After getting rejected at $0.117 amid a broader market pullback, DOGE has hovered between $0.09 and $0.1. In fact, the memecoin has closed at lower highs for three consecutive days.

As of this writing, Dogecoin traded at $0.101, up 1.33% on the daily charts, indicating heightened volatility. Amid this market consolidation, both buyers and sellers have intervened, thereby extending the market weakness.

Dogecoin demand weakness prolongs

Since Dogecoin’s [DOGE] upside move collapsed at $0.15, bulls have attempted and consistently failed to strengthen the uptrend.

As a result, their attempt proved futile, resulting in a price below $0.1. Despite the drop, buyers have remained active.

As such, every time Dogecoin dropped below $0.1, buyers have stepped in to defend this level.

On the 18th of February, for example, when the memecoin dipped, buyers stepped in and bought at a discount. Buyer’s Strength rose to 9,2 a significant jump from 48 the previous day.

However, the demand remains weak as evidenced by the demand index. This indicator has remained negative for three consecutive days, currently around -0.026.

A negative Demand Index indicates that selling activity has consistently outpaced buying activity. Thus, whenever buyers entered the market, sellers also entered.

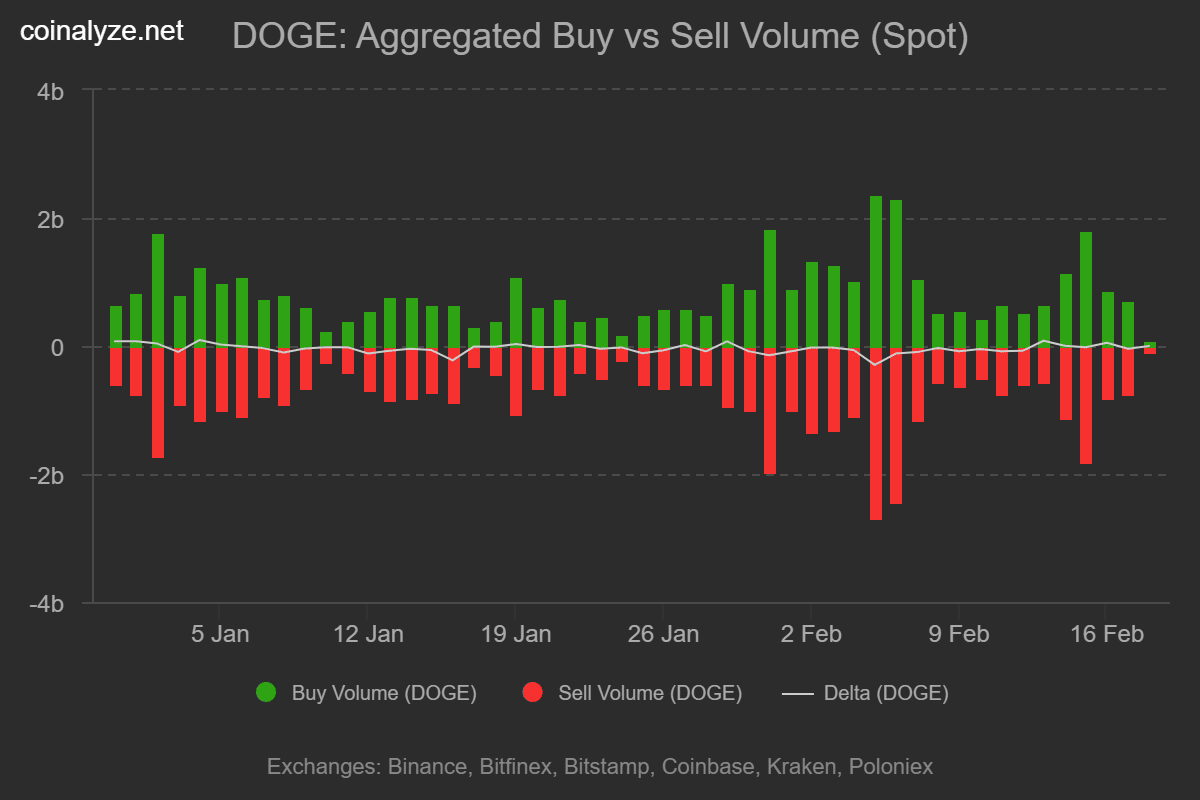

For instance, over the past 24 hours, Dogecoin recorded 830.8 million in Sell Volume compared with 783 million in Buy Volume.

