Stablecoins are gaining traction in regions where inflation is rampant and traditional banking is either unreliable or inaccessible. In Latin America, where economic volatility is a fact of life, El Dorado positions itself as a crypto-native alternative to outdated financial infrastructure. It’s a bold move—offering digital dollars, peer-to-peer (P2P) trading, and low-fee transactions to users in places where just holding onto the value of your money is a challenge.

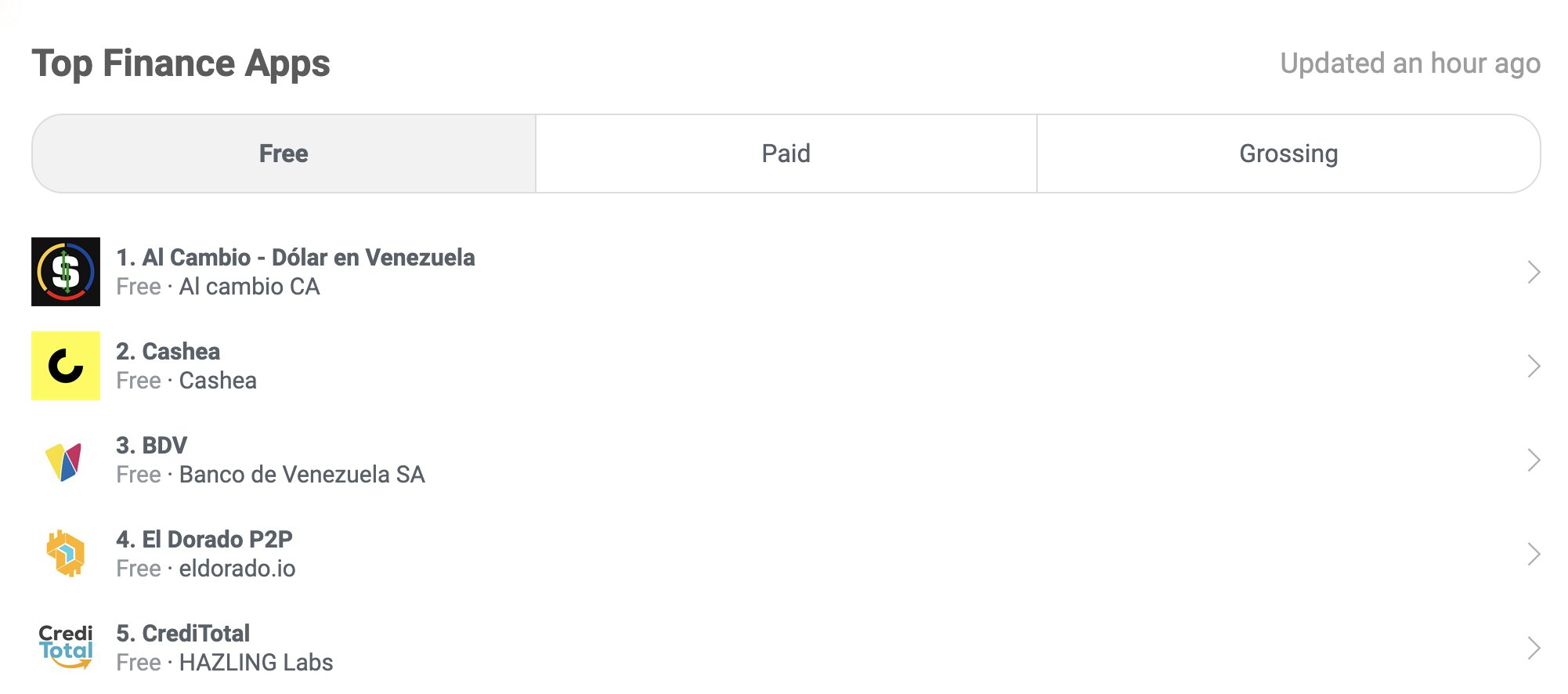

El Dorado is a stablecoin-powered “superapp” that lets users buy, sell, store, and send crypto with a focus on USDT and MountainUSD (USDM). With over 600,000 users and three million transactions processed, it’s one of the fastest-growing finance apps in the region. In 2024, it even ranked among the top five finance apps in Venezuela—a country where the local currency has practically collapsed.

But does El Dorado live up to the hype? And can it scale beyond being a niche product for crypto-savvy users?

How El Dorado Works

At its core, El Dorado is a P2P stablecoin marketplace that allows users to transact with minimal friction. The platform integrates several features aimed at reducing costs, increasing access, and insulating users from local currency risk.

1. P2P Stablecoin Trading

El Dorado lets users trade stablecoins like USDT and USDM directly with one another, without going through a centralized exchange. This enables better rates, lower fees, and faster settlements—key benefits in an environment where traditional banking can be expensive and inefficient.

2. Gasless Transactions via Tron

One of the standout features is El Dorado’s partnership with Tron DAO, which enables gasless USDT transactions. By absorbing network fees, the app makes sending and receiving digital dollars more affordable, especially for low-income users who would otherwise be priced out of crypto.

