- Chainlink has unlocked 19M tokens and this could define LINK’s direction in the short-term

- Top whale wallets offloaded 13 million tokens two days before the unlock event

On 15 March, Chainlink [LINK] unlocked 19M tokens worth $269M as part of its quarterly schedule, according to blockchain analytics platform Spot On Chain. The firm stated,

“14.875M $LINK ($212.9M) was sent to #Binance. 4.125M $LINK ($56.2M) was transferred to multi-sig wallet ‘0xD50’”

Despite the massive unlock, however, LINK remained unscathed at press time, up about 6% following Bitcoin’s rebound to $85k. Hence, the question – Can LINK completely shrug the unlock without dumping? AMBCrypto looked at price reactions from past unlocks for insights.

LINK’s post-unlock analysis

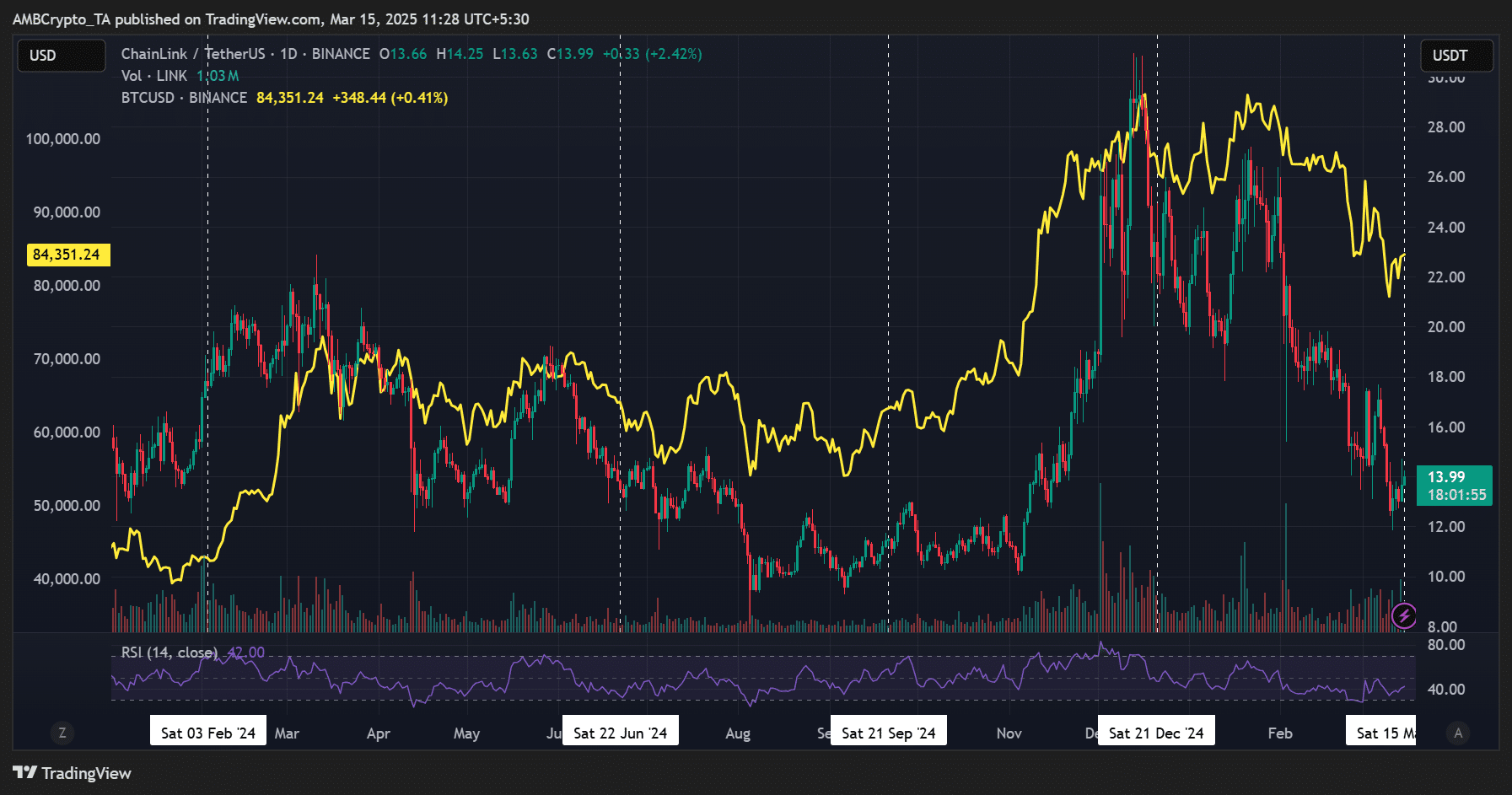

According to Spot On Chain, the latest unlocked amount was similar to February 2024, but lower than the 21M token released in June last year. The past unlocks (vertical, dotted white lines) were plotted against BTC’s price action (yellow) on the charts.

