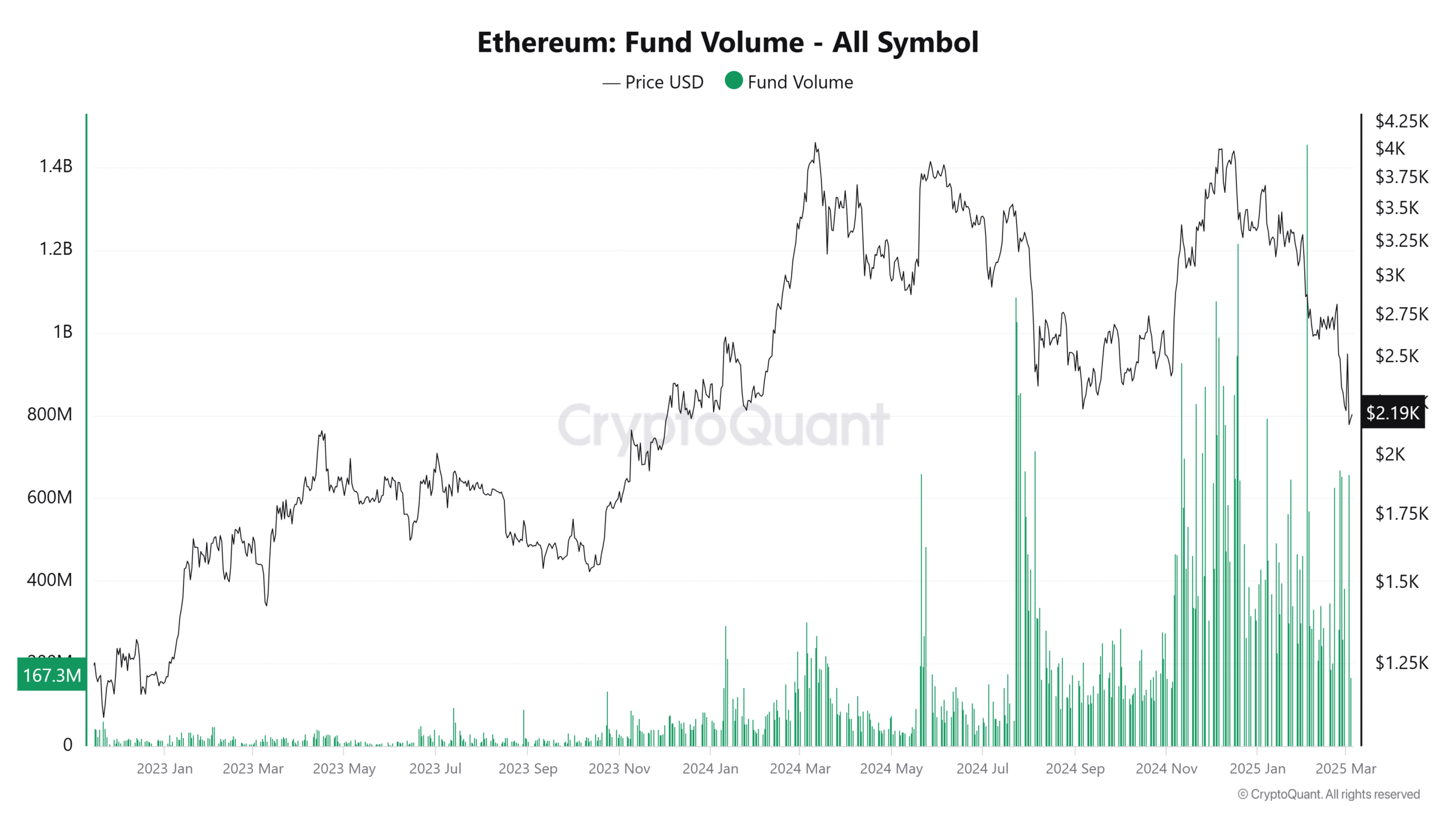

- ETH’s funding volume chart from 2023 to March 2025 showed price fluctuations and trading activity.

- The peak of 160.89K new addresses in early 2021 mirrored the recent 17,855.3 ETH purchase, suggesting fresh investor interest.

