- SPX6900 surged 24% to hit $1.0179, with trading volume jumping 184.91% to $140.21 million.

- A bullish RSI crossover supported momentum, but a pullback to $0.9073 is likely if profit-taking begins.

SPX6900 [SPX] bounced off the $0.83 support earlier this week and hasn’t looked back.

The memecoin rallied 24% in 24 hours, tagging a three-month high of $1.0179. As of this writing, it traded at $0.996—up 17.29% on the daily chart.

Over the same period, SPX saw its trading volume skyrocket, surging by 184.91% to hit a total of $140.21 million.

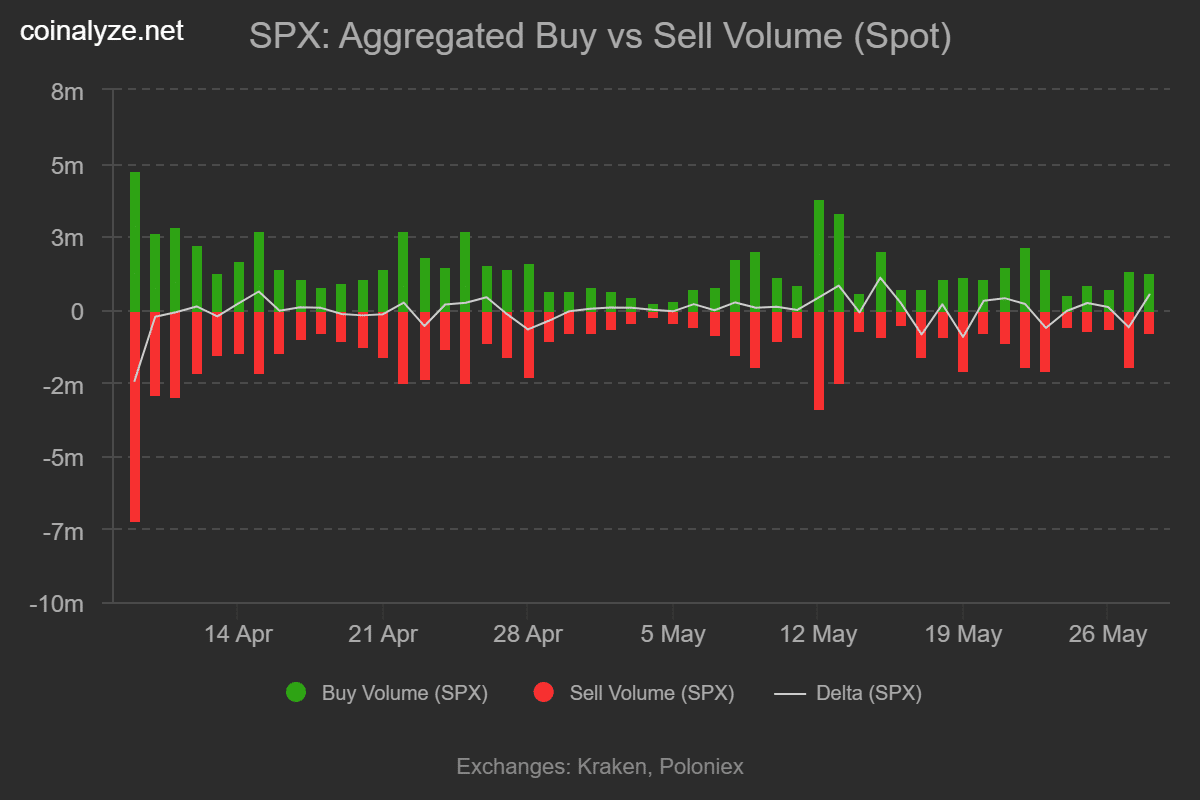

Spot market data confirms strong buy-side momentum

The increase in trading volume and rising prices indicate strong demand for SPX6900. As a result, SPX is experiencing renewed interest, with new investors entering the market.

This demand is evident as buyers have gained control of the market.

According to Coinalyze, buyers scooped 1.27 million SPX in 24 hours, with a positive Delta of 506,000 tokens.

That reflects clear demand dominance.