Apart from last September’s unlock, LINK had a red daily session close for the rest of the events. However, LINK bounced back after one or two days, marking a local bottom unless Bitcoin dropped lower. Whether the trend will repeat itself for the latest unlock event remains to be seen.

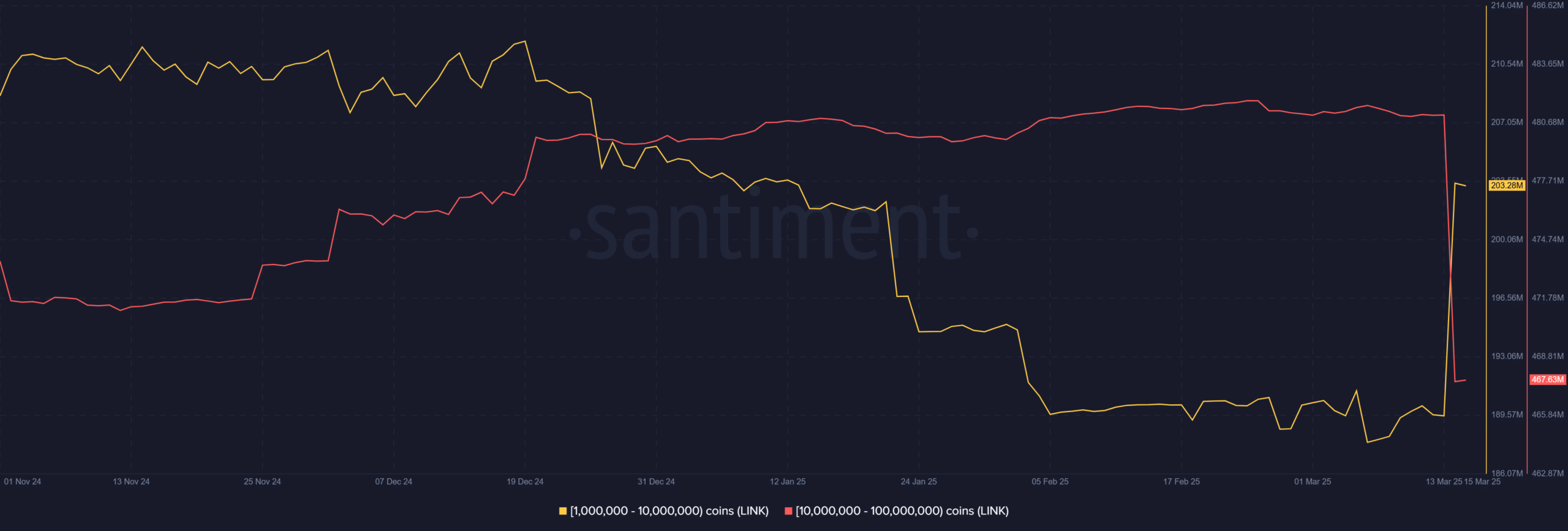

That being said, the largest whale wallets holding 10M -100M LINK tokens (red) offloaded about 13 million tokens ahead of the unlock (on 13 March). At press time, this cohort held 467.63M LINK.

On the contrary, the 1M-10M LINK wallet cohort absorbed their offloading, which held about half of the 467.63M LINK tokens held by the large whale.

On the trading side, one large player went long on LINK with a $7.1 million position size, hours before the unlock on Hyperliquid. However, he was sold at a loss after the unlock. Spot On Chain added,

“The “50x ETH” whale dumped 1.34M $LINK on-chain for $18.36M at ~$13.7 in the past two hours, losing $512K (-2.7%).”

