- Whale deposits from Galaxy Digital signal potential market shift but also raise concerns over price stability.

- UNI faces a critical demand zone, with short liquidations suggesting bullish sentiment in the short term.

Galaxy Digital has recently made waves by depositing 600K Uniswap [UNI] tokens worth $4.37M to Binance and OKX.

This action is part of a larger strategy, with 5.26 million UNI tokens, valued at $40.6M, deposited over the past week.

Such large transactions can significantly impact market sentiment, as whales often have the power to influence price movements.

Therefore, traders are questioning whether this whale movement is signaling an impending rally or if it’s just the precursor to a deeper correction for Uniswap [UNI].

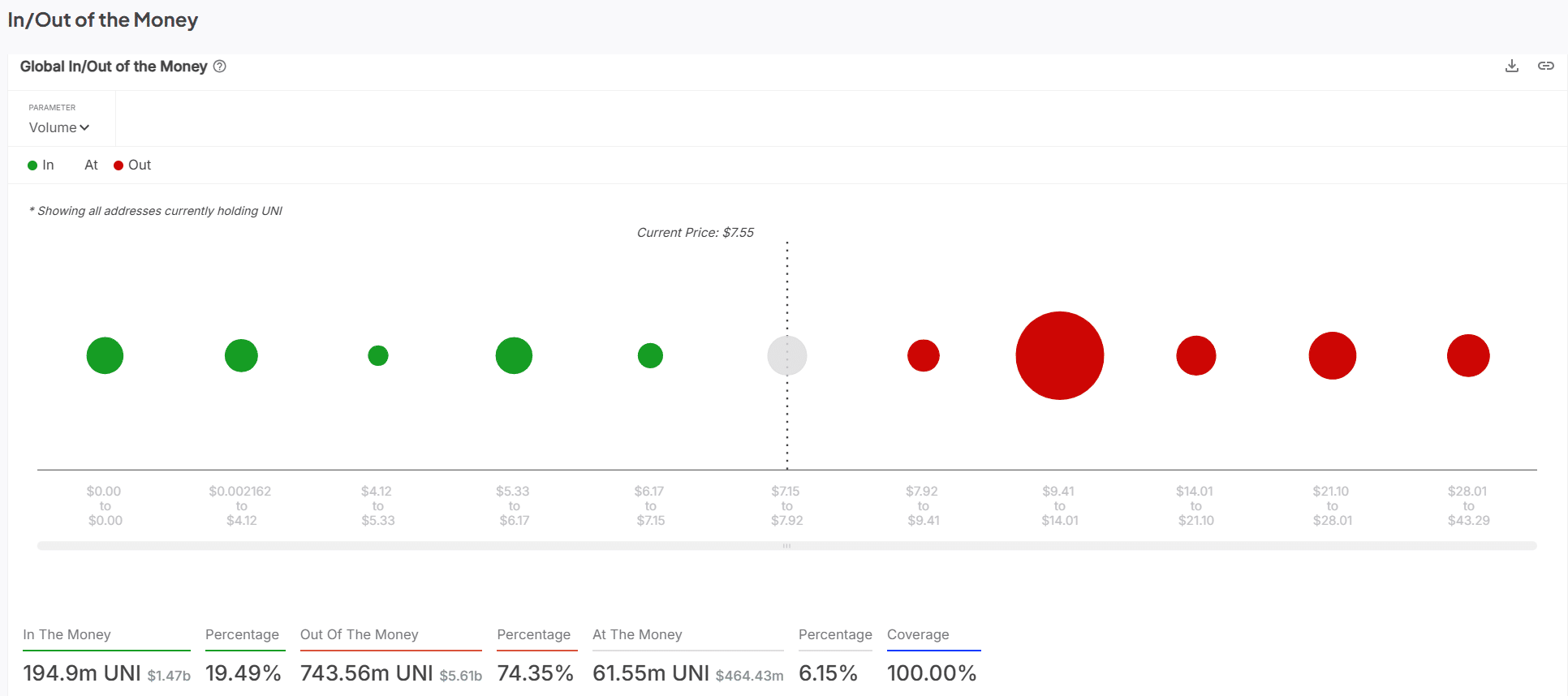

What does the in/out of the money analysis suggest for Uniswap?

Currently, 19.49% of Uniswap holders were “in the money,” representing 194.9 million UNI tokens.

