- Stablecoin exchange reserves highlighted rising buying power in the market

- Bitcoin’s dominance chart suggested the market could favor BTC in the coming weeks

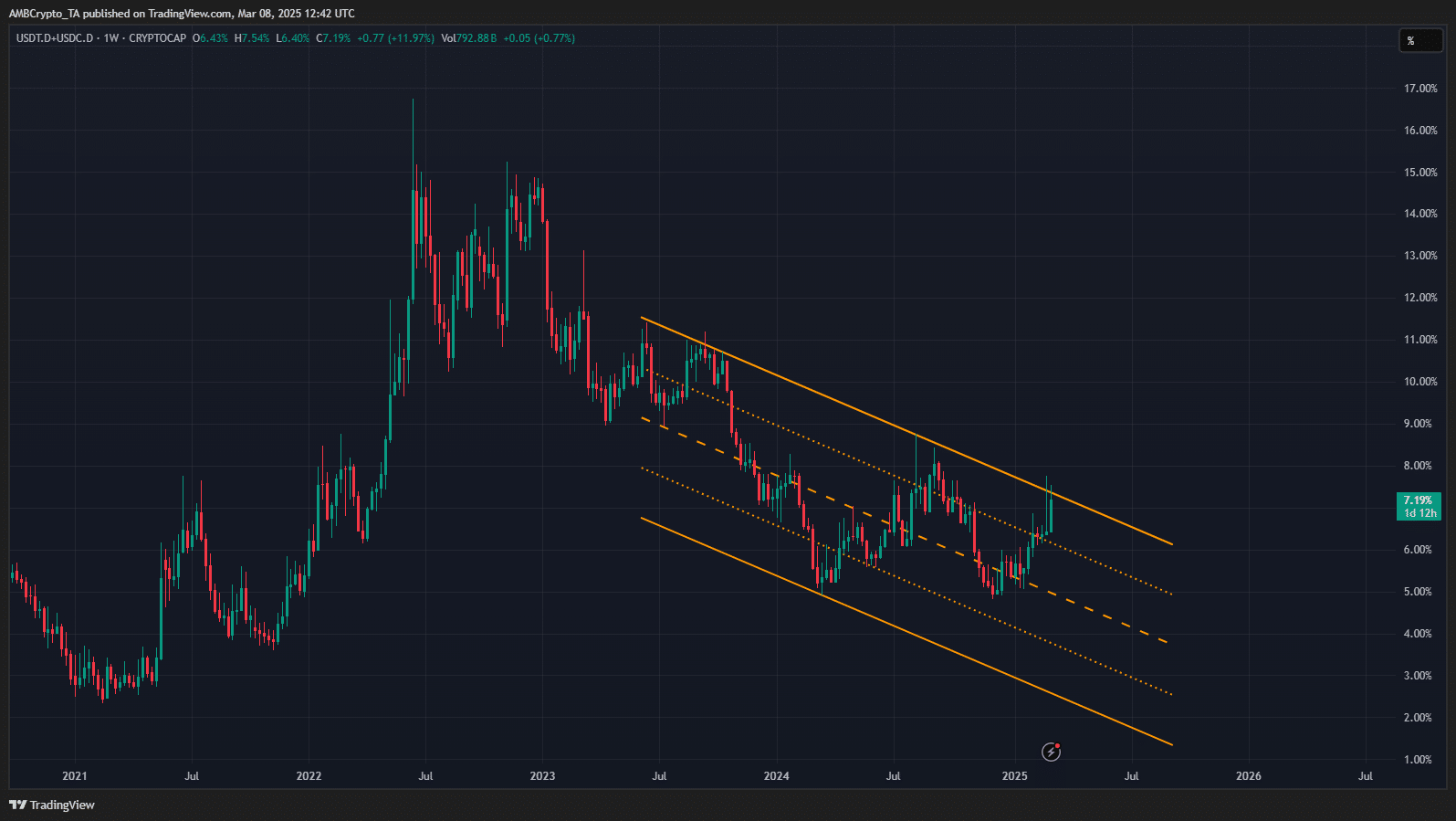

Tether [USDT] and USD Coin [USDC] are the largest stablecoins by market capitalization right now. In fact, their combined dominance stood at 7.19% at press time. The dominance trends of Bitcoin [BTC] or stablecoins can shed light on market-wide sentiment and what the future price movements could be.