Capital rotates into futures

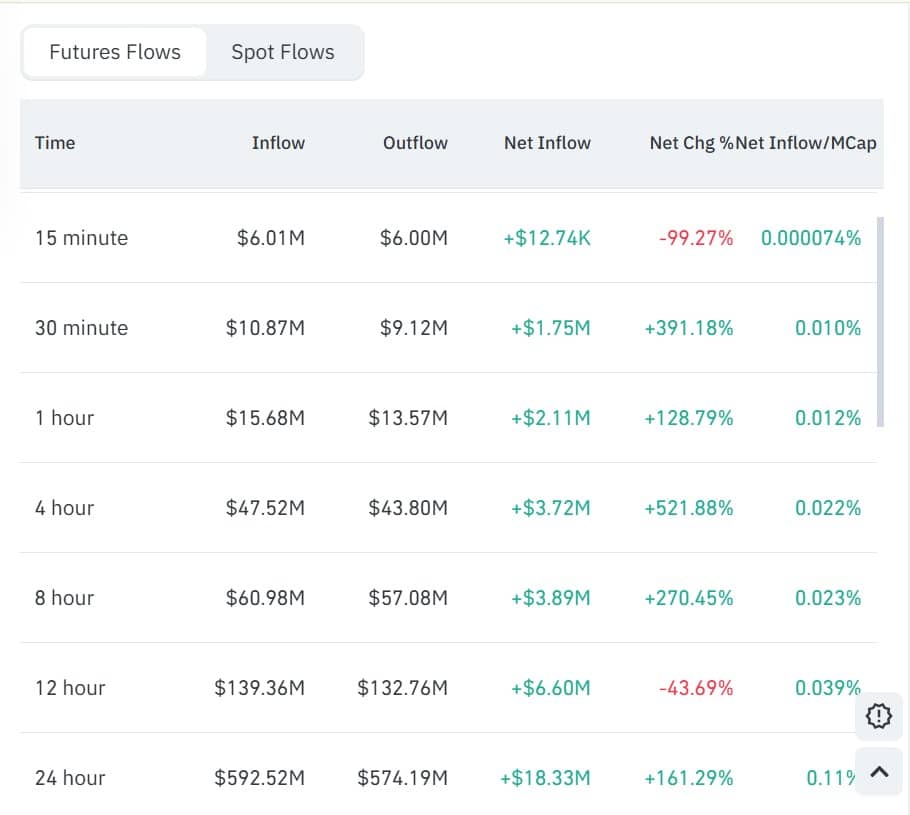

While Dogecoin recently struggled to sustain spot-market inflows, investor demand for futures positions has increased sharply.

According to CoinGlass, Dogecoin’s Futures Inflow rose to $591.5 million compared to $574.19 million in Futures Outflows. As a result, the memecoin’s Futures Netflow surged 161% to $18.33 million, a clear sign of aggressive positioning.

When capital flow spikes here, it suggests that new positions are being opened and derivatives activity is increasing again. Thus, investors entered the market to take either short or long positions.

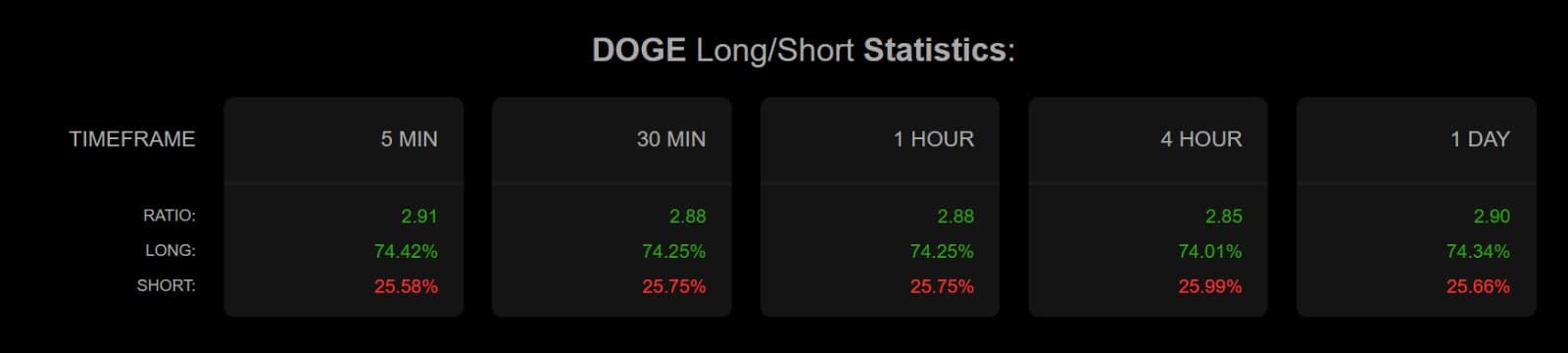

This shift is particularly significant on Binance, as evidenced by its long-short ratio on CoinGlass and Coinalyze.

The memecoin’s Long/Short Ratio rose to 2.90, with long positions accounting for 74.34% and shorts for 25.6%. In this case, the recent capital mostly flowed into long positions.

With longs dominating, this suggests that most traders were bullish and placed bets anticipating higher prices.

Can DOGE hold $0.1 support?

At press time, DOGE was testing the $0.1 support level. The memecoin has struggled to maintain this level amid increased selling pressure and low investor confidence.

As a result, the memecoin’s Relative Strength Index (RSI) has held within the bearish zone for four consecutive days. A prolonged stay below 50 for RSI indicates sustained pressure.

At the same time, its DMI dropped to 19, while ADX and ADXR rose to 46 and 54, respectively. With the positive index recording the lowest level, it signaled strong downward momentum.

Such market signals suggest the prevailing trend is dominant and it’s likely to continue. Therefore, if selling pressure persists, DOGE will decline further to $0.08 –$0.1.

However, if buyers, especially those entering futures, apply pressure, the memecoin will retest $0.1 and jump to $0.12.

Final Summary

- DOGE remains within a narrow range amid rising selling pressure and declining demand.

- Dogecoin sees renewed interest for futures positions, as investors eye another leg up.