- In a key improvement, one whale moved $19.54 million price of ETH to Kraken.

- Market sentiment remained divided, with conflicting indicators from key indicators.

Regardless of a short interval of turbulence on the twenty fifth of November, Ethereum [ETH] has demonstrated resilience, posting a day by day achieve of 1.38%.

This restoration contributes to a formidable weekly enhance of 9.85%, underscoring the market’s present bullish momentum.

But, regardless of these beneficial properties, warning continued. Refined bearish indicators remained in play, with the potential to drive ETH decrease if broader market situations deteriorate.

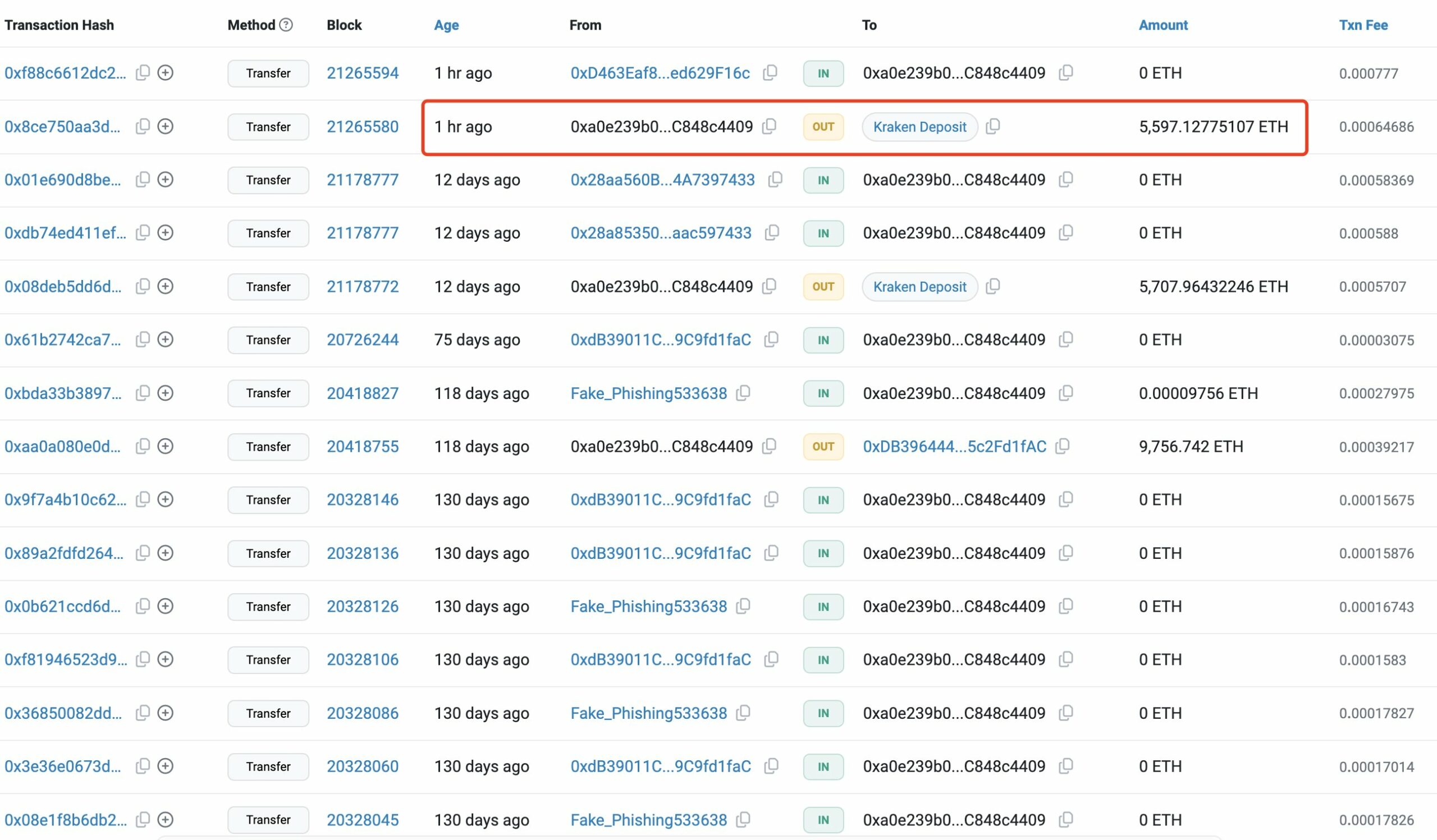

Whale transfers ETH, probably triggering a worth drop

In keeping with information from Lookonchain, a whale pockets related to ETH Devcon lately moved 5,597 ETH—price $19.45 million—into the cryptocurrency change Kraken.

The transaction got here shortly after ETH briefly reclaimed the $3,500 stage. Such actions are sometimes seen as bearish, as giant inflows to exchanges usually sign intentions to promote, whether or not for profit-taking or as a result of declining market confidence.

