Rug pulls have become one of the most pervasive risks in the DeFi space, eroding investor confidence and hindering the industry’s long-term viability. A rug pull is a type of fraud where a project’s developers abandon the initiative after amassing significant investor funds, leaving token holders with worthless assets.

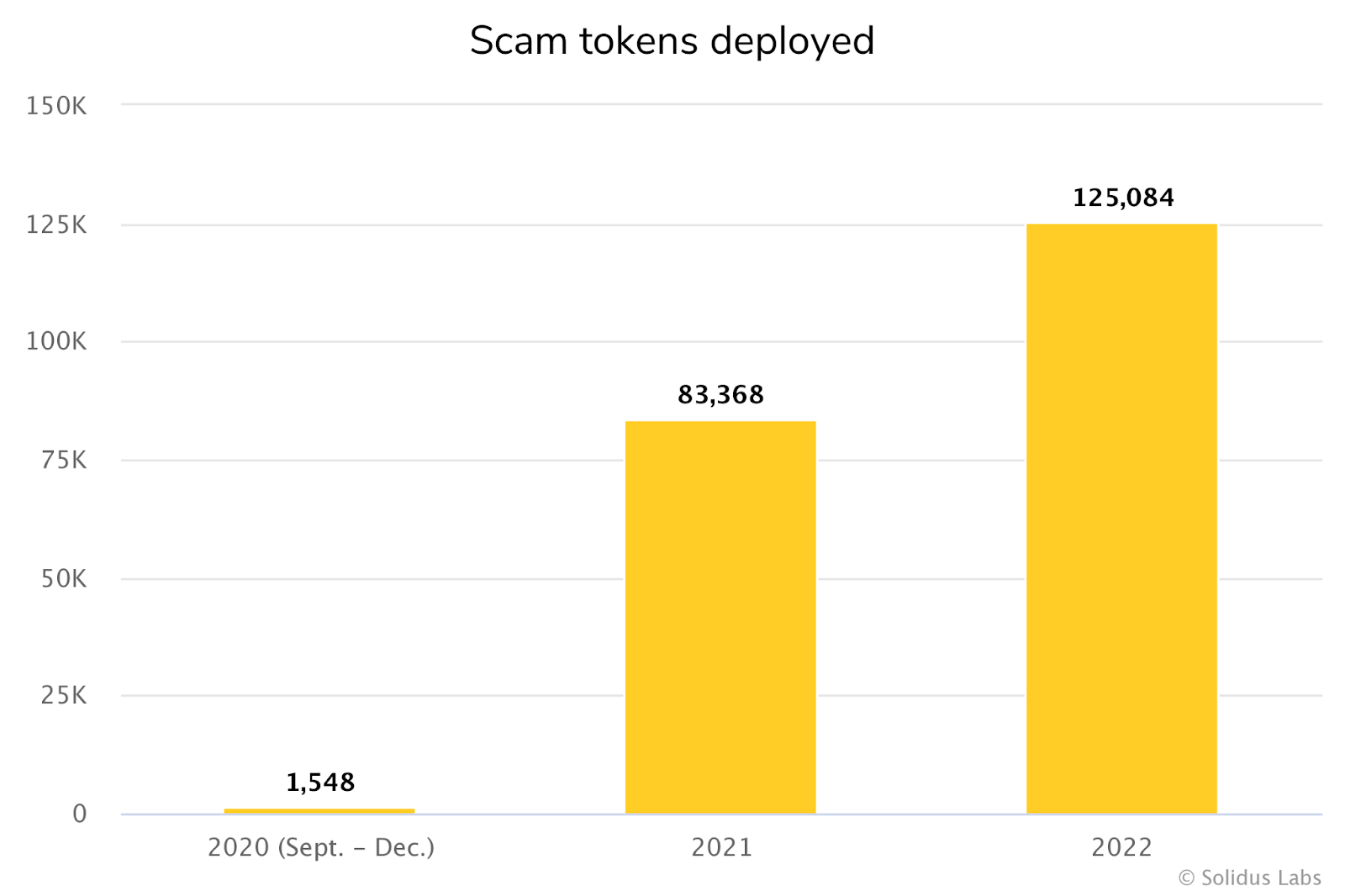

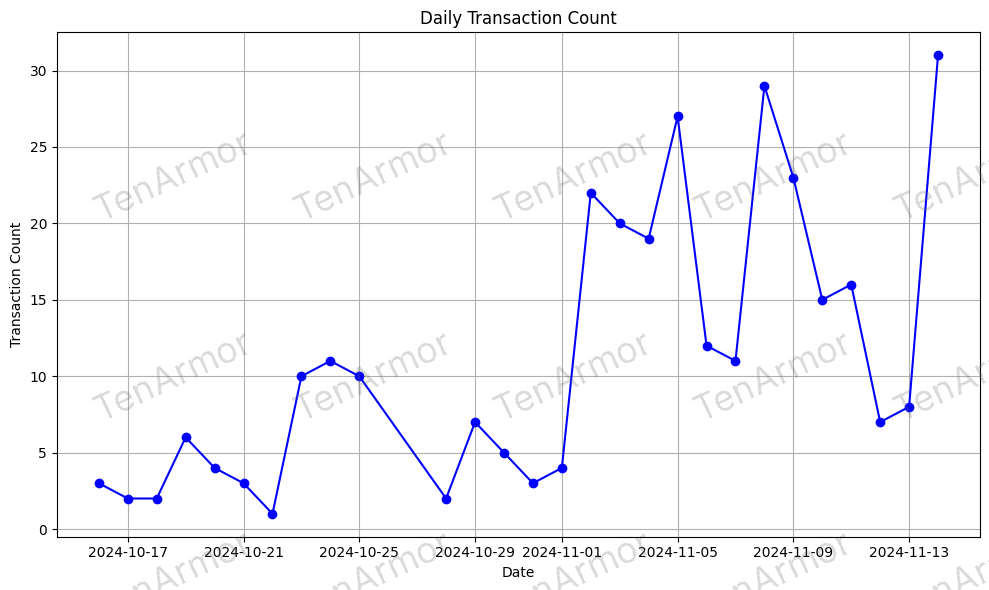

The scale of this crisis is staggering. A 2022 report from blockchain risk monitoring firm Solidus Labs revealed that over 117,000 scam tokens were launched that year alone—a 41% increase from 2021. With an average of 15 new scam tokens emerging every hour, nearly 2 million investors have fallen victim to rug pulls. On November 14, 2024, rug pull incidents peaked at 31 in a single day, with cumulative monthly losses reaching $15 million.

Some of the most infamous cases include the 2021 Squid Game (SQUID) token scam, which exploited the hype around the Netflix series to steal $3.3 million, and the AnubisDAO rug pull, where developers drained $60 million in ETH within 24 hours of launch. According to Solidus Labs, a shocking 12% of all BNB Chain tokens are scams.

Given the scale of the problem, one might assume that the growth of decentralized finance (DeFi) would be impacted. Surprisingly, it has not been. However, there is potential for further growth if the issue of rug pulls is addressed. Tackling rug pulls presents a unique challenge, as traditional insurance models typically avoid covering fraud due to the associated high moral hazard. On the other hand, DeFi insurance offers hope because it is tailored specifically to the industry.

DeFi Insurance Models and Their Approach to Risk

DeFi insurance has emerged as a promising solution to mitigate risks associated with hacks, smart contract exploits, and governance failures. Unlike traditional insurance, which relies on centralized companies and underwriters, DeFi insurance operates through decentralized models where liquidity providers pool funds, and smart contracts execute payouts based on predefined conditions.

The core principles of DeFi insurance include:

- Decentralized Risk Sharing: Users contribute funds to liquidity pools to collectively cover risks.

- Smart Contract Automation: Claims and payouts are executed through code rather than human intermediaries.

- Community Governance: Claim approvals and policy decisions are often made through decentralized governance mechanisms, where token holders vote on outcomes.

Despite its innovative approach, DeFi insurance primarily focuses on technical risks such as smart contract failures rather than human-driven fraud, including rug pulls. Below is an analysis of three major DeFi insurance platforms—Nexus Mutual, InsurAce, and Unslashed Finance—and their approach to risk.

Major DeFi Insurance Platforms and Their Coverage Criteria

| Platform | Coverage Focus | Key Features |

| Nexus Mutual |

|

|

| InsurAce |

|

|

| Unslashed Finance |

|

|

Why Rug Pulls Are Not Covered

As you can see, none of these platforms offer protection against rug pulls. Unlike smart contract failures or technical exploits—often caused by coding errors and mitigated through audits and security measures—rug pulls are fundamentally different. They are deliberate acts of fraud where project teams abandon their initiatives after amassing investor funds, leaving behind worthless tokens. This human-driven deception poses a unique challenge for insurers, making rug pull protection impractical and unsustainable.

