- Whale-linked PEPE deposit and two-sided liquidations reflect heightened volatility without clear directional bias.

- Positive Large Holder Netflow and investor wallet growth signal structural support, even as retail interest declines.

A wallet linked to James Wynn deposited 240 billion Pepe [PEPE]—valued at $3.36 million—into Binance, raising concerns about potential sell-side pressure.

However, the wallet still holds over 203 billion PEPE, worth $2.85 million.

At the same time, market-wide liquidations showed $132.89K in longs and $95.3K in shorts wiped out, reflecting intense two-way pressure.

This dual liquidation trend suggests heightened uncertainty as neither bulls nor bears dominate.

Therefore, PEPE’s next directional move may depend more on sentiment stabilization than isolated whale actions, especially with volatility shaking out overleveraged traders on both sides of the spectrum.

Are committed investors replacing speculative traders?

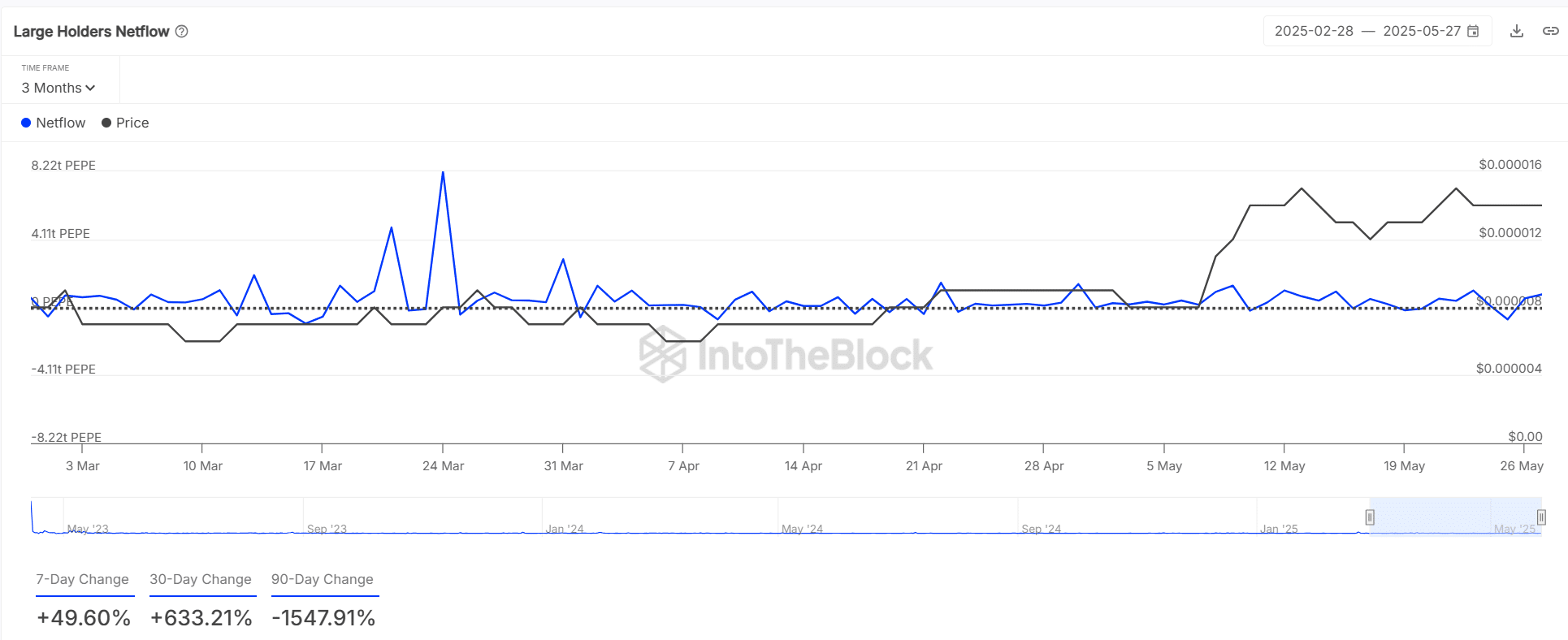

Despite recent whale deposits, Large Holder Netflow remained firmly positive. In fact, netflows surged 633.21% over the past 30 days, with a 49.6% jump in the last week alone.

