- Bitcoin lost $6,000 in a few hours, plunging below $83K during a severe sell-off.

- Ethereum crashed by nearly 15%, driven by massive liquidations and trade war concerns.

President Donald Trump’s victory initially fueled strong bullish momentum in the crypto market. However, the landscape has since shifted, with unprecedented volatility gripping digital assets.

Major cryptocurrencies like Bitcoin [BTC] and Ethereum [ETH] have experienced extreme price swings. The frequency of flash crashes has surged, wiping out billions in market value.

Since January, these rapid declines have become more frequent, raising concerns among investors. With Trump’s new tariff threat on the EU, the global crypto market cap stood at $2.86T, at press time, after a 1.88% decrease over the last day.

Unsurprisingly, Trump’s move has left the crypto community disappointed, as highlighted by X (formerly Twitter) user CryptoGoos. He stated,

Why are flash crashes taking place?

Seeing this, analysts suggest that multiple factors are driving this instability, offering deeper insights into the underlying market dynamics.

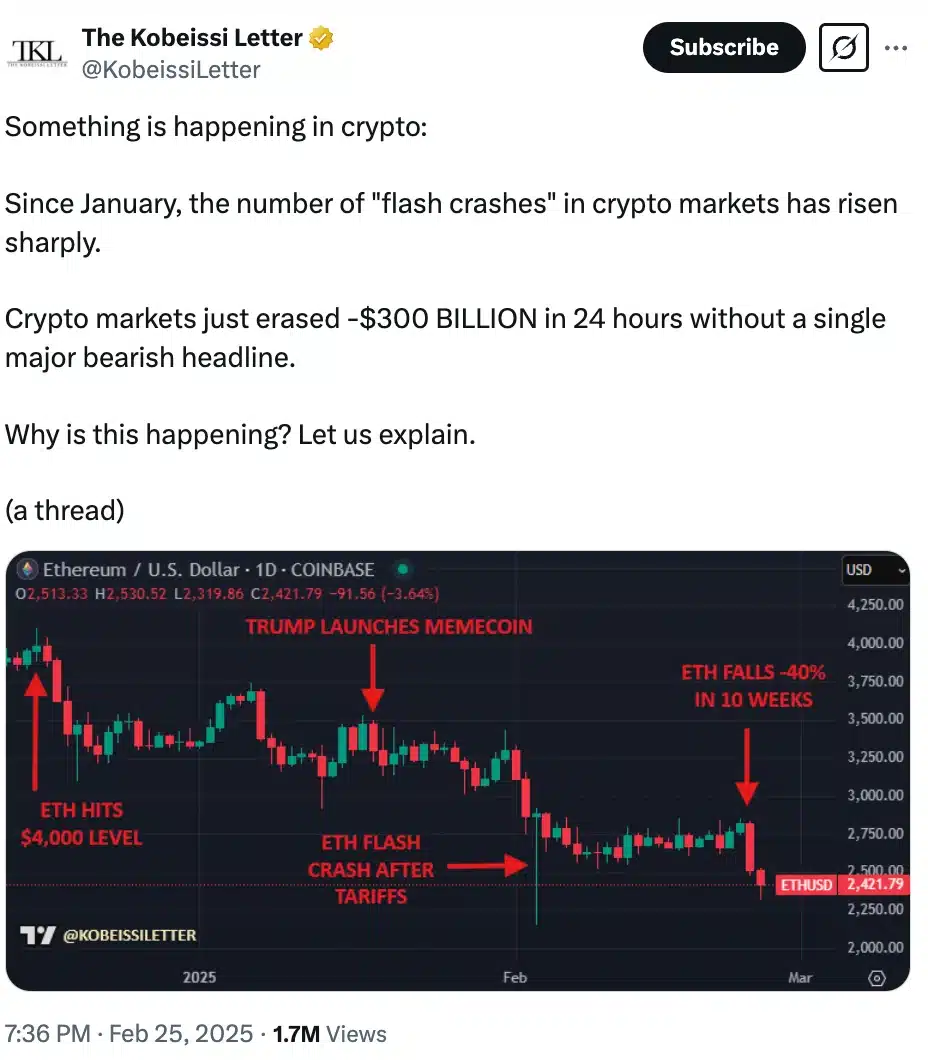

According to the Kobelsi Letter’s recent post, the rise in flash crashes highlights the growing unpredictability of the crypto sector.

Flash crashes in the crypto market have become more frequent, often occurring without any significant bearish news. This left investors scrambling for answers.

Bitcoin’s sharp drop on the 26th of February fueled extreme fear, pushing market sentiment to a five-month low at 25.

As of the latest update, the fear index has plunged to 10, signaling intense market anxiety.

Meanwhile, Ethereum faced even steeper losses, experiencing a staggering 15% crash in the past week and about 5% in the past 24 hours, driven by massive liquidations and escalating trade war concerns.

Institutional vs. retail investors

Providing further insight, The Kobeissi Letter identified a widening gap between institutional and retail investors as a key driver behind recent flash crashes.

