As part of the push to make Synthetix staking great again, Synthetix is focused on deepening liquidity for its native stablecoin, sUSD. A crucial part of this effort is the sUSD/sUSDe Curve pool, which offers LPs an opportunity to earn incentivized yield while strengthening stablecoin liquidity across DeFi.

In this guide, we’ll walk through how to participate and stake your LP tokens for additional rewards.

Why Provide Liquidity?

Liquidity is the backbone of a stablecoin’s utility. sUSD is designed to power the Synthetix ecosystem, serving as the primary settlement asset across Synthetix Exchange and upcoming vaults. By providing liquidity to the sUSD/sUSDe pool on Curve, LPs earn rewards while helping ensure deep, efficient markets for sUSD.

The pool accepts two assets:

- sUSD – The stablecoin backing Synthetix’s onchain trading ecosystem.

- sUSDe – A yield-bearing synthetic dollar from Ethena (@ethena_labs), which provides passive earnings to holders.

Please Note: Due to the yield bearing qualities of sUSDe, market prices above $1 are normal.

How to Deposit

Step 1: Acquire sUSD or sUSDe

To provide liquidity, you’ll need either sUSD or sUSDe.

- sUSD can be obtained by swapping on any major DEX aggregator, such as Llamaswap.

- sUSDe can be acquired by staking USDe on Ethena or purchasing directly on a DEX aggregator such as Llamaswap.

Curve allows depositors to choose any amount of each token to deposit, but LPs may earn positive slippage from providing the stable which balances the pool.

Step 2: Add Liquidity

Liquidity providers can deposit sUSD, sUSDe, or both into the sUSD/sUSDe Curve pool and receive LP tokens representing their share of the pool.

By adding liquidity, you earn by facilitating swaps between sUSD and sUSDe, supporting deeper liquidity for Synthetix’s ecosystem.

Step 3: Stake Your LP Tokens

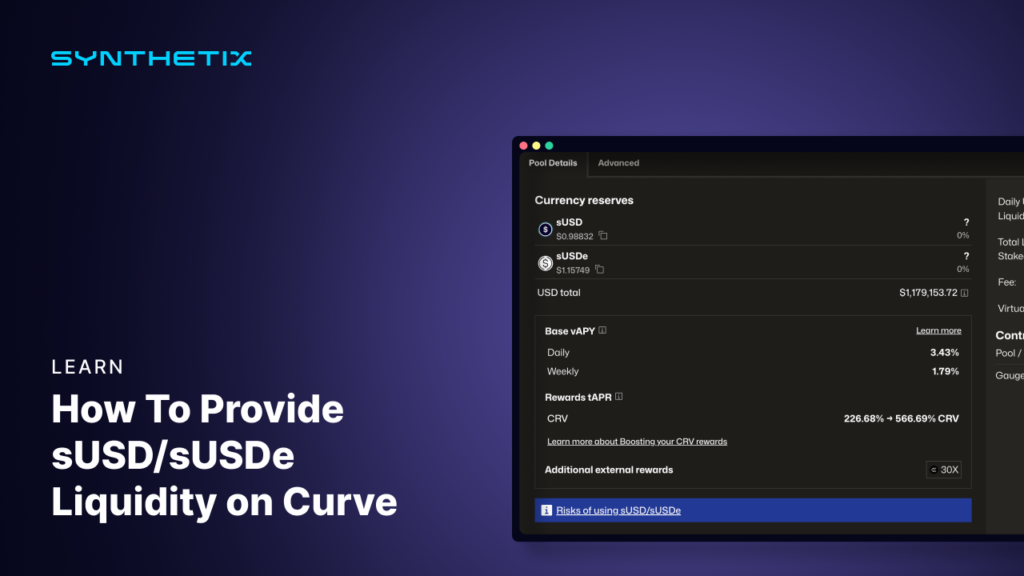

After depositing, LP tokens can be staked on Curve in the Rewards Gauge to earn CRV rewards.

Current yield is shown in the pool details. The pool’s tAPR may be boosted with locked CRV, or veCRV, but all LPs will earn tAPR. Learn More About Curve’s Rewards.

Risks of LPing

Providing liquidity in DeFi comes with risks, including smart contract vulnerabilities and impermanent loss. LPs should evaluate risks before depositing. Learn More About Curve Pool Risks

Stay Connected

The sUSD/sUSDe pool is a core part of strengthening Synthetix’s stablecoin and offering LPs an opportunity to participate in the Synthetix ecosystem. To follow more news from Synthetix, join the community.

Join the conversation: discord.gg/synthetix

Subscribe to TG: https://t.me/+v80TVt0BJN80Y2Yx

Follow us on X: x.com/synthetix_io