- Derivative traders in the market are bullish on ENA, opening long contracts in anticipation of a rally.

- Spot traders, on the other hand, oppose this rally, selling ENA and increasing supply in the market.

While the overall market trends going downward, Ethena [ENA] is taking a different path. At the time of writing, the asset had rallied 4.96% in the past 24 hours, with its weekly gain standing at 8.06%.

Although the bullish trend is just beginning, AMBCrypto found that derivative traders are driving the recent rally, while spot traders remain in opposition. Here’s what could happen next.

Derivatives traders drive market momentum

Derivative traders are the core force behind ENA’s recent surge, and key metrics continued to rise.

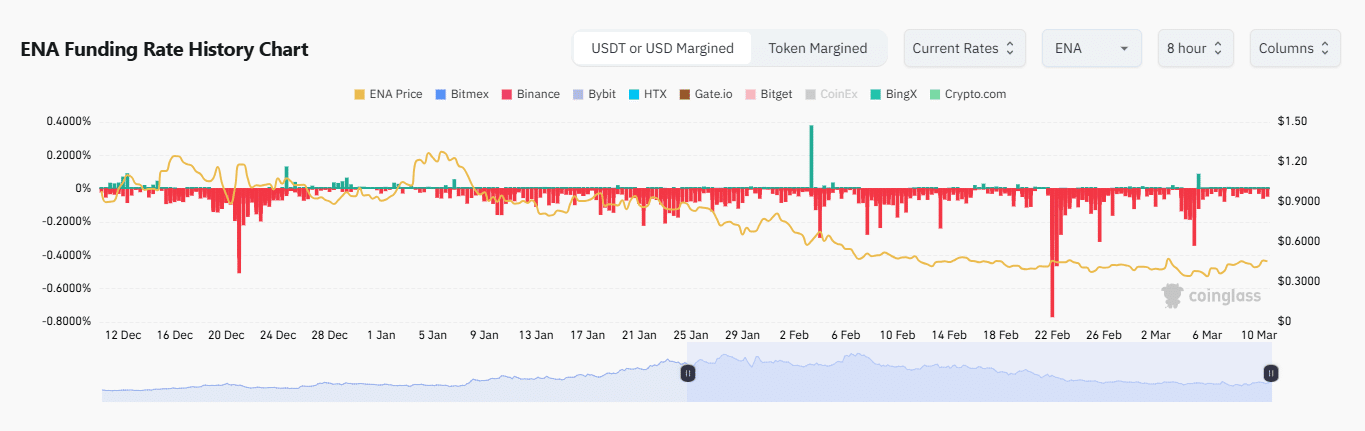

The Funding Rate, which tracks market sentiment by measuring price differences between spot and futures markets through a premium fee, indicates a buying trend.

At press time, the Funding Rate was at 0.0011%, a positive value. This shows traders with long contracts are paying a premium, expressing confidence in favorable market movements.

Open Interest (OI) growth reinforces this sentiment. OI has increased by 4.23% to $423.98 million within 24 hours. This increase indicates more long positions being opened.

The rally seems to be largely influenced by Binance traders. The Taker Buy Sell Ratio highlights buying versus selling volume across multiple exchanges. A ratio above 1 indicates more buyers, while a ratio below 1 signals more sellers.

