Bitcoin, the cornerstone of the cryptocurrency market, achieved outstanding milestones in 2024, with costs touching the $100,000 mark. Its position as a monetary asset has grown immensely, with institutional curiosity and world adoption contributing to its meteoric rise. Wanting towards 2025, a number of key elements and market developments point out a promising trajectory for Bitcoin, alongside potential challenges. Under, we current an in depth forecast supported by knowledge, evaluation, and insights, together with these from Coin Push Crypto Alerts.

Brandt has shared the present parabolic profile for Bitcoin, noting that whereas the sample is obvious, the precise trajectory might evolve because the market progresses.

Understanding Bitcoin’s Worth Motion: Historic Cycles and Patterns

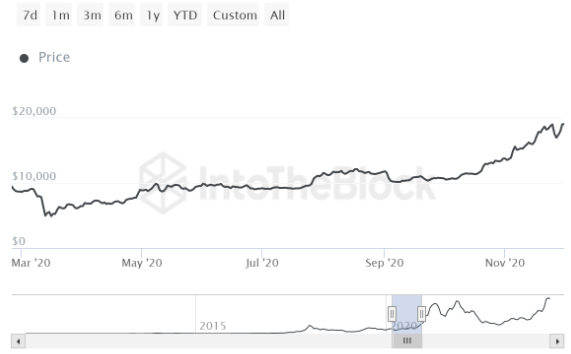

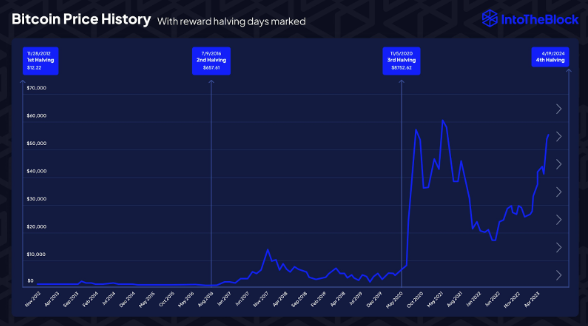

Bitcoin’s historic efficiency demonstrates that every halving cycle is adopted by a strong bull run. These are sometimes characterised by parabolic value actions and notable corrections earlier than consolidation. Right here’s a historic snapshot of Bitcoin’s efficiency round halving occasions:

| Halving Date | Worth 1 Month Earlier than | Worth 1 Month After | Cycle Excessive Following Halving | Cycle Low After Correction |

| November 28, 2012 | $10.26 | $13.42 | $1,163 (Nov 2013) | $152 (Jan 2015) |

| July 9, 2016 | $583.11 | $597.50 | $19,783 (Dec 2017) | $3,122 (Dec 2018) |

| Could 11, 2020 | $6,909.95 | $9,850 | $69,000 (Nov 2021) | $16,000 (Nov 2022) |

| April 21, 2024 | $67,911 | $70,135 | $??? (2025 Anticipated) | $??? |

Key Takeaways:

- Bullish Runs: Traditionally, Bitcoin experiences a 12–18 month bullish part post-halving.

- Parabolic Patterns: Worth ascends parabolically, typically adopted by corrections of as much as 80%.

Insights from Coin Push Crypto Alerts stress the significance of staying up to date with real-time crypto alerts throughout these phases to pinpoint optimum entry and exit factors.

Set up Coin Push cell app to get worthwhile crypto buying and selling alerts as cell notifications.

Bitcoin Seasonality and Market Sentiment

Seasonal developments play a major position in Bitcoin’s value actions. For instance, knowledge suggests stronger upward developments in Q1 and This autumn, whereas Q2 and Q3 typically see value consolidation. Coin Push Crypto Alerts highlights that Bitcoin’s present value close to $100,000 aligns with historic seasonal peaks.

Affect of Bitcoin Halving Occasions

The April 2024 halving occasion decreased block rewards from 6.25 BTC to three.125 BTC, traditionally a key driver of Bitcoin’s bullish runs. Earlier halving cycles witnessed value surges of 180% or extra. Analysts, together with Ali Martinez, forecast that the present bullish part will prolong properly into 2025.

#Bitcoin design round four-year cycles, pushed by its #halving occasions, typically mirrors its value motion.

Traditionally, this interprets to three years of bullish developments adopted by 1 12 months of bearish correction. As per this cycle, $BTC is in an upward part, doubtlessly extending… pic.twitter.com/7B4sIpiWH8

— Ali (@ali_charts) December 29, 2023

Bitcoin as a Secure-Haven Asset

Amid world financial uncertainties, Bitcoin’s position as a safe-haven asset has grown. Ark Make investments describes Bitcoin as a groundbreaking financial system providing monetary sovereignty and minimal counterparty threat. Rising institutional participation, together with investments from U.Ok. pension funds, underscores its standing as a risk-off asset.

