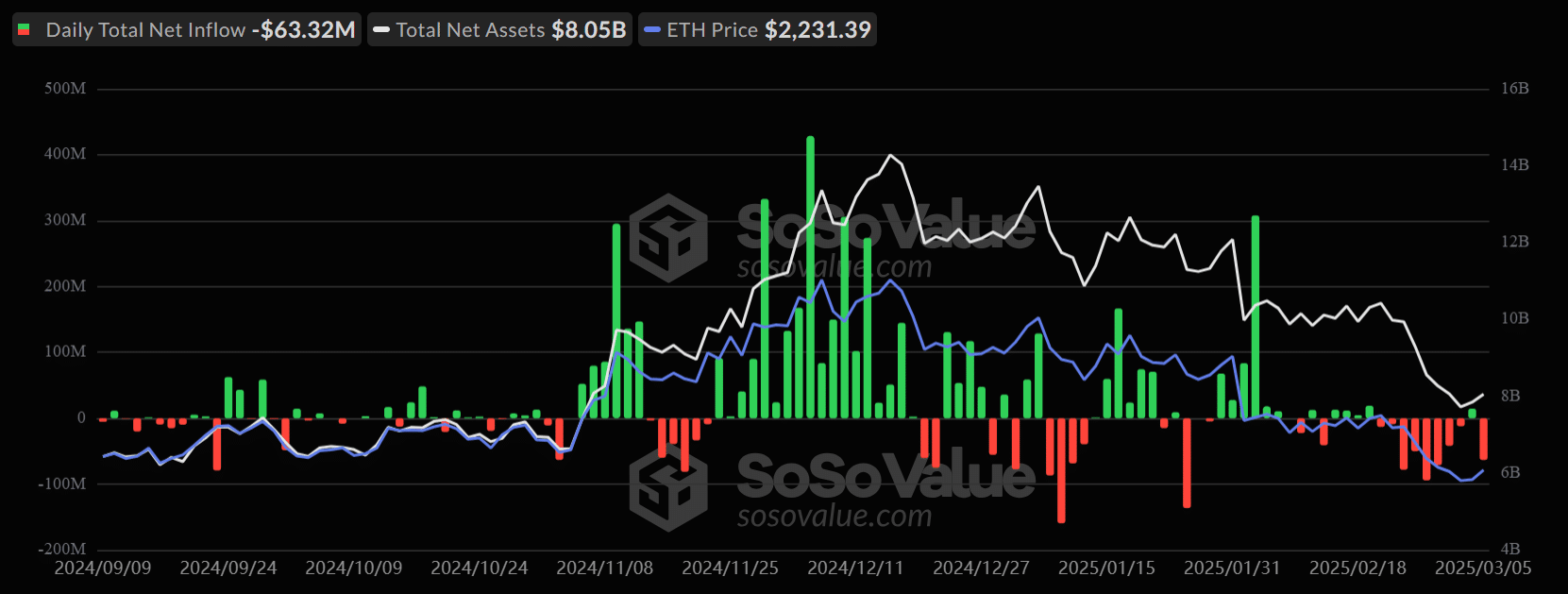

- ETH ETF flows briefly turned positive on Tuesday but logged $63M outflows on Wednesday.

- There was an increased interest in ETH as a corporate treasury asset.

Ethereum [ETH] ETF flows turned positive after 10 days of an outflow trend, signaling a likely renewed demand for the altcoin.

On the 4th of March, the products logged $14.58M inflows, and marched with a relatively stronger trading volume, noted Matthew Sigel, head of digital research at VanEck. He said,

“ETH – Yesterday marked the first positive flow day for ETH ETPs in 10 trading sessions. Trading volumes were also strong yesterday at $527mn vs. the running average since launch of ~$358mn.”

Institutions adopt ETH despite choppiness

However, the trend hasn’t been reversed yet, as the products saw $63 million in outflows on the 5th of March.

When zoomed out on a weekly timeframe, the products saw $60M outflows this week compared to last week’s $333M bleed-out. Simply put, the ETH ETF sell-off relatively eased this week.

That said, ETH has seen renewed interest as a corporate treasury reserve despite the ongoing choppy markets.

The Nasdaq-listed BioNexus Gene Lab Corp (BGLC) unveiled its ETH corporate treasury, citing the blockchain’s liquidity and financial innovation.