Ethereum’s [ETH] market remains highly reactive to large purchases and institutional activity, which can influence price trends and overall sentiment.

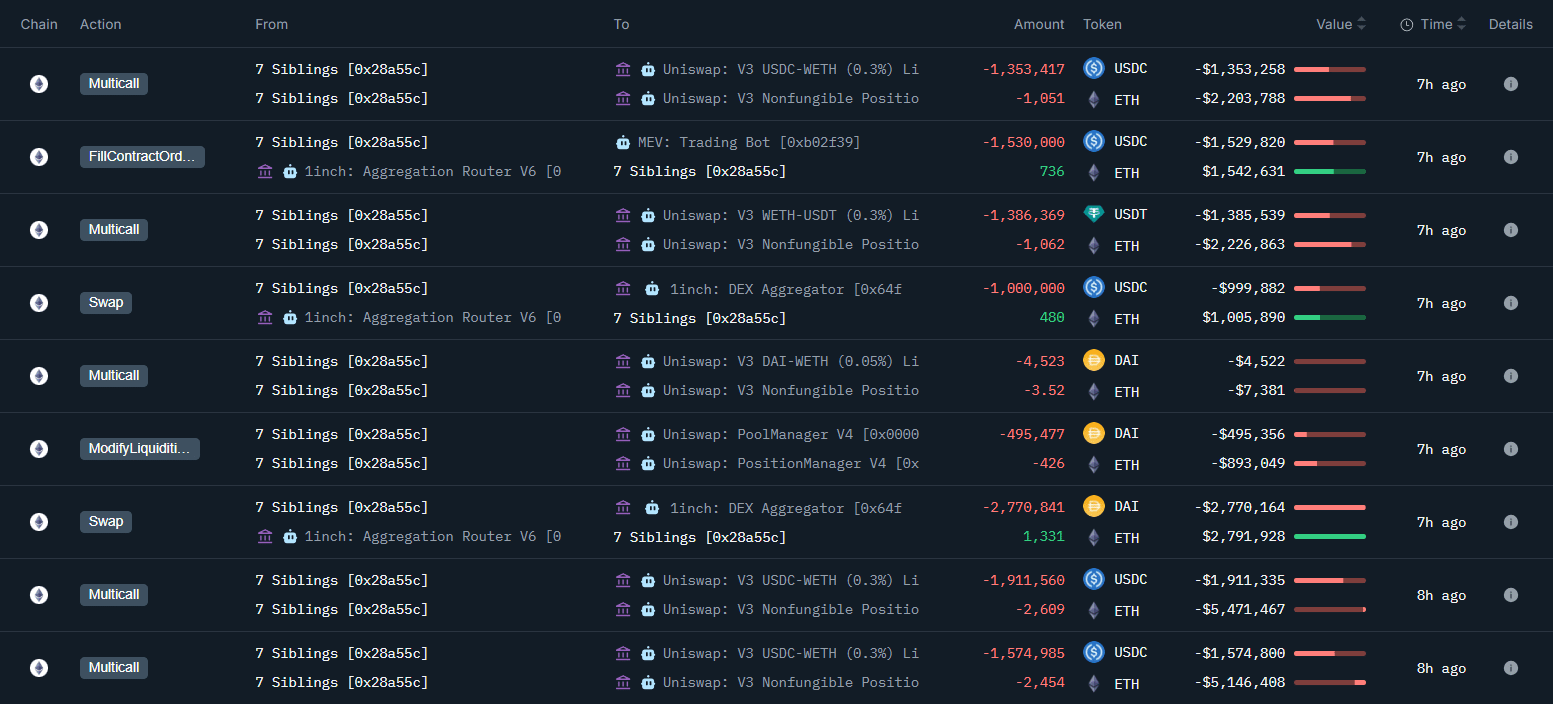

The recent acquisition of 17,855.3 ETH by “7 Siblings” raised speculation about a potential market rebound or strategic investor positioning.

The mysterious entity, “7 Siblings,” acquired 17,855.3 ETH for $36.68M in DAI, USDC, and USDT, averaging $2,054 per ETH.

This entity reportedly held over 1,169,015 ETH valued at $2.53B across two wallets. Such a significant investment indicated strong confidence in Ethereum’s long-term value.