Hence, the question – What can we find out from their metrics, and how does it combine with the BTC dominance chart to give actionable insights for traders?

Stablecoin and Bitcoin dominance metrics show altcoins could be set to suffer more

The combined dominance of Tether and USD Coin have been moving within a descending channel on the 1-week chart, plotted in orange. The movement of the stablecoin dominance can be inversely related to crypto prices. Higher stablecoin dominance implies investors prefer to hold stables, instead of altcoins or Bitcoin.

Conversely, a fall in dominance from USDT and USDC would imply investors’ capital is pouring into other assets, driving their prices higher and indicating a more bullish market setting.

In the aforementioned chart, the descending channel formation meant the dominance would soon fall. A breakout is possible, but unlikely, as this channel has been respected since July 2023. A fall in stablecoins’ dominance could see an uptrend for Bitcoin, and potentially many altcoins too.

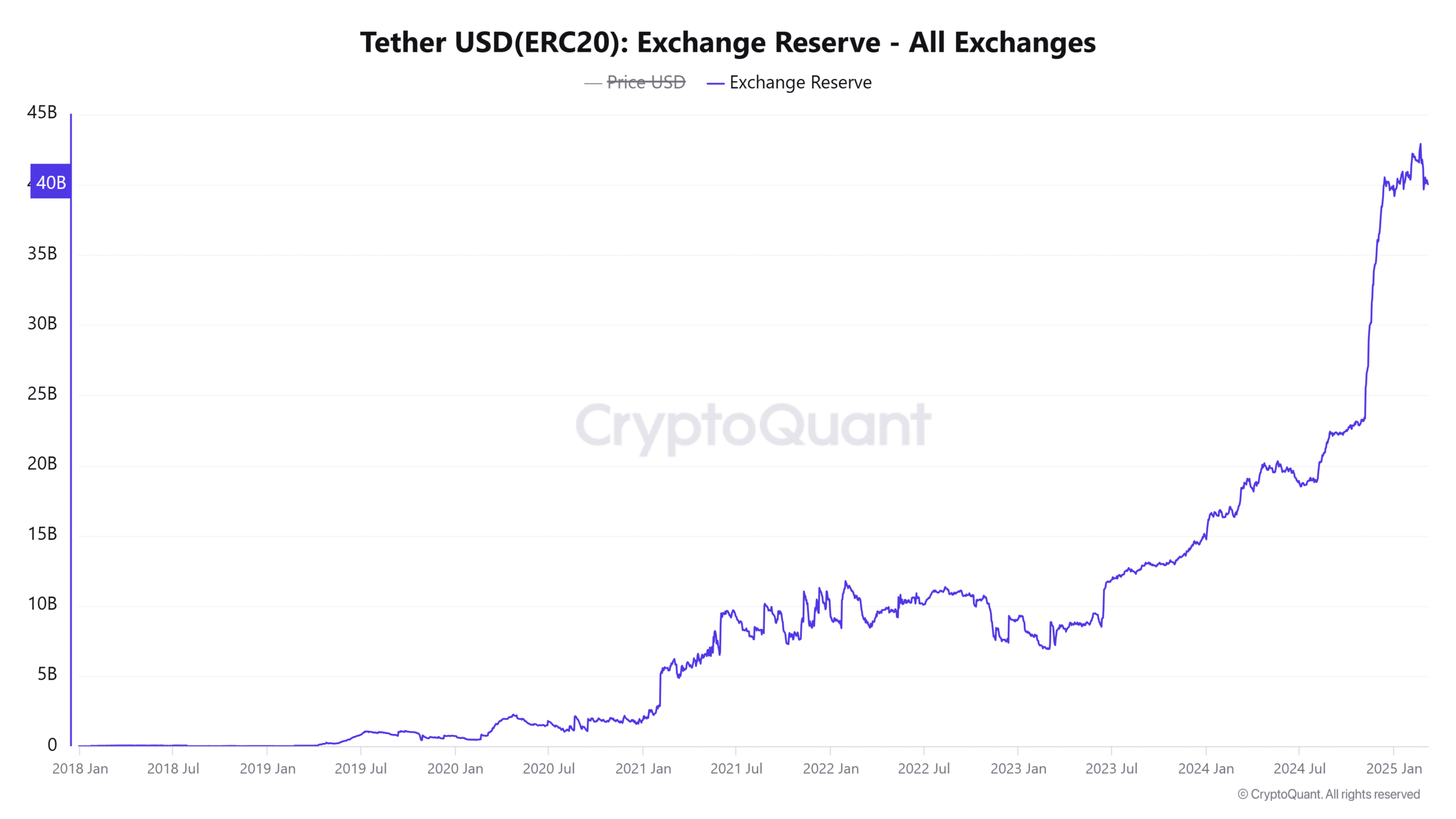

Source: CryptoQuant

Generally, a crypto asset’s rising exchange reserves would imply heightened chances of selling pressure.

