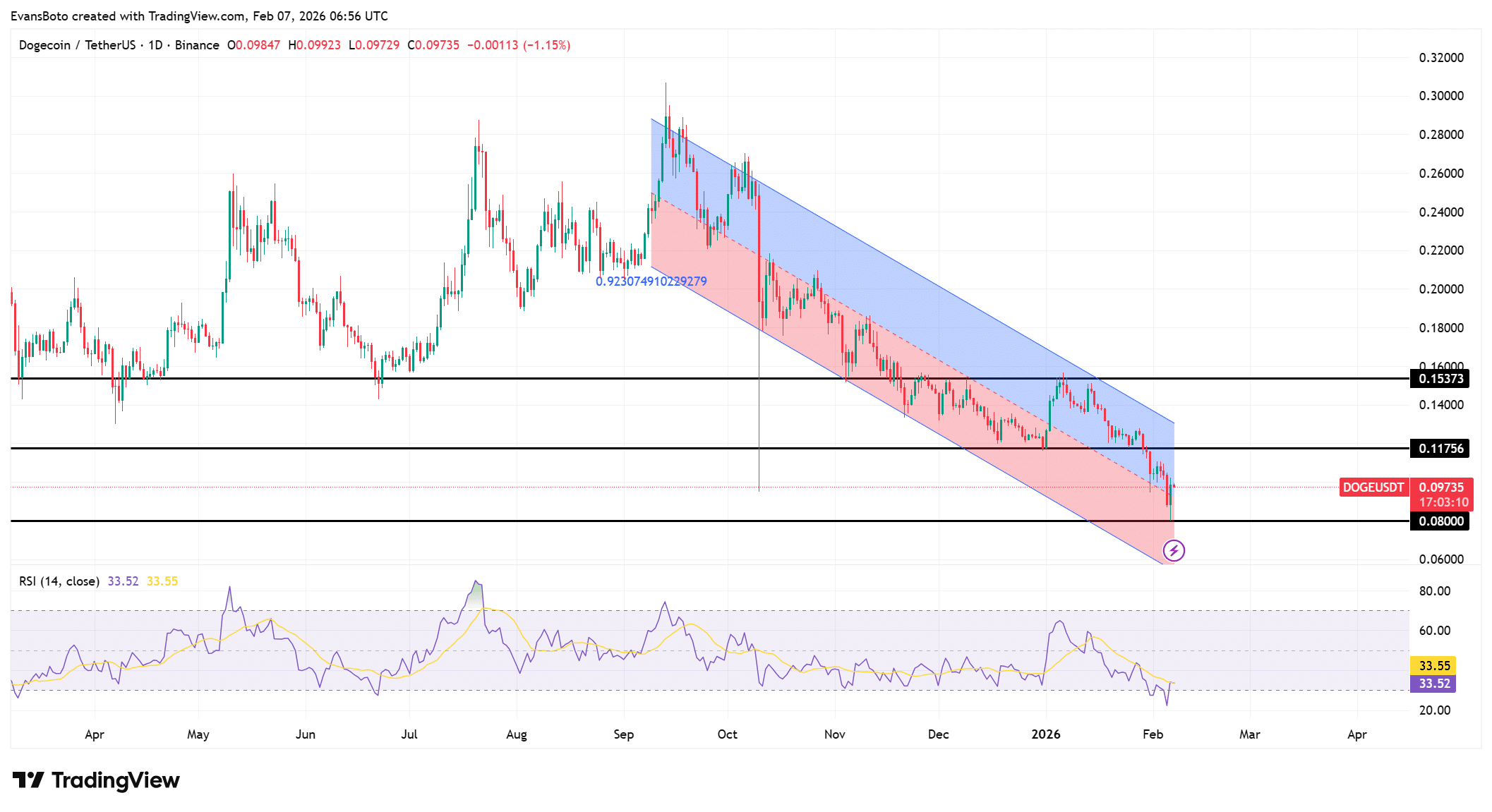

Dogecoin [DOGE] has drifted toward the lower boundary of its descending structure as a TD Sequential buy signal prints on the daily chart near $0.095. The signal appears after weeks of controlled selling rather than panic-driven liquidation.

DOGE has spent months trending lower from its September peak, yet selling pressure has gradually lost intensity. Recent candles exhibit shorter bodies and slower follow-through, suggesting potential exhaustion.

