On September 18th, 2025, Messari published a research report titled “Understanding Spheron: A Comprehensive Overview.” The study, produced by Messari’s independent analysts, provides a detailed look into Spheron’s technology, tokenomics, ecosystem, and growth trajectory. While we encourage everyone to read the full report, here are the most important takeaways.

Celebrating Our Journey and Growth

Messari’s report begins by tracing Spheron’s journey from its origins as ArGoApp in 2020, where the focus was on decentralized hosting for Web3 applications. By 2021, the team shifted direction, retiring the storage product and launching Spheron Network with a broader vision: to build a decentralized compute layer for the world. Over time, the network has evolved with several important milestones, including decentralized container deployments in 2024, the release of the “On-Demand by DePIN for GPUs” whitepaper, and the launch of Supernoderz and Skynet in early 2025, which made node participation and AI agent building accessible through no-code platforms.

The financial performance of the network was another highlight. By mid-July 2025, Spheron had already generated $10M in annual recurring revenue (ARR), and by the end of August, this number had crossed $12M. Importantly, this traction came before the launch of the SPON token, showing that Spheron’s network utility and demand are not purely token-driven but built on real-world adoption.

Expanding Our Ecosystem and Partnerships

The report highlighted how Spheron has become a cornerstone in the DePIN and AI infrastructure sectors. Today, the network has built more than 100 strategic partnerships, working with projects such as DAWN, Sentient, Wire Blockchain, and Warden Protocol. These collaborations highlight the versatility of the network, which powers decentralized AI workloads, enables consumer devices to act as nodes, and supports cross-chain applications.

Beyond integrations, Spheron has also raised over $7.1 million in venture funding to accelerate its vision. The Messari report recognized the importance of this backing, which includes support from Protocol Labs, Consensys Mesh, Zee Prime Capital, Nexus Venture Partners, and Tykhe Ventures, along with a strategic investment from Arcanum Ventures earlier this year. This diverse investor base underlines confidence in Spheron as a long-term player in decentralized infrastructure.

Showcasing Our Dual-Node Architecture

One of the most detailed sections of the Messari analysis was the technology that underpins Spheron. The network operates on a dual-node architecture consisting of Provider Nodes and Fizz Nodes. Provider Nodes are enterprise-grade machines contributed by data centers, while Fizz Nodes are lightweight clients that allow individuals to contribute spare GPUs or CPUs from personal hardware such as desktops and laptops.

Provider Nodes are chosen through a matchmaking process that takes into account a range of criteria: the provider’s pricing, uptime record, geographic location, reputation, resource availability, stake, and even a degree of randomness to prevent centralization of rewards. Once selected, a provider enters into an on-chain lease agreement with the user, ensuring transparent and secure deployment.

Fizz Nodes, meanwhile, are designed to make participation easy for everyday users. They consist of three main components: a pricing configuration to set resource costs, an orchestrator that manages container deployments, and a service tunnel that connects local machines to the wider Spheron network. Through the Gateway Service, Fizz Nodes can work collectively, forming subnets with their own micro-economies and governance rules. This dual-node model extends Spheron’s reach, combining enterprise reliability with grassroots decentralization.

Payment Streaming and Secure Escrow

Messari’s research also detailed Spheron’s payment and escrow system. When users rent compute, they deposit funds into an escrow wallet, which locks the required amount for the lease and then streams payments to providers in real-time based on block timestamps. If workloads end early, unused funds are automatically refunded, ensuring fairness on both sides.

The system also enforces rules for token usage. Payments made in non-SPON tokens incur a 5% facilitation fee, whereas transactions conducted in SPON are fee-free, creating an incentive to use the native token. Providers also contribute a share of their earnings back to the network treasury. Together, this creates a self-sustaining loop where usage fuels rewards, and rewards encourage participation.

SPON Token Utility and Distribution

The Messari report reaffirmed the central role of SPON in the Spheron ecosystem. The token is used for compute payments, staking, rewarding node operators, and in the future for governance decisions. Providers are required to stake SPON to activate their bidding engines, and delegators can stake alongside providers to share in rewards, broadening participation.

The token allocation was outlined in detail: 24% for network rewards released over 48 months, 21.4% for team and advisors with a four-year vesting schedule, 21.26% for pre-sale investors, 1.33% for strategic investors, 10% for the foundation treasury, 9.01% for airdrops and bounties, 8% for ecosystem initiatives, and 5% for liquidity at launch.

The report also noted the introduction of the Secure Compute buyback-and-burn mechanism, where tokens are repurchased with surplus network revenue and permanently removed from circulation. The first burn, executed in September 2025, retired 0.65% of the total supply.

