When price diverges from fundamentals, it’s often seen as a bullish signal. Strong on-chain metrics suggest investors aren’t giving up. Instead, they’re still committing capital and betting on the network’s long-term potential. Any short-term pullback? That’s usually just weak hands getting shaken out, setting the stage for a rebound once speculation cools off.

Considering this, it’s easy to see why Solana [SOL] could be following a similar path.

SOL has pulled back 31% so far in 2026, putting it among the weaker performers this year. And yet, the network’s activity remains robust, with capital continuing to flow into growth areas like RWAs, hitting new all-time highs.

Building on this momentum, Solana’s DeFi TVL hit a new all-time high of $80 million, fueled by strong stablecoin inflows. When you put it all together, TVL is one of the clearest indicators of investor conviction in SOL.

High liquidity and a growing TVL show that capital is being locked, signaling confidence in the network. This is also confirmation that fundamentals are diverging from price, a pattern usually seen when a token is undervalued.

So, naturally, the question arises – Is SOL undervalued? If it is, it could set the stage for a rebound once market sentiment flips to risk-on. That said, a closer look suggests this might still be an overly optimistic view for Solana.

Speculative buzz returns to Solana amid memecoin mania

Memecoin performance is putting SOL’s market momentum to the test.

Over the past 30 days, their performance has diverged sharply. The memecoin sector’s market cap fell by 3.5% to $30.2 billion, while SOL dropped by 8.5% over the same period. In short, memecoins outperformed Solana.

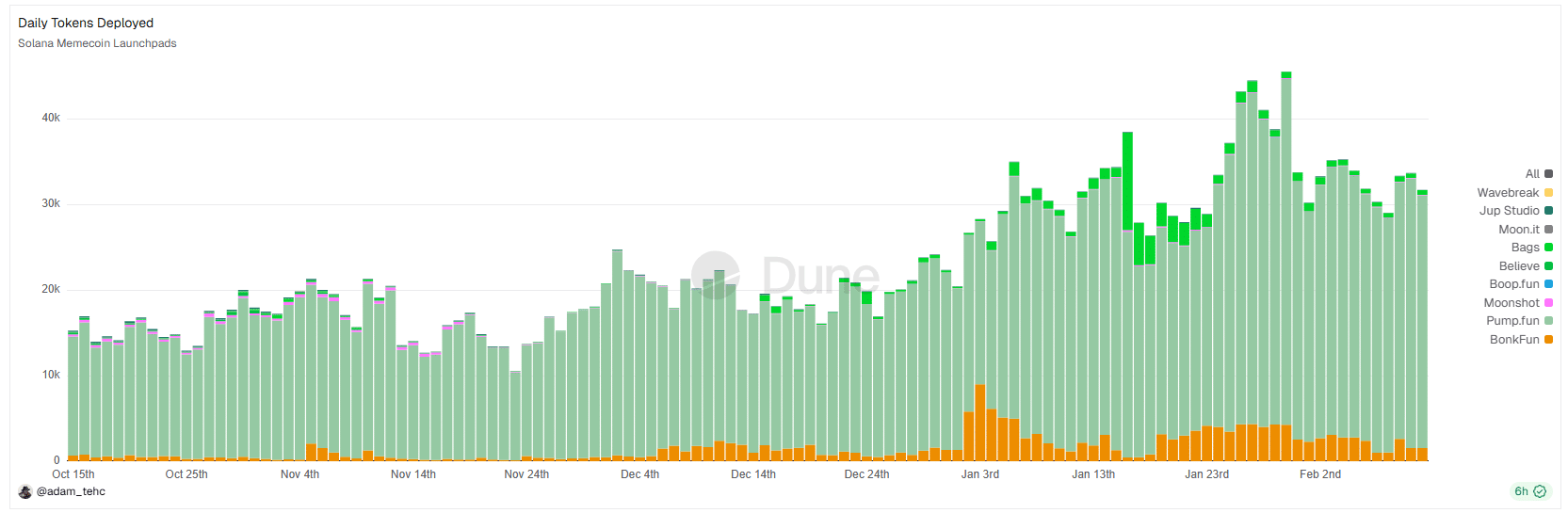

On-chain data might explain this gap too. According to Dune Analytics, Solana meme launchpads processed nearly $100 million in daily volume. Meanwhile, new token launches have averaged 30,000 per day this week.

Put simply, the data highlighted the ongoing speculative frenzy on the network.

Further backing this trend, Pippin [PIPPIN] surged over 100% in a single week, surpassing $535 million market cap. By comparison, core memecoins like Dogecoin [DOGE] and Shiba Inu [SHIB] posted declines.

Why does this matter? High memecoin activity can be bearish, as these tokens are often traded for short-term gains. In this context, Solana’s divergence on-chain and in price might not reflect a textbook bullish setup.

Instead, it might be indicative of how speculation is masking the network’s strength. As a result, the argument that Solana is undervalued is weaker, making its climb back to the $100-level a challenging one.

Final Summary

- Solana’s on-chain activity, DeFi TVL, and capital inflows seemed to be illustrative of strong long-term investor conviction.

- Surging Solana memecoins emphasize speculative trading, undermining the case for SOL being undervalued.