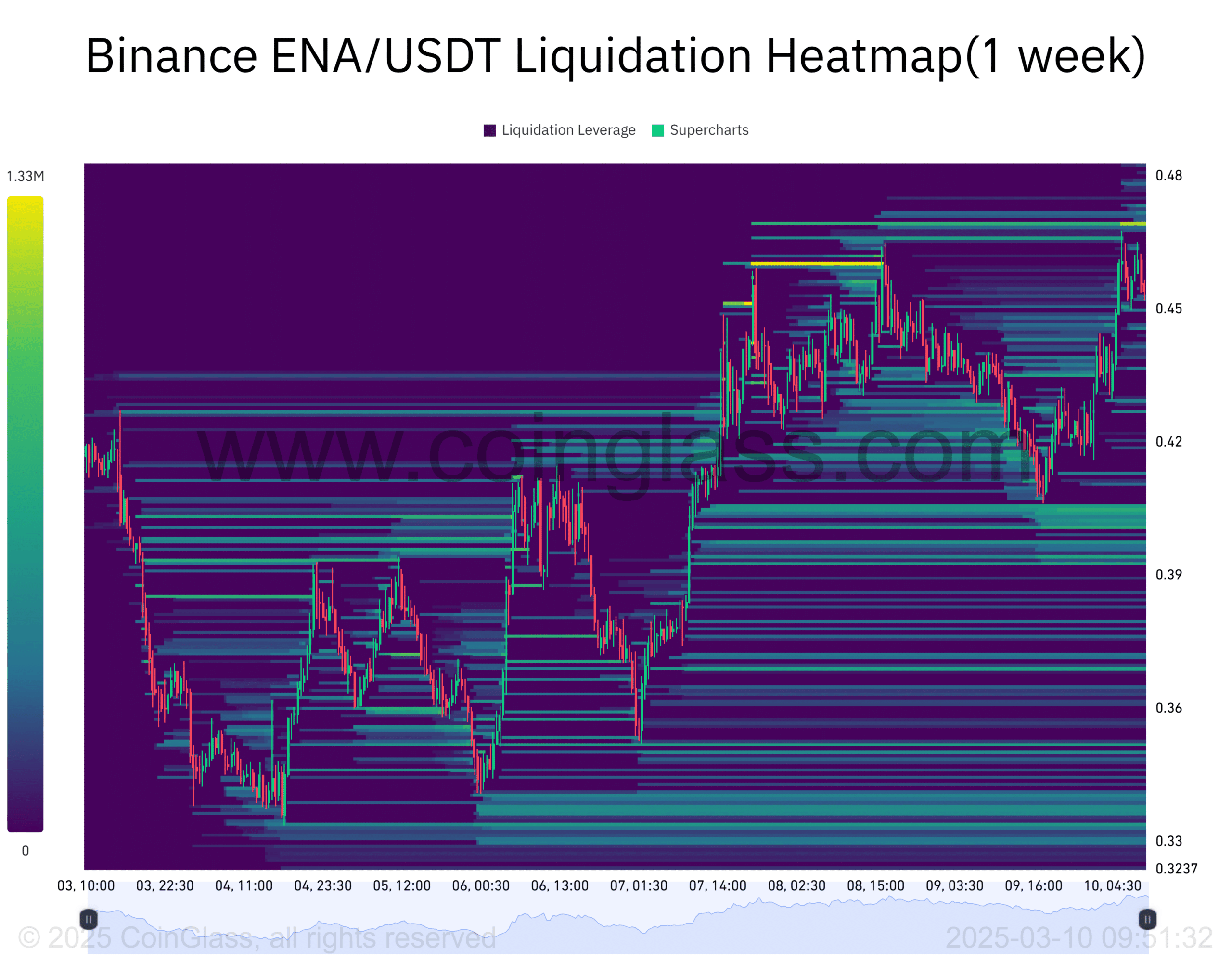

At the time of writing, Binance’s Long-to-Short Ratio stood at 1.5549, confirming bullish bias among traders. A review of Binance’s weekly liquidation heatmap points towards a potential rally on the horizon.

At the time of writing, a significant liquidity cluster is at $0.469, with $1 million in sell orders. Liquidity clusters often act as price magnets, drawing prices toward them due to market dynamics.

ENA might rally into this zone, clear the sell orders, and either retrace briefly or continue upward.

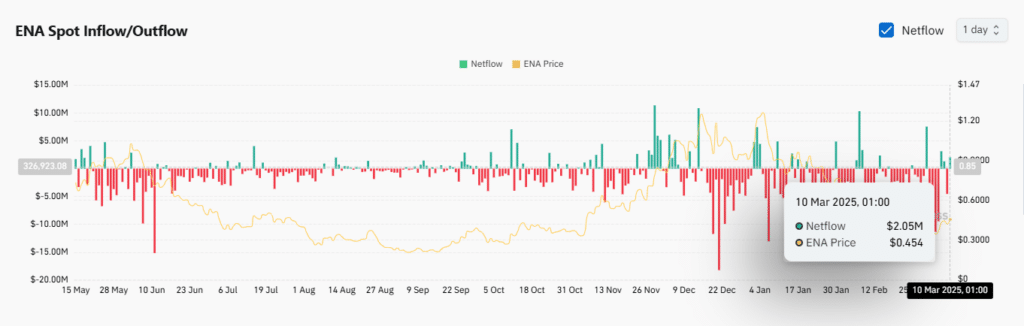

While the derivatives market is making substantial bets, spot traders are adopting a contrasting approach by actively selling.

ENA: Spot market sees increased selling

Spot traders, who buy and sell assets without leverage, have begun offloading their ENA holdings. Over the past 24 hours, Coinglass exchange netflow shows that $2.05 million worth of ENA has been sold.

Significant sell-offs may signal a market downturn or traders securing profits following recent gains.

If the latter holds, it aligns with bullish sentiment in the derivatives market, suggesting potential future rallies. Profit-taking is typically temporary, with spot traders expected to resume buying activity shortly after.

However, if selling pressure in the spot market persists while derivatives traders keep buying, ENA might remain range-bound. This situation is likely to continue until one trend decisively overtakes the other in the market.