Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The crypto market is on high alert ahead of April 2, a date some analysts are calling “the biggest event of the year by an order of magnitude.” Macro economist Alex Krüger (@krugermacro), warns that President Donald Trump’s upcoming announcement of new reciprocal tariffs could deliver a seismic jolt to global markets — including crypto.

Why April 2 Is Massive For Crypto

In a post shared on X, Krüger describes the looming announcement, which the president has dubbed “Liberation Day,” as “10x more important than any FOMC” meeting: “April 2nd is similar to election night. It is the biggest event of the year by an order of magnitude. 10x more important than any FOMC, which is a lot. And anything can happen.”

According to Krüger, Trump might choose one of several paths: “Trump could go soft, in which case markets would rally fast and furiously. Or could go half-way, adding uncertainty on timelines, in which case markets would take out the stops of all longs and shorts. Or go all out, in which case markets could easily crash another 10% to 15%, fast.“

Related Reading

Krüger also suggests that “the US economy is still strong, but will highly likely slow down due to tariffs regardless of the path Trump chooses.” Nevertheless, he notes that many economists have already factored in a sharp year-end slowdown. He stresses that April 2 could mark the peak of market anxiety, aligning with the arrival of US Tax Day just two weeks later. “Either way, you all want to be prepared and ready to act on ‘Liberation Day.’ It will be big.”

Trump’s “Liberation Day” announcement will reportedly focus on “reciprocal tariffs” targeting specific countries or blocs deemed to maintain unfair trade barriers. Although this strategy appears “more targeted than the barrage he has occasionally threatened,” officials familiar with the matter believe it could still prove far-reaching.

President Trump has repeatedly signaled that these tariffs would be significant. Citing trade disparities with nations such as the European Union, Mexico, Japan, South Korea, Canada, India, and China, he asserts the US has been treated unfairly for too long. In remarks from the Oval Office, he declared: “April 2nd is going to be liberation day for America. We’ve been ripped off by every country in the world, friend and foe.”

Worst Case Scenario

Aides and allies suggest that while some countries may be excluded, Trump is looking for immediate impact. Tariff rates could take effect right away, adding to market fears of spiraling retaliation. In this case, Krüger says: “In worst case scenario sh*t would hit the fan then tariffs would start coming off as Trump negotiates hard in the following month, in which case peak negativity would hit around week 2 of April, which would coincide with US Tax Day.”

Related Reading

Senior officials, including National Economic Council Director Kevin Hassett and Treasury Secretary Scott Bessent, have indicated that the administration is focusing on a “dirty 15” group of countries where tariff and non-tariff barriers are allegedly most egregious. Hassett recently remarked, “It’s not everybody that cheats us on trade, it’s just a few countries, and those countries are going to be seeing some tariffs.”

For the crypto market, global macroeconomic events have increasingly played a pivotal role in price action in recent weeks. The April 2 “Liberation Day” announcement arrives at a time when digital asset traders already face headwinds from monetary policy shifts and a slowing global economy. Krüger believes that if the tariffs come in softer than expected, “markets would rally fast and furiously.” On the other hand, a maximalist tariff approach could deliver a significant shock, potentially denting cryptocurrencies.

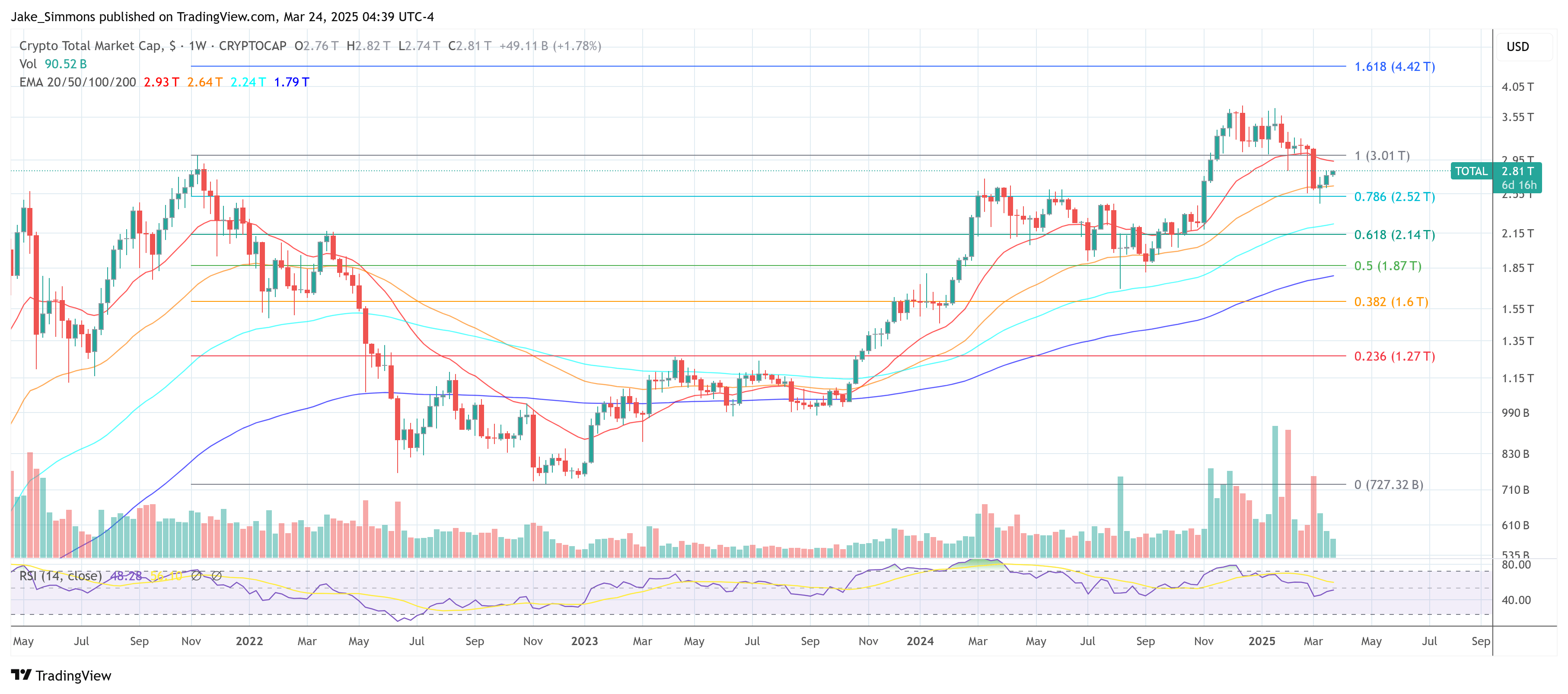

At press time, the total crypto market cap stood at $2.81 trillion.

Featured image from iStock, chart from TradingView.com