As crypto heads we always speak about crypto is an exit from the tyranny of paper currencies that slowly steal from the population. The past week has been particularly defining in the acceleration of that. However, before we talk about the past week lets talk about the past few weeks.

On April 2nd, Trump announced widespread sweeping tariffs that shocked the global economy. Many believed that he was bluffing, but this time it seemed like Donny was dead serious about his unhinged idea. Global markets believed it too, and that was clearly reflected in our portfolios as they tanked. RIP.

Anyways, it’s important to unpack what really happened and why it was the key defining moment, or will be marked as one in history books.

By saying that goods imported into America will cost more it created a few counter reactions. Primarily, the cost of goods will go up as the costs will be passed to consumers or eaten by producers/exporters. As a result you have two reactionary pathways that kick off:

a) Increased costs for consumers

-

Weak consumer spending projected in S&P500 stock earnings (stonks go down, scramble to safe assets)

-

Inflation projections mean higher demands to compensate for risk (bond yields go up)

b) Increased costs for producers

-

American companies need to spend more to make the same product (earnings go down)

-

International exporters need to undercut to maintain the same prices or increase prices to save margins (sovereigns not happy)

What’s amazing in both a) and b) is that no one wins. However, most importantly all of this creates MASSIVE uncertainty in global markets as we saw. The part we need to focus in all of this is the bond market. It doesn’t matter if you’re Trump or God, you must respect the bond market.

Why? I touched on this, in part, in a previous article (https://kermankohli.substack.com/p/usdjpy-the-most-important-chart-in) however I’ll extend a bit more here.

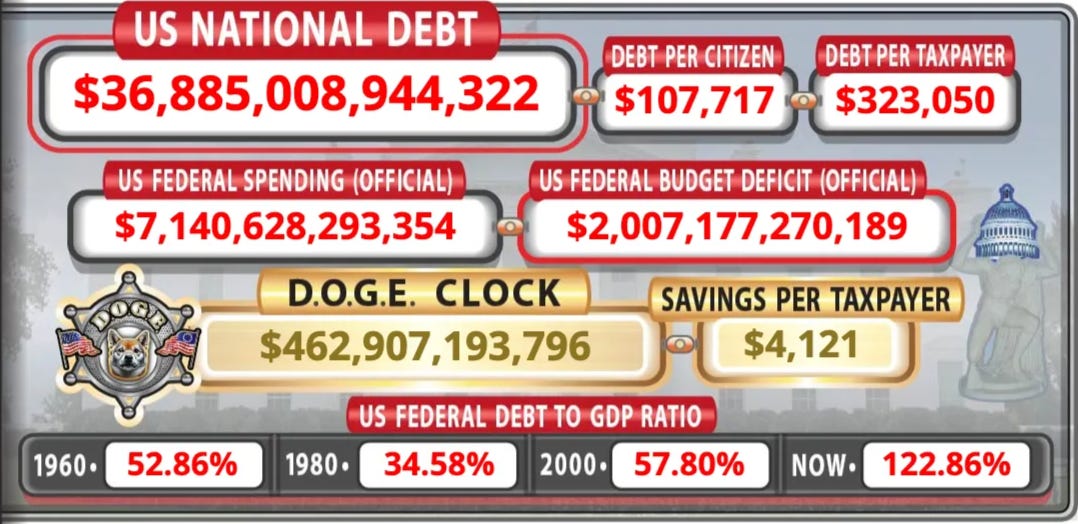

As we all know the United States is in a lot of debt, like $36T worth. However, that situations gets even worse when your interest rates are higher. Remember, selling bonds means the yields increase. Price down, yields up.