Institutional players, particularly Wall Street hedge funds, have ramped up their short positions on Ethereum by 500% since November 2024, reflecting an unprecedented level of bearish sentiment.

In just one week, short positioning on Ethereum surged by over 40%, contributing to its sharp 40% decline since December, while Bitcoin has dropped by 15%.

On the other hand, institutions continue to accumulate Bitcoin, whereas retail investors are fueling extreme volatility in smaller altcoins like Solana.

This market “polarization” has created liquidity “air pockets,” making sell-offs more severe by triggering cascading liquidations and intensifying price instability.

Despite recent volatility, market sentiment toward crypto appears to be shifting toward cautious optimism.

What lies ahead?

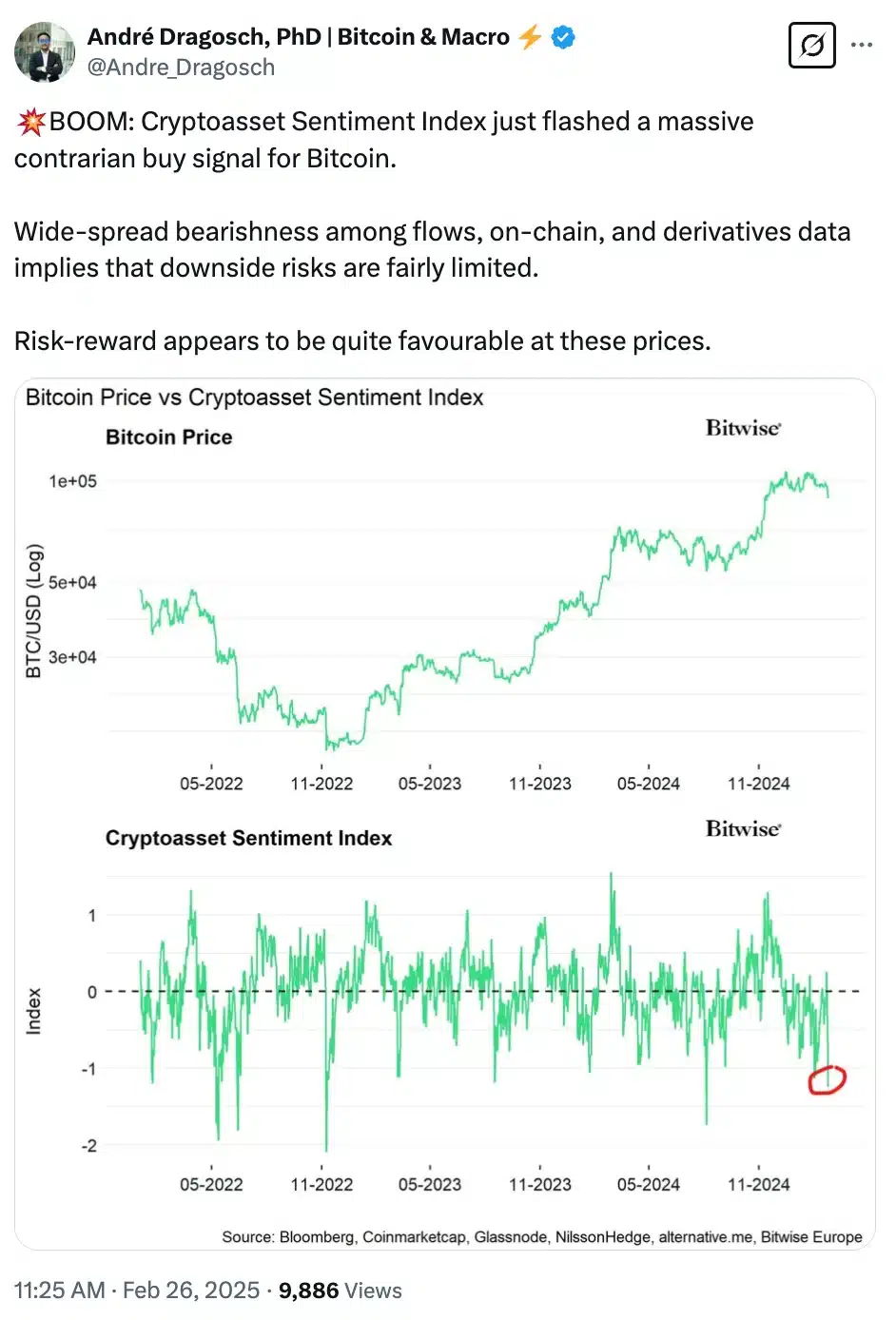

Andre Dragosch, European Head of Research at Bitwise, pointed to the Cryptoasset Sentiment Index, which signals a strong contrarian buy opportunity for Bitcoin.

He noted that widespread bearish sentiment across flows, on-chain metrics, and derivatives suggests limited downside risk, making the current price levels attractive.

However, not all experts share this view—Standard Chartered has cautioned that Bitcoin may experience further downside before regaining its bullish momentum.

As BTC hovered around $86,745.68, down 2.67% in the past 24 hours at press time, investors remain divided on whether the worst is truly over.