- Less than 24 hours after triggering a $4 million loss in Hyperliquid’s HLP Vault, the same whale trader reappeared

- If whales can manipulate liquidation engines, smaller traders may feel at a disadvantage.

The whale trader responsible for Hyperliquid’s $4 million vault loss yesterday is back in action, executing another round of high-leverage trades across multiple platforms.

This time, the trader deposited $4.08 million USDC into GMX. He initially shorted Ethereum [ETH], but quickly closed the position and switched to a long, securing a $177,000 profit.

After closing the profitable GMX trade, the whale moved $2.3 million USDC into Hyperliquid [HYPE], opening a 25x long position on ETH and a 40x short position on BTC.

The return of the same whale in such a short time frame raises critical questions – Is this just smart trading, or another attempt to exploit liquidation mechanics?

On-chain data unveils a high-risk playbook

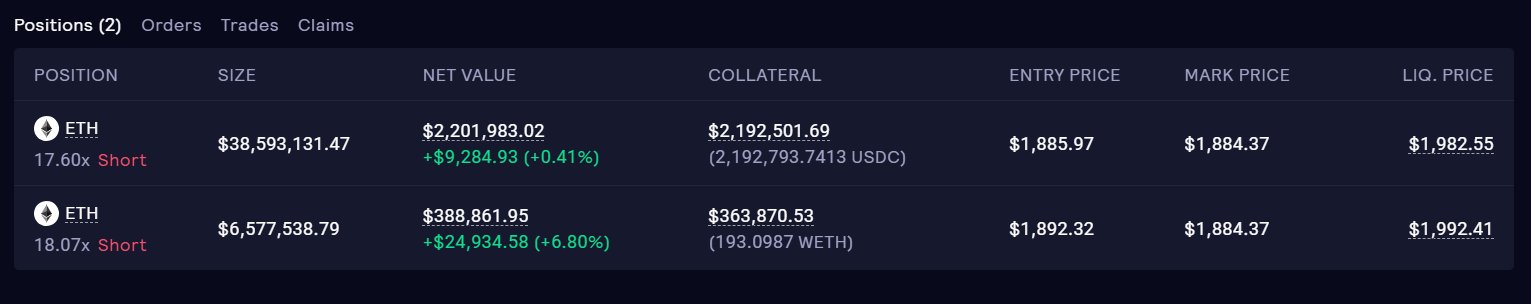

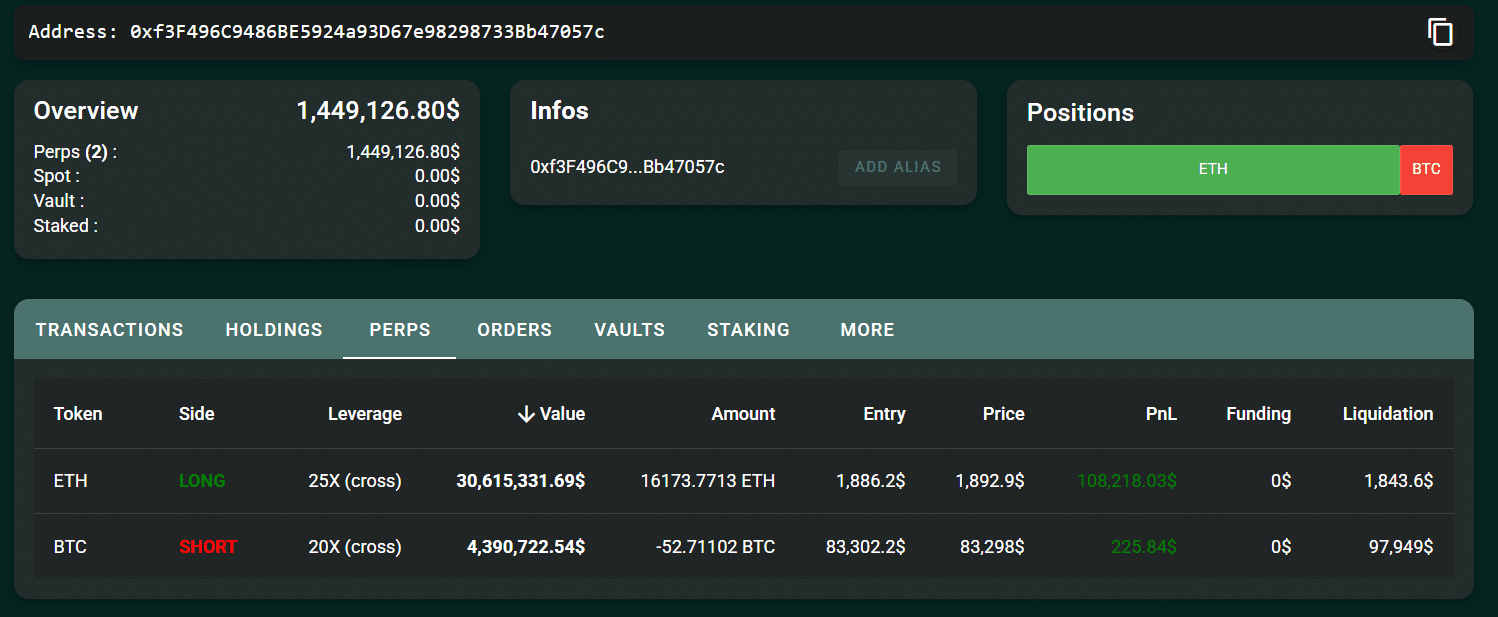

On-chain data from Lookonchain revealed the latest positions of a crypto whale.

