MilkyWay (MILK) is a liquid staking protocol for Celestia, a modular blockchain specializing in Data Availability.

The project has yet to release detailed tokenomics, but recently the team announced an airdrop of 100 million MILK (10% of the total supply) for the community.

Due to the lack of complete information about the distribution mechanism, price analysis must primarily rely on fully diluted valuation (FDV)—that is, assuming the full supply and examining various price scenarios.

Read more: Binance Wallet Hosts MilkyWay (MILK) TGE on PancakeSwap

How Does MilkyWay Work? Differentiation Through a Celestia-Native Liquid Staking Model

MilkyWay enables users to stake TIA and receive milkTIA — a liquid staking token (LST) that can be utilized across various DeFi applications. Users can trade milkTIA, use it as liquidity, or reinvest it, providing maximum flexibility. The core technology stack of MilkyWay includes:

-

Built-in Restaking Module: MilkyWay goes beyond simple staking by allowing users to restake their TIA into additional security services within the Celestia ecosystem, or eventually into other modular chains.

-

Validator Abstraction: The protocol design eliminates the need for users to manually choose validators. Instead, the system automatically optimizes validator selection for performance and safety, similar to Lido’s approach.

-

Celestia-Native Architecture: Unlike multichain staking protocols, MilkyWay directly leverages Celestia’s Data Availability and modular execution layers. This allows for the deployment of lightweight, gas-efficient DeFi modules.

-

Modular-First Design: MilkyWay aims to become the default staking infrastructure for rollups that use Celestia as their DA layer — just as EigenLayer has emerged as a secondary security layer for Ethereum’s L2 ecosystem.

MilkyWay’s technological edge lies in its seamless integration into the modular stack, providing not just staking but a middleware staking layer where staking, restaking, DA, and security services operate flexibly across layers. If Celestia’s rollup ecosystem continues to expand, MilkyWay is positioned to become a foundational component, not merely a “staking DApp,” but a core staking middleware for the modular Web3 world.

Funding Sources and Estimated Tokenomics

To date, MilkyWay has raised approximately $6 million across its funding rounds. The Seed round in April 2024 raised $5 million, led by Binance Labs, Polychain Capital, and other investors such as HackVC, LongHash, and Crypto.com Capital.

MilkyWay has not yet released its official tokenomics. However, based on the announced airdrop of 100 million MILK, representing 10% of the total supply, it can be inferred that the maximum supply would be around 1 billion tokens.

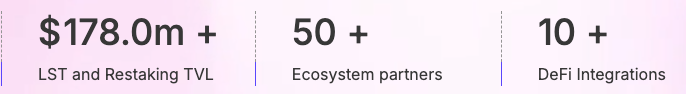

According to the latest data from MilkyWay’s official page, the total value of assets staked and restaked through the platform has reached approximately $172 million.

With TIA currently priced at around $2.94, the estimated amount staked is about 58.5 million tokens.

Source: MilkyWay

This indicates a relatively strong and active participation from the Celestia and MilkyWay communities.

Price Analysis Based on FDV Scenarios

The starting point assumes a total supply of 1 billion MILK tokens. In that case, the token price and FDV have a linear relationship:

FDV = Total token supply × Price.

Conservative Scenario

FDV ≈ $50 million (price ~ $0.05). At this price point, MILK’s value would only amount to 15% of KernelDAO‘s initial FDV upon listing.

This could happen if the market turns cautious or there is strong selling pressure from airdrop recipients. However, this is considered the most conservative and lower-bound scenario for MilkyWay.

Base Case Scenario

FDV ≈ $100-200 million (price ~ $0.10-0.20). In this case, MILK would trade around $0.10–0.20, aligning with KernelDAO’s current FDV (~$180 million).

This is a reasonable baseline scenario, roughly matching the segment of liquid staking/restaking projects on BNB Chain (like KernelDAO) that MilkyWay is targeting.

If MILK reaches ~ $0.10 (FDV ~ $100 million), it would be considered “undervalued” compared to KernelDAO.

At ~$0.20 (FDV ~ $200 million), it would be slightly higher but still acceptable if MilkyWay attracts healthy liquidity inflows.

