t.co/isZhpa3caS pic.twitter.com/JfhMa5J3kv— glassnode (@glassnode) February 26, 2025

Over time, Bitcoin has shown its ability to recover and set new record highs; these swings are inevitable in the nature of its market action. Even in bull markets, Bitcoin regularly undergoes brief declines that help to shake off weak hands before it picks back up its increasing trajectory.

Present Market Conditions

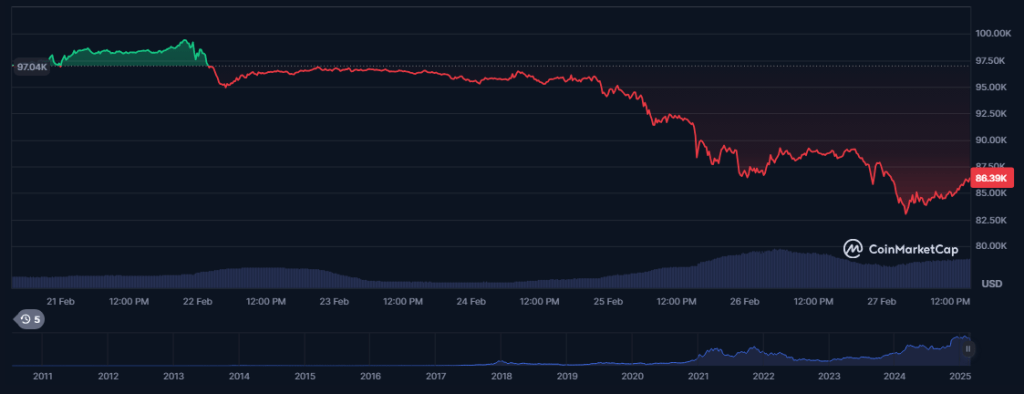

On February 27, 2025, Bitcoin was trading at $85,800, representing a 4% decrease from the previous day’s close. The intraday high was $89,230 and the intraday low was $82,460. The most recent 15% decline in the weekly frame surpasses the cycle’s average drawdown of 8.50% but is significantly less than the 26% decline in previous cycles.

Compared to other corrections, which have often lasted for months, this one is very modest. Many analysts argue that it is not a sign of deeper market concern, but rather a natural part of Bitcoin’s cycle.

Meanwhile, according to on-chain analysis, unless Bitcoin swiftly bounces back over the $92,000 level, there is a chance that lower lows will persist in the near future.

This barrier is crucial, since it represents the juncture at which the majority of short-term traders achieve profitability. Alternatively, as they mitigate their losses, Bitcoin may retrace to $70,000, or $71k.

Factors Influencing The Recent Decline

The price of Bitcoin has gone down for a number of reasons. As always, sentiment is a big factor in the bitcoin market, and even small changes in investor trust can cause big price swings.

There has also been panic selling because of worries about security, especially after the Bybit hack, which cost the crypto exchange $1.5 billion in losses.

Inflation fears, central bank policies, and global economic uncertainty have also caused investors to be more cautious with risk assets. These external pressures often drive Bitcoin’s volatility, making its price highly reactive to changing financial conditions.

Related Reading

Based on how it has behaved in the past, Bitcoin’s growth cycle seems to include dips, even though it is currently going down. It slowly got better after years of losses and reached its highest point after consolidations.

Featured image from Reuters, chart from TradingView