The trader recently made strategic moves on GMX and Hyperliquid, leveraging large sums to capitalize on price fluctuations.

On GMX, the whale initially shorted ETH/USD with $4.08 million USDC. Later, they flipped to a long position, securing profits of $177,000.

Moreover, on Hyperliquid, the whale opened a long ETH position with 25x leverage.

The position size is $30.54 million, with an entry price of $1,886.20. Their liquidation price is set at $1,804, and the press time profit and loss stood at $35,436.05.

For Bitcoin [BTC], the whale took a short position with 40x leverage with position size being $19.09 million, with an entry price of $83,156.45. Their liquidation price is $88,844, and their press time profit and loss was $13,880.49.

The trader’s aggressive use of leverage signals a high-risk, high-reward approach. Millions in USDC are actively moving between GMX and Hyperliquid.

Seemingly, this is a sign of a liquidity-optimized strategy, allowing them to deploy capital quickly and profit from small price movements.

Déjà vu? Same tactics, bigger positions

The similarities between today’s trades and yesterday’s liquidation event cannot be ignored.

Just a day ago, this same whale withdrew margin from Hyperliquid before liquidation, forcing the HLP Vault to absorb losses. The timing of these withdrawals allowed the trader to shift risk onto the exchange while exiting with minimal damage.

Now, the trader has returned with even larger positions. This time, profiting from precise entry and exit points.

The rapid transitions from short to long on GMX and Hyperliquid suggest an awareness of liquidation engine behavior, possibly taking advantage of inefficiencies in automated risk management systems.

Market analysts are now debating whether this is a repeatable pattern.

Hyperliquid’s response to yesterday’s liquidation event included reduced leverage limits – BTC trades were capped at 40x and ETH at 25x. However, these changes did not prevent today’s whale trades, which still reached the new maximum allowable leverage.

CEX vs. DEX leverage – Who handles it better?

Bybit CEO Ben Zhou weighed in on the Hyperliquid whale liquidation, highlighting a critical issue in liquidation mechanics.

“To me, this ultimately leads to the discussion on Leverage, DEX vs CEX capabilities to offer low or high leverage.”

Zhou pointed out that this issue isn’t exclusive to Hyperliquid. In fact, both CEX and DEX exchanges face the same challenge when handling liquidations at scale. While lowering the leverage may be an effective solution, Zhou said this could be bad for business.

“CEX or DEX in this case faces the same challenge, our liquidation engine also takes over the whole position when whales get liquidated. I see that HP has already lowered their overall leverage; that’s one way to do it and probably the most effective one, however, this will hurt business as users would want higher leverage.”

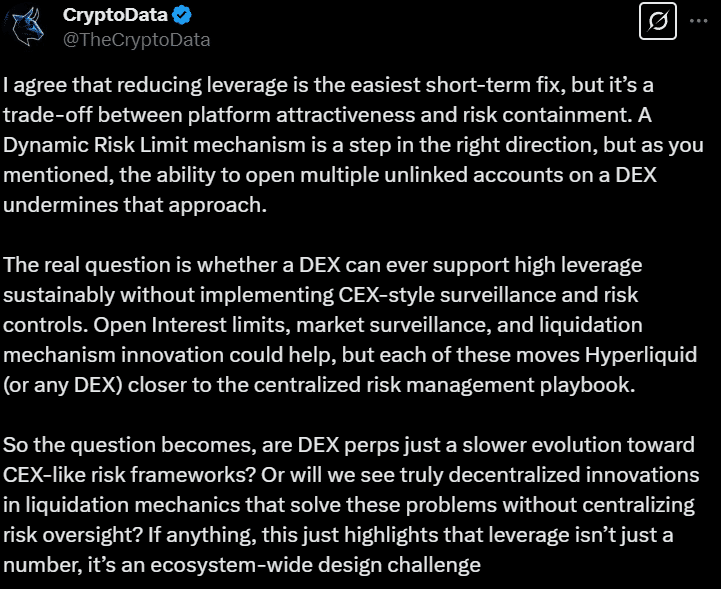

On-chain analysts joined the discussion, agreeing that reducing leverage is an easy short-term fix while highlighting the bigger picture problem.

“The real question is whether a DEX can ever support high leverage sustainably without implementing CEX-style surveillance and risk controls. Open Interest limits, market surveillance, and liquidation mechanism innovation could help, but each of these moves Hyperliquid (or any DEX) closer to the centralized risk management playbook.”

Hyperliquid’s confidence shaken?

The impact of the whale liquidations is already being felt across Hyperliquid’s ecosystem.

Dune Analytics data revealed that Hyperliquid saw net outflows of $166 million on 12 March, the same day the whale’s position was liquidated.

With traders and industry leaders now debating the future of DEX leverage, Hyperliquid faces a critical decision.

As Ben Zhou put it,

“Would be interesting to see how it develops, maybe new innovation on liquidation mechanism?”