Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Recession risks and macro uncertainty are currently once again at the center of market discourse, with Bitcoin being down -20% from its peak. Yet macro analyst Tomas (@TomasOnMarkets) contends that the broader economic backdrop is not as dire as some headlines suggest, even though certain datasets have pointed to weaker growth in early 2025.

“Doesn’t look very recessionary to me?” Tomas wrote in a recent post on X, echoing the skepticism he has maintained for months. He pointed to specific indicators that began sliding in February but have started to stabilize. According to his analysis, US growth nowcasts—which aggregate various real-time measures of economic growth—“fell throughout February but have been leveling off for three weeks.” He likewise referenced the Citi Economic Surprise Index (CESI), which tracks how actual economic data compares to consensus forecasts. Since January, the CESI had been in a downturn, implying that data releases were coming in below expectations, but it has also steadied in recent weeks.

Related Reading

“Falling CESI = data coming in below expectations, rising CESI = data coming in above expectations,” Tomas explained, highlighting the significance of the index for market sentiment. The upshot is that, while markets grew increasingly defensive during the early-year weakness, these indicators are no longer deteriorating at the pace observed at the start of 2025.

Why Bitcoin Mirrors Summer 2024

Tomas then turned his attention to parallels between the current environment and two notable past episodes: the turbulence of Summer 2024 and the rout of late 2018. He underscored that, in each case, global markets encountered a sharp drawdown triggered by what he labeled “growth/recession scares,” combined with other exogenous pressures.

“For me, the two recent instances that are the most similar to today in terms of both price action and macro backdrop are Summer 2024 and late 2018,” he wrote. During Summer 2024, concerns over growth plus a widespread yen carry trade unwind contributed to a 10% equity-market drawdown. In late 2018, an escalating trade battle during the first Trump-era tariff moves similarly prompted an initial correction in equities of about 10%, eventually deepening into a further 15% pullback.

Now, with equity markets having also suffered approximately a 10% peak-to-trough decline recently, Tomas sees distinct echoes of those historical moments. He noted that such parallels extend to Bitcoin, which fell around 30% in Summer 2024 and 54% in late 2018—close to the 30% slide it has endured this time around. The question, he posed, is which path lies ahead: will the market follow the relatively contained Summer 2024 correction, or will it spiral into a more painful chain of losses similar to late 2018’s extended selloff?

Related Reading

“So which way?” Tomas asked, underscoring the uncertain juncture facing both crypto assets and equities. His stance leans toward expecting a scenario more akin to Summer 2024 than to the tumult of 2018. In his words, “I’m still in the camp that tariffs won’t be as bad as many expect — I’ve been here for months,” a viewpoint he believes also helps explain the somewhat surprising resilience in risk assets lately. He suggested that “some of the noises over the past couple of days are potentially pointing towards this outcome, which is probably why risk assets have jumped today,” although he stopped short of claiming any definitive resolution.

Several factors, in Tomas’s view, bolster the case that today’s landscape aligns more closely with Summer 2024 than with late 2018. One is the recent easing of financial conditions, which had tightened earlier in the year but have since moderated. Another is the US dollar’s notable weakening in recent weeks, a stark contrast to its ascent during 2018 that intensified selling pressure on global assets.

Tomas added that most leading indicators still support a continued business cycle expansion, a stance he believes is less reflective of the contractionary signals that rattled investors nearly seven years ago. Another contributing element, he noted, is the generally favorable seasonal pattern for US equity indices, which often rebound after a weak February and find firmer footing by mid-March. Finally, tight credit spreads—still below their highs seen in August 2024—point to stable credit markets that do not appear to be pricing in severe economic distress.

Beyond the question of macro signals, Tomas openly admitted fatigue with the swirl of discussions around economic policy catalysts. “I’m honestly really bored with all the tariff talk,” he wrote, while reminding followers that April 2 remains pivotal for clarity. “April 2nd ‘tariff liberation day’ will probably play a big role in deciding,” he concluded.

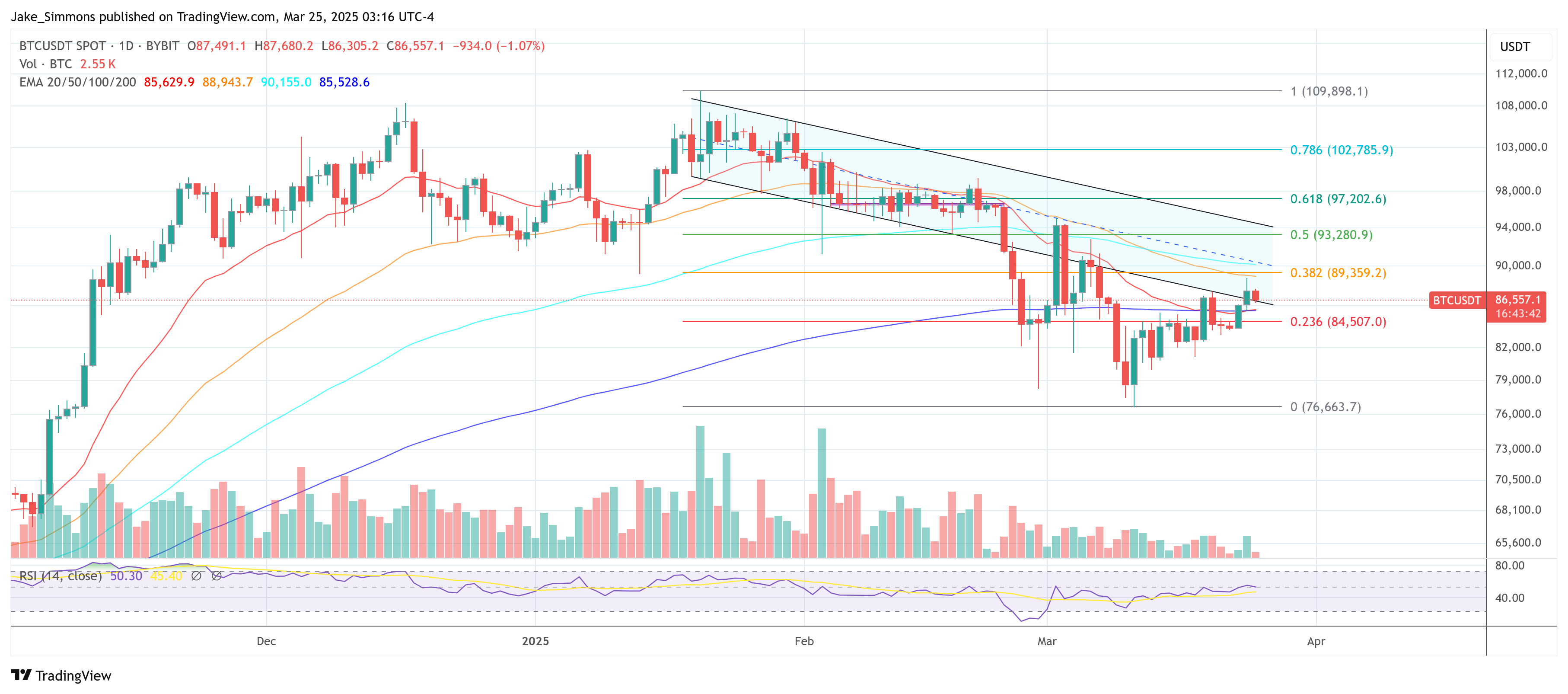

At press time, Bitcoin traded at $86,557.

Featured image created with DALL.E, chart from TradingView.com