However, this signal does not invalidate the broader trend. Instead, it flags a potential pause or tactical rebound within a dominant downtrend.

Therefore, the setup invites caution rather than optimism, especially while DOGE price remains below key resistance levels.

Downtrend structure still caps Dogecoin rebounds

At press time, Dogecoin traded near $0.096 after rising roughly 6.3% over the past 24 hours, reflecting a reaction off structural support rather than a trend reversal.

Dogecoin prices continue to follow a descending regression channel that has controlled movement for months.

On the downside, the $0.080 zone remains the primary support, where previous selloffs stalled. Above the current price, $0.117 stands as the key resistance that has repeatedly rejected recovery attempts since November.

Any sustainable rebound must reclaim this level first. Beyond it, $0.153 marks the next upside target aligned with prior distribution and the channel’s upper boundary.

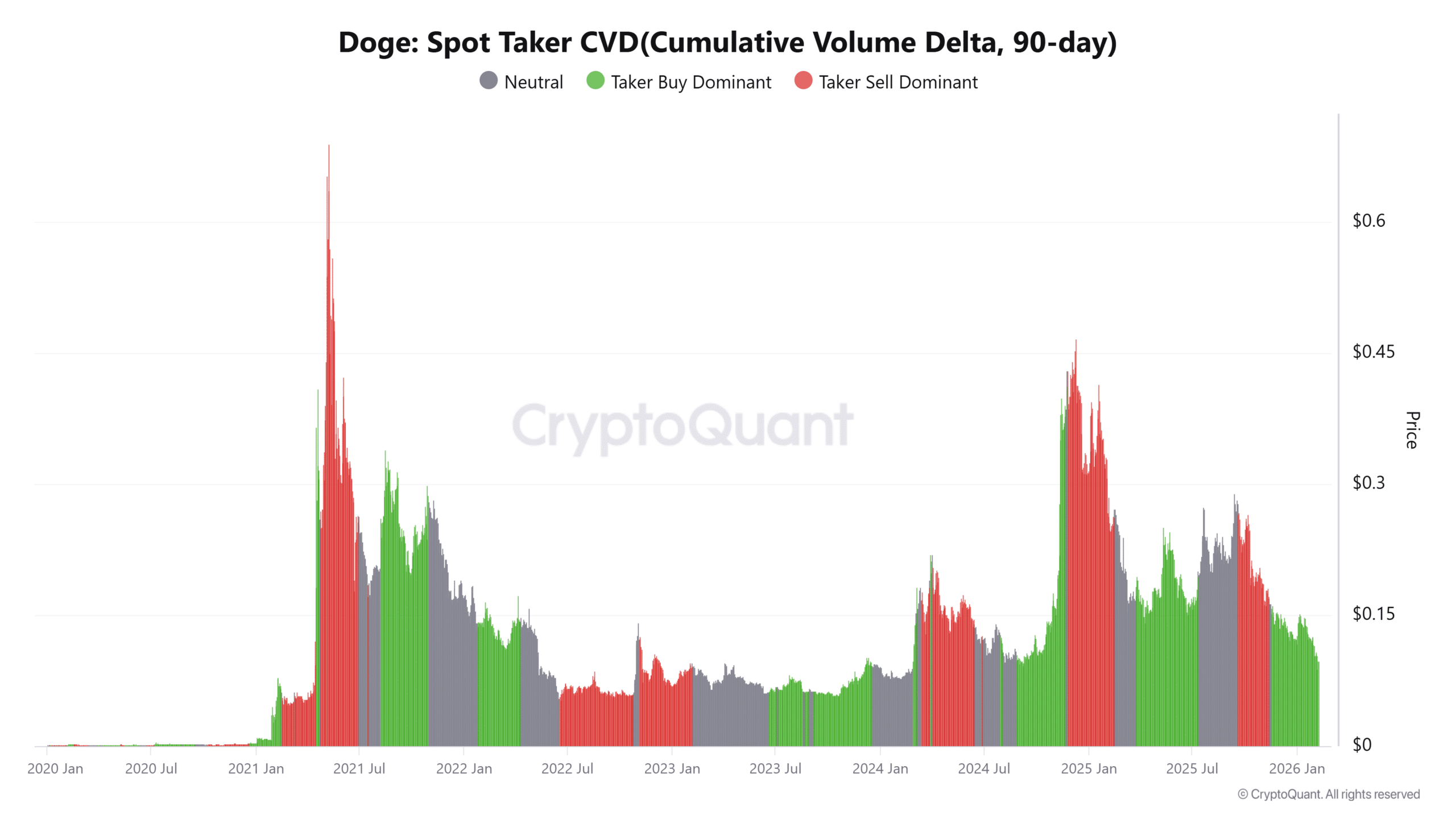

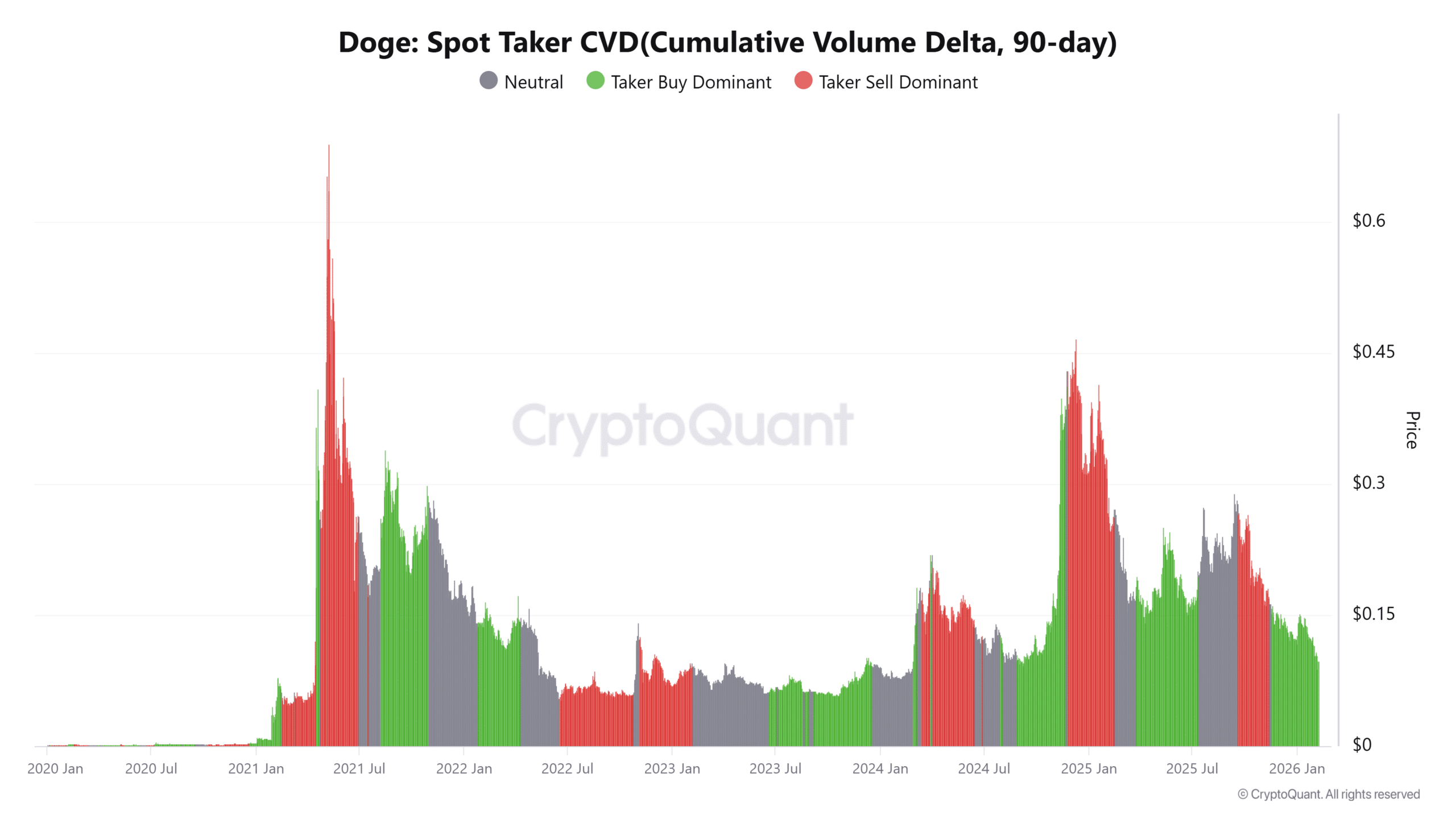

Buyers stay active beneath the surface

Spot Taker CVD remains buyer‑dominant despite prolonged price weakness.

