- Ripple’s case could end in days or weeks if they enter a private agreement with the SEC.

- More bettors and Options traders expected XRP to dip below $2 by the end of March.

In February, President Donald Trump’s new SEC paused or permanently dismissed most crypto investigations started by the Biden regime.

However, the Ripple [XRP] case has been conspicuously missing from the dismissal list.

Pathway to end Ripple case

Reports have emerged that the Ripple case could also be over soon, per Fox Business journalist Eleanor Terret, citing people familiar with the matter. She said,

“Two well-placed sources tell me that the SEC vs. Ripple case is in the process of wrapping up and could be over soon.”

She added that the only sticking issue was Judge Analisa Torres’s ruling, which fined Ripple $125M for the institutional sale of XRP and a permanent injunction against selling XRP to this investor category.

On his part, the pro-XRP attorney Jeremy Hogan said that such an outcome would only be possible if the parties reached a private agreement covering the sticky points.

“The only way the case could “be over” soon is if Ripple and the SEC reach a private settlement agreement.”

What’s next for XRP?

If dismissal happens, it could lift the regulatory clarity that has capped the altcoin upside for over 4 years.

Although some have argued that President Trump’s election win and the ensuing 500% rally meant that XRP had priced the regulatory clarity, the ETF speculation was still at play.

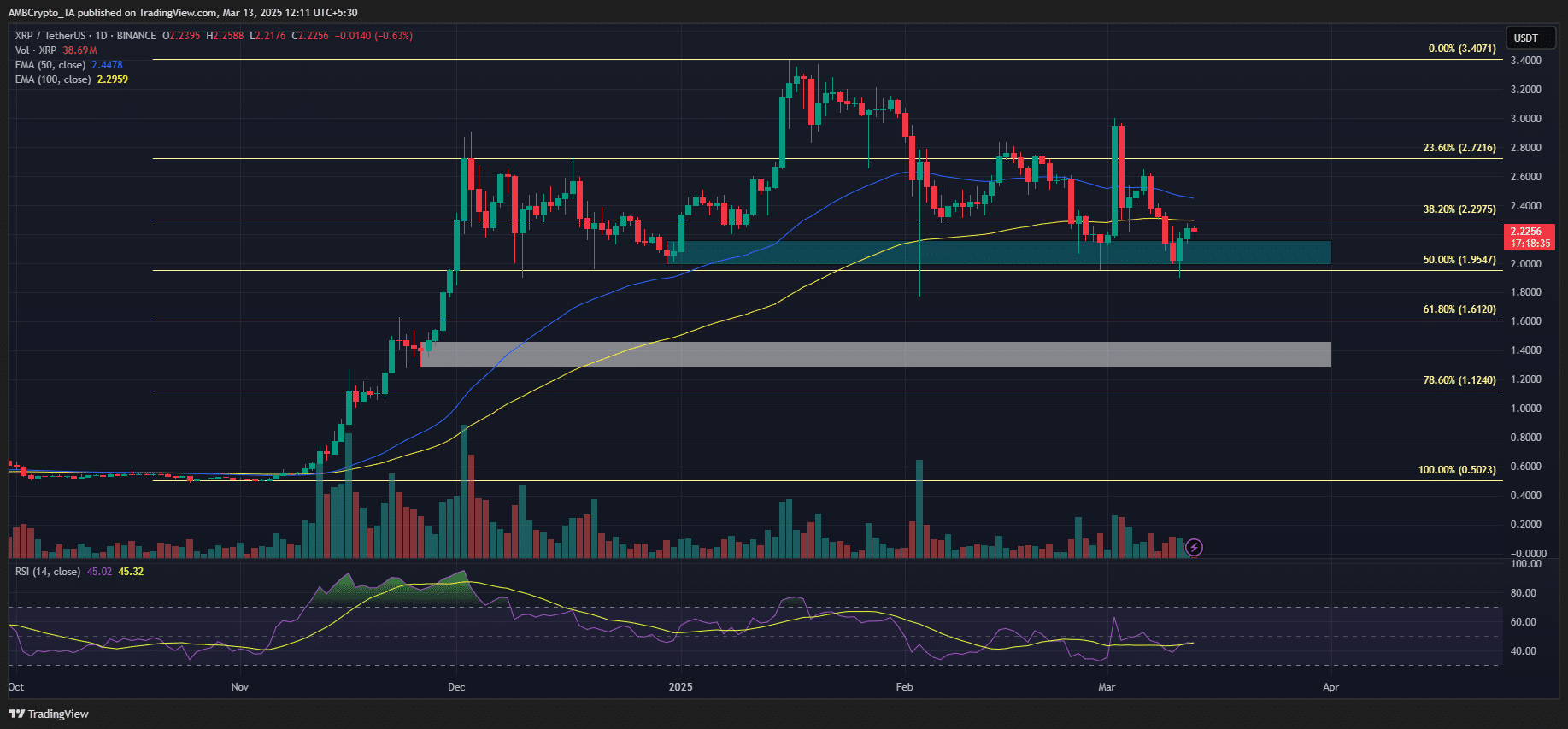

At press time, XRP’s post-US election gain had sightly dropped to 340%, valued at $2.2 on price charts.