So, if the interest rate on your debt were to go up, it makes this situation even worse. Now what happens when you put in sweeping tariffs that undermine economical sense, two really bad things:

-

Investors sell bonds realising that the US is digging themselves into a deep hole

-

Your allies threaten to sell bonds because their economies rely on exporting goods to the United States

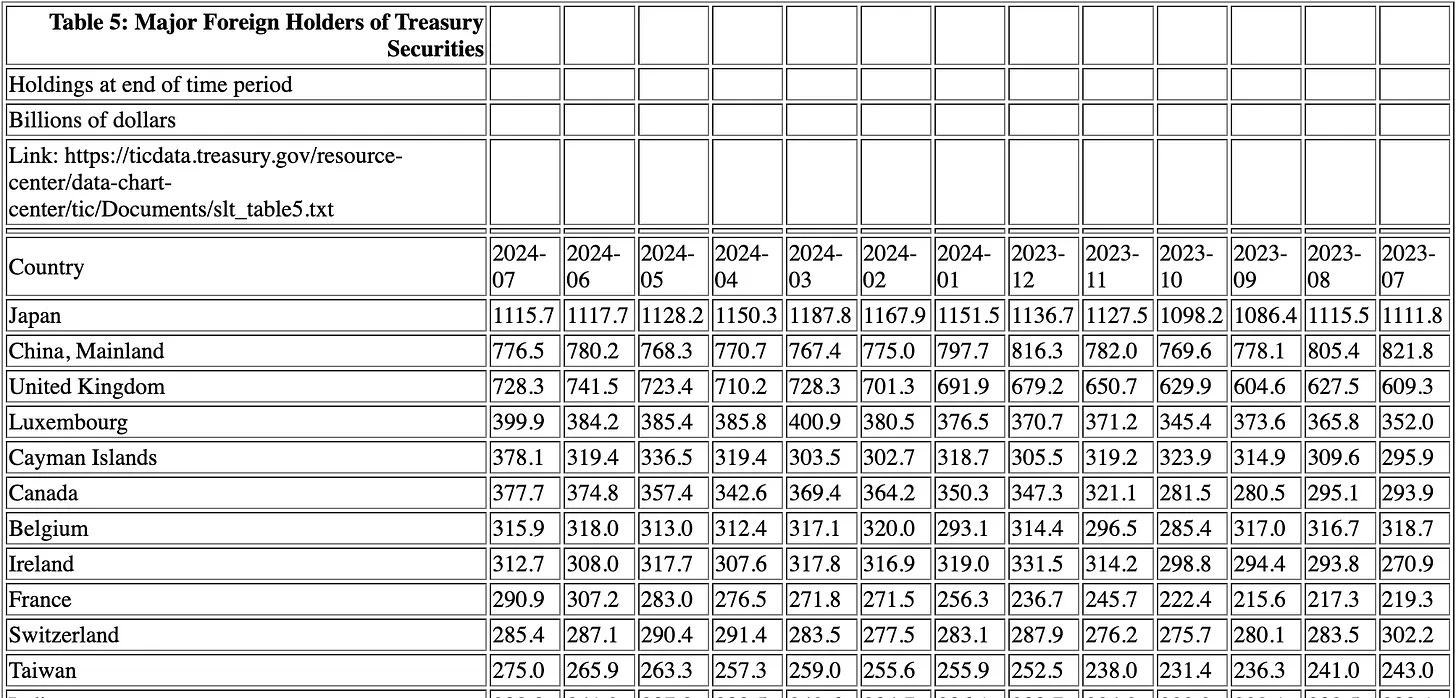

Here’s a chart of countries that hold US Treasuries and by how much. The last thing you’d want to do is to implement sweeping tariffs on them (which surely you wouldn’t do right)? Haha.

It didn’t take very long for Trump and his advisors to realise the economic severity of their decisions and that’s why we saw a softening stance around “implementing a pause” and “speaking with allies”. While the US thought they had leverage in one department, their glass jaw was mercilessly exposed by the international sovereign community. Here’s a chart of the US 10 year treasury yields, as you see they shot up from 3.99% to 4.55% in just over a month! The bond market is not happy.