This suggests large wallets are still accumulating PEPE despite short-term fluctuations.

Interestingly, this follows a steep 90-day netflow dip of over -1500%, marking a potential trend reversal. Therefore, these net inflows may indicate growing long-term conviction among big players.

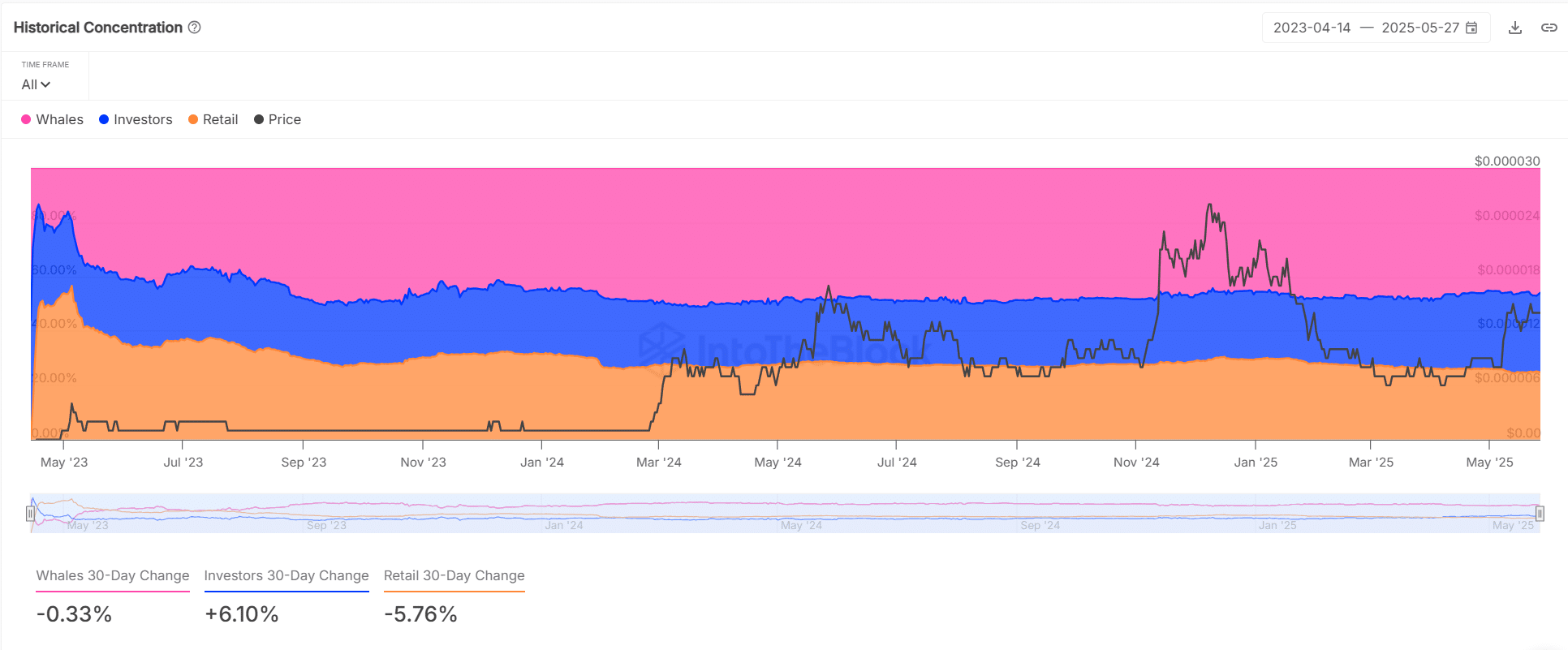

On top of that, PEPE’s holder profile is shifting. Retail wallets shrank by 5.76% over 30 days, while investor-tier addresses rose by 6.10%.

Whale holdings saw minimal change, down just 0.33%.

Therefore, the current market structure favors mid-sized investors over speculative retail actors. This redistribution may reduce erratic price swings but could also mute explosive upside potential typical of memecoins.

