Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain data shows Bitcoin and the altcoins have seen their trading volume decline recently, a sign that trader interest in the market is waning.

Trading Volume Is Down Across The Cryptocurrency Sector

In a new post on X, the on-chain analytics firm Santiment has discussed about how the trading volume has changed for the various assets in the cryptocurrency sector.

The “trading volume” here refers to a measure of the total amount of a given coin that was involved in trading activities on all exchanges during the past 24 hours. This metric shouldn’t be confused with the “transaction volume,” which keeps track of the amount involved in transfers across the network, including peer-to-peer (P2P) trades.

Related Reading

When the value of the trading volume is rising, it means the investors are engaging in more trades on the exchanges. Such a trend implies the interest in the cryptocurrency is on the increase.

On the other hand, the indicator witnessing a decline suggests the traders may be paying lesser attention to the coin, as they are lowering the number of their moves.

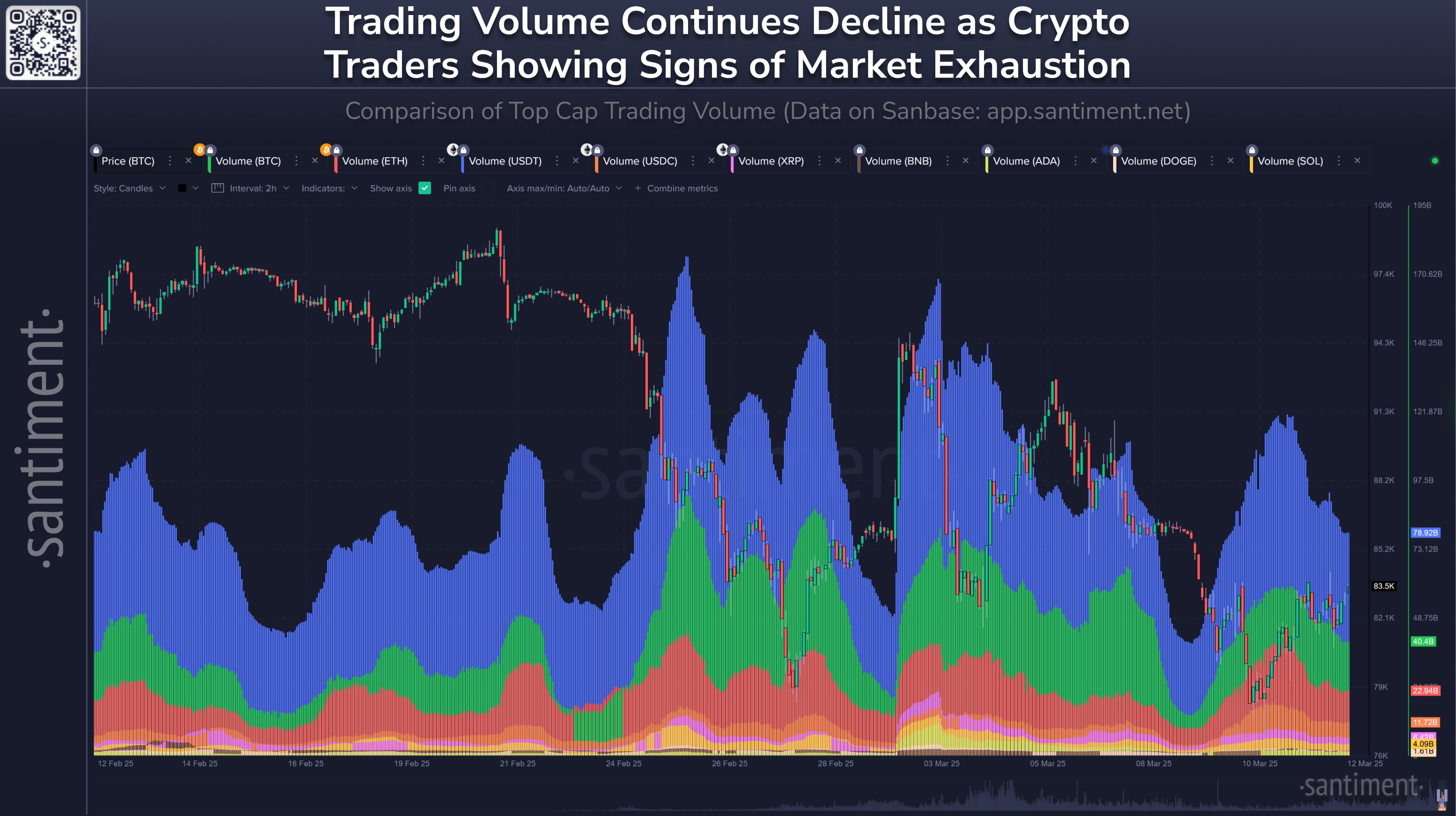

Now, here is the chart shared by the analytics firm that shows the trend in the trading volume for Bitcoin and the various top altcoins over the past month:

As is visible in the above graph, the trading volume across the sector hit a peak late last month, which means the investors were participating in a large amount of spot moves related to Bitcoin and company.

The spike in trading activity came as prices of the various assets observed a plunge. Generally, the market tends to come alive in volatile periods, as traders rush to make panic moves, whether for selling or buying. As such, the volume increase would make sense.

While volatility has continued in the last couple of weeks since then, however, the volume has interestingly been following a downward trajectory instead. To be sure, there have been spikes deviating to the upside, but the overall trend has remained in the down direction.

“When trading volume for major cryptocurrencies consistently drops, even during slight price recoveries (like we have seen Wednesday), it typically points toward diminishing trader enthusiasm,” explains Santiment.

Historically, price moves have usually required a certain level of interest from the investors to be sustainable. This is because it’s only when a large amount of investors are making trades that moves like this can obtain the fuel that they need to keep going.

Related Reading

Thus, with trader participation seemingly reaching exhaustion, it’s possible that Bitcoin and other assets may not be able to put together any lasting recovery rallies.

“To signal a healthier and more sustainable recovery, bulls generally will want to see both rising prices and rising volumes simultaneously,” explains the analytics firm. “Until trading activity increases meaningfully, cautious market sentiment is likely to dominate.”

BTC Price

At the time of writing, Bitcoin is trading around $82,900, down over 9% in the last week.

Featured image from Dall-E, Santiment.net, chart from TradingView.com