Sol Strategies has captured the spotlight with an explosive 41% surge in its stock price over Friday and Saturday, following the company’s announcement of being included in VettaFi’s indices, which are tracked by Invesco’s prominent BLKC and SATO ETFs.

The surge didn’t just stop over the weekend; as the U.S. markets opened today, Sol Strategies’ stock climbed an additional 5.40%, showing the strong momentum the company has built.

The excitement stems from Sol Strategies’ official post on April 27, where the firm expressed immense gratitude for being included among other leading blockchain and crypto companies represented in Invesco’s ETFs.

This inclusion marks a major milestone for Sol Strategies, adding it to an elite roster of crypto-related stocks, alongside MicroStrategy (MSTR), Riot Platforms (RIOT), Coinbase (COIN), and Galaxy Digital (GLXY).

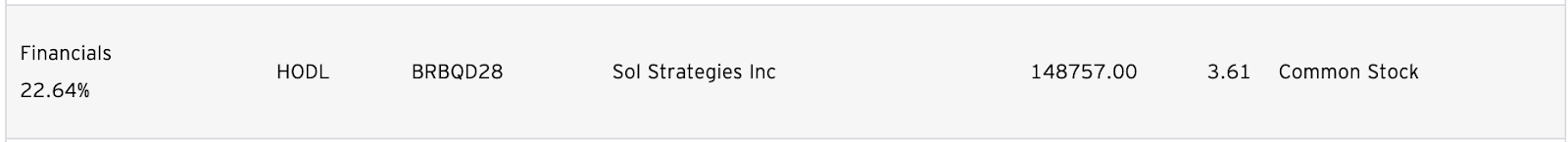

With a weighting of 3.61% in the financials sector of the ETF portfolio, Sol Strategies has earned the highest percentage share among its peers.

A New Star Among Invesco’s Crypto Heavyweights

Reviewing the ETF’s current holdings as of April 25, 2025, Sol Strategies boasts the highest allocation among the financial sector stocks, outpacing even Galaxy Digital (3.02%), Coinbase (2.57%), and Bitcoin Group SE (2.56%).

This prominent positioning places Sol Strategies in an elite category, alongside large-cap crypto miners, blockchain service providers, and financial platforms, including Cipher Mining (CIFR), Bitdeer (BTDR), and Riot Platforms (RIOT).

Yet, while many mining companies listed are currently grappling with diminishing profitability due to Bitcoin’s recent price stagnation and elevated operational costs, Sol Strategies presents a markedly different narrative.

Unlike traditional mining operations, which are heavily exposed to energy costs and Bitcoin price volatility, Sol Strategies’ validator-first approach leverages the Solana blockchain’s staking rewards system.

Through acquisitions such as Laine and Stakewiz.com, as well as strategic partnerships like the recent collaboration with Pudgy Penguins for the PENGU Validator, Sol Strategies has built a scalable and resilient validator business.

With a 7.41% average delegator APY and over 3.35 million SOL staked, the company ensures steady revenue regardless of broader market downturns affecting miners.

Given these structural advantages, Sol Strategies could continue its upward trajectory, particularly compared to peers such as Bitfarms (BITF) and Hive Digital Technologies (HIVE), which are more susceptible to market downturns.

While traditional miners might struggle to maintain their positions in Invesco’s indices, Sol Strategies’ diversified staking income and strategic innovations provide a more robust platform for sustainable growth.

Strategic Financing, Validator Expansion, and Future Prospects

The April 23 announcement of the $500 million convertible note facility with ATW Partners marked a transformative moment for Sol Strategies.

Unlike typical debt financing, where interest payments are cash-based and can strain liquidity, Sol Strategies’ novel approach ties note interest payments directly to staking yields, with interest capped at 85% of the yield generated.

This design ensures that each dollar raised and deployed becomes immediately accretive to the company’s balance sheet.

Additionally, the optional conversion feature allows ATW Partners to convert their Notes into common shares at prevailing market prices, aligning their incentives with Sol Strategies’ long-term success.

Beyond financial engineering, Sol Strategies has made strategic moves to expand its dominance as a validator.

The $24 million acquisition of three major Solana validators in March instantly doubled the company’s SOL holdings.

Meanwhile, the partnership with Pudgy Penguins to launch the PENGU Validator introduces additional growth vectors, tapping into the massive community-driven ecosystem Pudgy Penguins commands.

With yields ranging from 7% to 11% accessible via the Phantom wallet, the PENGU Validator is designed to attract new delegators and enhance Sol Strategies’ reputation as the premier validator operator within the Solana ecosystem.

The post Sol Strategies and Invesco ETF Inclusion Rockets Stock 47% in Two Days appeared first on Cryptonews.