Factors aligning to support the next move

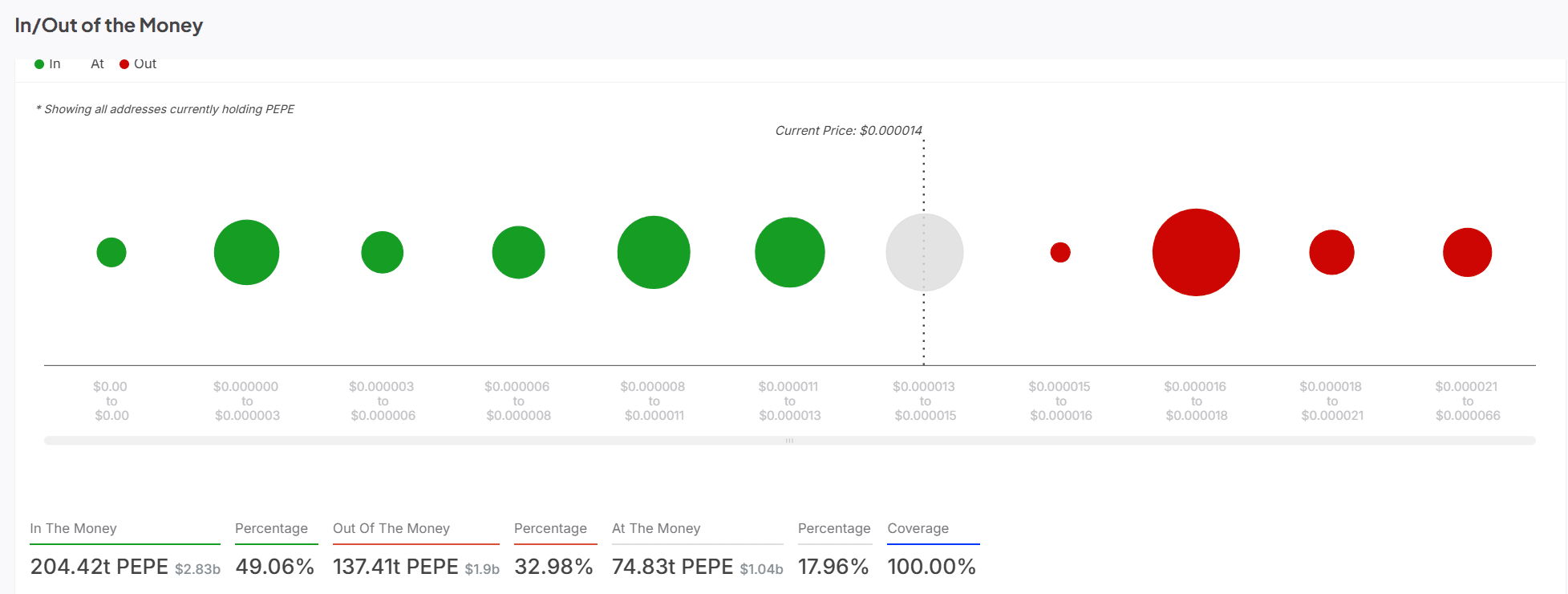

At press time, 49.06% of PEPE holders were “in the money,” while 32.98% were underwater and 17.96% were at break-even.

This distribution supports key price levels, as many profitable holders may resist selling unless triggered by a steep drawdown.

At the same time, those holding at a loss might sell into strength, capping potential breakouts. This balance introduces a complex tug-of-war between profit preservation and recovery exits.

Adding to that, the Open Interest-Weighted Funding Rate stood at +0.0094%, revealing slight bullishness. However, the absence of aggressive long bias implies a measured market, not euphoric, but not fearful either.

This balance leaves room for gradual upside, without triggering forced exits.

Can PEPE break out as it consolidates near key levels?