However, a hike in USDT reserves on centralized exchanges implies heightened buying power. In fact, their trend has been pointing higher over the past 18 months, with rapid growth seen especially in November 2024.

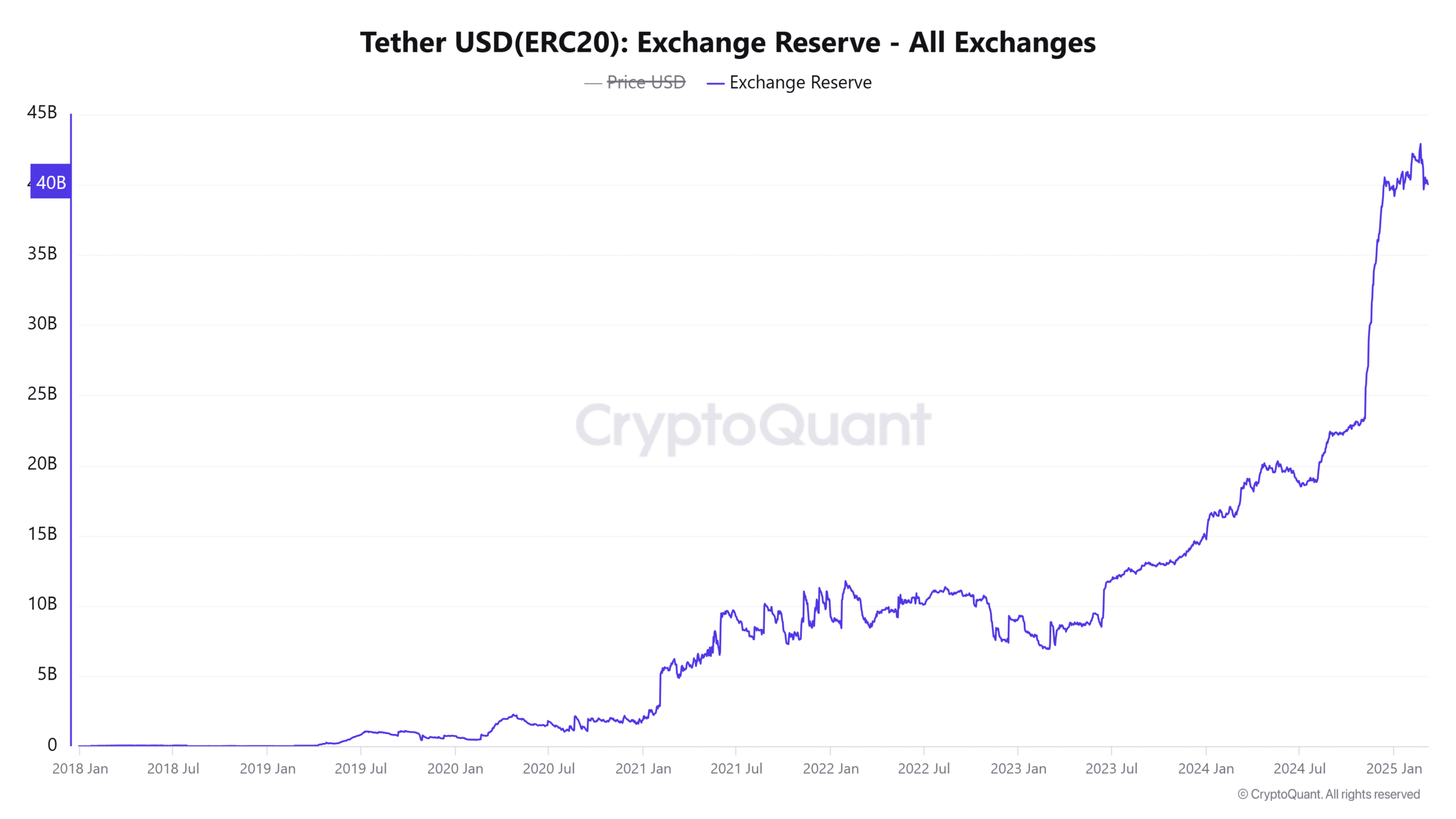

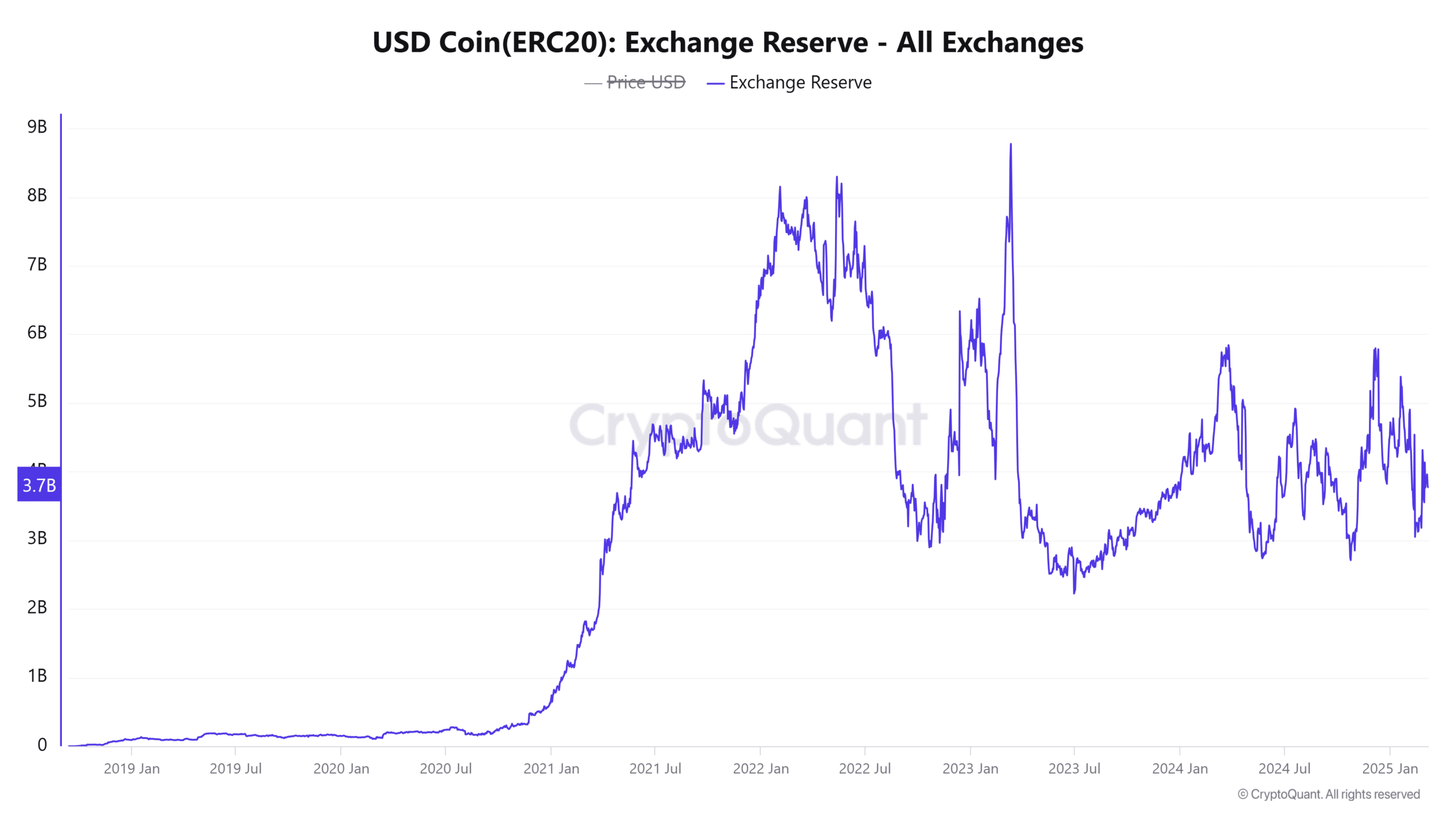

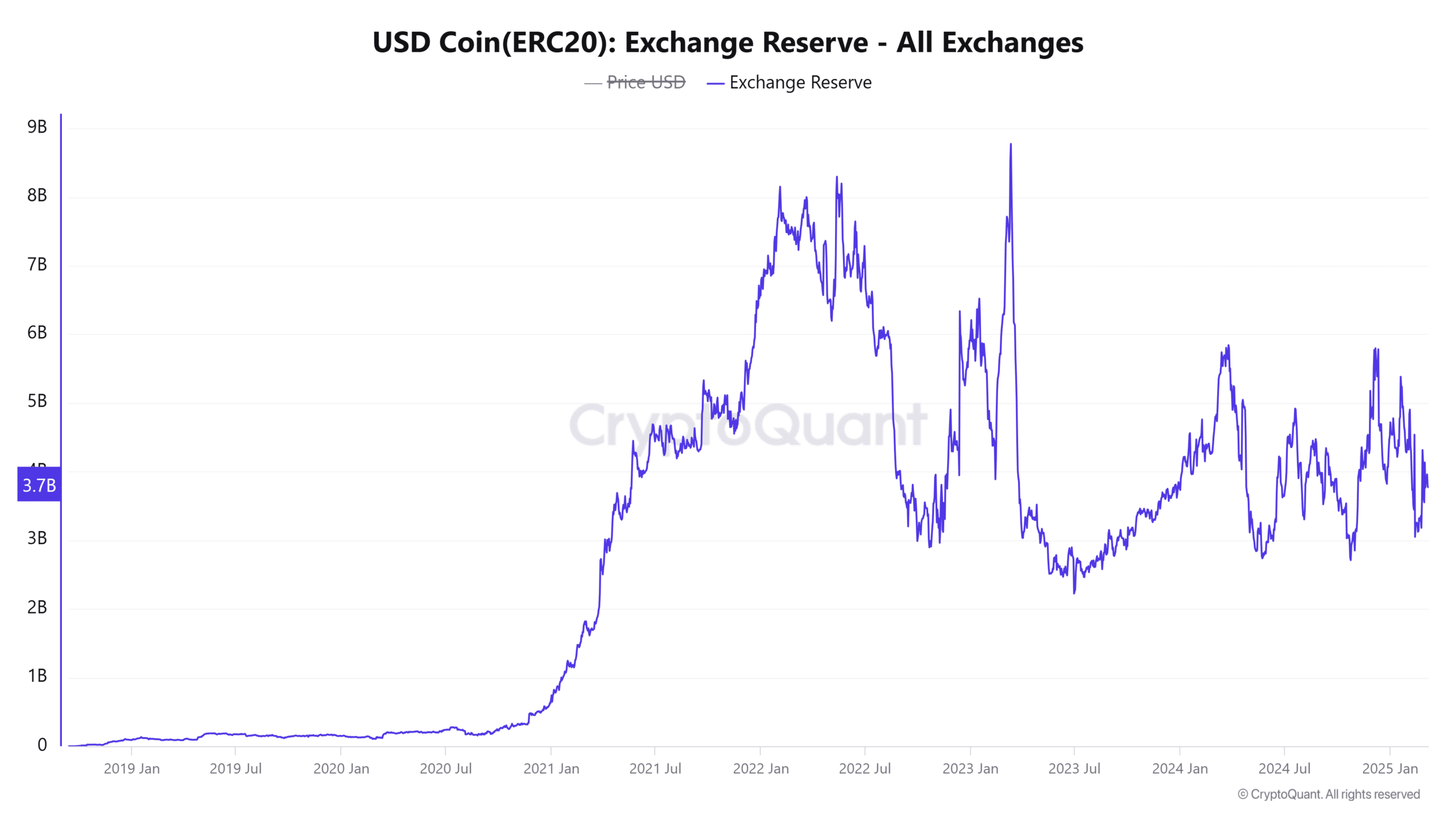

Source: CryptoQuant

USD Coin also saw growth in its exchange reserves, but not as constant as USDT.

The reserves were at $4.2 billion at press time, compared to USDT’s $42.1 billion. These volumes suggested that USDT likely remains the favored stablecoin for trading and liquidity purposes.