Fraud is difficult to underwrite because it is not a system failure but an intentional manipulation of trust. Traditional insurance models also avoid covering fraud for the same reason—there is no reliable way to quantify or mitigate the risk without exposing the insurer to excessive financial losses.

Another key factor is the lack of on-chain detectability. While smart contracts are programmable and transparent, allowing for auditing tools to identify potential risks before an attack occurs, rug pulls often involve deceptive tactics that extend beyond the blockchain. Developers might create a seemingly legitimate project, build hype through manipulated social media campaigns, and fabricate audits or partnerships to gain credibility. By the time investors realize they have been defrauded, the perpetrators have already disappeared, making it impossible for an insurance provider to intervene or verify claims reliably.

Moreover, covering rug pulls would threaten the financial sustainability of DeFi insurance. Insurance protocols operate by pooling liquidity from users who stake funds to provide coverage. If rug pulls were included in coverage policies, insurers would face a flood of unpredictable, high-value claims that could quickly deplete liquidity pools. Unlike smart contract failures, which can be modelled based on historical data, fraud claims are volatile and could overwhelm the system, rendering it unworkable.

Additionally, governance structures within DeFi insurance protocols pose another challenge. Many DeFi insurers rely on decentralized autonomous organizations (DAOs) to approve claims, meaning payouts depend on community votes rather than predefined, verifiable conditions. This system introduces potential conflicts of interest, where token holders might reject rug pull-related claims to preserve the integrity of the insurance pool. The result is inconsistent claim approvals, prolonged disputes, and diminished trust in the insurance model.

Does DeFi Insurance Build Trust, Even If It Can’t Fully Cover Rug Pulls?

Even though DeFi insurance cannot fully mitigate the risk of rug pulls, it still plays a crucial role in fostering trust within the ecosystem. By covering smart contract exploits and protocol failures, these insurance products establish a baseline level of security that encourages both retail and institutional investors to participate in DeFi.

Moreover, the presence of insurance incentivizes projects to adhere to higher security standards, conduct thorough audits, and implement transparency measures. Institutional investors, in particular, are more likely to engage with DeFi if they have some form of risk mitigation in place, even if it does not cover all possible threats.

Additionally, the growth of DeFi insurance could push for better self-regulation within the industry. If insurance providers begin integrating project credibility assessments—such as mandating third-party audits, implementing vesting periods for developer funds, and requiring on-chain governance structures—they could indirectly reduce the prevalence of rug pulls by setting industry standards.

Final Thoughts

DeFi insurance, as it stands, is more of a patch than a cure when it comes to mitigating risks in the space. While it provides a safety net for smart contract failures, governance exploits, and stablecoin depegging, it does little to shield investors from the far more pervasive and damaging threat of rug pulls.

The fundamental problem lies in the nature of rug pulls—they are acts of deception rather than technical failures. This makes them difficult, if not impossible, to underwrite. Fraud risk is virtually impossible to quantify in a permissionless system where anonymity is the norm. Additionally, governance-driven claim approvals introduce their own challenges, such as conflicts of interest and delayed resolutions.

Even if DeFi insurers attempted to cover rug pulls, the sustainability of their liquidity pools would be in jeopardy, as widespread fraud-related claims would likely drain resources faster than they could be replenished.

However, dismissing DeFi insurance entirely would be short-sighted. It plays a crucial role in building investor confidence by mitigating other technical risks that would otherwise deter participation. More importantly, its existence pressures DeFi projects to maintain higher security standards, undergo audits, and implement transparency measures. While it cannot single-handedly eliminate the threat of rug pulls, it can contribute to a broader culture of accountability in the industry.

The real question is whether DeFi insurance gives investors a false sense of security. The answer depends on how it is framed. If positioned as a safeguard against all risks, it is misleading. But as part of a broader risk management strategy—one that includes due diligence, project vetting, and community-driven oversight—it remains a valuable tool.

The future of DeFi insurance will depend on its ability to evolve beyond compensating for technical failures and toward incentivizing industry-wide best practices that make rug pulls less viable in the first place. Until then, investors should treat it as a risk-mitigation tool rather than an infallible safety net

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you want to read more market analyses like this one, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

The post Can DeFi Insurance Products Solve the Problem of Rug Pulls? appeared first on DeFi Planet.