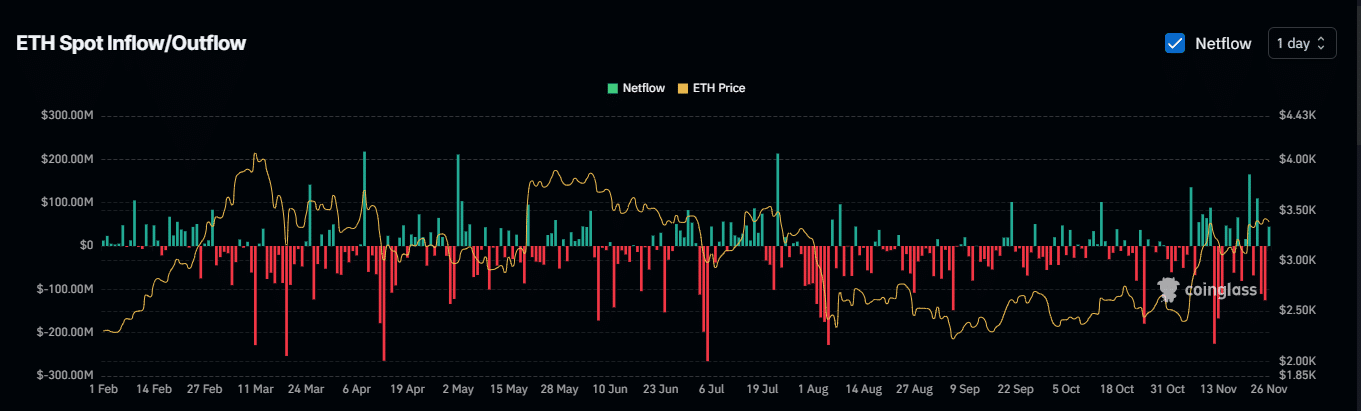

AMBCrypto discovered the general Alternate Netflow supplies a special perspective on ETH’s potential transfer.

Market members align with whales

Alternate Netflow, which measures the move of property out and in of exchanges, is a key indicator of market sentiment.

Optimistic Netflow sometimes indicators bearish sentiment as property transfer into exchanges for potential promoting, whereas destructive Netflow displays bullish sentiment, indicating withdrawals for holding.

On the twenty fifth of November, Netflow was destructive, with $125.17 million withdrawn from exchanges—a bullish sign that outweighed whale exercise.

Nonetheless, the Netflow has since turned constructive, with $53.96 million moved again to exchanges.

If this development continues, it might enhance promoting stress on ETH, suggesting that market members have been now leaning towards promoting slightly than holding.

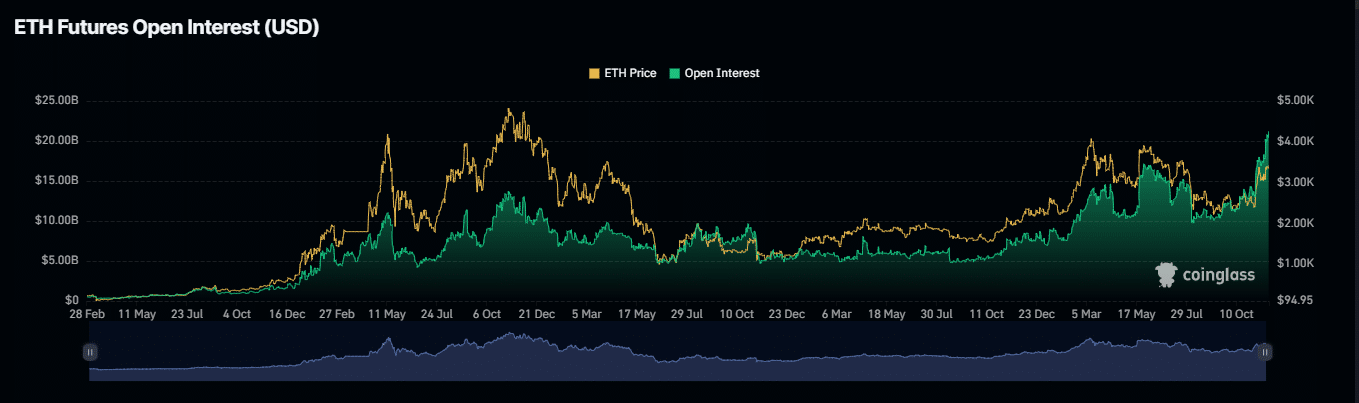

ETH’s subsequent transfer is unclear

At press time, market sentiment remained divided. On the bearish aspect, $52 million in lengthy positions have been liquidated, reflecting important losses because the market moved in opposition to bullish merchants—a transparent signal of promoting stress.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

In the meantime, Open Curiosity hit a bullish peak, reaching $21.44 billion—the very best in two years. This surge prompt a rising variety of lengthy by-product contracts, signaling optimism for a possible worth enhance.

Till these opposing indicators converge, ETH’s worth route will stay unsure.