Outside of the financial impact, there is a real human impact these tariffs have had too. You see the largest purchasers of treasuries are these other countries. Given all the hostility towards them and the rhetoric that they need to pay premium for the United State’s physical protection, they’re all starting to question why they support such a country and start to re-evaluate their relationship. This re-evaluation comes in the form of treasury bond purchases and holdings. We’ll touch on this later but the key part to remember is:

The cost of debt for the United States is going to increase as investors demand more yield for the uncertainty imposed.

We’ve talked a lot about treasuries but there’s another equation we need to talk about, and that’s Elon Musk’s efforts with the Department of Government Efficiency. The idea with it that it could save up to $2T from the budget. However that figure fell short massively and we only got $150b, if that’s even possible to verify.

Funnily enough this was kind of bearish for crypto because costs could come down by that much, there probability of Bitcoin being needed has hard money reduced. Not only are the savings gone, Elon is also gone from DOGE. If someone like him can’t bring the situation under control, it’s highly unlikely that anyone else will. As Lyn Alden says: “nothing stops this train”.

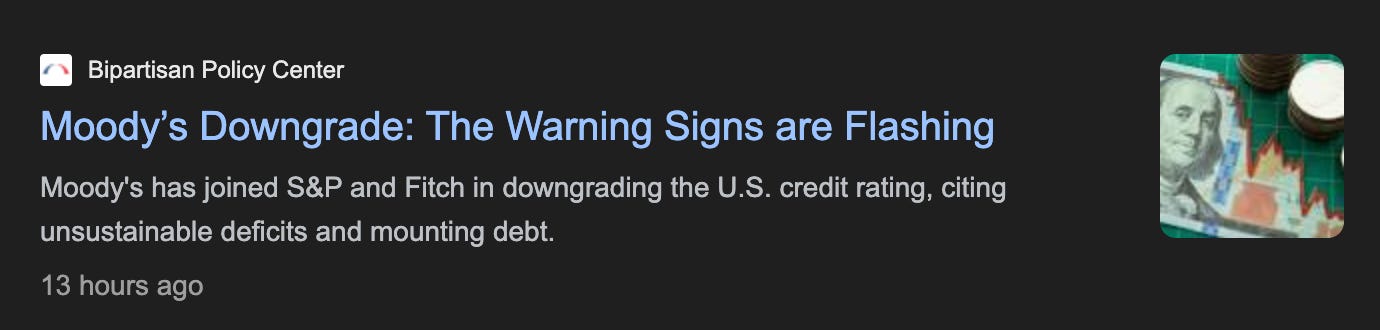

Now let’s fast forward to the past week or so. There were two newsworthy events that got lost in the noise. The first was the downgrade of US treasuries being AAA rated (the literal definition of being the highest quality debt on the market) to AA. If the thing that is meant to be the “risk free rate” is suddenly more risky… then what do we do?

Well the first answer, is that we demand more money for this increased risk. That’s exactly what the bond market decided to do. Longer dated treasury bonds are the first to be caught in this firing line because people have to take a 20 year view on the US government when the current year isn’t looking great.