AMBCrypto then evaluated LINK’s selling pressure on centralized exchanges (CEXes) to gauge the potential direction for LINK.

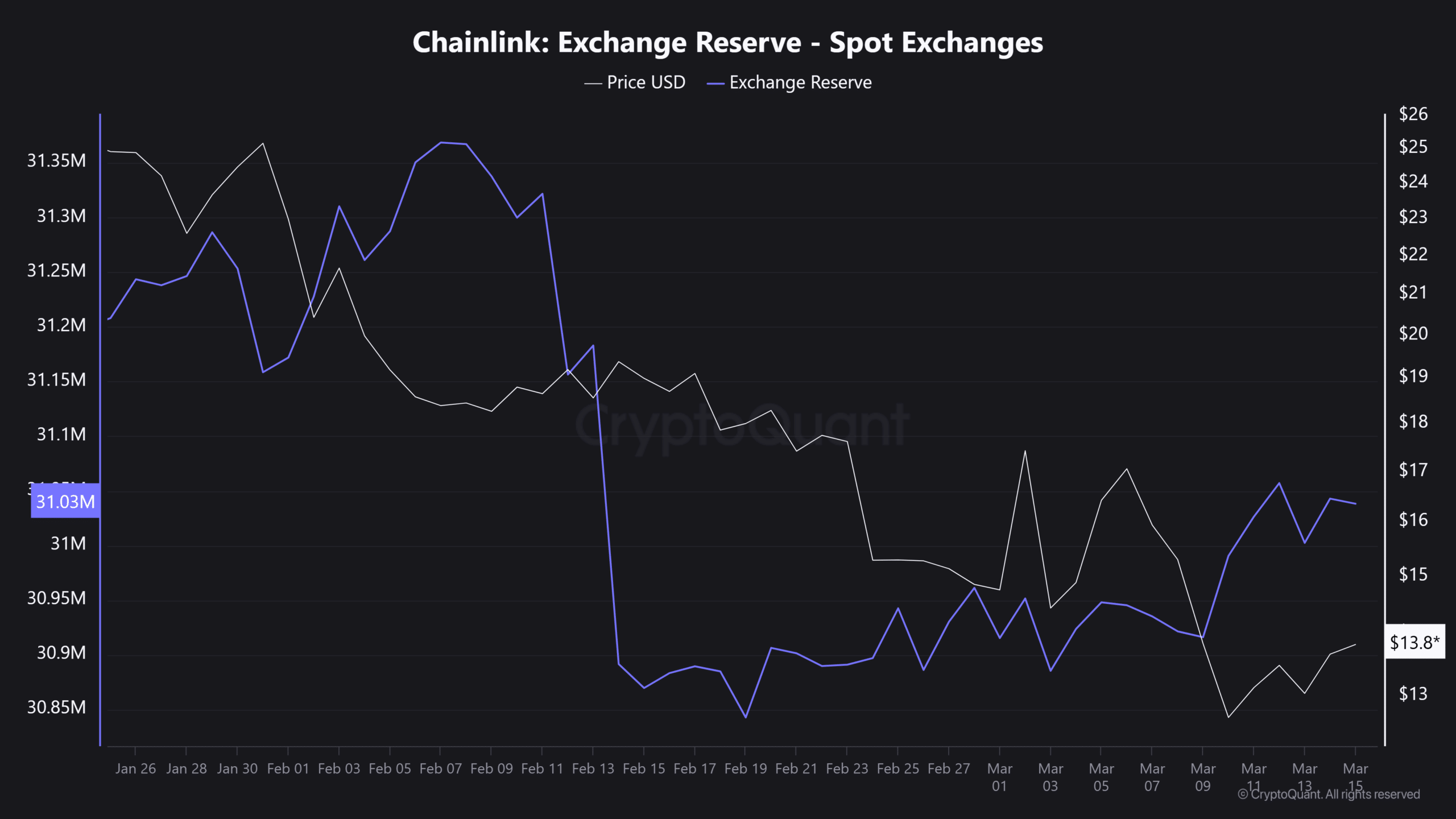

Although sell pressure was somewhat flat at press time, offloading increased over the past two days. The exchange reserves jumped from 30.8M tokens to 31M tokens, underlining a slight uptick in selling pressure before the unlock.