Institutional Inflows and Market Growth

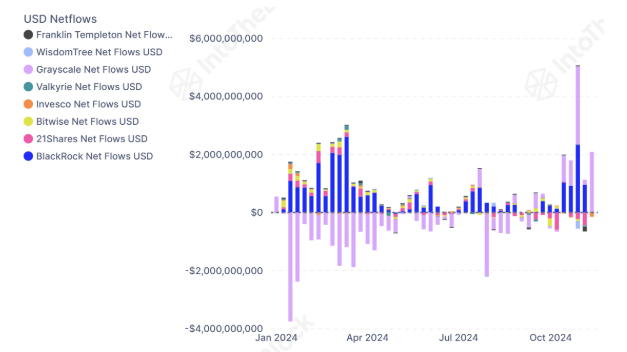

Spot Bitcoin ETFs as a Catalyst

The introduction of spot Bitcoin ETFs has revolutionized Bitcoin’s funding panorama. Monetary giants like BlackRock and Vanguard have pushed ETF adoption, with BlackRock amassing $40 billion in belongings shortly after its launch. Analysts challenge ETF inflows may double by 2025, doubtlessly pushing Bitcoin past $150,000.

I get requested rather a lot on intvs whether or not all Ten btc ETFs will survive and the reply is 100% sure they may all be right here in a 12 months. Even the least in aum, $BTCW, has a wholesome $74m. Out of the 108 ETFs launched in 2024 to this point it ranks sixteenth. (high 15%). That is how insane all that is. pic.twitter.com/ZVQ5ho3u2C

— Eric Balchunas (@EricBalchunas) March 13, 2024

For extra insights, find out about crypto risks and trends.

Keep tuned for extra updates and assets as we proceed to explore the exciting world of Bitcoin, Ethereum, altcoins, and extra!

For extra insights and recommendations on staying safe in the crypto market, comply with Coin Push Crypto Alerts for the newest updates on crypto alerts and alerts, making certain you stay knowledgeable in the course of the bull run of 2024.

Company Bitcoin Holdings

MicroStrategy’s accumulation technique, with 200,000 BTC valued at over $30 billion, has additional legitimized Bitcoin as a company reserve asset. This pattern is predicted to affect different establishments, contributing to cost stability and development.

Macroeconomic and World Developments

- Inflation and Financial Insurance policies: Bitcoin has gained recognition as a hedge towards inflation, significantly as central banks ease financial insurance policies.

- Geopolitical Uncertainty: Bitcoin’s decentralized nature makes it a horny safe-haven asset throughout geopolitical turmoil.

- Nationwide Adoption Developments: Nations like El Salvador and the Central African Republic integrating Bitcoin into their economies bolsters its demand and value stability.

Bitcoin’s Community Metrics: Hash Price and Mining Exercise

Bitcoin’s community well being stays strong, with its hash price hitting an all-time excessive in October 2024. A powerful hash price alerts community safety and miner confidence in long-term value appreciation. Publish-halving, mining profitability dipped however rebounded as Bitcoin approached six figures.

Bitcoin Hashrate Hits All-Time Excessive

“After the halving, there was a noticeable lower in hashrate, however with the alternative and upgrading of present mining gear, the hashrate started to pattern upwards beginning in July.” – By @DanCoinInvestor

Hyperlink 👇… pic.twitter.com/tUDkCHrzDP

— CryptoQuant.com (@cryptoquant_com) November 22, 2024

Projected Hash Price for 2025

As mining expertise advances, the community’s hash price is predicted to exceed 500 EH/s by mid-2025, additional strengthening Bitcoin’s safety and decentralization.

Worth Forecasts for 2025: Professional Predictions

Bullish Projections

- $150,000 – $200,000: Analysts like Tom Lee and Cathie Wooden anticipate Bitcoin reaching $200,000 by late 2025, pushed by institutional demand and diminishing provide.

- $120,000 – $140,000: Conservative estimates account for mid-term corrections, setting a goal vary of $120,000 to $140,000.

Bearish Eventualities

If macroeconomic circumstances worsen, Bitcoin may briefly right to $80,000 earlier than resuming its bullish trajectory.

Key Predictions for 2025

Potential Corrections: Brief-term value dips may function alternatives for long-term accumulation.

Sustained Bullish Momentum: Analysts predict development extending as much as 500 days post-halving.

Institutional Help: Elevated ETF and institutional investments are prone to drive costs larger.

Keep related with Coin Push Crypto Alerts. As a reminder, we don’t facilitate shopping for, promoting, or buying and selling, however we try to maintain you knowledgeable concerning the dynamic world of cryptocurrencies.