On Polymarket, bettors eyed the $3.5 level for the March price target with a massive $257K volume. However, the $3.5 level only accounted for a 7% chance per the prediction site.

Most bettors, with relatively small-sized bets, expected (40% chance) XRP price would drop to $1.7 this month.

Interestingly, most Deribit Options traders also expected XRP to dip below $2 and surge above $3 by the end of March.

The probability of reclaiming $3 on the Options platform was 15% at press time, while a dip to $1.7 had 90%-100% odds.

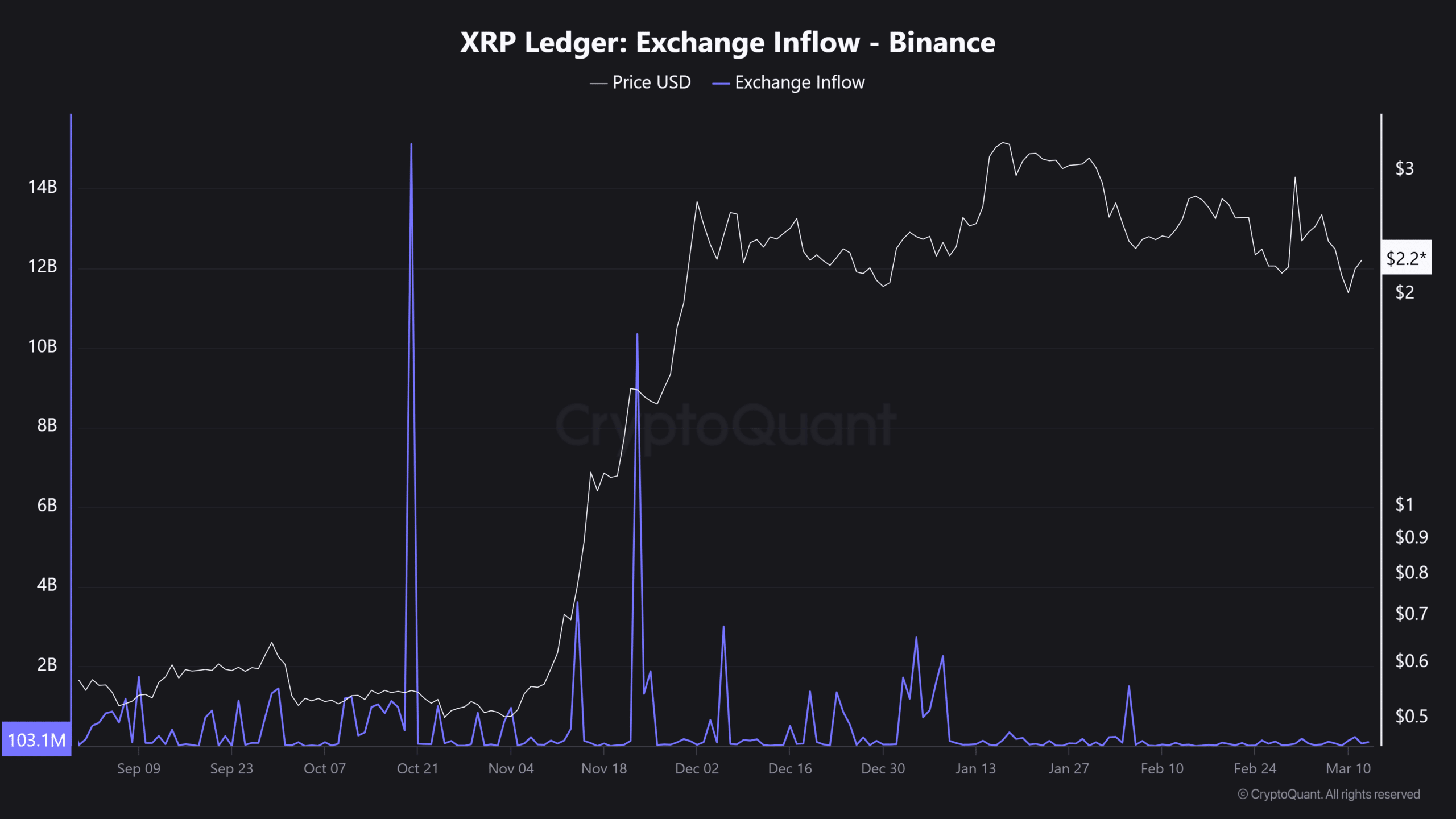

That said, the selling pressure on CEXes (centralized exchanges), as measured by Exchange Inflow, has been flat since mid-January.

This could explain how XRP still held its massive election gain while most have retraced to November levels or lower.

Whether the ETF approval or the Ripple case dismissal will be a ‘sell-the-news’ event and heighten whale sell-offs remains to be seen.

From a price analysis perspective, the $2 has been the key support to watch since last December. It also coincided with the 50% Fibonacci retracement level, while the golden ratio of 61.8% level was at $1.6.

Simply put, losing $2 would change the XRP market structure and embolden bears to seek $1.6 or $1.4 if market sentiment worsens.