Ethereum (ETH) has been underperforming on this cycle, trailing far behind Bitcoin’s spectacular rally to new all-time highs. Whereas Bitcoin captures headlines with its continued surge, ETH struggles to reclaim its yearly highs, leaving many traders questioning its subsequent transfer.

Regardless of the lackluster worth motion, information from CryptoQuant CEO Ki Younger Ju reveals a silver lining for ETH holders. In accordance with Ju, many ETH traders are enduring unrealized losses, harking back to ETH’s early 2020 backside earlier than its explosive bull run. This means that the present market circumstances would possibly supply a novel alternative for long-term ETH traders.

Ju’s evaluation highlights that substantial worth recoveries have traditionally adopted such phases of unrealized losses. If Ethereum begins to realize momentum and shut the hole with Bitcoin, the potential beneficial properties could possibly be large. For traders, this might mark the start of an upward pattern, rewarding those that stay affected person throughout this era of consolidation.

With market sentiment shifting and historical data supporting a bullish case, ETH’s subsequent transfer could possibly be pivotal. Buyers and analysts intently watch ETH’s worth motion, hoping for indicators of a breakout that might reignite its momentum and ship vital returns.

Final Probability To Purchase Ethereum?

Regardless of Ethereum’s underwhelming efficiency this cycle, there are indicators of bullish worth motion in current weeks. ETH has remained comparatively stagnant in comparison with Bitcoin’s meteoric rise. Nonetheless, optimistic alerts recommend this could possibly be the final alternative to build up ETH at discounted costs earlier than it begins its ascent towards new highs.

Critical data from CryptoQuant CEO Ki Young Ju sheds gentle on an attention-grabbing improvement: the ETH-BTC NUPL (Web Unrealized Revenue/Loss) has reached a 4-year low. This means that, regardless of Ethereum’s lagging efficiency towards Bitcoin, many ETH holders are enduring unrealized losses.

This mirrors Ethereum’s early 2020 backside scenario, simply earlier than it started its explosive rally. Ju believes that this era of underperformance would possibly current a chance for long-term ETH traders, because it may set the stage for a possible surge.

Nonetheless, Ju additionally notes that Ethereum’s future closely depends upon the income generated by Web3 purposes, notably via stablecoins. Whereas the ecosystem stays promising, it additionally feels closely leveraged, and the difficulty of sustainable development via Web3 app income doesn’t appear more likely to resolve anytime quickly.

Over a one-year timeframe, Ju finds ETH much less interesting than BTC, though regulatory readability sooner or later may change the dynamics and improve Ethereum’s enchantment. For now, this era of consolidation presents a crucial second for ETH believers to place themselves earlier than any vital worth actions.

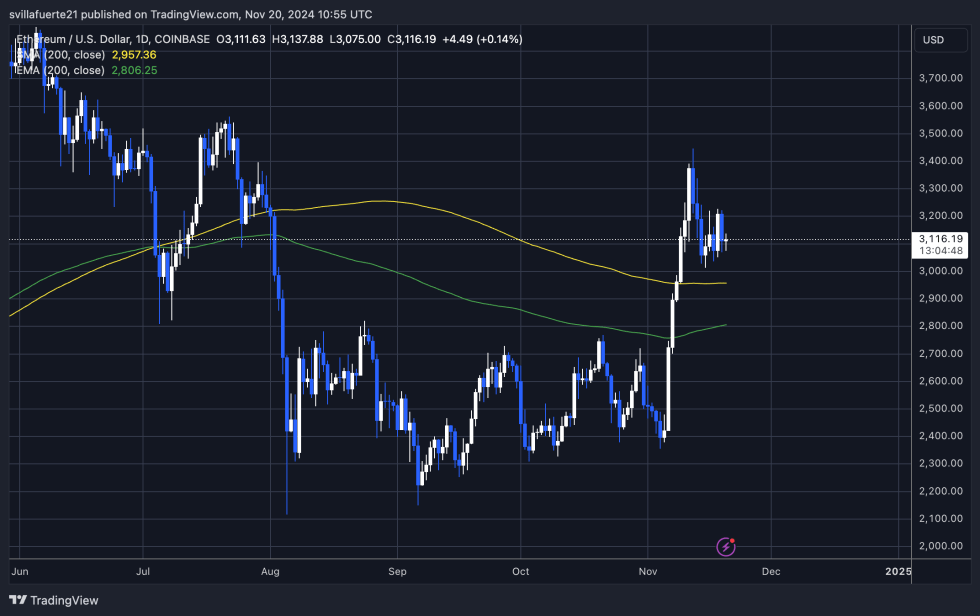

ETH Testing Essential Demand

Ethereum is testing essential demand above the $3,000 degree, buying and selling at $3,120 after a number of days of sideways consolidation under its native excessive at $3,446. This consolidation means that ETH is getting ready for a possible breakout, particularly with its current surge above the important thing 200-day shifting common at $2,957. Holding above this key assist degree is crucial for sustaining bullish momentum.

If Ethereum stays above the 200-day shifting common and continues its upward trajectory, the subsequent main resistance zone would be the native excessive at $3,446. A profitable breakout above this degree may pave the best way for ETH to problem its yearly highs, probably reaching the $4,000 mark.

The present worth motion signifies a stable demand basis above $3,000, and if ETH can preserve this degree, it may set off a bullish surge. Nonetheless, failure to carry above the 200-day shifting common may result in a retest of decrease assist ranges, reminiscent of $2,900 and even $2,500.

As of now, ETH stays poised for a possible transfer greater, and merchants are watching intently for affirmation of a breakout to new highs.

Featured picture from Dall-E, chart from TradingView