Disclaimer: All hyperlinks offered are for informational functions solely. Coin Push Crypto Alerts doesn’t endorse or take duty for the content material or providers offered on exterior web sites.

Disclaimer: The data offered on this article doesn’t represent funding recommendation, monetary recommendation, buying and selling recommendation, or some other recommendation, and shouldn’t be handled as such. Coin Push Crypto Alerts doesn’t advocate shopping for, promoting, or holding any cryptocurrency. All the time conduct your due diligence and seek the advice of a monetary advisor earlier than making any funding selections.

Be part of Coin Push Crypto Alerts for Prime Crypto Calls

There are indications that the crypto will probably be distributed to gamers over two years reasonably than unexpectedly. This strategy is probably going designed to stop a fast drop in value after itemizing, with the intention that solely the “whales” will stay to progressively purchase up your cash.

Set up Coin Push Crypto Alerts in the present day and take step one in the direction of mastering the market in 2024. Select reliability, select transparency, and unlock the complete potential of the upcoming bull-run.

Coin Push

Coin Push Crypto Alerts stands as a testomony to the ability of mathematical algorithms and data-driven analysis in providing actionable insights to traders. By prioritizing reliability and transparency, Coin Push Crypto Alerts empowers merchants to make knowledgeable selections and navigate the advanced crypto market with confidence.

And at all times keep in mind – No fortune telling, simply math!

With Coin Push Crypto Alerts main the best way, traders can trade smarter, not tougher, and seize the numerous alternatives the crypto market affords. Select reliability, select transparency, and install Coin Push Crypto Alerts.

Comply with Us on social @coinpushapp

Disclaimer: Crypto is a high-risk asset class. This text is offered for informational functions and doesn’t represent funding recommendation. You could possibly lose your whole capital.

Commerce Like a Professional with Coin Push Crypto Alerts

Are you seeking to enhance your trading skills or confirm your strategies? AltSignals gives exact buying and selling signals to help both novice and experienced traders. Discover Coin Push to remain ahead of the market and make knowledgeable buying and selling selections.

Set up Coin Push Crypto Alerts in the present day and take step one in the direction of mastering the market in 2024. Select reliability, select transparency, and unlock the complete potential of the upcoming bull-run.

Word: Coin Push Crypto Alerts doesn’t present buy or sell suggestions however goals to supply instructional insights that will help you make knowledgeable buying and selling selections. For extra detailed analysis and trading strategies, think about leveraging the insights from Coin Push Crypto Alerts. Nevertheless, their effectiveness relies upon largely on how they’re used. By understanding the character of those alerts, the place they originate, and find out how to determine dependable ones, merchants could make knowledgeable and strategic selections, maximizing their potential for achievement.

FAQ

What drives Bitcoin’s value cycles?

Halving occasions, institutional adoption, macroeconomic circumstances, and technological developments.

Can Bitcoin attain $200,000 by 2025?

Whereas formidable, this goal is dependent upon sustained ETF inflows and world adoption.

Is Bitcoin nonetheless unstable in 2025?

Regardless of decreased volatility as a consequence of institutional involvement, vital value swings stay seemingly.

Coin Push Crypto Alerts serves as a useful useful resource for people and companies fascinated about staying knowledgeable about developments in decentralized cloud computing and the broader crypto house. By offering well timed updates and insights on trends related to crypto signals, together with Bitcoin, Ethereum, and altcoins, Coin Push helps customers navigate the quickly evolving panorama. Because the trade strikes in the direction of decentralization, Coin Push goals to equip customers with the knowledge wanted to make knowledgeable selections and capitalize on rising alternatives out there.

#bitcoinsignals #ethereumsignals #cryptoalerts #bullrun

Keep forward of the curve with Coin Push Crypto Alerts—your trusted supply for the newest updates, crypto alerts, and insights into the 2024 bull run. 🚀

Divergence Between MicroStrategy and Bitcoin Costs

Traditionally, MicroStrategy’s (MSTR) inventory has mirrored Bitcoin’s value developments as a consequence of its huge cryptocurrency holdings. Nevertheless, a notable divergence has been evident since October 2024. MSTR’s inventory surged by 50% after breaking free from a consolidation part, whereas Bitcoin’s value remained close to the higher restrict of its consolidation zone. This disparity might sign market hesitation in committing to substantial strikes in Bitcoin’s valuation.

