Bitcoin holders are celebrating one year since the 2024 Bitcoin halving by praising BTC’s resilience amid a global trade war and suggesting an accelerated market cycle due to a growing institutional presence.

The 2024 Bitcoin halving reduced block rewards from 6.25 Bitcoin (BTC) to 3.125 BTC, slashing new BTC issuance in half.

Despite rising concerns over a global trade war and escalating tariff tensions between the United States and China, BTC has climbed more than 33% since April 2024, Cointelegraph Markets Pro data shows.

“So, even though Bitcoin’s showing resilience, I think the mix of past experiences, economic uncertainty, and this selling pressure is keeping investors on the sidelines, waiting for a stronger green light before they jump in,” said Enmanuel Cardozo, a market analyst at asset tokenization platform Brickken.

Cardozo added that institutional investment from firms such as Strategy and Tether could speed up Bitcoin’s traditional four-year halving cycle. He added:

“For the 2024 halving in May, that puts the bottom around Q3 this year and a peak mid-2026, but I think we might see things move it a bit sooner because the market’s more mature now with more liquidity.”

However, Bitcoin’s trajectory remains tied to broader monetary policy, the analyst added. He said a US Federal Reserve rate cut in May or June may “pump more money into the system and push Bitcoin up faster.”

The halving is a built-in feature of the Bitcoin network that assures Bitcoin’s scarcity, which is considered one of BTC’s defining monetary characteristics.

Related: Crypto, stocks enter ‘new phase of trade war’ as US-China tensions rise

ETFs and institutions fuel faster cycle

Institutional adoption and Bitcoin exchange-traded funds (ETFs) may be contributing to a shorter market cycle, according to Vugar Usi Zade, chief operating officer at Bitget exchange.

Continued institutional buying, including by Bitcoin ETFs, paired with Bitcoin’s rising scarcity, may accelerate Bitcoin’s rise to new highs, he told Cointelegraph.

“With growing scarcity triggered by the halving, Bitcoin will likely retest its all-time high if it breaches the $90,000 mark in the coming weeks,” Usi Zade said. “While the halving offers a good basis for growth based on demand and scarcity, the timeline for impact on price can vary over time.”

He noted that Bitcoin’s growth remains closely tied to traditional financial markets and investor sentiment.

Related: Bitcoin speculative appetite declines as investors seek safety

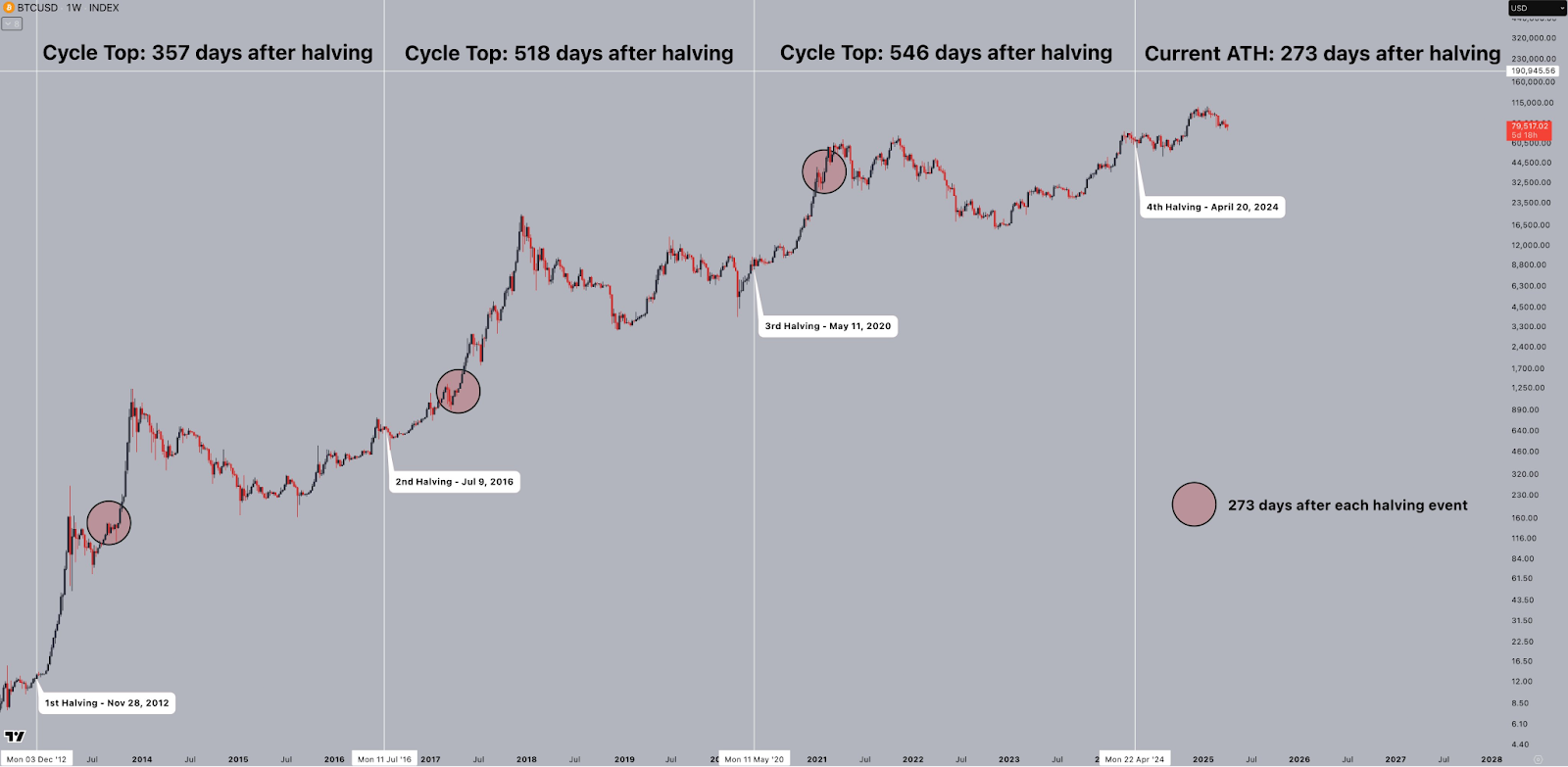

Bitcoin reached a new all-time high above $109,000 on Jan. 20, 273 days after the 2024 Bitcoin halving, signaling an accelerated market cycle.

In comparison, it took Bitcoin 546 days to reach an all-time high after the 2021 halving, and 518 days after the 2017 halving, according to data shared by popular crypto trader Jelle, in an April 8 X post.

Magazine: Bitcoin’s odds of June highs, SOL’s $485M outflows, and more: Hodler’s Digest, March 2 – 8