- Ethereum’s market displayed intriguing dynamics, hinting at a potential recovery.

- ETH’s volatility over the past month peaked at 81.61%, and then, dipped to 45.87%.

Ethereum’s [ETH] market recently displayed intriguing dynamics, hinting at a potential recovery.

Whales, Smart Money (SM), and Small DEX Traders (SDTs) showed varying levels of buying activity on decentralized exchanges (DEXs). Does this mean ETH is bound to surge?

Analyzing whale and retail buying trends

The DEX market on Ethereum revealed a recovery signal, particularly from whales, over 24 hours. Whales’ buy volume reached $9.41 million, surpassing sell volume at $6.17 million, indicating strong accumulation.

This positive disparity suggested confidence among major investors. Over six hours, Whales maintained a buying volume of $1.73 million against a selling volume of $1.60 million, reinforcing bullish sentiment.

SM and DTs also leaned toward buying, though margins were narrower. In 24 hours, SM recorded a buying volume of $1.77 million versus a selling volume of $1.96 million, showing cautious optimism.

Moreover, SDTs posted a buying volume of $3.21 million against a selling volume of $2.34 million, pointing to modest accumulation. These trends echoed the idea that the market might have stabilized, potentially marking a bottom.

However, the modest differences raised questions about whether this was a relief bounce before another drop, as selling pressure persisted among smaller traders.

Correlation with broader market activity

Furthermore, ETH’s price action aligns with broader market trends, as seen in the recent chart analysis.

The previous rally from late 2023 to early 2024 saw ETH surging by 157.49%, reflecting strong bullish momentum following a bottoming structure.

The current price pattern appears to be forming a similar structure near key moving averages, suggesting a potential rebound. A projected upside move of 228.2% could align with past cycles, indicating Ethereum’s resilience in recovering from market corrections.

The alignment with historical trends supports the thesis of a market bottom.

ETH: Assessing market flows and investor sentiment

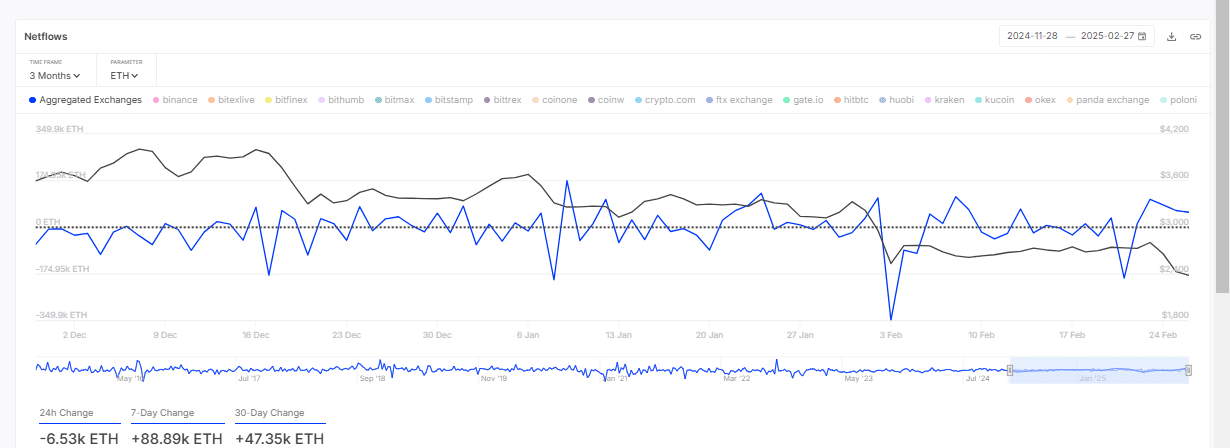

Additionally, ETH’s total Netflow stood at 55.34K ETH, reflecting net inflows over time. However, the 24-hour netflow dropped to -6.53K ETH, signaling a recent outflow.

Over the past seven days, netflows rose to +88.89K ETH, and over 30 days, they reached +47.35K ETH, indicating a longer-term accumulation trend.

These figures suggest that, despite short-term selling pressure, institutional or large holders accumulated Ethereum, aligning with whales’ buying activity on DEXs.

This pattern supported the hypothesis of a market bottom, as net inflows over longer periods often preceded price recoveries. Yet, the 24-hour outflow hinted at profit-taking or uncertainty, raising concerns about a relief bounce.

Ethereum’s volatility trends and market sentiment

Finally, ETH’s volatility over the past thirty days peaked at 81.61% on the 25th of February, and dipped to 45.87% on the 29th of January, reflecting significant price swings.

At the time of writing, volatility stabilized around 15.47%, in the last 15 hours, down from a recent high. This indicates a potential calming of market sentiment.

This reduction aligned with whales’ buying and net inflow trends, suggesting the market might have found a bottom after intense fluctuations.

High volatility often precedes major price movements, and the current stabilization could signal an upward trend. This is similar to October 2023, when Ethereum rallied after a volatile period.

However, traders should remain cautious, as the recent drop to 15.47% might precede another spike. This could indicate a relief bounce before further decline.

The bullish catalysts—new leadership at the Ethereum Foundation, gas limit changes, and staking integration for the spot Ethereum ETF—could sustain this recovery if volatility continues to ease.