Despite a $30 billion surge in stablecoin supply to new record levels, cryptocurrency investors remained cautious as they awaited market stability amid US tariff fears.

The total stablecoin supply rose by more than $30 billion in the first quarter of 2025, even as the overall crypto market capitalization fell 19%, according to a new report by crypto intelligence platform IntoTheBlock.

“The correlation between crypto and stocks climbed as macro expectations quickly shifted from “golden era” optimism to tariff-led doom and gloom,” according to IntoTheBlock’s quarterly report, shared with Cointelegraph.

Source: ITB Capital Markets

The stablecoin supply’s growth reflects a “cautious stance, with investors holding stablecoins as a hedge, likely waiting for market stability or better entry points,” according to Juan Pellicer, senior research analyst at IntoTheBlock crypto intelligence platform.

Related: Stablecoin rules needed in US before crypto tax reform, experts say

Industry leaders have predicted that the stablecoin supply may surpass $1 trillion in 2025, potentially acting as a significant crypto market catalyst.

“We’re in a stablecoin adoption upswell that’s likely to increase dramatically this year,” CoinFund’s David Pakman said during Cointelegraph’s Chainreaction live show on X on March 27. “We could go from $225 billion stablecoins to $1 trillion just this calendar year.”

The stablecoin supply surpassed the $219 billion record high on March 15. Analysts see the growing stablecoin supply as a signal for the continuation of the bull cycle.

Related: Stablecoins, tokenized assets gain as Trump tariffs loom

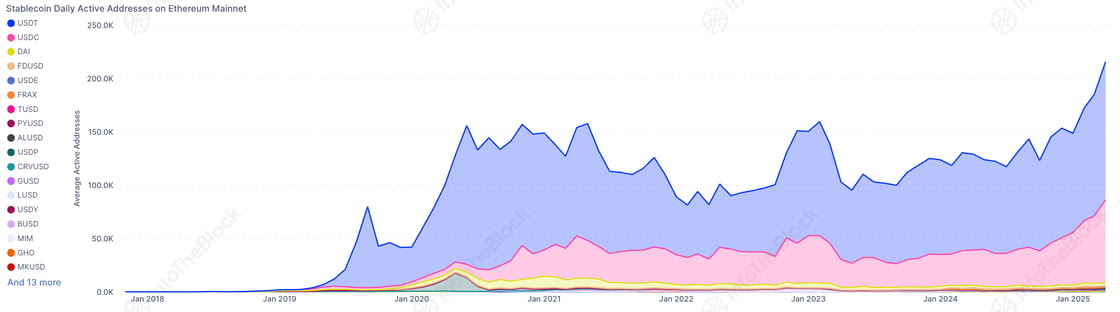

Stablecoin activity soars on Ethereum

During the first quarter of the year, the Ethereum network saw over $3 trillion worth of stablecoin transactions on the mainnet, excluding layer-2 networks.

The number of unique addresses using stablecoins on Ethereum mainnet also surpassed the record 200,000 mark for the first time in March.

Stablecoin daily active addresses on Ethereum mainnet. Source: IntoTheBlock

Despite the growing blockchain activity, the price of Ether (ETH) fell by over 45% during the first quarter of 2025, Cointelegraph Markets Pro data shows.

ETH/USD, 1-year chart. Source: Cointelegraph Markets Pro data shows.

The decline in ETH is linked to a combination of broader macroeconomic concerns and Ethereum-specific pressures, such as increased competition from networks like Solana and the rise of layer-2 protocols.

“Some analysts argue that layer-2 solutions dilute ETH’s value by shifting activity off the main chain, but this overlooks how L2s still rely on Ethereum for security and pay fees, contributing to its ecosystem,” Pellicer said.

He added that the decline in ETH is more likely due to market sentiment and uncertainty about Ethereum’s ability to capture value from its broader ecosystem.

Still, other analysts see a silver lining to the tariff-related investor concerns. Nansen analysts predicted a 70% chance for crypto markets to bottom by June 2025 as tariff negotiations advance.

Magazine: Bitcoin $500K prediction, spot Ether ETF ‘staking issue’— Thomas Fahrer, X Hall of Flame