“BGLC is pioneering a corporate strategy that exclusively focuses on Ethereum (ETH) as a treasury reserve asset, recognizing its unique strengths in liquidity, security, and financial infrastructure.”

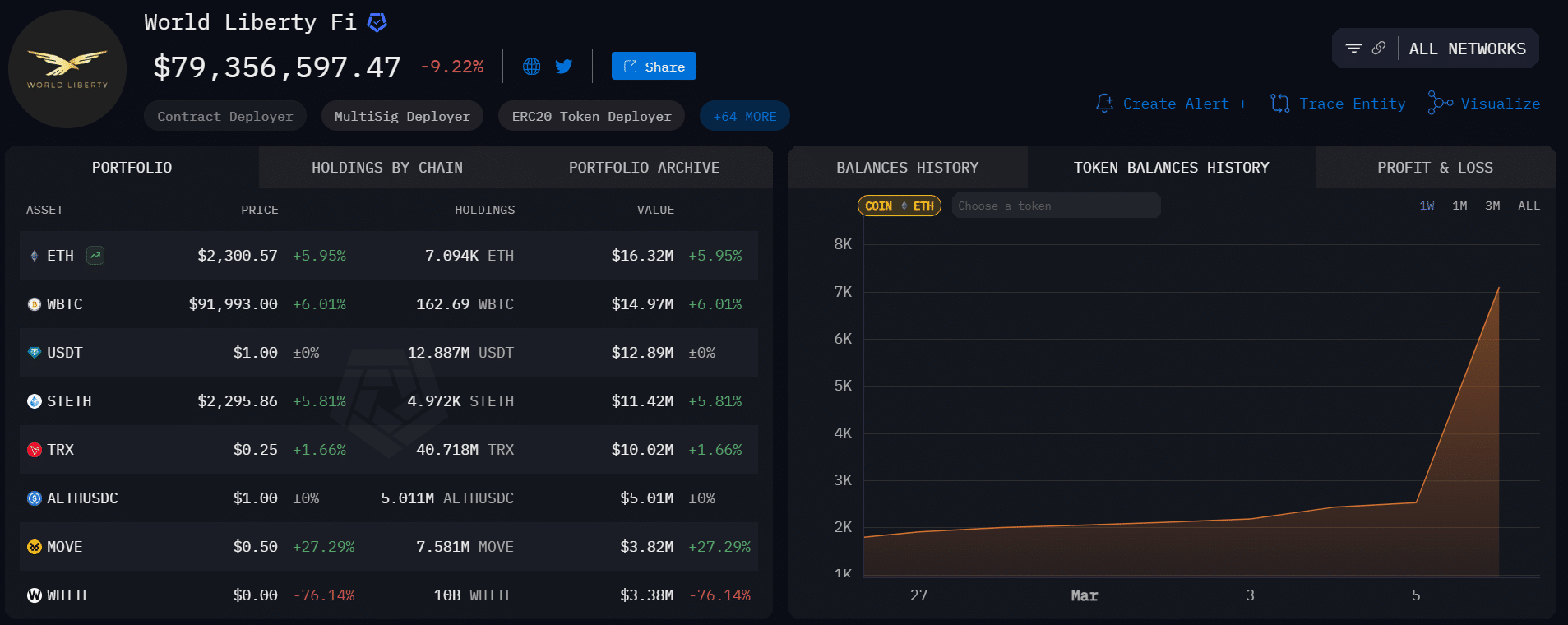

In March, the Trump-linked World Liberty Financials more than doubled its ETH holdings from 2K coins to over 7K, worth $16M at press time.

Source: Arkham

Unfortunately, the altcoin’s price has strongly recovered despite the renewed institutional interest.

According to blockchain analysis firm IntoTheBlock, ETH’s MVRV value, a valuation metric, dipped to levels seen before the current bull market began in late 2023.

“Ethereum’s MVRV hit 1.01 yesterday. This is the lowest value since October 2023, when Ethereum was trading just below $1600.”

The firm noted that such low levels typically marked local bottoms, but further downside risk couldn’t be overruled given the current market uncertainty.