Roadmap and What’s Ahead

Looking forward, Messari highlighted Spheron’s roadmap for the remainder of 2025. In Q3, the focus is on product enhancements: dashboards for both providers and users to monitor utilization, support for AMD GPUs, escrow balance alerts, and the launch of the Agent Marketplace and Docker Marketplace, which will open new avenues for developers to deploy, monetize, and scale their workloads.

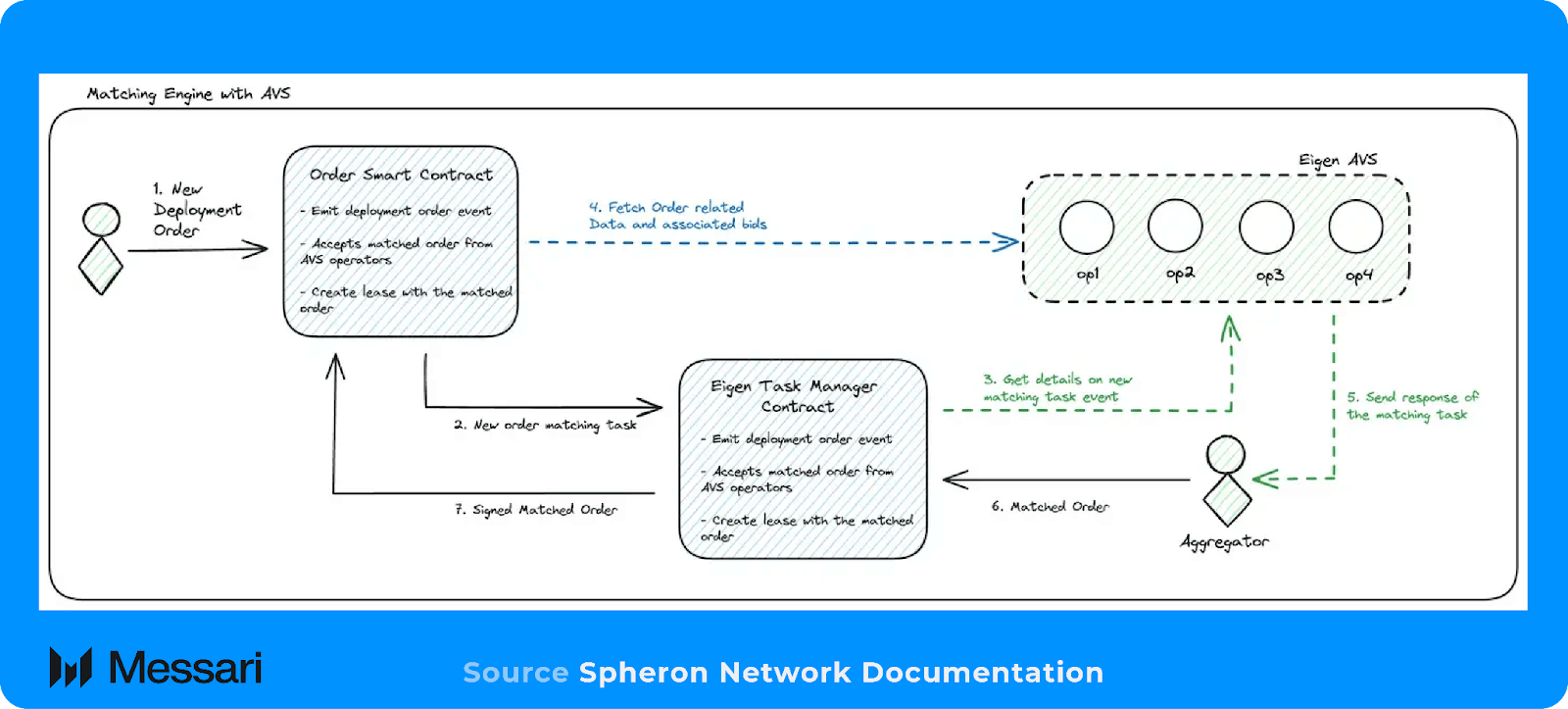

In Q4, attention shifts to scaling and security. The network will introduce Multi-Party Computation (MPC) and Trusted Execution Environments (TEEs) for sensitive data protection, decentralize its matchmaking engine, and launch the Slark Node validation network for improved reliability. Features such as automatic workload replacement and dynamic price rebalancing will strengthen uptime guarantees, while enterprise partnerships and global data center onboarding will expand the network’s footprint worldwide.

Spheron’s Growth Potential

Messari’s conclusion positions Spheron as a frontrunner in decentralized compute. With real revenues, a sustainable token economy, and infrastructure designed to meet the demands of AI and Web3 builders, Spheron is uniquely placed to challenge cloud incumbents and become a cornerstone of the DePIN ecosystem. The combination of Provider Nodes, Fizz Nodes, and the SPON token economy provides the foundation for a compute network that is scalable, resilient, and community-owned.

You can read Messari’s full report here: 👉 Understanding Spheron on Messari