On the other hand, a far larger portion—74.35%—sat “out of the money,” indicating that most Uniswap holders are currently facing losses.

This high concentration of underwater positions could play a pivotal role in UNI’s future price action. If the price of UNI rises, many holders may break even, potentially triggering a wave of selling.

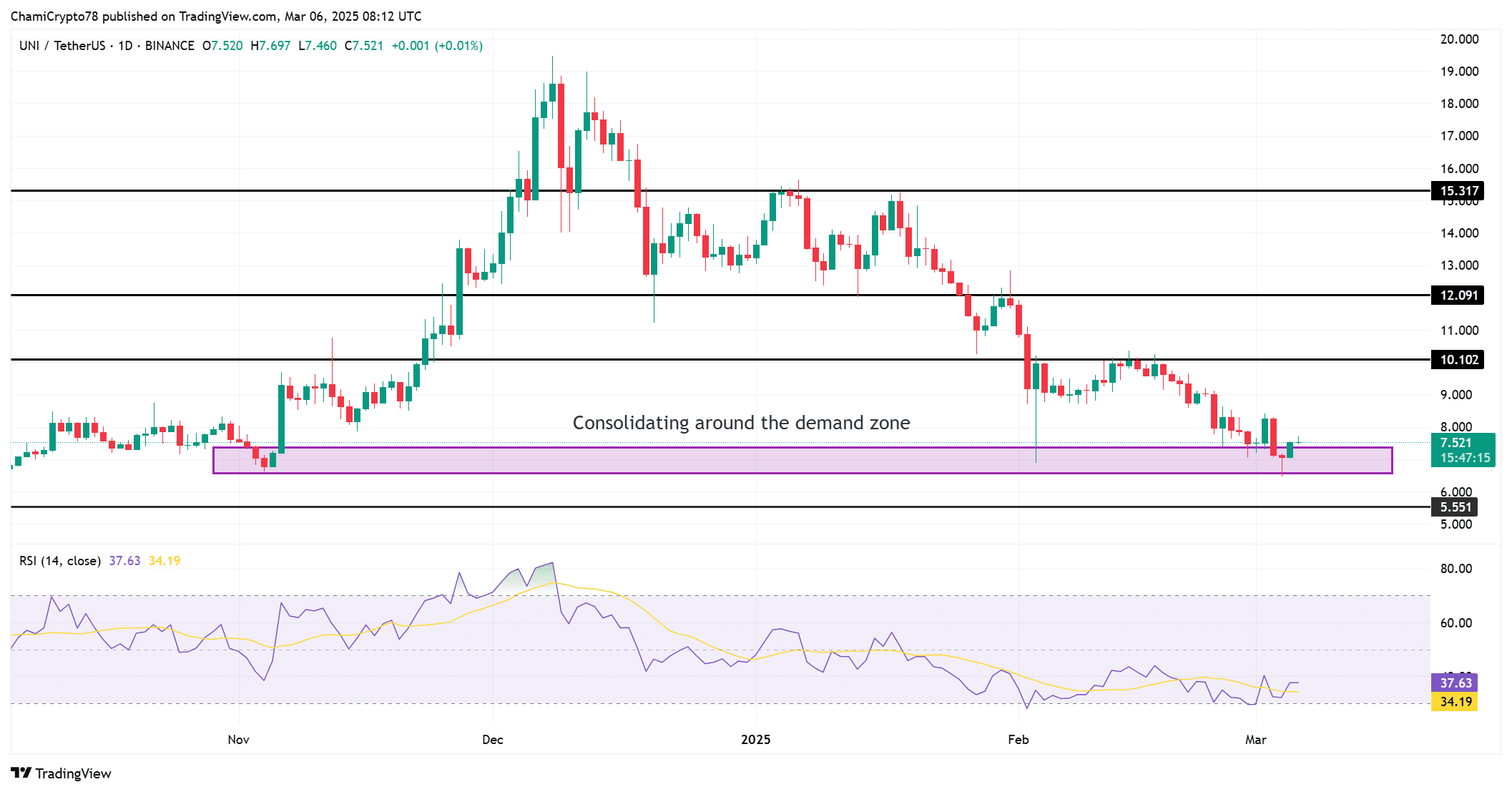

UNI’s price action: Consolidation or collapse?