Aggressive market buys continue to outweigh sells, showing demand is absorbing available supply rather than exiting. This contrasts sharply with panic selloffs, where CVD typically turns deeply negative.

Instead, DOGE shows steady bid absorption near local lows. However, buyers are not chasing prices higher. They are stepping in quietly as sellers lose urgency.

Therefore, CVD supports the idea of accumulation through absorption rather than speculative momentum.

This dynamic strengthens the relevance of the TD Sequential signal, since both point toward slowing downside pressure rather than immediate trend reversal.

Source: CryptoQuant

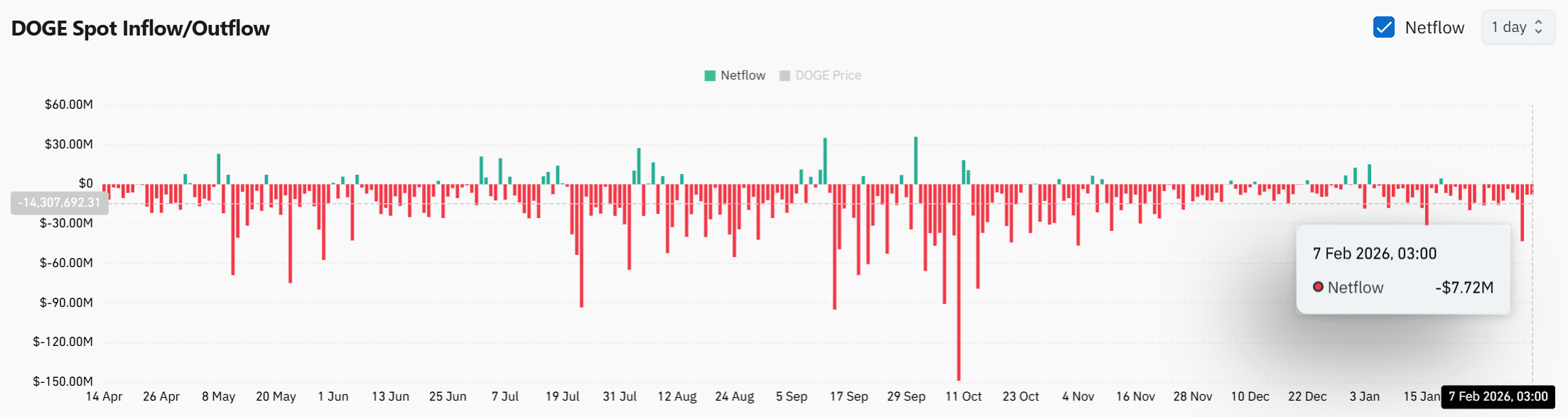

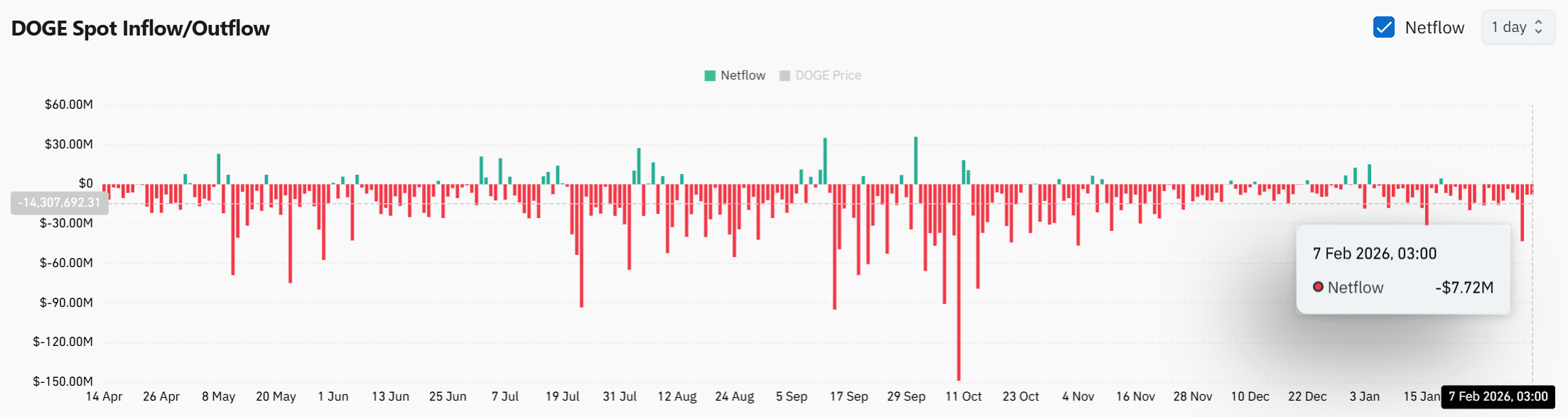

Dogecoin exchange outflows hint at tightening supply

Spot netflows reinforce this narrative. DOGE continues recording net-negative exchange flows, including a recent daily outflow of approximately $7.7 million as of writing.

Tokens leaving exchanges during weakness suggest holders are not positioning for immediate distribution.

Instead, sell-side availability appears to shrink near local lows. However, these flows do not yet confirm aggressive accumulation.

They simply show reduced willingness to sell into weakness. Combined with buyer-dominant CVD, this trend limits downside acceleration unless new selling catalysts emerge.

Therefore, while bearish structure persists, liquidity conditions no longer strongly favor sustained forced selling from current levels.

Source: CoinGlass

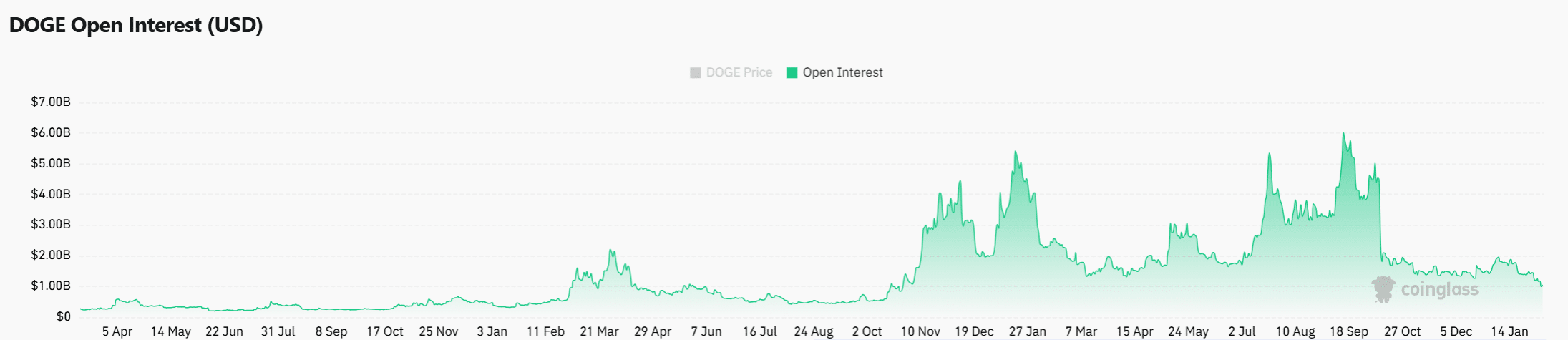

Leverage rebuilds near support, raising volatility risk

At the time of writing, Open Interest (OI) climbed by over 5%, pushing total derivatives positioning to around $1.04 billion while price remains compressed. This increase shows traders re-entering leverage near support rather than abandoning positions.

However, rising OI without a structural breakout increases volatility risk instead of directional clarity.

Both long and short positioning appear active, suggesting traders anticipate expansion rather than continuation. Therefore, the current zone carries heightened liquidation sensitivity.

A decisive move beyond resistance or below support could trigger sharp, leverage-driven follow-through in either direction.

Source: CoinGlass

To conclude, Dogecoin’s TD Sequential buy signal aligns with channel exhaustion, buyer absorption, and reduced exchange supply, but the broader downtrend still dominates price structure.

While conditions support a short-term stabilization or relief bounce, confirmation depends on DOGE reclaiming key channel levels.

Until then, the setup favors volatility over conviction, with downside risk fading but not fully resolved.

Final Thoughts

- Dogecoin’s current structure favors recovery attempts as accumulation replaces reactive selling near long-term support.

- A confirmed move above resistance would likely shift sentiment from defensive positioning toward trend continuation trades.