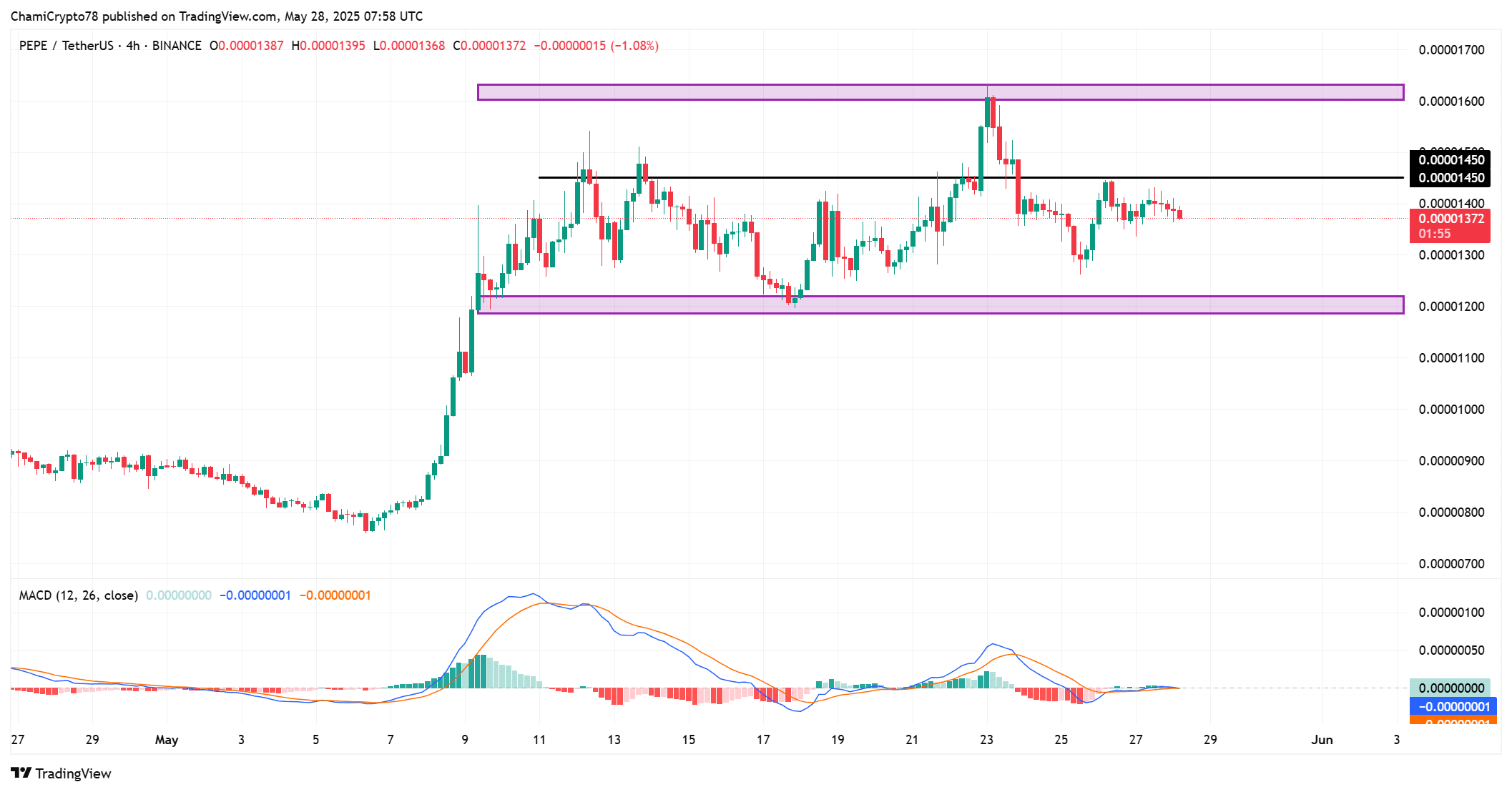

PEPE continues to trade within a defined range, with resistance at $0.00001600 and support near $0.00001200. The price recently hovered around $0.00001371, marking a 3.17% drop in 24 hours.

MACD readings remain flat, indicating limited momentum and a neutral outlook. This range-bound behavior reflects indecision, as bulls and bears await a breakout trigger.

Until then, PEPE is likely to consolidate. If price breaks above $0.00001450 with volume support, a push toward the upper band is possible.

However, failure to hold above $0.00001300 could invite bearish pressure. The current standoff keeps both scenarios equally plausible.

Can PEPE escape its tight range or will volatility prevail?

PEPE’s price action remains caught between accumulation and liquidation, with both bulls and bears taking damage.

Whale inflows conflict with investor growth and retail weakness, while technicals show consolidation without clear momentum.

Therefore, until external catalysts or volume spikes emerge, PEPE is likely to stay within its current range, though with rising pressure on both sides.