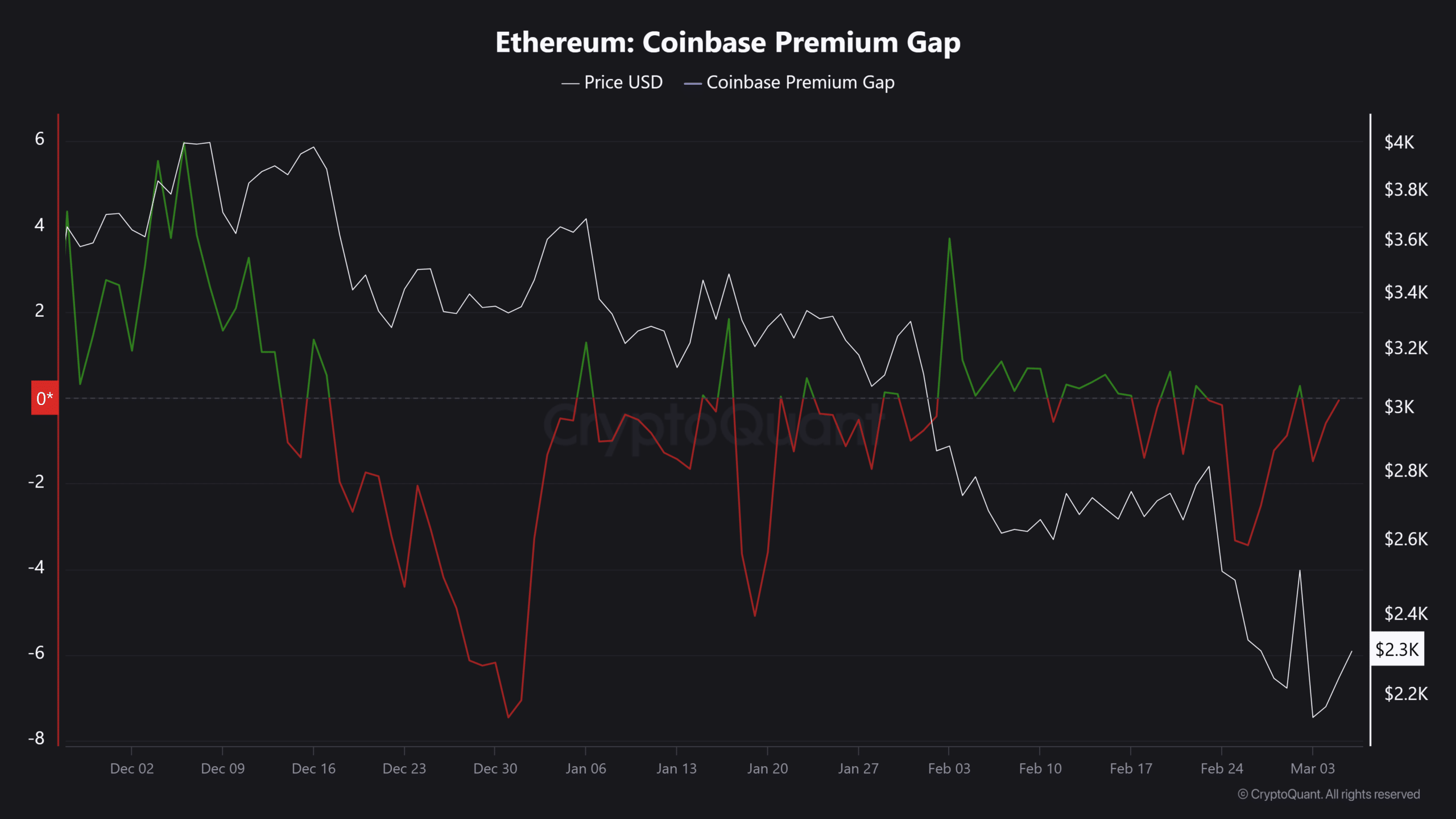

On the demand side, the U.S. investors’ appetite for ETH, as tracked by the Coinbase Premium Index (CPI), has been overwhelmingly lukewarm in 2025.

The altcoin could strongly recover only if the demand becomes sustainably positive.

Meanwhile, ETH was up 16% from the low of $1993 and was valued at $2300. Crypto trader Cryp Neuvo speculated that the altcoin could climb higher after sweeping the range lows.