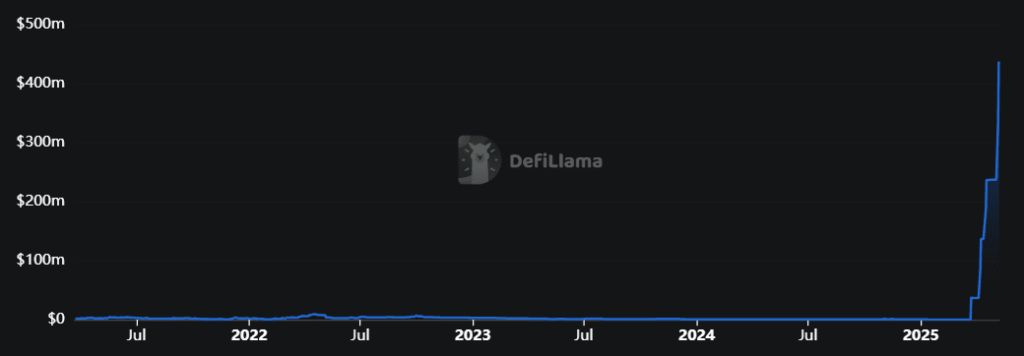

Centrifuge, a leading tokenization ecosystem, experienced a significant expansion of its decentralized protocol over the last three months, culminating in a major spike earlier this week. The total value locked (TVL) of the Centrifuge Protocol rose from $237 million on Tuesday to a record $437 million as of this writing, as per DefiLlama.

Centrifuge has been a leading real-world asset tokenization (RWA) platform for years, helping users tokenize assets through non-fungible tokens (NFTs) and DeFi tools.

One of its flagship products is Tinlake, a decentralized open marketplace and investment venue for tokenized assets. The decentralized application enables users to tokenize real estate, invoices, royalties, and other assets, transforming them into NFTs. These NFTs can be used as collateral to borrow from investors.

However, the recent TVL spike is not related to Tinlake but to the Centrifuge tokenized fund. Earlier this year, the platform launched the Janus Henderson Anemoy Treasury Fund, a professional fund licensed by the British Virgin Islands Financial Services Commission (FSC) and open to non-US investors.

It invests exclusively in short-term U.S. Treasury Bills with a remaining maturity of 0 to 3 months to reduce price and duration risks while offering liquidity and decent returns. The bonds are held directly by the Fund, which mints JTRSY tokens to investors. Investments and redemptions are processed in USDC.

Since its February launch, the annual percentage yield (APY) has been fluctuating between 3.3% and 4.6%, with a target figure of 3.8%.

Tokens are available on multiple chains, including Ethereum, Centrifuge itself, Base, Celo, and Arbitrum, but Ethereum currently accounts for the largest share.

Thanks to the contribution of Centrifuge and the growth of other RWA projects over the past weeks, including BlackRock BUIDL, Ondo Finance, and Paxos Gold, the RWA sector in DeFi crossed the $12 billion mark on May 9, reaching a new all-time high.

Stay on top of things:

Subscribe to our newsletter using this link – we won’t spam!