Ark Make investments’s Imaginative and prescient: Bitcoin Worth Predictions for 2030

Cathie Wooden, CEO of Ark Make investments, stays bullish on Bitcoin’s long-term prospects. Leveraging insights from on-chain knowledge and broader market indicators, she predicts Bitcoin’s worth may vary from a base case of $650,000 to a peak of $1.5 million by 2030. A pivotal milestone occurred after Bitcoin’s April 2024 halving, the place its provide development price dropped to 0.9%, making it scarcer than gold for the primary time. This shortage strengthens its enchantment as a high-value, limited-quantity asset.

Ark Make investments’s knowledge underscores Bitcoin’s resilience. By November 13, 2024, Bitcoin’s value stood at 1.33 occasions its earlier cycle peak of $67,589 (achieved in November 2021). Moreover, the utmost drawdown in the course of the 2022 bear market—76.9%—was considerably much less extreme than corrections in prior cycles: 86.3% in 2018, 85.1% in 2015, and 93.5% in 2011. This pattern factors to rising maturity and stability in Bitcoin’s market dynamics.

Projecting Bitcoin’s Future Development

Ark Make investments’s fashions reveal that Bitcoin’s efficiency since its final cycle low has grown 5.72 occasions, carefully matching the features of 5.18x and 5.93x recorded throughout equal phases within the 2015–2018 and 2018–2022 cycles. If Bitcoin maintains this trajectory, its value may climb 15.4x from the earlier cycle low, reaching $243,000 by mid-2025—roughly 880 days after the November 2021 low.

Present projections estimate Bitcoin’s worth may vary between $104,000 and $124,000 by December 2024. These estimates align with historic patterns, the place efficiency multiples hover between 2.48x and a pair of.94x throughout comparable durations.

Institutional Adoption and Regulatory Shift

The narrative round Bitcoin is more and more formed by institutional involvement. Spot Bitcoin ETFs have launched new avenues for capital influx, with monetary titans like BlackRock and Constancy spearheading adoption. Moreover, VanEck’s newest report underscores an optimistic outlook, predicting Bitcoin may attain $180,000 throughout the subsequent 18 months as a consequence of regulatory enhancements and rising institutional curiosity.

Potential U.S. regulatory adjustments may additionally play a major position in Bitcoin’s trajectory. A shift towards a extra favorable coverage setting, coupled with reductions in Federal Reserve rates of interest, would possibly enhance speculative belongings, together with Bitcoin. Seasonal elements, corresponding to the standard December rally, may additional speed up Bitcoin’s value features because it continues to outperform conventional indices.

Professional Opinions on Bitcoin’s 2025 Potential

Crypto analysts stay largely optimistic about Bitcoin’s future:

Peter Brandt anticipates Bitcoin reaching $135,000 in 2025.

Ari Paul envisions a extra conservative peak of $125,000 within the present cycle.

VanEck analysts see the continuing bull market as simply starting, pushed by institutional adoption and favorable macroeconomic circumstances.

Navigating Bitcoin’s Volatility

Regardless of its bullish outlook, Bitcoin is just not resistant to corrections. As Peter Brandt cautions, the market may expertise vital pullbacks, particularly in spring 2025. For long-term buyers, these corrections might current alternatives to build up Bitcoin at lower cost factors.

Closing Ideas

As Bitcoin’s ecosystem matures, its enchantment as a scarce, inflation-resistant asset continues to develop. Components like institutional adoption, ETF inflows, and shifting macroeconomic developments are setting the stage for a powerful end to 2024 and sustained momentum into 2025. With value targets starting from $104,000 to $243,000, Bitcoin stays a focus for buyers navigating the ever-evolving crypto panorama.

For real-time insights and updates on market actions, Coin Push Crypto Alerts gives invaluable instruments to remain forward on this dynamic market. Because the bull run unfolds, staying knowledgeable will probably be important to capitalizing on Bitcoin’s potential.

Conclusion: Navigating Bitcoin’s Future with Coin Push Crypto Alerts

Bitcoin’s evolution right into a mainstream monetary asset underscores the significance of staying knowledgeable. Coin Push Crypto Alerts gives real-time insights to assist buyers navigate the dynamic crypto market. With 2024’s halving fueling momentum and institutional inflows including credibility, Bitcoin’s 2025 outlook stays optimistic. Equip your self with the proper instruments and information to capitalize on Bitcoin’s future potential.

With the 2024 halving fueling bullish momentum and institutional inflows including credibility, Bitcoin’s outlook for 2025 stays optimistic. Keep knowledgeable, strategize, and capitalize on alternatives as Bitcoin continues to redefine world finance.

Bitcoin ETFs have crossed $90b in belongings, after yesterday’s $6b leap ($1b in flows $5b in mkt appreciation).. they now 72% of the best way to passing gold ETFs in belongings. pic.twitter.com/7I3TMC8CfZ

— Eric Balchunas (@EricBalchunas) November 12, 2024