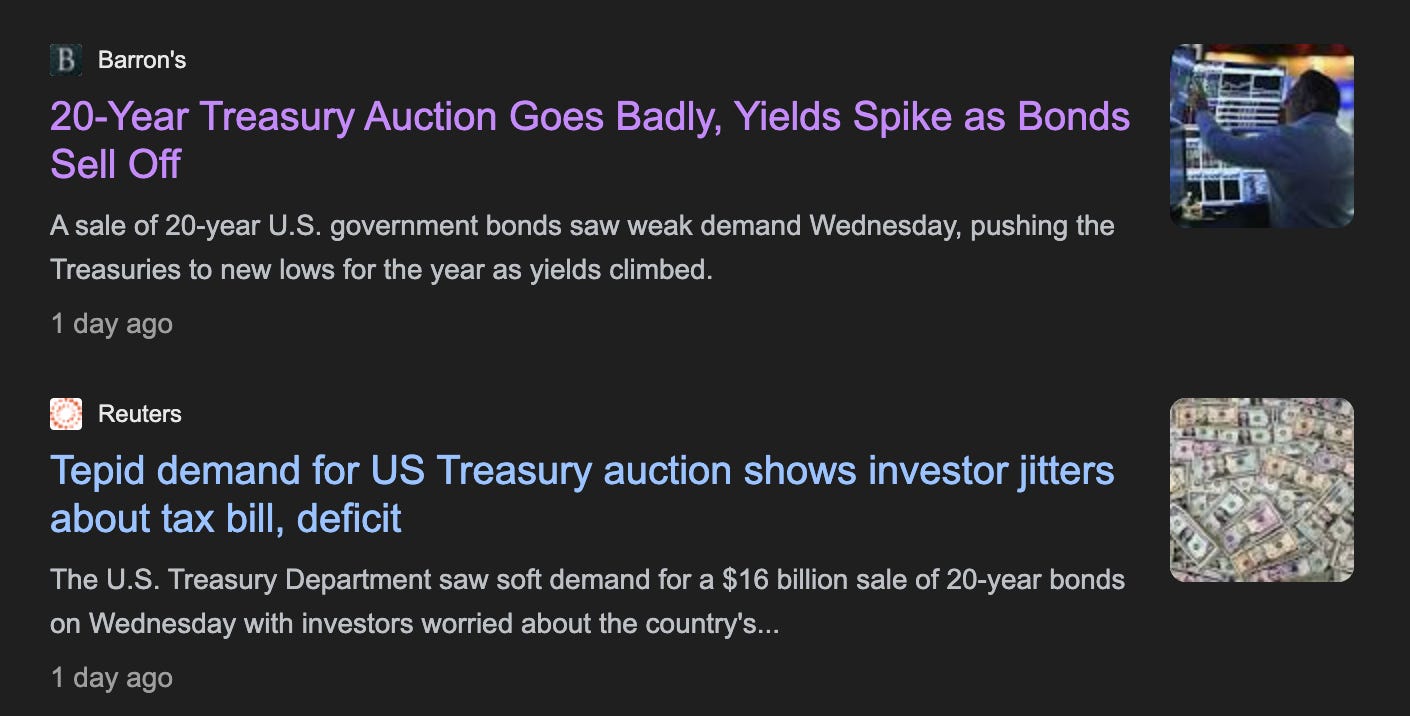

Every month US treasury bonds are auctioned off. This week, the 20 year auction went badly. Why? Well no one really wanted to buy them.

As a result, we saw 20 year treasury yields spike to the highest they’ve been since 2007! The trend is not healthy.

Is there anything that can be done to reverse this trend? Not really unfortunately. In order for things to improve either of these four things need to happen:

-

The US government has to make a lot more money

-

The US government has to spend a lot less money

-

The US government needs to be able to borrow money at a lower rate

-

The US grows GDP massively through AI/crypto (possible but has too many variables to properly factor)

Not a single one of these things is a slam dunk to solve. On the first point, we actually have the opposite being proposed with tax cuts that would decrease revenue.

Is there any escape from this? No, not really. We have entered an economic black hole where all paths are net-negative for the dollar. How so? Well to get out of this there is only pathway.

The Fed will have to step in and purchase bonds to ensure future treasury auctions do not fail. Where do they get this money from? Money printerrrrr. Not only will they want to prevent them from failing, they will use these fresh prints to artificially control yields. If you don’t know how this story goes, please read my Japan Yen article here:

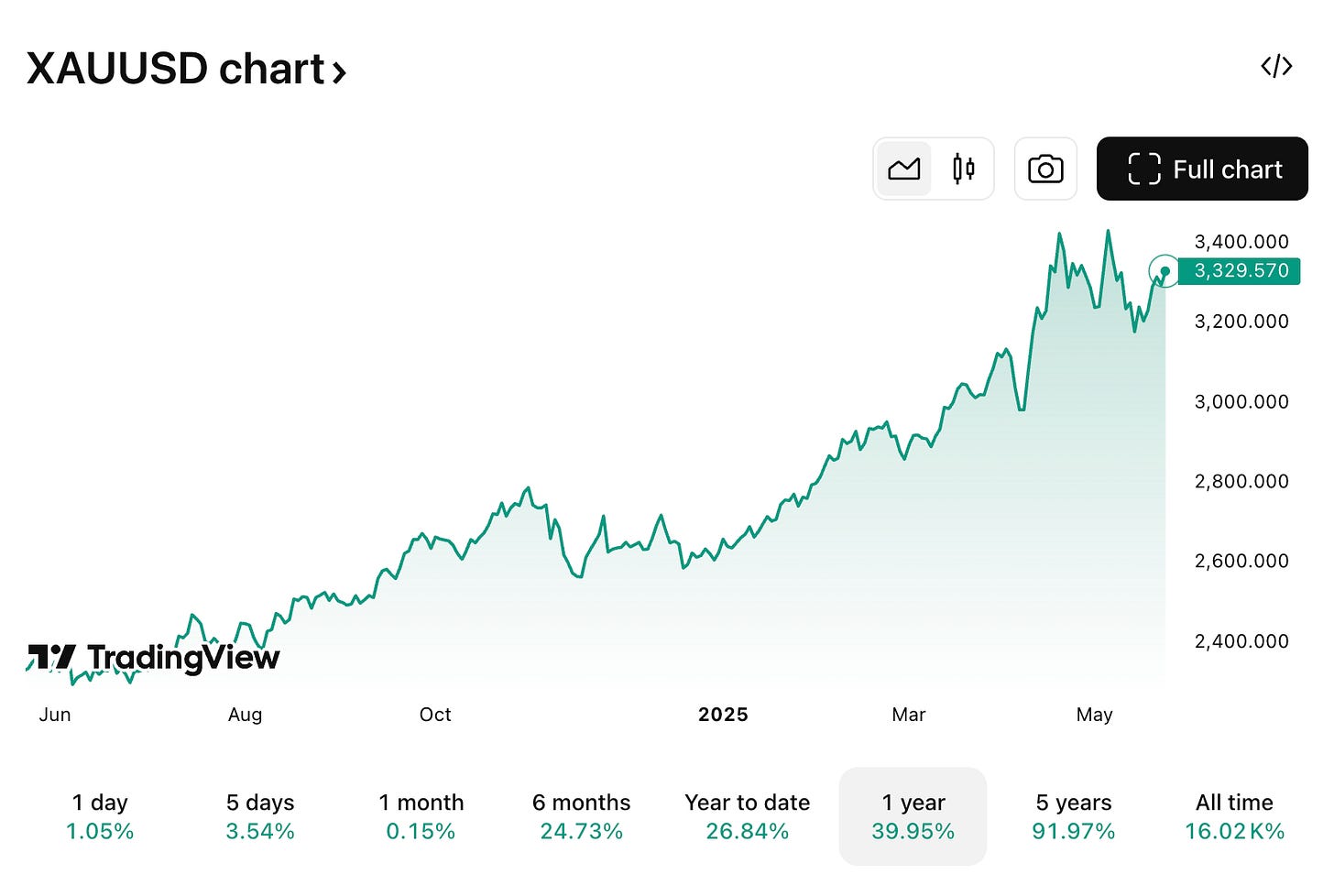

I’m not some rare genius who knows this, the broader market understands this and we can see it being reflected in these two charts:

or this chart if you’re more of a boomer.

In case it isn’t clear: there is a real flight to safety and assets that will protect against the inevitable printing of money are soaring an anticipation of this future.

It’s actually a bit grim when you think of it: most of the world believes in the sovereign paper they are issued to store their life energy, only for it to be stolen from them silently through complex abstractions they aren’t educated enough to understand. Their only chance of escaping this trap is crypto which they deem to be a scam.

We’re entering a very strange territory where Bitcoin will continue to climb higher, not because of retail mania, but because the smartest money on the planet is already betting on the collapse of the dollar.

Nothing stop this train. Just hope your seat is good enough and you’re positioned well for it. The start of the end is here and you’re alive to experience it in slow motion as it happens.

Believe in the right things.