Uniswap has been in a downtrend recently, now testing a critical demand zone around the $7.50 mark. This is a crucial juncture where UNI could either rebound or break below the demand zone, which would be a sign of further weakness.

At press time, UNI was trading at $7.52, reflecting a modest 1.4% increase in the past 24 hours. However, with the RSI at 37.63, there is potential for a rebound if the support at this demand zone holds.

Traders will need to monitor closely to see if Uniswap can maintain this level or if a breakdown below the demand zone is in the cards.

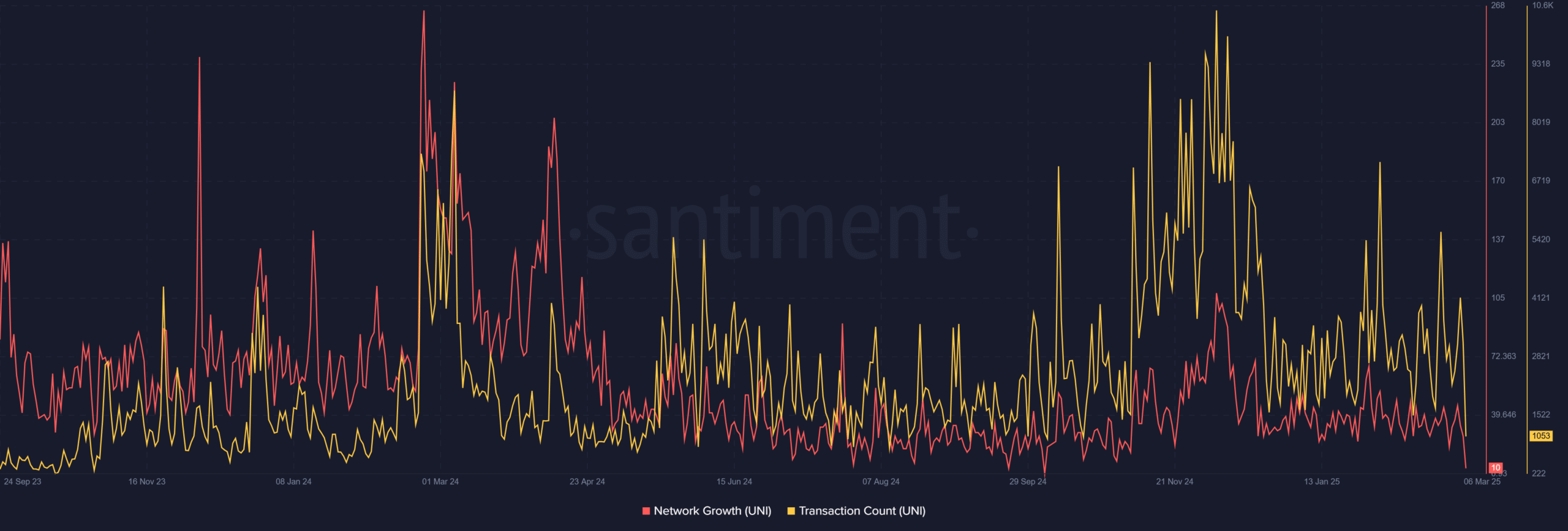

Network growth and transaction count drop: A warning sign?

The network growth and transaction count have seen significant declines, with the latest data showing just 10 new addresses joining the network. Additionally, the transaction count remains low at 1,053.

This drop in network activity indicates a decline in market interest, as fewer transactions typically suggest reduced demand.

If this trend continues, it may signal a lack of investor confidence, which could negatively affect Uniswap’s price in the near term.

UNI’s short liquidations have spiked, with $48.03K in short positions liquidated on Binance compared to just $10.1K in long liquidations.

This suggests a potential short squeeze, where traders betting against UNI are being forced to cover their positions, adding upward pressure to the price.

The low long liquidations imply minimal selling pressure.

Will UNI rebound or face a deeper decline?

Uniswap faces a challenging market environment.

Despite Galaxy Digital’s whale activity, technical indicators, the in/out of the money analysis, and declining network growth all point towards a potential correction rather than a breakout.

However, the higher short liquidations signal that a potential short squeeze could push UNI’s price higher.

Therefore, unless UNI can break through resistance and stabilize above key support levels, a deeper decline seems more likely.