Solid, a fintech startup that once branded itself as “the AWS of fintech,” has officially filed for Chapter 11 bankruptcy protection. The filing was submitted on April 7 in the U.S. Bankruptcy Court for the District of Delaware.

Founded in 2018 and formerly known as Wise, Solid had raised approximately $81 million from prominent investors, including FTV Capital and Headline. At the peak of its momentum in August 2022, the Palo Alto-based startup announced a $63 million Series B funding round led by FTV Capital, bringing its total valuation to $330 million, according to PitchBook.

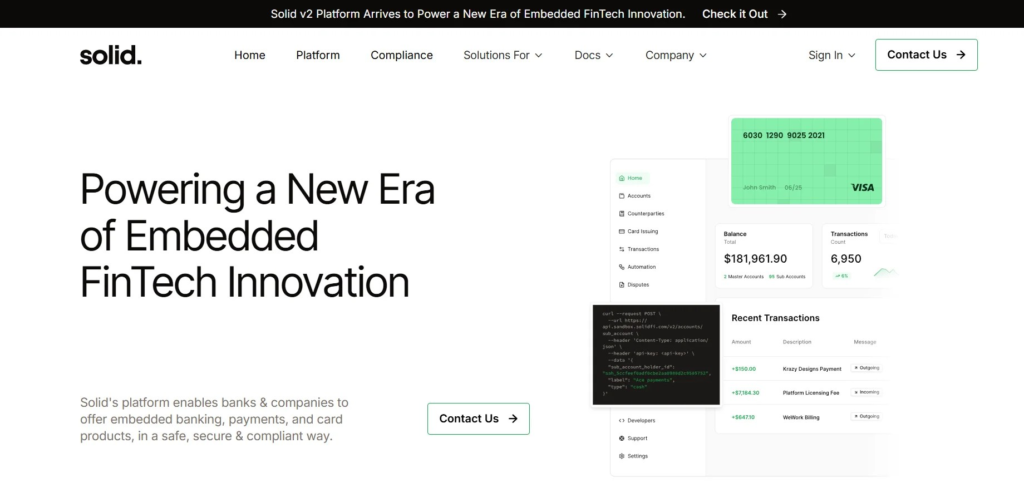

Solid operated as a banking-as-a-service (BaaS) platform, enabling fintech and vertical SaaS companies to embed financial services such as banking, payments, cards, and even crypto products through easy-to-integrate APIs. It attracted attention for its ambitious positioning in the fintech space and claimed to have experienced a 10x revenue growth, doubled its customer base to over 100 clients, and reached profitability by mid-2022.

However, the company’s trajectory has shifted dramatically. According to bankruptcy documents, Solid is now exploring restructuring or a potential sale. Co-founder Arjun Thyagarajan expressed cautious optimism despite the filing.

“After considering all options, we’ve decided that a voluntary Chapter 11 restructuring is the best course,” he told TechCrunch. “We’re optimistic that the court-supervised sale process will attract the right buyer, leading to a positive outcome for the company, customers, and shareholders. Solid intends to continue operating its business in the ordinary course through this process.”

The bankruptcy filing reveals that Solid was unable to secure additional capital following its last round and became embroiled in costly legal disputes. In 2023, its major investor, FTV Capital, filed a lawsuit seeking to recover its $61 million investment. The firm accused co-founders Thyagarajan and Raghav Lal of misrepresenting key metrics like revenue and customer churn and demanded their resignation.

In response, the founders countersued FTV and partner Robert Anderson, alleging aggressive and unethical conduct. They painted FTV as a private equity firm that turned hostile once its investment underperformed, resorting to unfounded accusations and intimidation tactics.

That legal dispute has since been resolved. According to the bankruptcy filing, the litigation with FTV was dismissed “with prejudice” in April 2024 following a settlement between both parties.

As of the petition date, Solid disclosed having approximately $760,000 in unsecured trade debt and around $7 million in cash, though $2 million of that was locked in non-liquid reserves. The company now reportedly has just three remaining employees.

A Restructuring or Fire Sale? What’s Next for Solid

Solid filed under Subchapter V of Chapter 11, which is designed for small businesses, offering faster timelines for restructuring and more flexibility in negotiating terms with creditors.

Notably, Solid isn’t the only BaaS company to face such a fate. In April 2023, fellow BaaS startup Synapse also filed for Chapter 11 bankruptcy, attempting to sell its assets in a $9.7 million deal to TabaPay, which ultimately fell through. In both instances, Evolve Bank & Trust was the partner bank—a detail drawing scrutiny. Recently, fintech firm Mercury disclosed that it had ended its relationship with Evolve as well.

The fallout from Solid’s bankruptcy has reached several corners of the fintech ecosystem. According to Fintech Business Weekly, Solid’s 20 largest unsecured creditors include major industry names like Amazon (AWS), Visa, Plaid, Trulioo, Spade, FS Vector, and several legal firms. Updates on the case were also shared by fintech commentator Jason Mikula and RK | Consultants on X (formerly Twitter).

As of now, FTV Capital has not issued a public comment on the matter.

For more insights and updates on Metaverse, DeFi, Blockchain, NFT & Web3, be sure to subscribe to our newsletter. Stay informed on the latest trends and developments in the decentralized world.