Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum (ETH) is facing significant selling pressure, trading below the $1,900 mark as market uncertainty continues to weigh on price action. After losing the critical $2,000 level, ETH plunged as low as $1,750, marking its lowest point since October 2023. Bulls are now under pressure, as they must defend the current demand zone to prevent further downside and restore investor confidence.

Related Reading

Market conditions remain fragile, with Ethereum struggling to find strong buying interest. If bulls fail to hold current support levels, ETH could see further declines, adding to the bearish sentiment that has dominated the market in recent weeks.

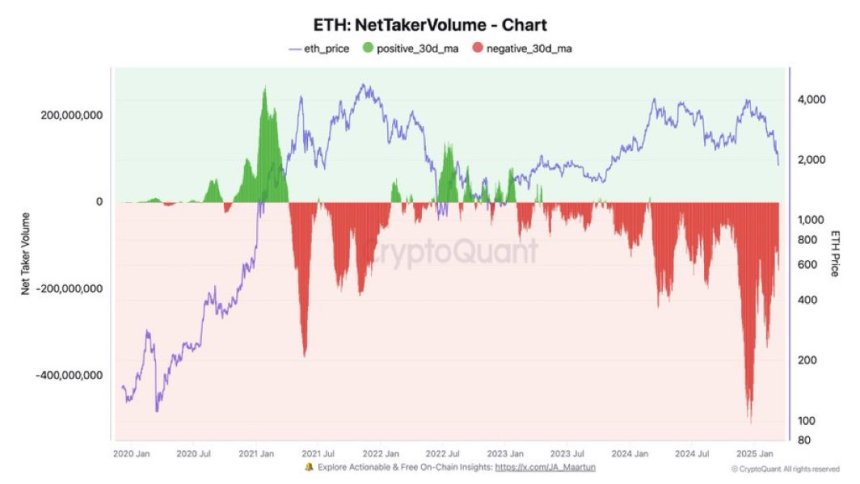

On-chain data from CryptoQuant reveals that Ethereum’s Net Taker Volume remains at a low level, indicating that selling pressure is still strong. This suggests that market participants are leaning bearish, with more sell orders than buy orders dominating Ethereum’s price action.

With ETH trading in a vulnerable position, the next few days will be crucial. If bulls can stabilize the price and push ETH back above $1,900, a potential recovery could begin. However, if selling pressure persists, Ethereum may continue its downward trend, testing lower support levels in the coming weeks.

Ethereum Faces Heavy Selling Pressure

Ethereum has lost over 57% of its value, creating an extremely difficult environment for bulls as the market remains in a deep downtrend. Currently, ETH is trading below a multi-year support level, which has now turned into a strong resistance zone. As ETH struggles to break back above the $1,900–$2,000 range, the bearish trend continues, with bulls failing to regain momentum.

Related Reading

The entire crypto market has suffered a breakdown, mirroring weakness in the U.S. stock market, as global trade war fears and growing uncertainty surrounding U.S. President Trump’s policies shake investor confidence. Since the U.S. elections in November 2024, macroeconomic volatility and uncertainty have been the dominant forces in driving markets lower. With no clear resolution in sight, investors remain cautious, as the U.S. stock market has now reached its lowest levels since September 2024.

Top analyst Quinten Francois shared data on X, revealing that Ethereum’s Net Taker Volume is at historic lows, signaling intense selling pressure. This indicates that sellers continue to dominate the market, preventing ETH from staging any meaningful recovery. Until buyers step in with strong demand, ETH may remain stuck in a bearish phase, with further downside risk if key support levels fail.

With Ethereum struggling below critical resistance and selling pressure increasing, the next few weeks will be pivotal in determining whether ETH can stabilize or if the market will see further losses. If bulls cannot reclaim lost ground, Ethereum could face even deeper corrections in the near term.

ETH Stuck In Range As Bulls Fight to Reclaim $2,000

Ethereum is currently trading at $1,880, remaining range-bound between $1,750 and $1,950 since last Monday. This tight trading range has kept ETH in a consolidation phase, with neither bulls nor bears gaining full control over price action.

For Ethereum to start a recovery rally, bulls must push the price back above $2,000 as soon as possible. A break and close above this psychological level would indicate renewed buying momentum, allowing ETH to potentially test higher resistance levels. However, Ethereum remains in a fragile position, as selling pressure continues to weigh on the market.

If ETH fails to hold its current levels and breaks below $1,750, it could result in a steady continuation of the downtrend, with further downside risks emerging. Bears would likely target lower support zones, extending the bearish phase and delaying any chance of a sustained recovery.

Related Reading

With uncertainty still dominating the market, traders are closely watching whether Ethereum can break out of this range or if it will extend its decline, following the broader market’s risk-off sentiment. The next few trading sessions will be critical for ETH’s short-term direction.

Featured image from Dall-E, chart from TradingView