Institutions typically accumulate assets during market dips, aiming for strategic entry points. The $2,054 price level aligned with recent lows, suggesting a calculated move.

If additional institutions followed suit, ETH could rise beyond $2,500, attracting retail investors. However, large players also manipulate markets, triggering FOMO before selling at peaks.

The $2.53B valuation indicated substantial influence, making a sell-off a risk that could push prices below $2,000.

Signs of strength or weakness?

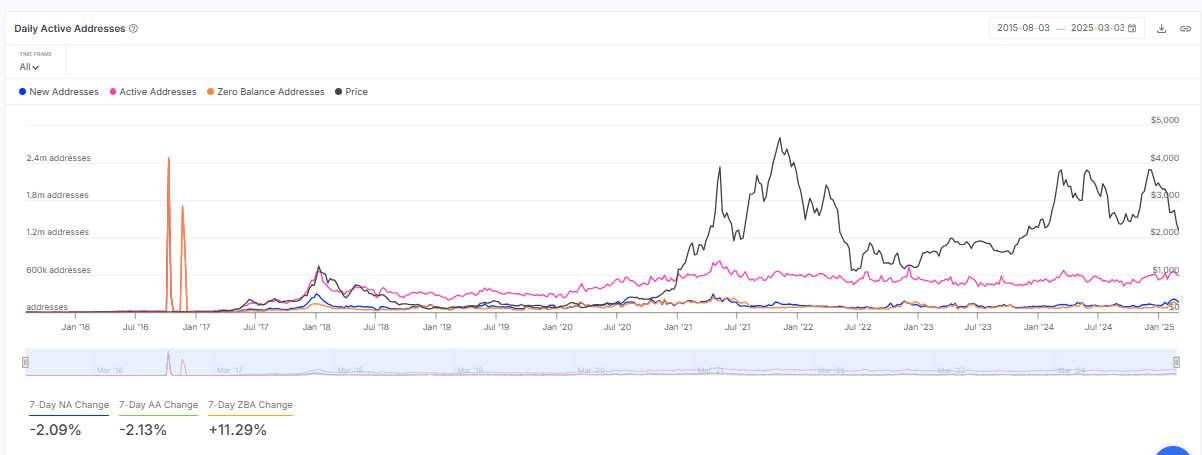

ETH’s active address showed total addresses at 847.59K, with 160.89K new addresses, 587.72K active addresses, and 98.98K zero-balance addresses as of the 5th of March.

Over the past seven days, new addresses declined 2.09%, active addresses dropped 2.13%, and zero-balance addresses increased 11.29%.

The peak of 160.89K new addresses in early 2021 mirrored the recent 17,855.3 ETH purchase, suggesting fresh investor interest.

The 587.72K active addresses indicated steady engagement, aligning with the $2.53B holdings from “7 Siblings.”

However, an 11.29% rise in zero-balance addresses signaled profit-taking or abandoned wallets, hinting at possible bearish sentiment.

If new addresses stabilize above 150K, it could confirm growing adoption. Conversely, a continued 2.09% decline might suggest weakening demand, pushing ETH below $2,054.

Traders should watch for a reversal, as 2021’s address surge preceded a $4,800 rally, hinting at potential institutional-driven price action.

Liquidity trends

Consequentially, ETH’s funding volume chart from 2023 to March 2025 showed ETH price fluctuations and trading activity.

The price peaked at $4,250 in late 2023, dropped to $2,194, then rebounded to $2,925 by March 2025.

Funding volume hit 1.4B in mid-2024, saw a low of 167.3M in early 2023, and spiked to 800M recently. This surge aligned with the “7 Siblings” $36.68M ETH purchase at $2,054, boosting fund volume to 800M.

Strong buying pressure at $2,925 suggested ETH could reach $3,500 if volume remains high. A drop below 400M might signal a correction toward $2,194.

Historical trends show 2021’s 1B volume surge led to a $4,800 breakout, indicating a similar move could occur with institutional backing.

Finally, Ethereum’s market remains highly reactive to institutional activity, with the 17,855.3 ETH purchase signaling potential bullish momentum.

Funding volume trends indicate possible upside if sustained, with $2,500 as a key level and $3,500 as a potential target. However, a drop below $2,000 remains a risk if selling pressure increases.