Additionally, exchange reserves on derivatives exchanges also spiked, hinting at high volatility and possible liquidation risks if excessive leverage is involved.

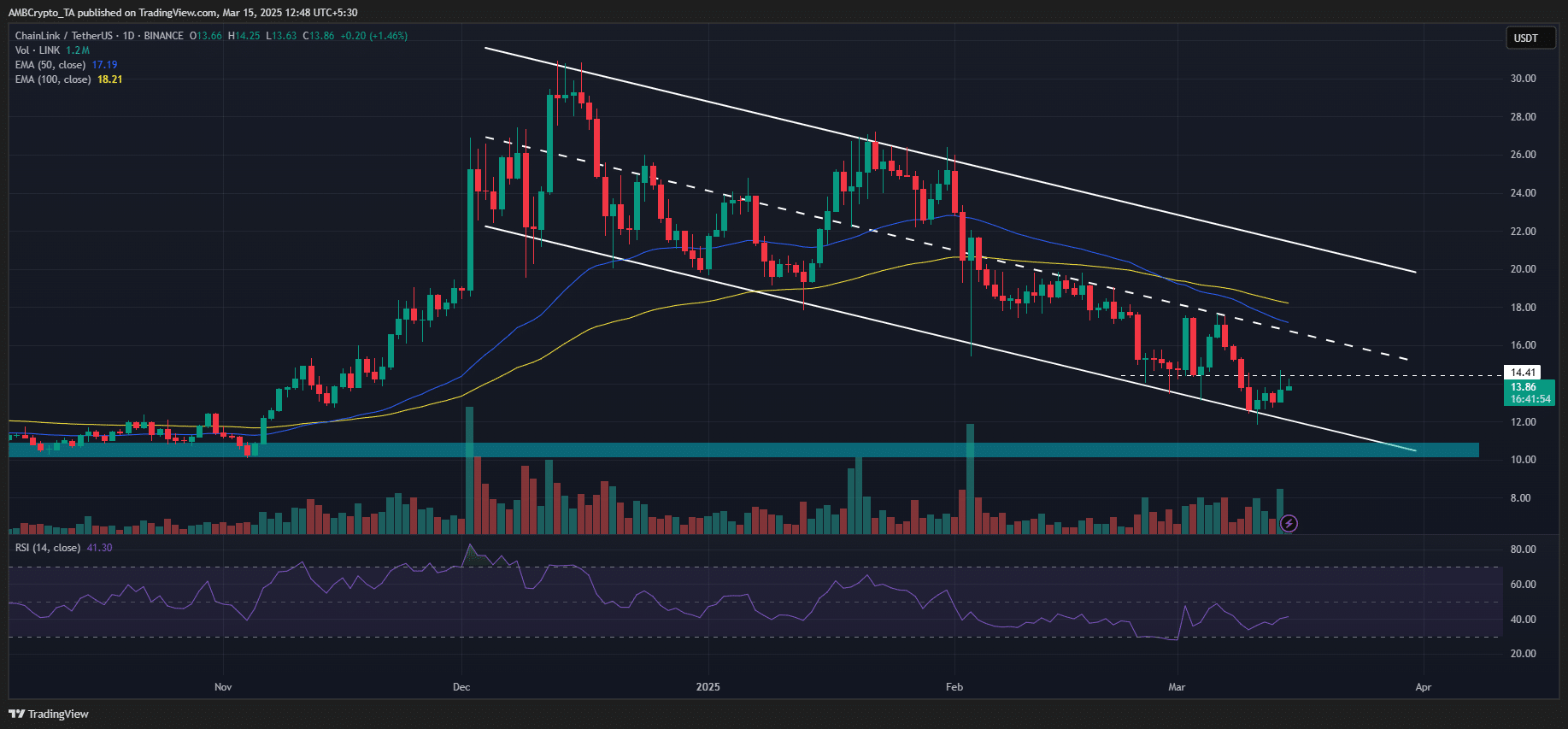

From a technical perspective on price, LINK bounced from its range-lows in the descending channel. If the rebound extends, the mid-range of $16-$17 could be tapped. However, sustained selling pressure could drag the altcoin to November U.S election levels of $10.