3. Self-Custodial Wallets

The platform also offers self-custodial wallets, developed with Mountain Protocol and Safe. These wallets give users full control of their assets, a major improvement over custodial solutions that carry counterparty risks. They also open the door to yield-bearing products like tokenized U.S. Treasuries.

4. Layer-2 Speed via Arbitrum

To address blockchain congestion and high gas fees, El Dorado integrates Arbitrum—a Layer-2 scaling solution. This improves speed and cost efficiency, making microtransactions viable in ways they aren’t on Ethereum mainnet or other slower chains.

What Sets El Dorado Apart?

In a region already familiar with platforms like Binance P2P and LocalBitcoins, El Dorado’s edge lies in three main areas:

- Deep Integration with Local Financial Apps: El Dorado connects with over 70 apps and financial institutions, allowing users to convert stablecoins to local fiat seamlessly.

- No Gas Fees: Unlike most competitors, the platform covers gas costs, lowering the barrier to entry.

- Localized Inflation Hedge: Instead of offering speculation-driven products, El Dorado focuses on dollar stability—a pressing need for users in Argentina, Venezuela, and elsewhere.

With these features, it is able to provide real-world benefits to its users.

1. Lower Remittance Costs

Remittance is a $100+ billion market in Latin America, and traditional providers charge between 5–10% per transaction. Sending $200 to Mexico through a bank or an MTO like Western Union can result in fees as high as $14.

El Dorado cuts these fees dramatically. Using gasless USDT transactions over Tron, users can send digital dollars at zero or near-zero cost. This represents a meaningful financial win for families who rely on international support.

2. Protection Against Inflation

Argentina’s inflation rate crossed 200% in 2024. Venezuela’s is even worse. In this environment, local fiat is practically unusable for long-term savings.

By offering access to USDT and USDM—stablecoins pegged to the U.S. dollar—El Dorado gives users a reliable store of value. It’s not glamorous, but it’s effective. Holding stablecoins is often safer than holding cash in a local bank account that might freeze or devalue overnight.

3. Financial Inclusion

Roughly 40% of Latin Americans remain unbanked. This isn’t just a poverty issue—it’s also about access. In rural areas, there may be no banks at all. El Dorado helps close this gap by allowing anyone with a smartphone to participate in the digital economy. Self-custodial wallets mean users don’t need approval from a centralized entity to store or transfer value.

4. Faster Settlements

Bank wires in Latin America often take several days to clear, and payment errors are common. By contrast, stablecoin transactions on Arbitrum or Tron settle within seconds. For people used to delays and blocked funds, this kind of speed is transformative.

Where El Dorado Falls Short

Despite its potential, El Dorado isn’t perfect. Several challenges could limit its growth or undermine user trust.

1. Dependency on External Networks

El Dorado relies heavily on infrastructure from Tron and Arbitrum. If these networks experience congestion, downtime, or policy shifts (e.g., removing support for gasless transactions), the app’s speed and cost-effectiveness could suffer. It’s a risk that El Dorado can’t directly control.

2. Stiff Competition

Platforms like Binance P2P, Paxful, and even WhatsApp-based crypto communities already serve many Latin American users. These alternatives are deeply entrenched and offer similar services. To stand out, El Dorado needs more than just lower fees—it must consistently offer a better user experience, stronger trust, and local relevance.

3. Education Gap

Crypto literacy remains low in Latin America. Many potential users don’t understand stablecoins, let alone how to use a self-custodial wallet. If El Dorado doesn’t invest in education and simple onboarding, it risks becoming a tool for only the tech-savvy few.

4. Regulatory Uncertainty

Crypto regulation in Latin America is a moving target. Governments in Brazil, Argentina, and Colombia have all floated different ideas—ranging from licensing requirements to outright bans on certain tokens. If regulators decide to crack down on stablecoins or demand stricter compliance, El Dorado may face disruptions.

AML/KYC rules are also tightening globally. While El Dorado currently supports self-custody and P2P transfers, future policies could force it to collect more user data, undermining its decentralized ethos.

Future Outlook

There’s plenty of upside for El Dorado if it plays its cards right. Countries like Argentina, Colombia, and Mexico are prime markets for expansion due to their large unbanked populations and persistent inflation.

But growth will require more than adding users. The platform must evolve beyond stablecoin transfers and offer real financial tools—think decentralized lending, fiat off-ramps, and small-business payment solutions. Expanding utility will be crucial for user retention and monetization.

Strategic partnerships will also be important. Aligning with regional fintech firms and telecom providers could fast-track adoption and help El Dorado build trust in communities where crypto still carries a stigma.

Most importantly, the platform must stay ahead of regulatory trends. That means building compliance-ready infrastructure without compromising user autonomy. If it can walk that line, El Dorado could become a staple of Latin America’s future financial system.

Disclaimer: This piece is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”