- SPX6900 had a strongly bullish outlook on the 1-day chart

- A move beyond $1.2 seemed likely, but the indicators showed short-term weakness from buyers

SPX6900’s [SPX] bulls have been charging higher over the past two weeks. The memecoin was not affected by Bitcoin’s [BTC] dip from $111k to $104k, and continued to trend higher through the chaos.

Since Sunday, 18 May, SPX has gained by 84% on the charts. The trading volume has been high too. Over the past week, the memecoin sector shed 9.6% of its value. However, the SPX6900 token rallied by 31.4%. This robust performance underlined relative strength.

SPX challenges $1.2 once again – Will the results differ this time?

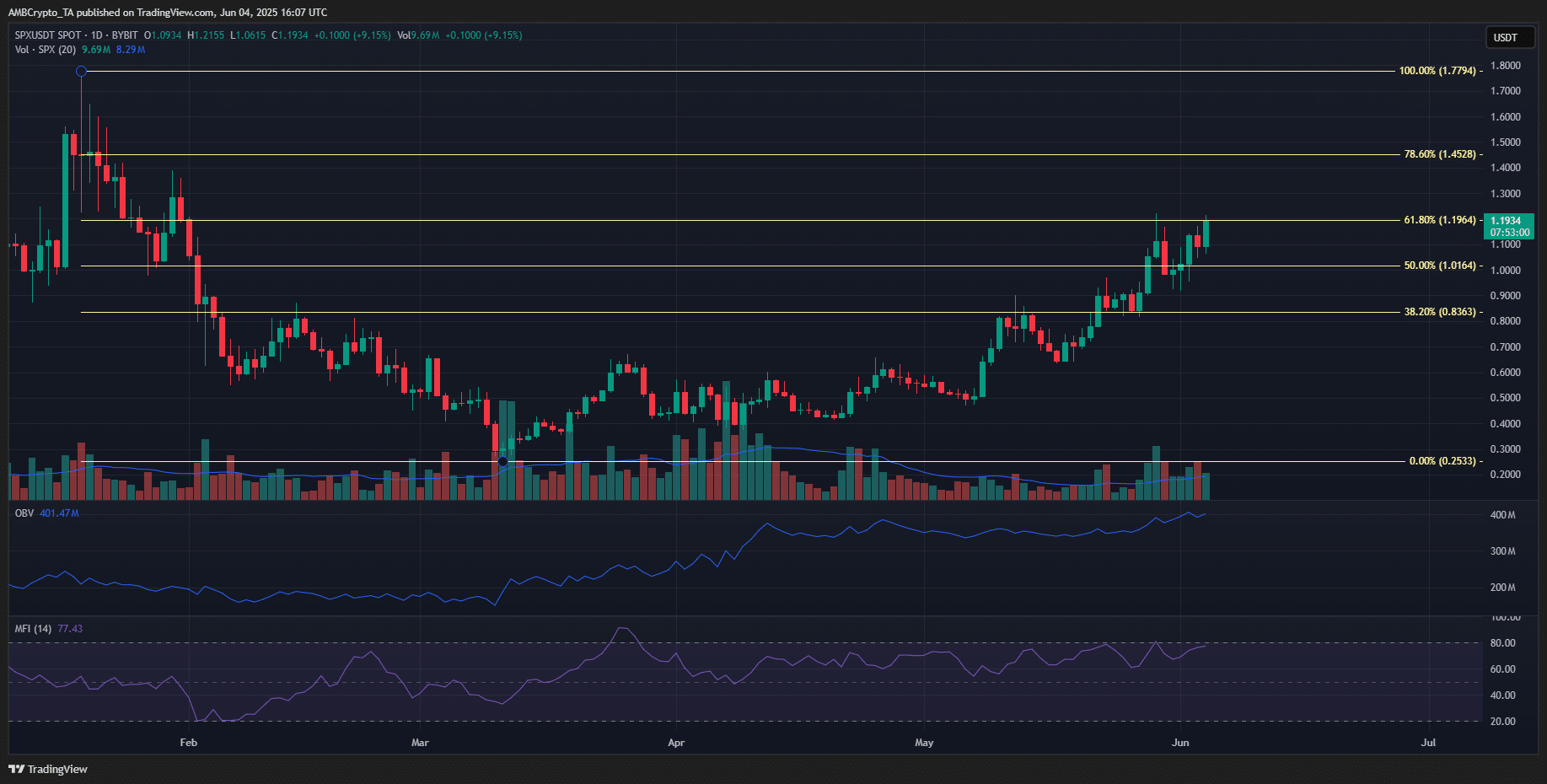

On the face of it, SPX looked ready to blast past the $1.2 resistance. This was the level that had rejected bulls a few days ago, and saw the token fall to $1. During this dip, the selling volume was nominal, as shown on the OBV.

The MFI highlighted strong upward momentum and buying pressure, with the same not forming a bearish divergence on the 1-day chart yet. Together, the technical indicators highlighted the strength of SPX6900’s bulls.

The price action of the past two weeks also favored a move beyond $1.2. The uptrend remained intact. SPX has shown a habit of retesting the Fibonacci retracement levels as support. Hence, a move beyond $1.2 and a retest would offer a buying opportunity.

On the 4-hour chart though, some concerns for the bulls began to emerge. While small, they were worth noting. The first cause for concern was the OBV. It had not made a new high at press time, even though the price was on the verge of pushing past $1.2.

The MFI made a peak at 75.6 on Tuesday, 03 June. If the indicator cannot push higher over the next day while SPX reclaimed $1.2, it would be a bearish divergence. If this comes to pass, retracement would follow.

SPX bulls have reasons to be firmly bullish, but can keep an eye on the 4-hour chart for signs of weakness from buyers. On the other hand, reclamation of $1.2 as support would set SPX6900 to challenge the $1.5 resistance next.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion