The memecoin market bounced a little, despite the rest of the market still struggling to register any gains over the last 24 hours. MOODENG was one of the few exceptions though, with its gains much more pronounced than the rest. In fact, the memecoin hiked by 16% over the past day.

While volume for the broader sector faded, that of MOODENG rose – A clear divergence. Hence, the question – How did the memecoin outperform the sector, despite having lost most of its market cap?

Leveraged traders fuel MOODENG price gains

The move seemed to have come from the Futures trading pairs. For instance, MOODENG was the top gainer on Binance Futures, confirming that leveraged traders were indeed behind the move.

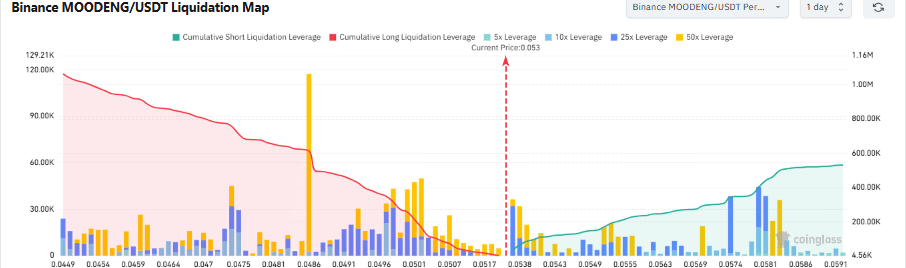

This trend was also evident on the liquidation map. Binance’s $1.06 million in cumulative long liquidation leverage was a third of the $3.60 million for OKX, Bybit, and Binance combined.

The highest leverage-driven buy was $0.0486 for all exchanges, as per CoinGlass.

Source: CoinGlass

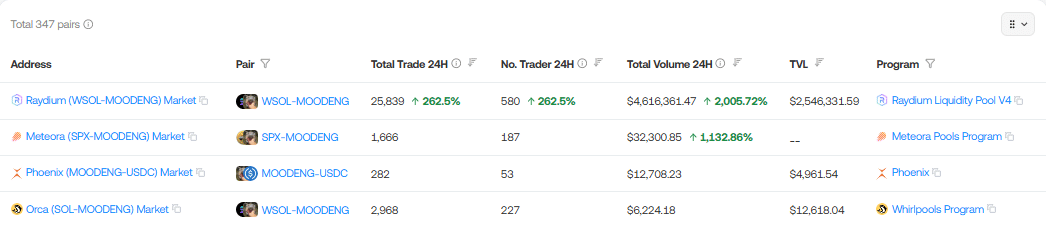

Additionally, the MOODENG liquidity pool on Raydium (RAY) saw a spike in activity. As per Solscan, both total trades and traders rose by 262% to 25,839 and 580, respectively.

The total trading volume on Raydium rose to $4.6 million – About a 2,005% change. Other DEX pools like Meteora and Orca also saw an increase in activity, though not as much.

Sentiment was also high, as CoinMarketCap data revealed that it was the trendiest Solana memecoin at press time. It was ranked first, while Pudgy Penguins (PENGU) came fifth.

Can this momentum last from a technical perspective?

Momentum on steroids!

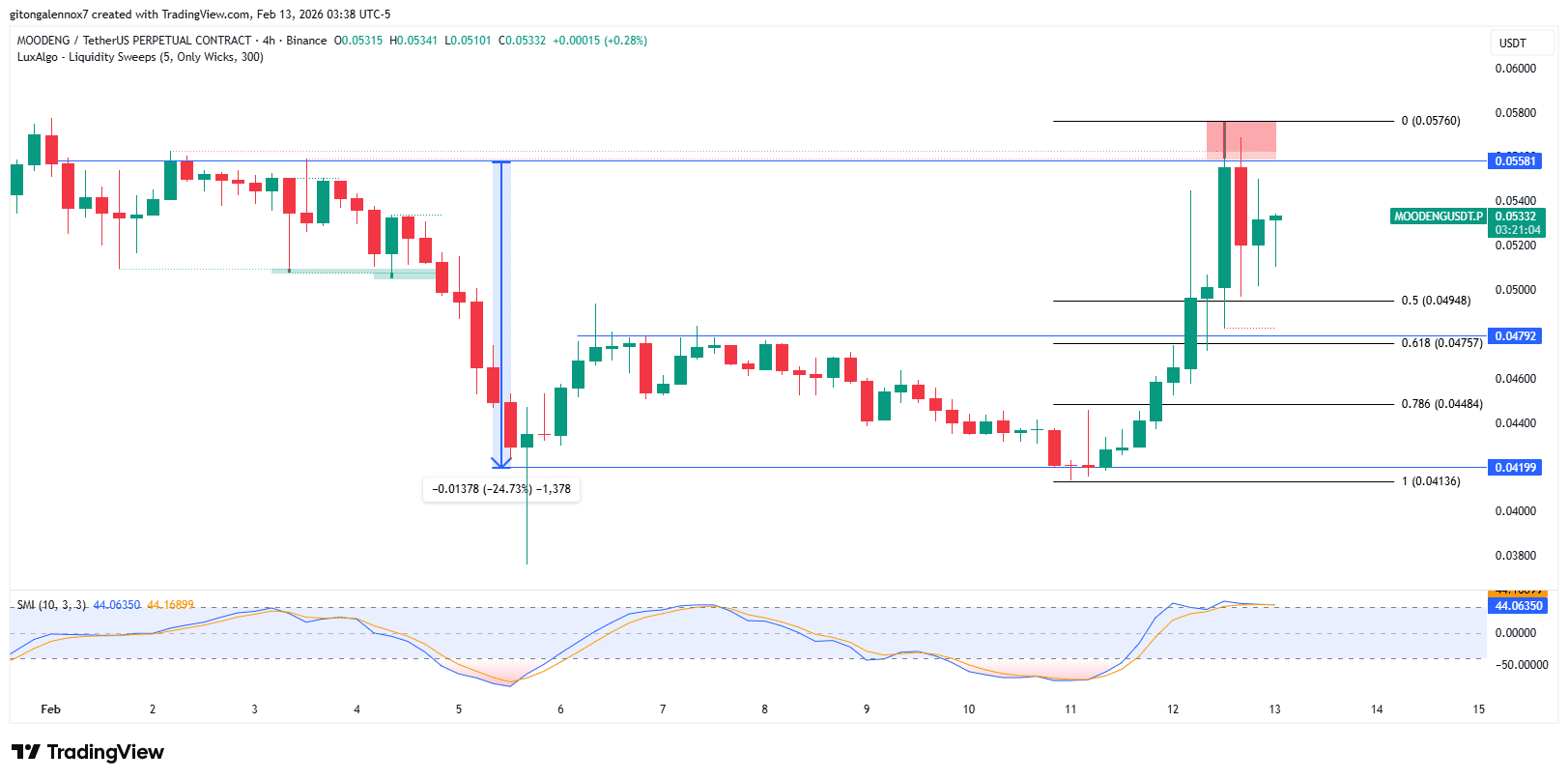

The price charts suggested that MOODENG’s momentum was high, as evidenced by the Stochastic Momentum Index (SMI). The SMI was 41.78 – A sign tha the memecoin had been on a bullish trend for the past two days.

However, the price was trading at a local resistance around $0.0558, alluding to a potential pullback. Price bounced off the 50% retracement level, but it’s unclear if the pullback would be enough to power a break past $0.0558.

Thus, MOODENG could likely drop to the 0.618 retracement level, which was at $0.04757. If this area is filled, a reversal pattern like a bullish engulfing could confirm a shift. Hence, target $0.058, and if broken, MOODENG could push past $0.060.

This did not rule out the chances of the price getting back to where the move was initiated at $0.04136 though. And, why was this so?

Will the leverage-driven pump last?

The move was driven by leverage, and usually, it is not sustainable in the long run.

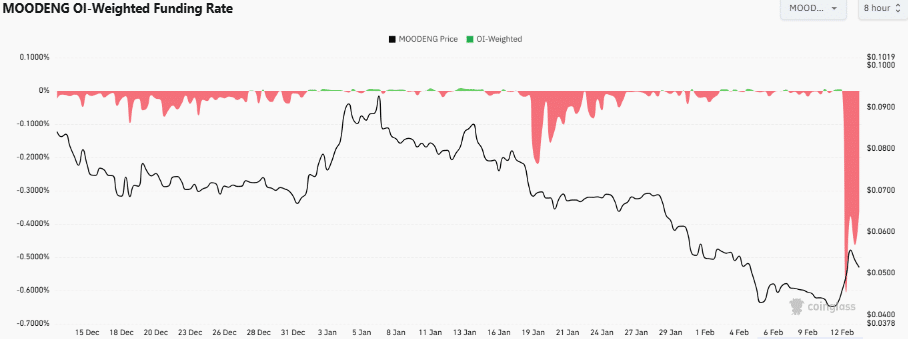

Looking at data from CoinGlass, the OI-Weighted Funding Rate had flipped back to red after eight hours. This meant that traders were slowly taking profits, explaining why the price was stalling around $0.0540.

However, this also underlined how a small shift in direction bias for leveraged trading can be influential to price changes. That said, MOODENG looked likely to stall before another rally or continue if more participants, especially spot traders, join the trend.

Final Thoughts

- MOODENG rallied by more than 16% in 24 hours, driven by leverage traders.

- MOODENG’s price rally at risk of collapse after traders withdrew leverage slowly.