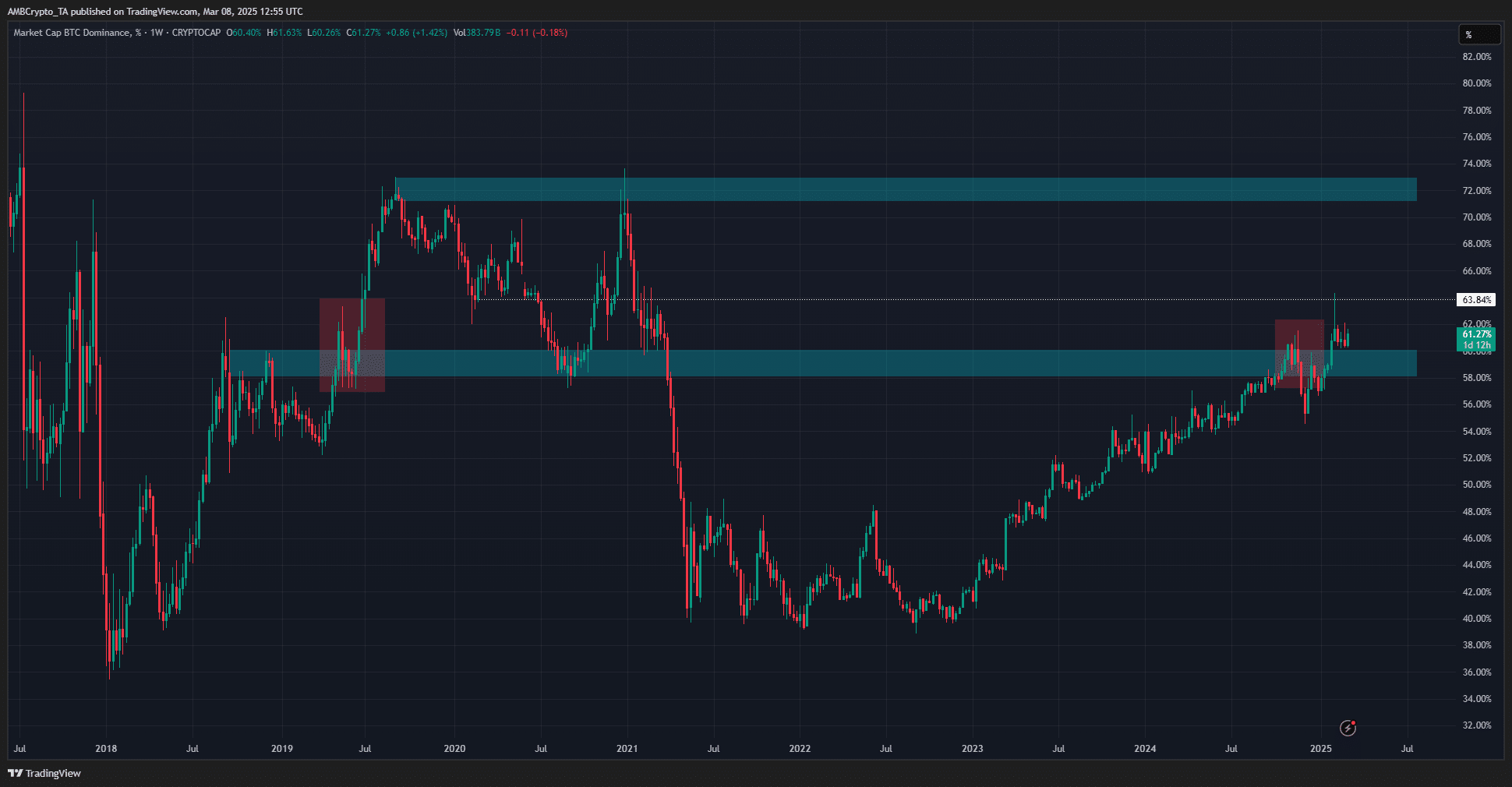

The weekly chart of BTC.D underlined some similarities between November-December 2024 and May 2019. On both occasions, the 60% level served as resistance and was flipped to support after a deviation beneath it.

What remained was a move to the 72% level. Like stablecoin dominance, BTC.D is inversely correlated to altcoin performance. An uptick in BTC.D implies Bitcoin gaining more value than the altcoin market (or shed less value).

However, capital rotation after strong BTC-centered gains could usher in an altseason. While the price action in recent months has killed this hope among market participants, perhaps, it might not be truly dead.