Bull Case

FDV ≈ $700+ million. Achieving this would require a massive catalyst, such as a major exchange listing combined with extreme speculative sentiment, more than how KernelDAO once reached an ATH valuation.

However, this also implies significant sell pressure early on, likely leading MilkyWay’s FDV to retrace toward KernelDAO’s current levels.

A fair price range for MILK is likely between $0.10 and $0.30 (FDV ~ $100–300M), roughly in line or slightly above KernelDAO.

Only expect prices above $0.50 in case of unexpected, highly bullish catalysts.

Investors should closely monitor key metrics like circulating supply at TGE, unlock schedules, and token distribution between the team and community treasury to better assess realistic valuations.

Comparison with KernelDAO and others

KernelDAO

Comparing MILK with other projects in the same sector on BNB Chain helps position its relative potential. A prime example here is KernelDAO (KERNEL) – a recently TGE liquid restaking protocol backed by Binance Labs. KERNEL has a total supply of 1 billion tokens and currently holds an FDV of approximately $179–180 million.

At the time of its listing (April 14, 2025), only about 16.23% of tokens were in circulation, with a price of $0.32, translating to an initial FDV of $320M. The Kernel team raised around $10 million across several funding rounds, involving Binance Labs and other major investment funds.

In terms of scale, KernelDAO has grown significantly: they launched a $40 million ecosystem fund to support the development of restaking projects on BNB Chain and reached over $1.7 billion in total value locked (TVL).

Source: DefiLlama

This highlights the enormous appeal of the restaking sector and Kernel’s strong capital attraction capabilities. Thus, KERNEL holds an FDV of around $180 million while managing multi-billion dollar assets.

Meanwhile, MilkyWay currently has less than $10 million worth of TIA staked within its platform. If MILK’s FDV surpasses Kernel’s range, meaning around $150 – 200 million, MilkyWay would need to attract more capital or rapidly increase its TVL to justify the valuation.

In terms of fundraising, MilkyWay raised $5 million (seed round), which is lower than Kernel’s $10 million but still backed by Binance Lab.

Kernel had a stronger foundation at launch, with its $180M FDV translating to just $0.20/token, it may appear slightly overvalued and will need to scale its staked assets quickly to justify the valuation. Current TVL and fundraising levels show MilkyWay must prioritize growth.

Puffer and Swell

Puffer and Swell are both liquid restaking protocols, operating in the same staking/restaking sector as MilkyWay. These two cases are relevant comparisons because they both conducted their TGE around the same time as MilkyWay and KernelDAO.

At the time of listing, PUFF launched at $0.53, equivalent to an FDV of approximately $530 million. However, the price dropped over 68% within just two weeks. Similarly, SWELL launched with a $300 million FDV and saw its price plummet 55–60% shortly after, reflecting heavy post-airdrop selling pressure and a “low-float-high FDV” structure.

KernelDAO with a $1.8 billion FDV but only ~16% of tokens in circulation, also followed this trend – its price fell to around $0.17, losing nearly 80% of its initial value.

In this context, MilkyWay (MILK) may enjoy better price stability and buffer post-listing if it launches at a significantly lower FDV (~$100–300 million), which is $0.1–$0.3.

However, given current market patterns, investors should remain cautious during the post-TGE phase, especially since MilkyWay has not released its full tokenomics and still locks a large portion of the supply.

Conclusion

Based on the overall analysis, the initial price of the MILK token will likely fall within the range of $0.10 – $0.30 (FDV of $100–300 million), assuming the market remains stable without major negative shocks.

In the long term, MilkyWay must prove its value by increasing TVL (staking TIA), expanding DeFi integrations, and improving liquidity.

The current trend on BNB Chain, which focuses on restaking/LST and large liquidity support programs, provides a favorable environment for staking-related projects like MilkyWay.

However, for MILK’s price to achieve sustainable long-term growth, the project must outperform competing solutions, especially KernelDAO, which already holds a large ecosystem fund and a massive TVL advantage.

Read more: Grass Could Be the Next Project Listed on Binance?