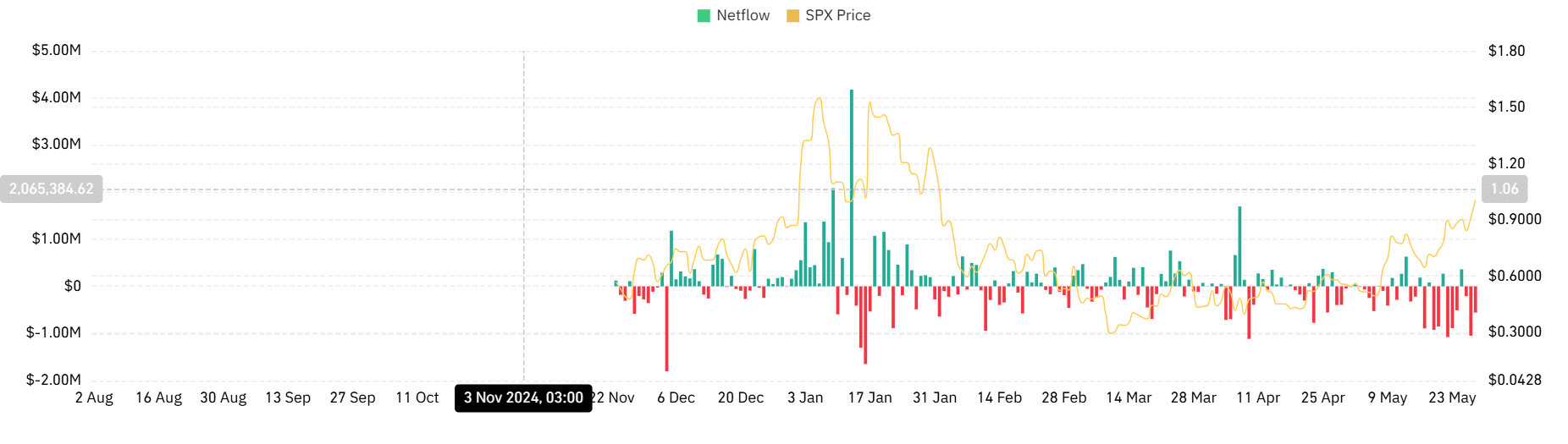

The same pattern is also observed in exchange activity. Earlier rallies failed as sellers flooded exchanges with positive Netflow.

Now, things are different as Exchange Netflow stayed within negative territory for three consecutive days. Currently, this metric has been around -$602k, reflecting higher outflows than inflows.

Thus, there are more withdrawals in the market than deposits, indicating high demand.

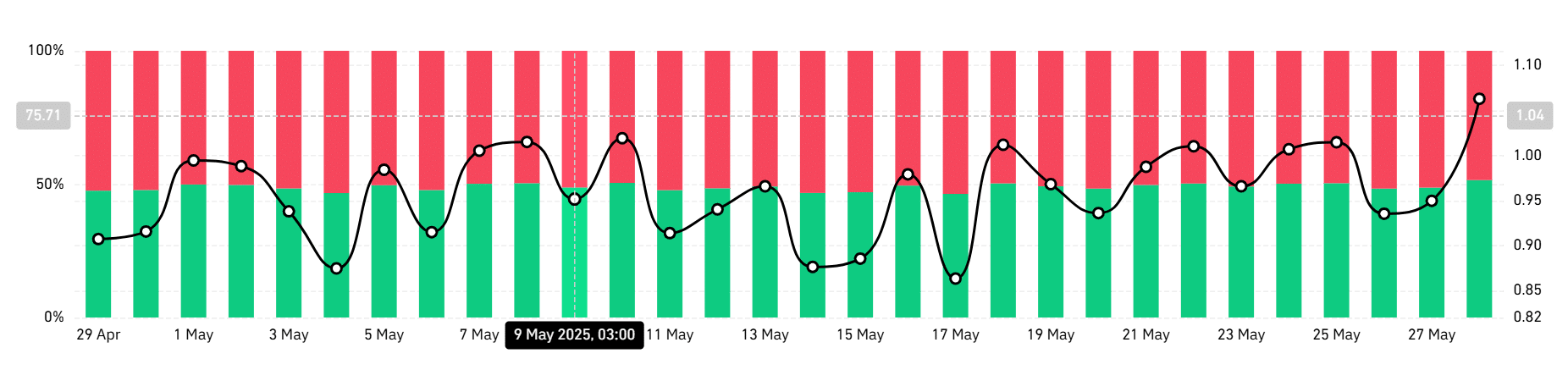

Futures market builds long pressure

The bullish mood extended to derivatives.

SPX6900’s Open Interest spiked 34.2% to reach $64.4 million, showing that traders were opening fresh long positions.

Looking at the memecoin’s Long/Short Ratio, it indicates that these positions are mostly long. Thus. Longs account for 51% of the Futures contracts.

This implies that most investors in the future are bullish and are actively betting on prices to rise further.

When spot demand, exchange outflows, and long-biased futures align, it often points to sustainable price strength, not just hype.

Can SPX sustain the uptrend?

According to AMBCrypto’s analysis, SPX6900 could be experiencing strong upward momentum backed by organic demand.

These market conditions have been validated over the past day as SPX made a bullish crossover on its RSI. A bullish crossover emerged here, suggesting that buyers are dominating the market as we have observed above.

Thus, bulls have taken control of the market, driving prices higher.

With bullish sentiment holding across the market, these conditions position SPX6900 for more gains on its price charts.

That said, the RSI was nearing overbought levels at 69.73. If profit-taking begins, the price could pull back to $0.9073.

For now, SPX bulls control the tempo. If demand holds, $1.3 could be the next magnet